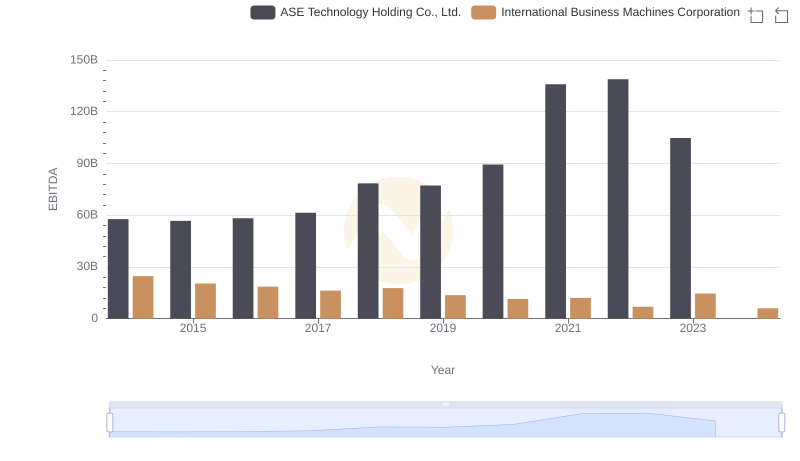

| __timestamp | ASE Technology Holding Co., Ltd. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 256591000000 | 92793000000 |

| Thursday, January 1, 2015 | 283302000000 | 81742000000 |

| Friday, January 1, 2016 | 274884000000 | 79920000000 |

| Sunday, January 1, 2017 | 290441000000 | 79139000000 |

| Monday, January 1, 2018 | 371092000000 | 79591000000 |

| Tuesday, January 1, 2019 | 413182000000 | 57714000000 |

| Wednesday, January 1, 2020 | 476978000000 | 55179000000 |

| Friday, January 1, 2021 | 569997000000 | 57351000000 |

| Saturday, January 1, 2022 | 670873000000 | 60530000000 |

| Sunday, January 1, 2023 | 581914471000 | 61860000000 |

| Monday, January 1, 2024 | 595410063000 | 62753000000 |

Unleashing insights

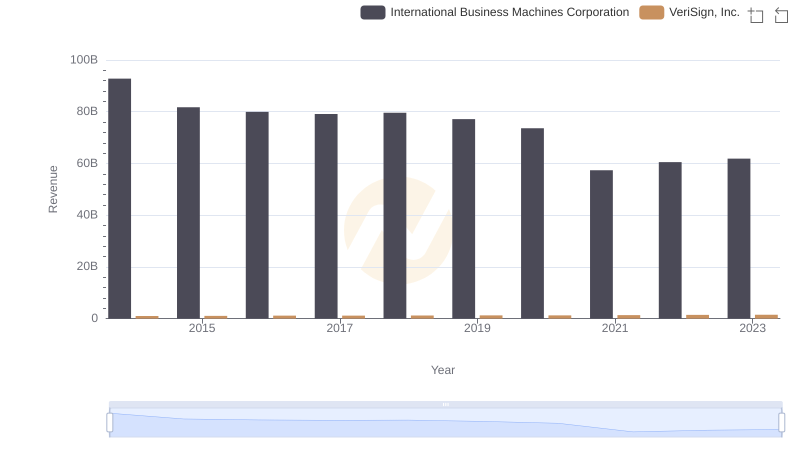

In the ever-evolving landscape of global technology, two titans stand out: International Business Machines Corporation (IBM) and ASE Technology Holding Co., Ltd. Over the past decade, these companies have showcased contrasting revenue trajectories. From 2014 to 2023, ASE Technology's revenue surged by approximately 127%, reflecting its robust growth in the semiconductor industry. In contrast, IBM's revenue experienced a decline of around 33%, highlighting challenges in its traditional business sectors.

ASE Technology's peak revenue in 2022 was nearly 11 times that of IBM's, underscoring its dominance in the semiconductor market. Meanwhile, IBM's revenue showed signs of stabilization in 2023, hinting at potential recovery. However, data for ASE Technology in 2024 remains elusive, leaving room for speculation. As these companies navigate the future, their strategies will be pivotal in shaping the tech industry's landscape.

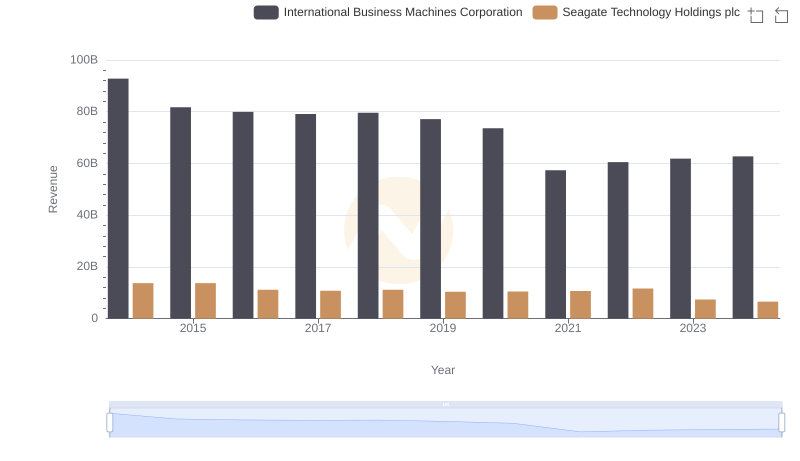

International Business Machines Corporation and Seagate Technology Holdings plc: A Comprehensive Revenue Analysis

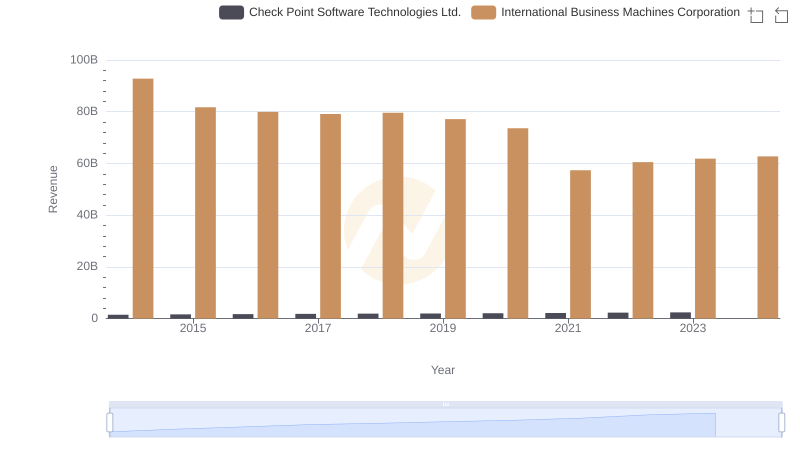

Annual Revenue Comparison: International Business Machines Corporation vs Check Point Software Technologies Ltd.

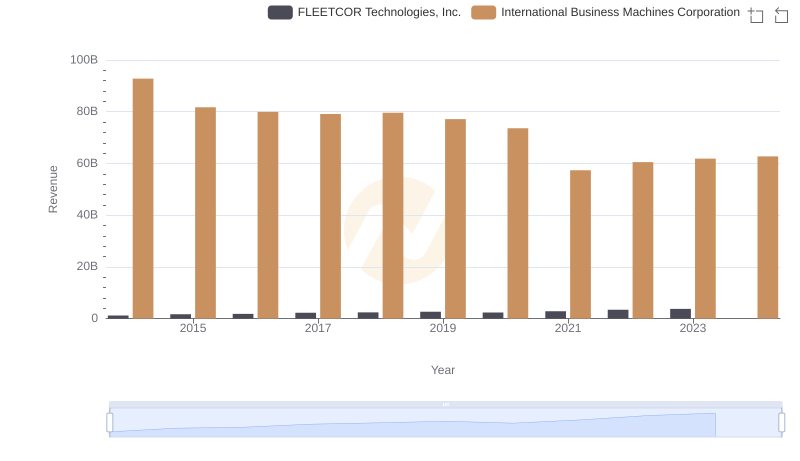

International Business Machines Corporation vs FLEETCOR Technologies, Inc.: Examining Key Revenue Metrics

Who Generates More Revenue? International Business Machines Corporation or Pure Storage, Inc.

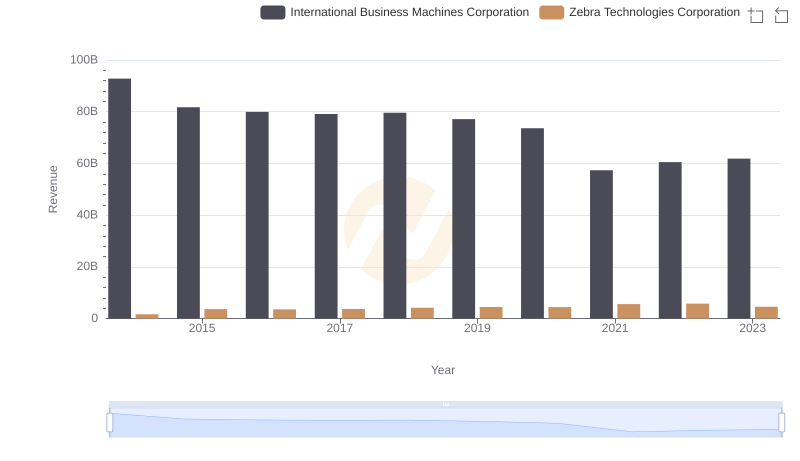

International Business Machines Corporation vs Zebra Technologies Corporation: Examining Key Revenue Metrics

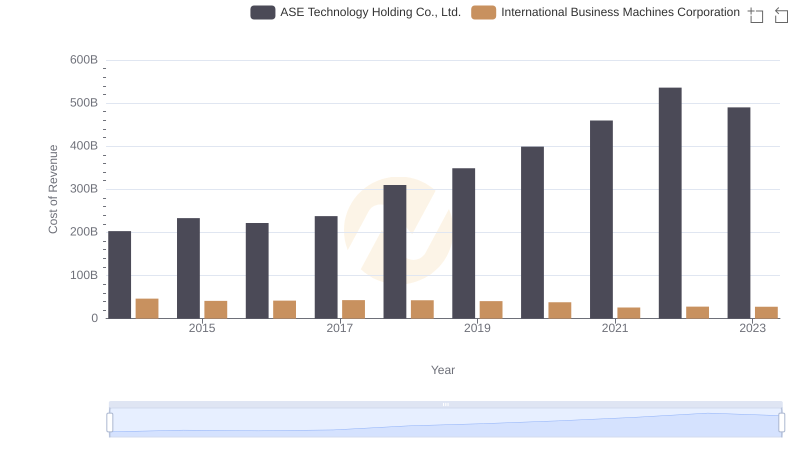

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: Efficiency in Cost of Revenue Explored

International Business Machines Corporation or SS&C Technologies Holdings, Inc.: Who Leads in Yearly Revenue?

Who Generates More Revenue? International Business Machines Corporation or VeriSign, Inc.

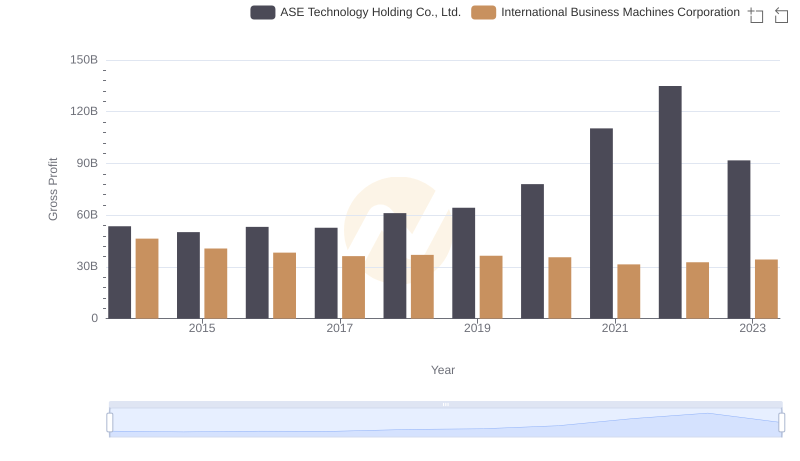

International Business Machines Corporation vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

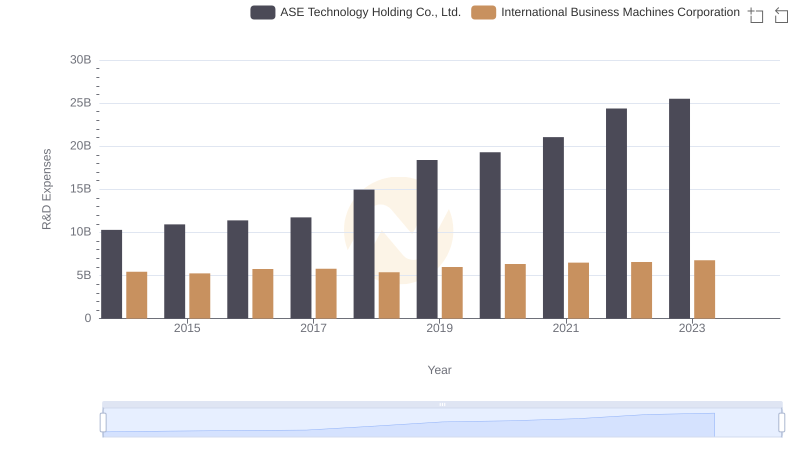

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and ASE Technology Holding Co., Ltd.

Comparing SG&A Expenses: International Business Machines Corporation vs ASE Technology Holding Co., Ltd. Trends and Insights

EBITDA Performance Review: International Business Machines Corporation vs ASE Technology Holding Co., Ltd.