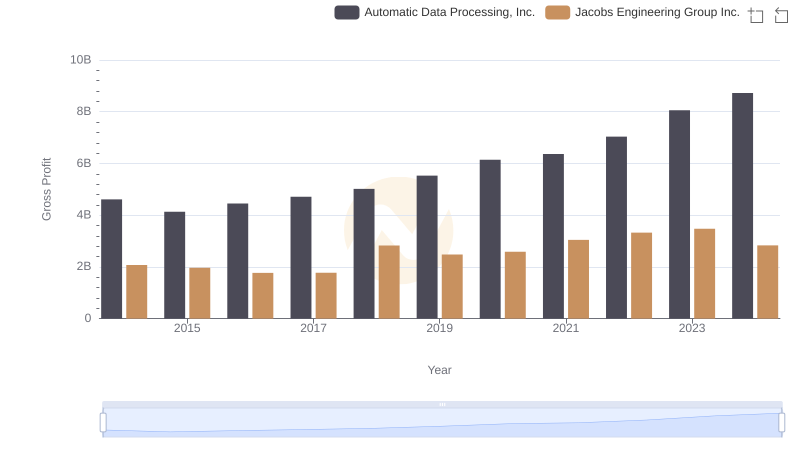

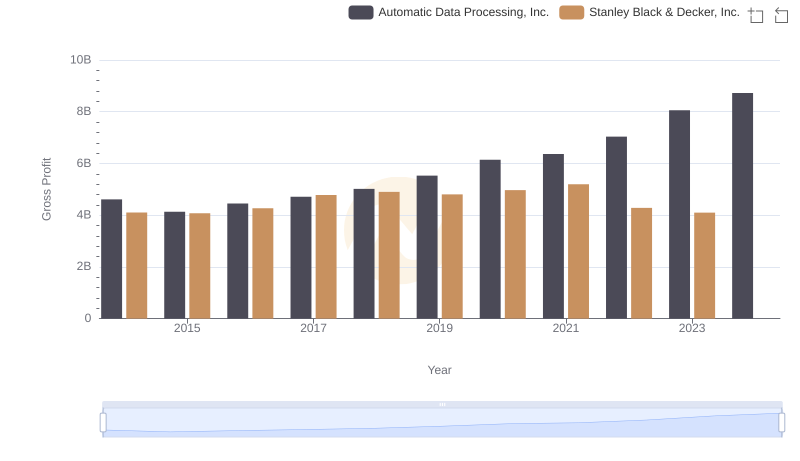

| __timestamp | Automatic Data Processing, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 4102700000 |

| Thursday, January 1, 2015 | 4133200000 | 4072000000 |

| Friday, January 1, 2016 | 4450200000 | 4267200000 |

| Sunday, January 1, 2017 | 4712600000 | 4778000000 |

| Monday, January 1, 2018 | 5016700000 | 4901900000 |

| Tuesday, January 1, 2019 | 5526700000 | 4805500000 |

| Wednesday, January 1, 2020 | 6144700000 | 4967900000 |

| Friday, January 1, 2021 | 6365100000 | 5194200000 |

| Saturday, January 1, 2022 | 7036400000 | 4284100000 |

| Sunday, January 1, 2023 | 8058800000 | 4098000000 |

| Monday, January 1, 2024 | 8725900000 | 4514400000 |

Cracking the code

In the ever-evolving landscape of American industry, Automatic Data Processing, Inc. (ADP) and Stanley Black & Decker, Inc. have carved out significant niches. Over the past decade, ADP has demonstrated a robust growth trajectory, with its gross profit surging by approximately 89% from 2014 to 2023. This growth underscores ADP's strategic prowess in the payroll and human resources sector.

Conversely, Stanley Black & Decker, a stalwart in the tools and storage industry, has experienced a more modest increase of around 25% in gross profit over the same period. Notably, 2023 data for Stanley Black & Decker is incomplete, highlighting potential challenges or strategic shifts.

These trends reflect broader economic shifts and the resilience of these companies in their respective fields. As we look to the future, the question remains: how will these giants adapt to the changing economic landscape?

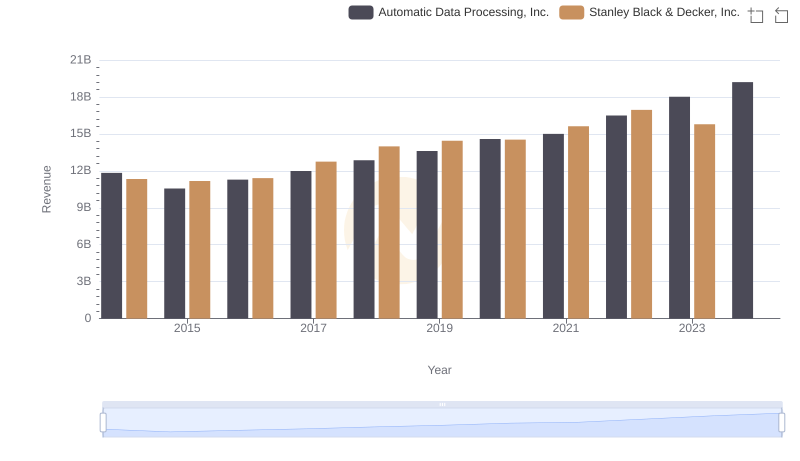

Revenue Insights: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc. Performance Compared

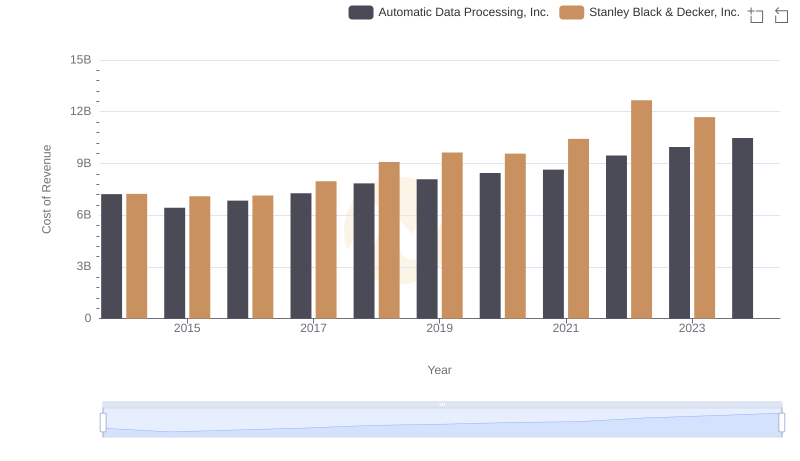

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

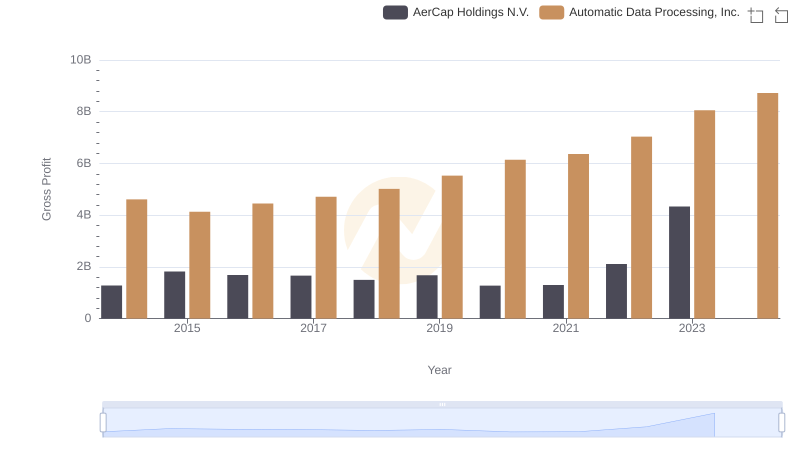

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

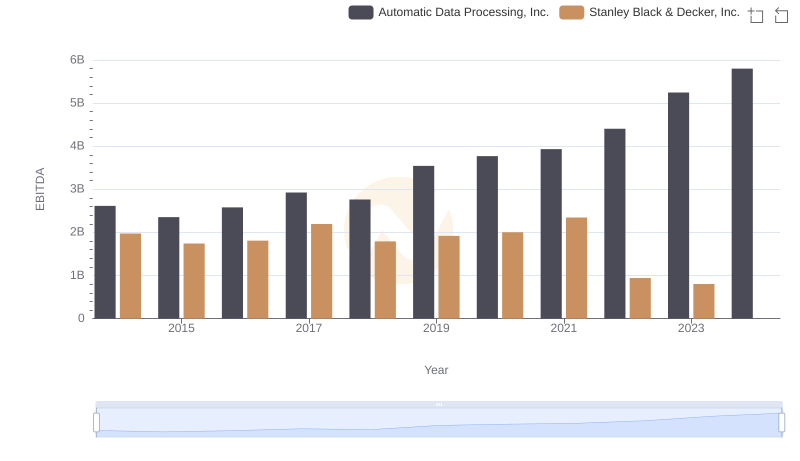

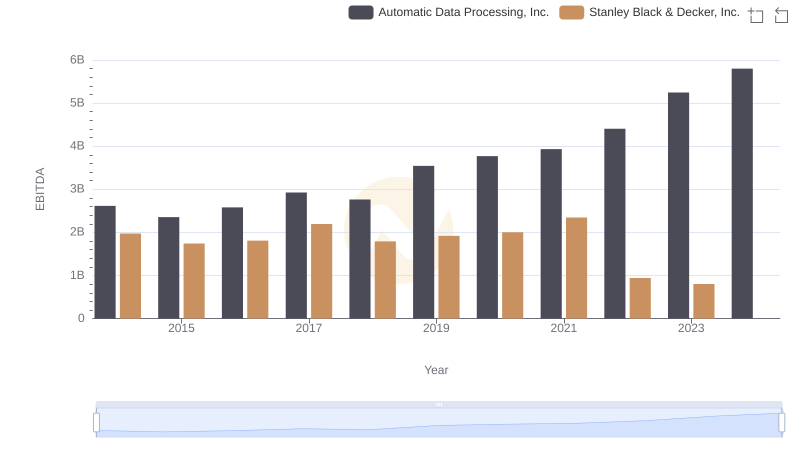

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison