| __timestamp | Ingersoll Rand Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 257168000 |

| Thursday, January 1, 2015 | 427000000 | 238558000 |

| Friday, January 1, 2016 | 414339000 | 217216000 |

| Sunday, January 1, 2017 | 446600000 | 220053000 |

| Monday, January 1, 2018 | 434600000 | 219271000 |

| Tuesday, January 1, 2019 | 436400000 | 133435000 |

| Wednesday, January 1, 2020 | 894800000 | 201718000 |

| Friday, January 1, 2021 | 1028000000 | 207982000 |

| Saturday, January 1, 2022 | 1095800000 | 216557000 |

| Sunday, January 1, 2023 | 1272700000 | 58753000 |

| Monday, January 1, 2024 | 0 | 32654000 |

Unleashing the power of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Ingersoll Rand Inc. and U-Haul Holding Company, two giants in their respective industries, offer a fascinating study in SG&A efficiency from 2014 to 2023.

Ingersoll Rand has seen a significant increase in SG&A expenses, rising by approximately 167% over the decade. This surge, peaking in 2023, reflects strategic investments in growth and innovation. However, the sharp rise in 2020 suggests a potential response to global economic shifts.

Conversely, U-Haul's SG&A expenses have decreased by about 77% since 2014, indicating a focus on cost efficiency and streamlined operations. The dramatic drop in 2023 could be attributed to strategic restructuring or market adaptation.

This analysis underscores the diverse strategies companies employ to navigate financial landscapes, offering valuable insights for investors and industry analysts.

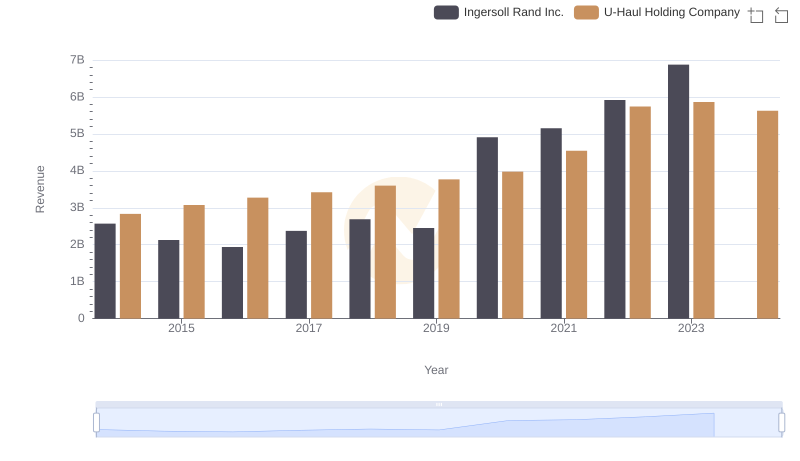

Revenue Showdown: Ingersoll Rand Inc. vs U-Haul Holding Company

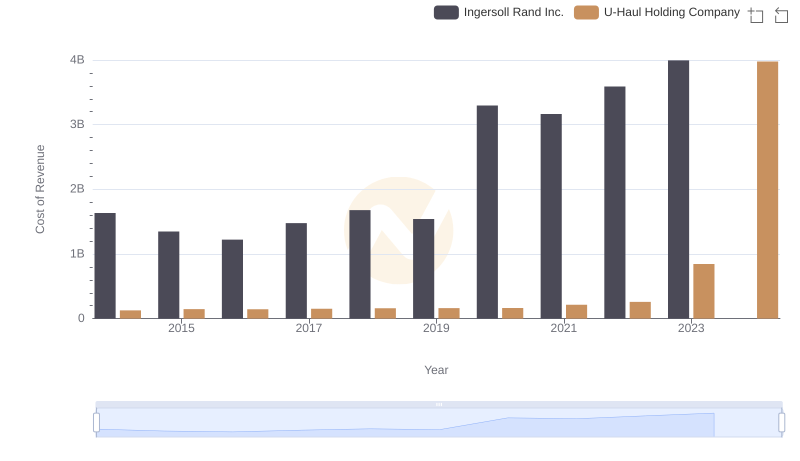

Ingersoll Rand Inc. vs U-Haul Holding Company: Efficiency in Cost of Revenue Explored

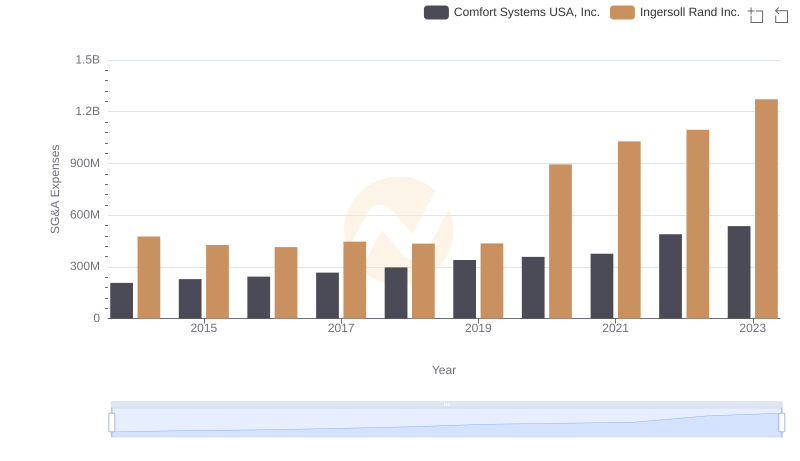

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Comfort Systems USA, Inc.

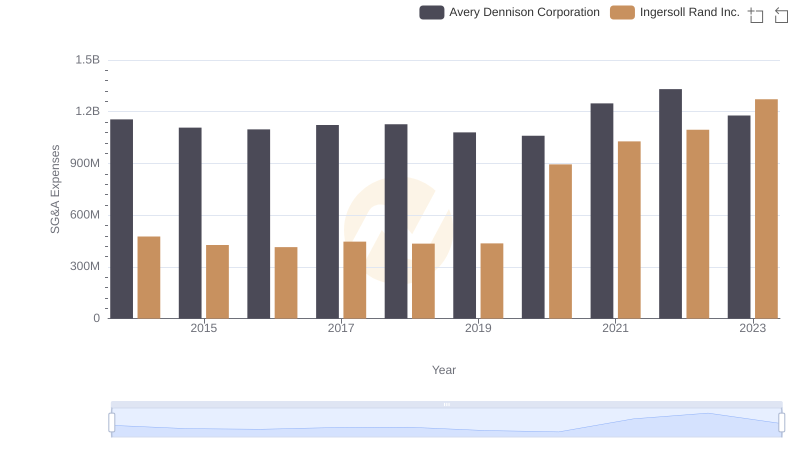

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Avery Dennison Corporation

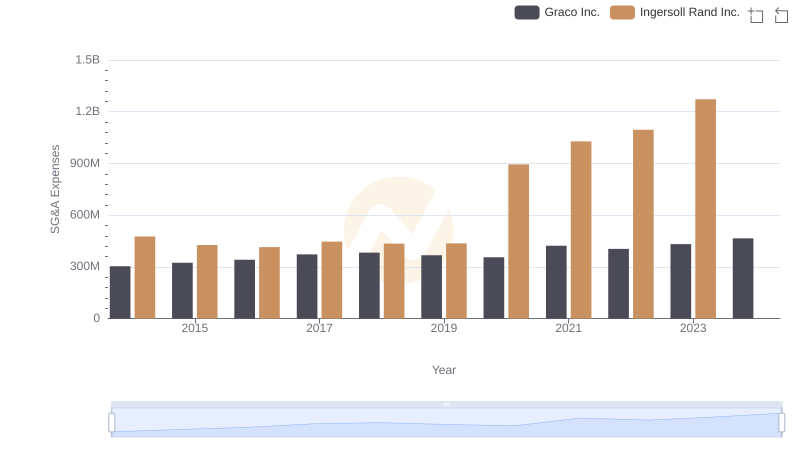

Ingersoll Rand Inc. vs Graco Inc.: SG&A Expense Trends

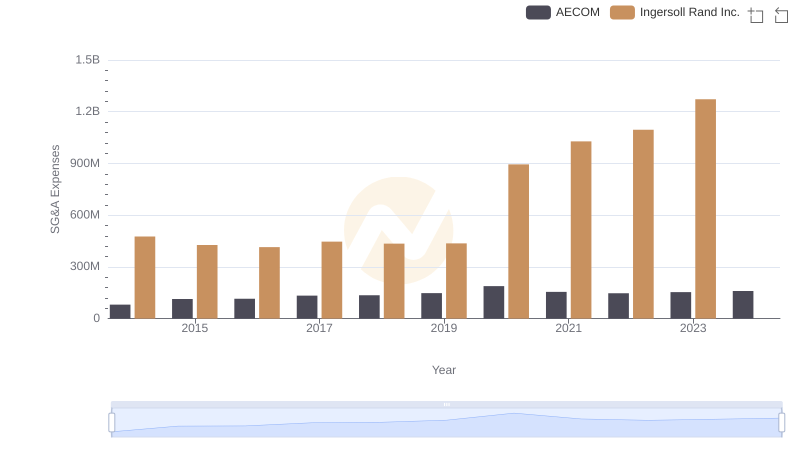

Ingersoll Rand Inc. or AECOM: Who Manages SG&A Costs Better?

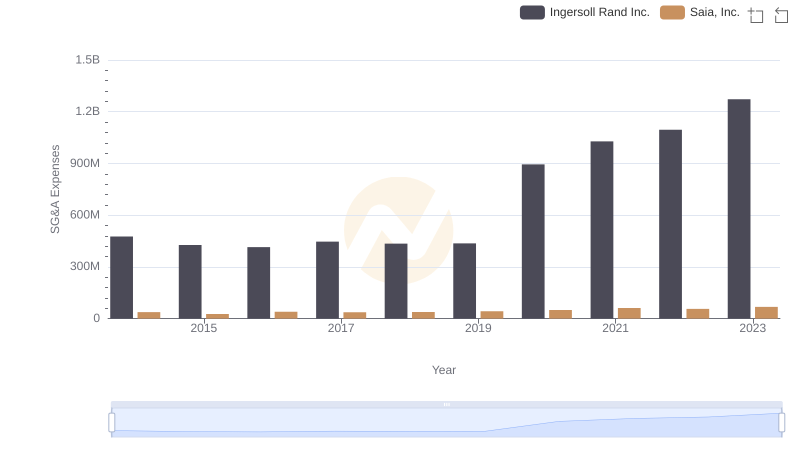

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Saia, Inc.

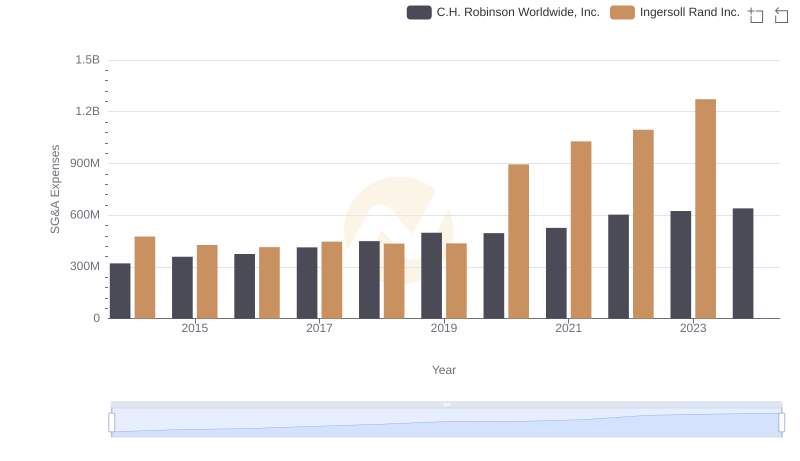

Breaking Down SG&A Expenses: Ingersoll Rand Inc. vs C.H. Robinson Worldwide, Inc.