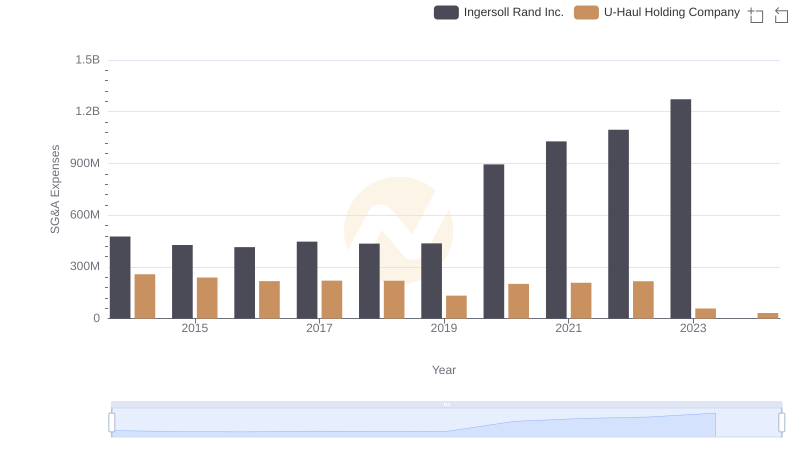

| __timestamp | Ingersoll Rand Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1633224000 | 127270000 |

| Thursday, January 1, 2015 | 1347800000 | 146072000 |

| Friday, January 1, 2016 | 1222705000 | 144990000 |

| Sunday, January 1, 2017 | 1477500000 | 152485000 |

| Monday, January 1, 2018 | 1677300000 | 160489000 |

| Tuesday, January 1, 2019 | 1540200000 | 162142000 |

| Wednesday, January 1, 2020 | 3296800000 | 164018000 |

| Friday, January 1, 2021 | 3163900000 | 214059000 |

| Saturday, January 1, 2022 | 3590700000 | 259585000 |

| Sunday, January 1, 2023 | 3993900000 | 844894000 |

| Monday, January 1, 2024 | 0 | 3976040000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate efficiency, understanding cost management is crucial. This analysis delves into the cost of revenue trends for Ingersoll Rand Inc. and U-Haul Holding Company from 2014 to 2023. Over this period, Ingersoll Rand Inc. demonstrated a significant increase in cost efficiency, with a notable rise of approximately 145% in their cost of revenue from 2014 to 2023. In contrast, U-Haul Holding Company showed a more modest increase of around 565% over the same period, indicating a different approach to managing their cost structure.

The data reveals a sharp increase in Ingersoll Rand's cost of revenue in 2020, which could be attributed to strategic investments or market expansion. Meanwhile, U-Haul's steady growth suggests a consistent strategy in managing operational costs. This comparison offers valuable insights into how these companies navigate financial efficiency in a competitive market.

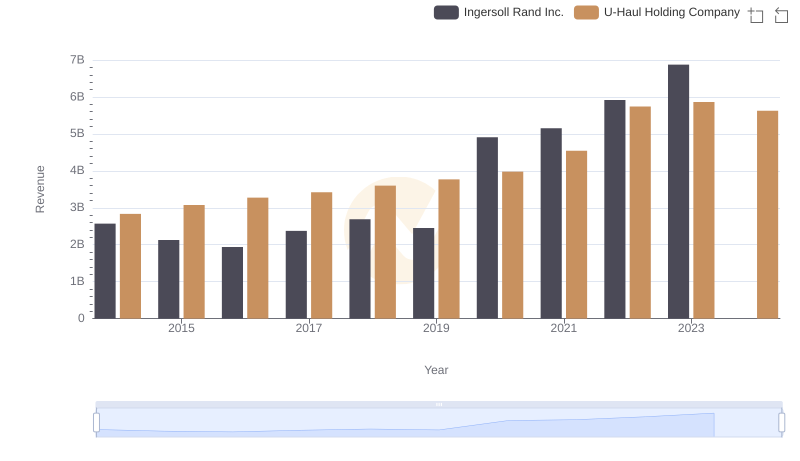

Revenue Showdown: Ingersoll Rand Inc. vs U-Haul Holding Company

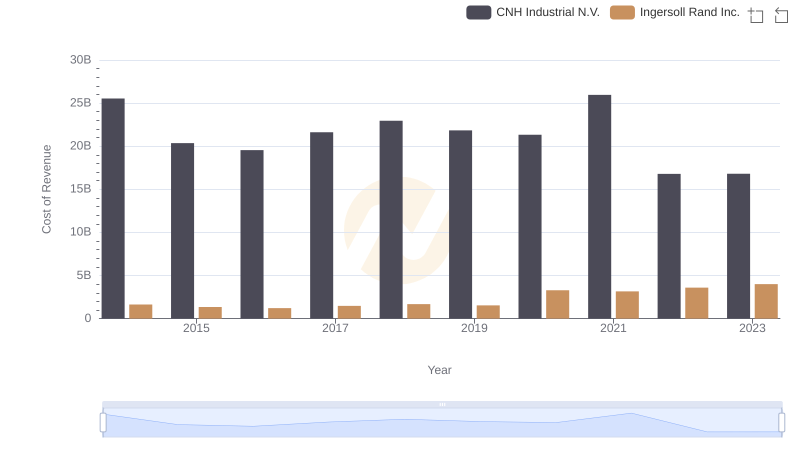

Cost of Revenue Trends: Ingersoll Rand Inc. vs CNH Industrial N.V.

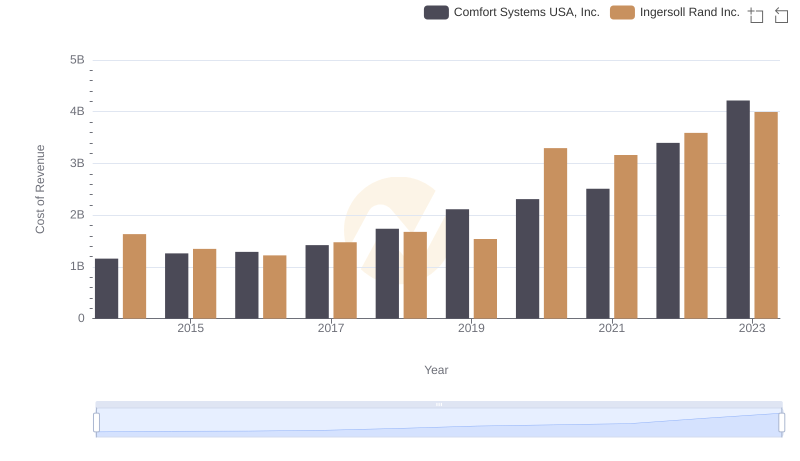

Analyzing Cost of Revenue: Ingersoll Rand Inc. and Comfort Systems USA, Inc.

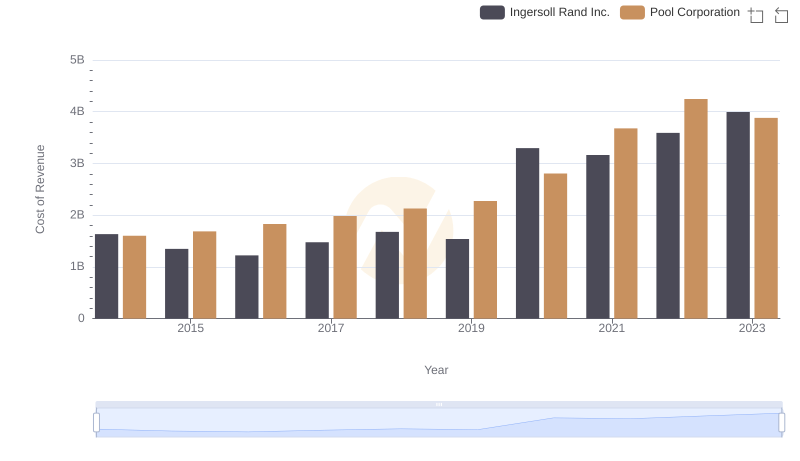

Cost Insights: Breaking Down Ingersoll Rand Inc. and Pool Corporation's Expenses

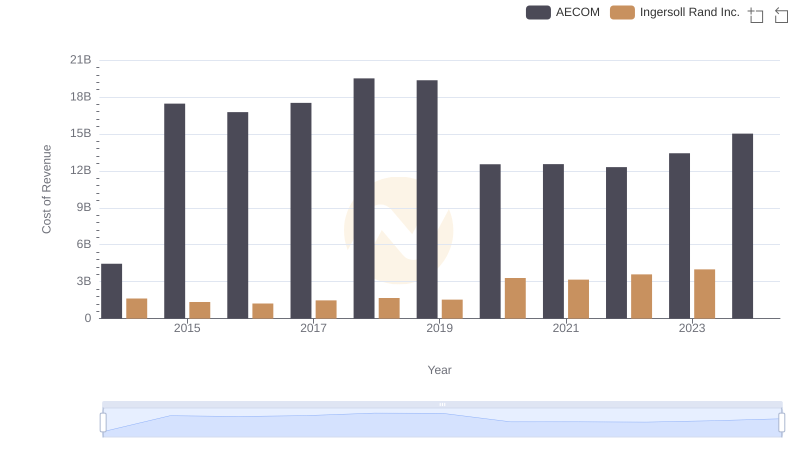

Cost Insights: Breaking Down Ingersoll Rand Inc. and AECOM's Expenses

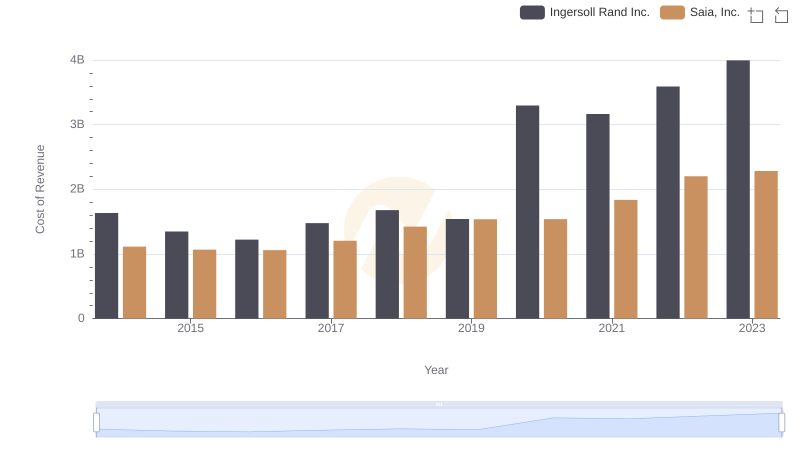

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Saia, Inc.

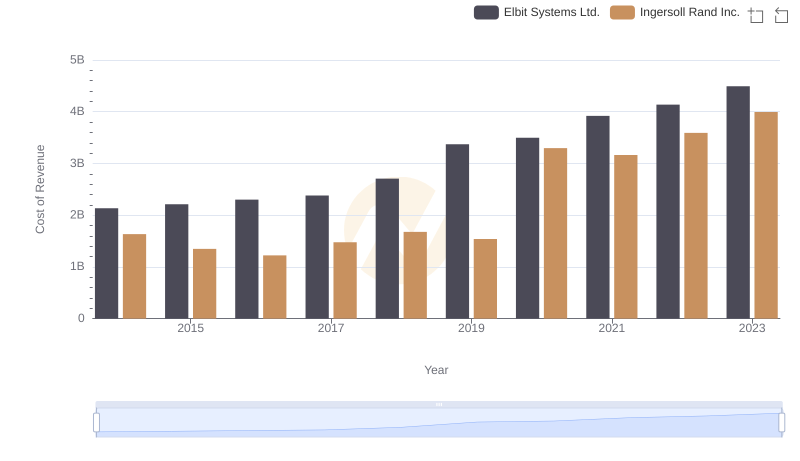

Cost of Revenue Trends: Ingersoll Rand Inc. vs Elbit Systems Ltd.

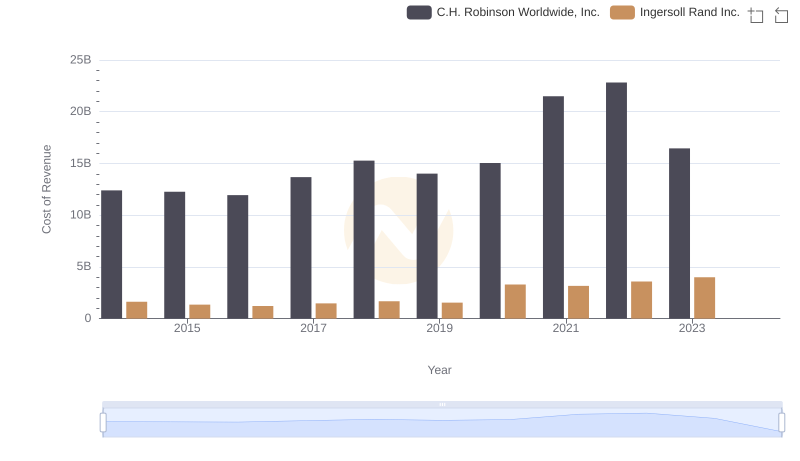

Cost Insights: Breaking Down Ingersoll Rand Inc. and C.H. Robinson Worldwide, Inc.'s Expenses

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and U-Haul Holding Company