| __timestamp | Axon Enterprise, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 776516000 |

| Thursday, January 1, 2015 | 128647000 | 783255000 |

| Friday, January 1, 2016 | 170536000 | 750483000 |

| Sunday, January 1, 2017 | 207088000 | 818595000 |

| Monday, January 1, 2018 | 258583000 | 871261000 |

| Tuesday, January 1, 2019 | 307286000 | 898745000 |

| Wednesday, January 1, 2020 | 416331000 | 841227000 |

| Friday, January 1, 2021 | 540910000 | 933356000 |

| Saturday, January 1, 2022 | 728638000 | 954609000 |

| Sunday, January 1, 2023 | 955382000 | 1067178000 |

| Monday, January 1, 2024 | 1153549000 |

Unleashing the power of data

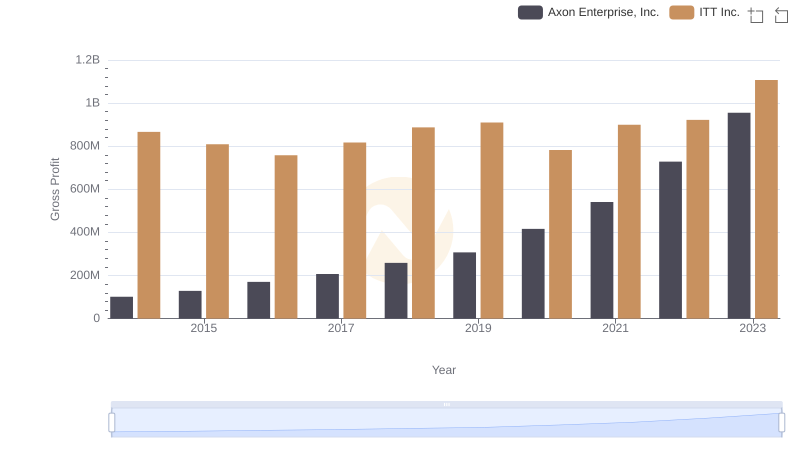

In the ever-evolving landscape of American industry, the financial trajectories of Axon Enterprise, Inc. and Curtiss-Wright Corporation offer a fascinating glimpse into the dynamics of innovation and tradition. Over the past decade, Axon Enterprise, known for its cutting-edge technology in public safety, has seen its gross profit skyrocket by over 840%, from approximately $101 million in 2014 to nearly $956 million in 2023. This remarkable growth underscores the increasing demand for advanced security solutions.

Conversely, Curtiss-Wright Corporation, a stalwart in the aerospace and defense sectors, has maintained a steady upward trend, with a gross profit increase of about 37% over the same period. By 2023, Curtiss-Wright's gross profit reached approximately $1.07 billion, reflecting its resilience and adaptability in a competitive market. This comparison highlights the diverse strategies and market forces shaping the financial landscapes of these two prominent companies.

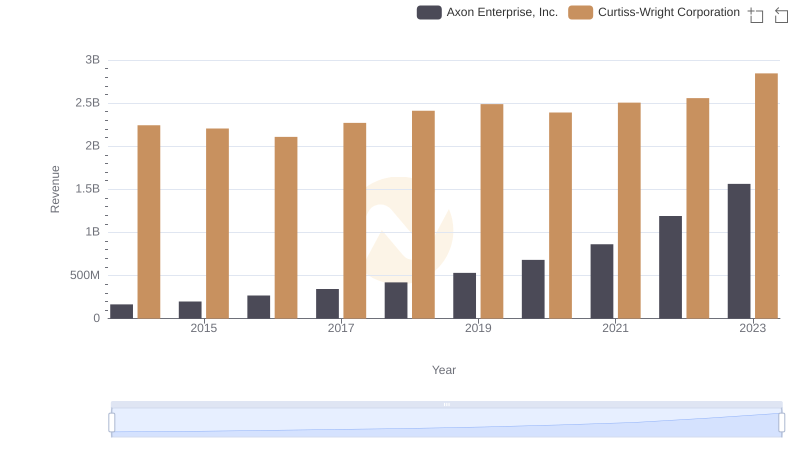

Annual Revenue Comparison: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

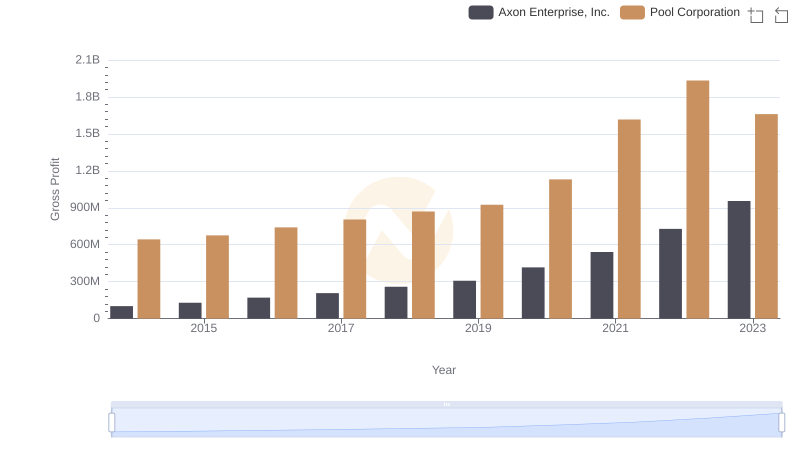

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Pool Corporation

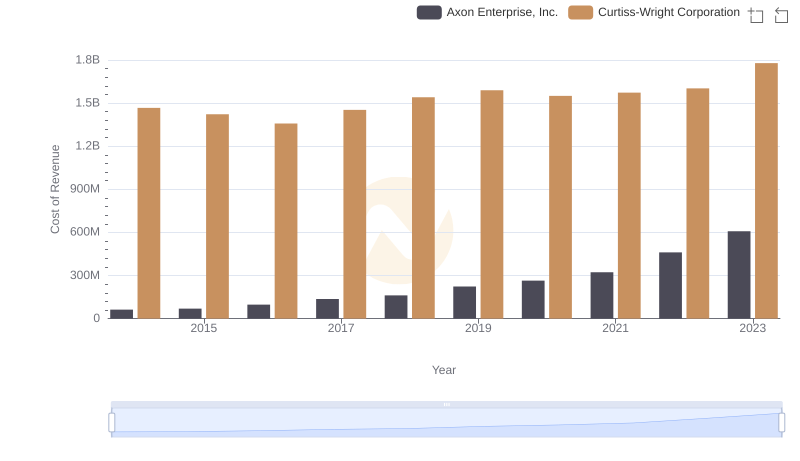

Cost of Revenue Trends: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

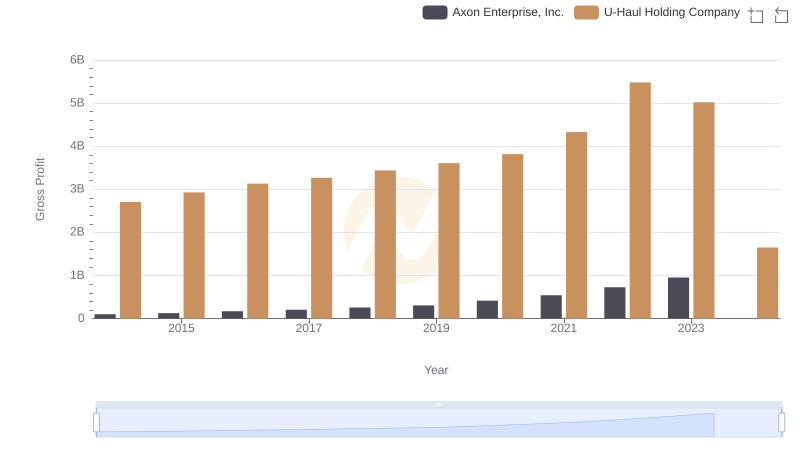

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and U-Haul Holding Company

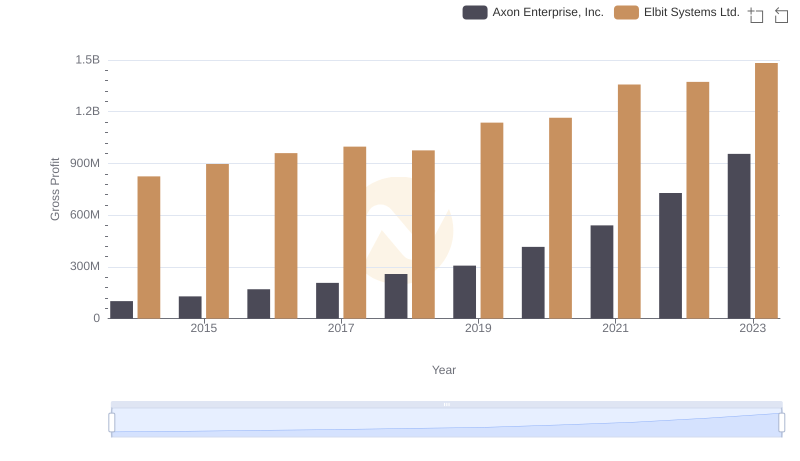

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Elbit Systems Ltd.

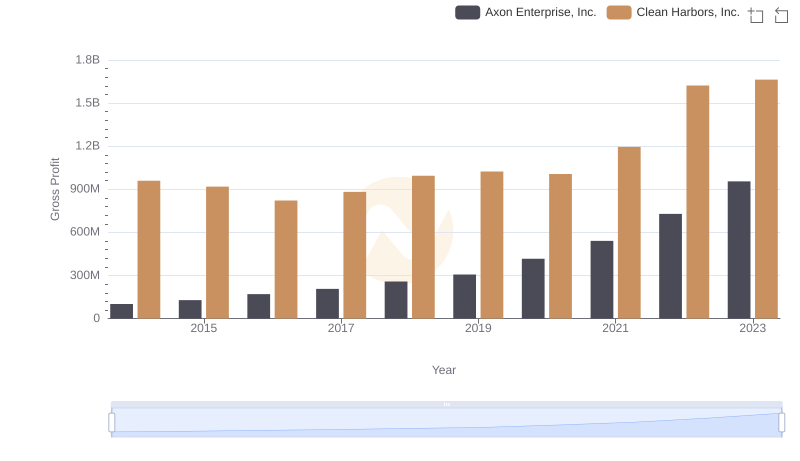

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Clean Harbors, Inc.

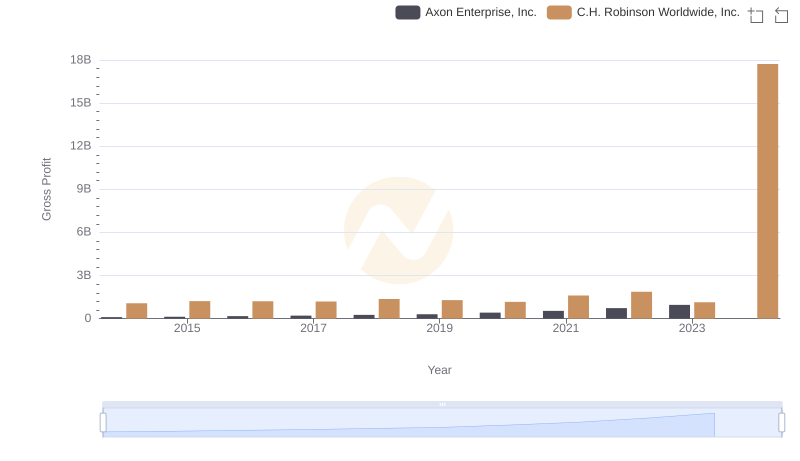

Gross Profit Trends Compared: Axon Enterprise, Inc. vs C.H. Robinson Worldwide, Inc.

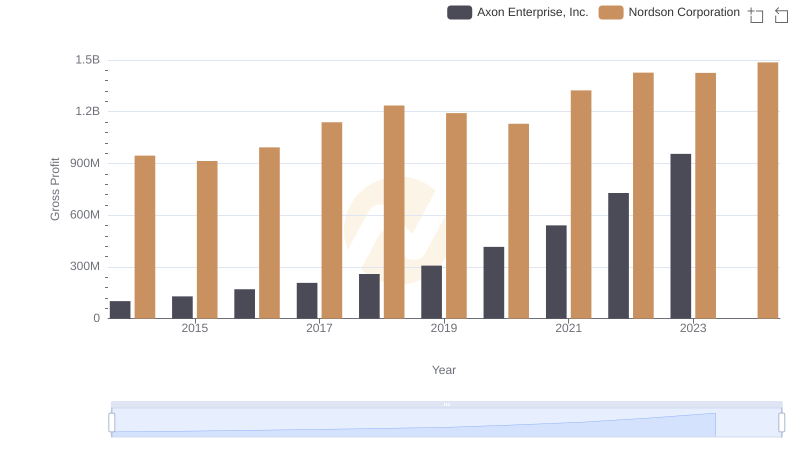

Axon Enterprise, Inc. vs Nordson Corporation: A Gross Profit Performance Breakdown

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and ITT Inc.

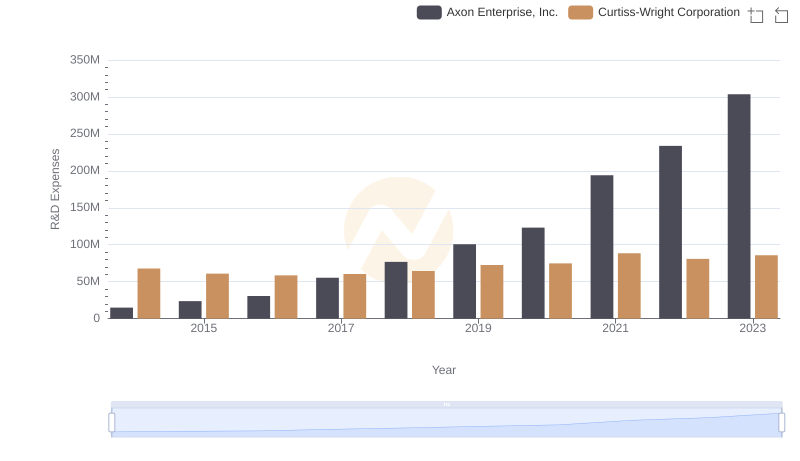

Research and Development Expenses Breakdown: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

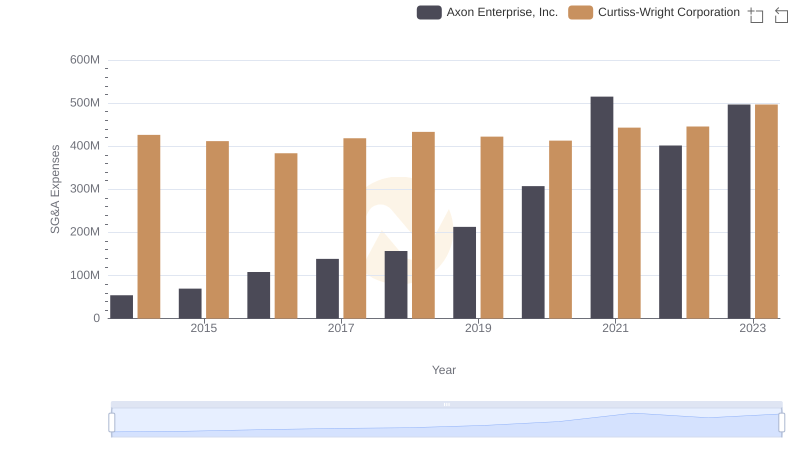

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Curtiss-Wright Corporation Trends and Insights