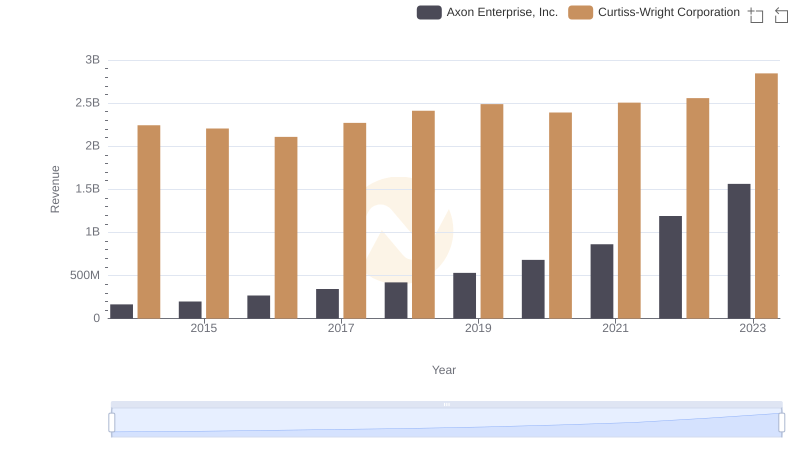

| __timestamp | Axon Enterprise, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 1466610000 |

| Thursday, January 1, 2015 | 69245000 | 1422428000 |

| Friday, January 1, 2016 | 97709000 | 1358448000 |

| Sunday, January 1, 2017 | 136710000 | 1452431000 |

| Monday, January 1, 2018 | 161485000 | 1540574000 |

| Tuesday, January 1, 2019 | 223574000 | 1589216000 |

| Wednesday, January 1, 2020 | 264672000 | 1550109000 |

| Friday, January 1, 2021 | 322471000 | 1572575000 |

| Saturday, January 1, 2022 | 461297000 | 1602416000 |

| Sunday, January 1, 2023 | 608009000 | 1778195000 |

| Monday, January 1, 2024 | 1967640000 |

In pursuit of knowledge

In the ever-evolving landscape of the defense and technology sectors, understanding cost dynamics is crucial. Axon Enterprise, Inc. and Curtiss-Wright Corporation, two giants in their respective fields, have shown distinct trends in their cost of revenue from 2014 to 2023. Axon, known for its innovative public safety solutions, has seen its cost of revenue grow by nearly 900% over this period, reflecting its aggressive expansion and increased production capabilities. In contrast, Curtiss-Wright, a stalwart in the aerospace and defense industry, has maintained a relatively stable cost structure, with only a 21% increase. This stability underscores its strategic focus on operational efficiency and cost management. The data reveals a fascinating juxtaposition: while Axon scales rapidly, Curtiss-Wright exemplifies steady growth. These insights provide a window into the strategic priorities and market positioning of these industry leaders.

Annual Revenue Comparison: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

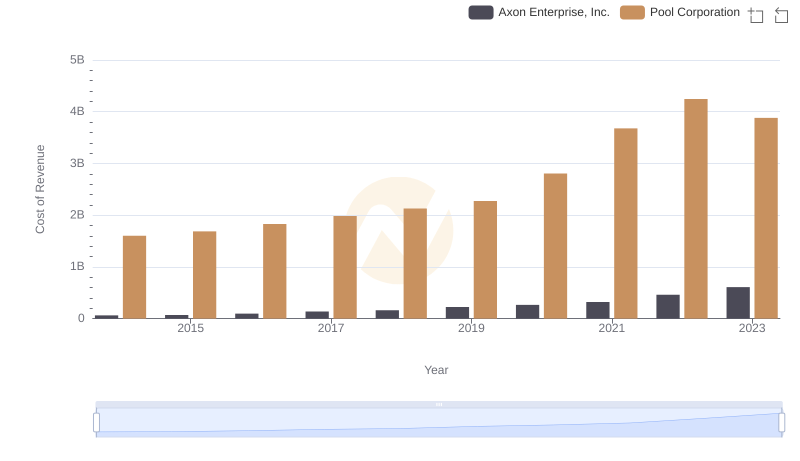

Cost of Revenue Comparison: Axon Enterprise, Inc. vs Pool Corporation

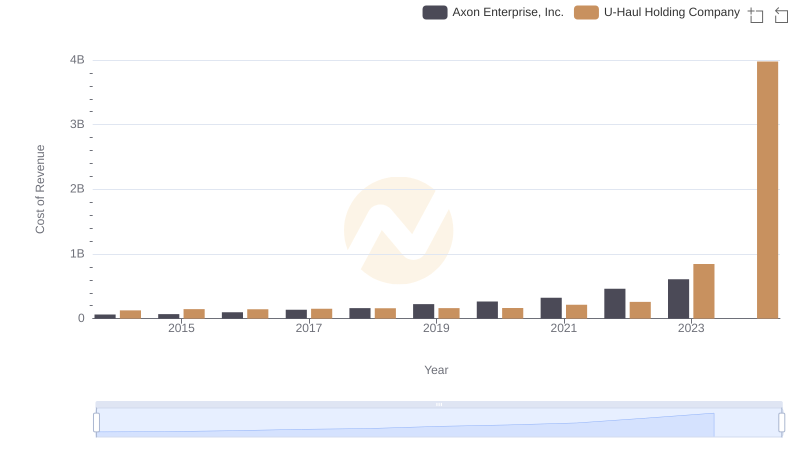

Cost Insights: Breaking Down Axon Enterprise, Inc. and U-Haul Holding Company's Expenses

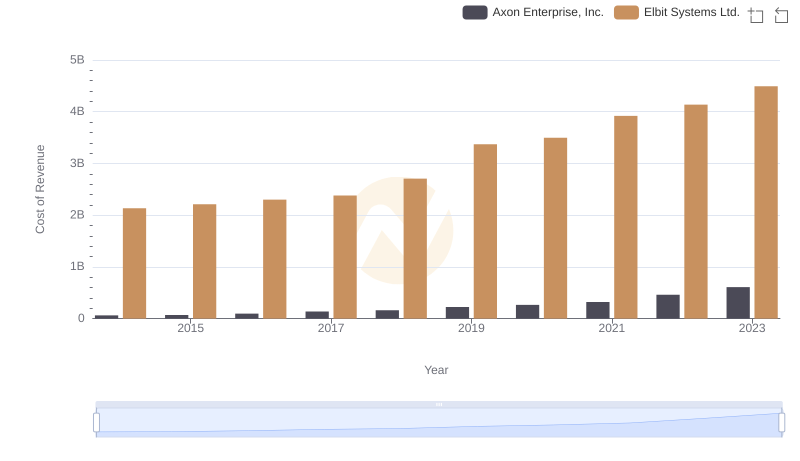

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Elbit Systems Ltd.

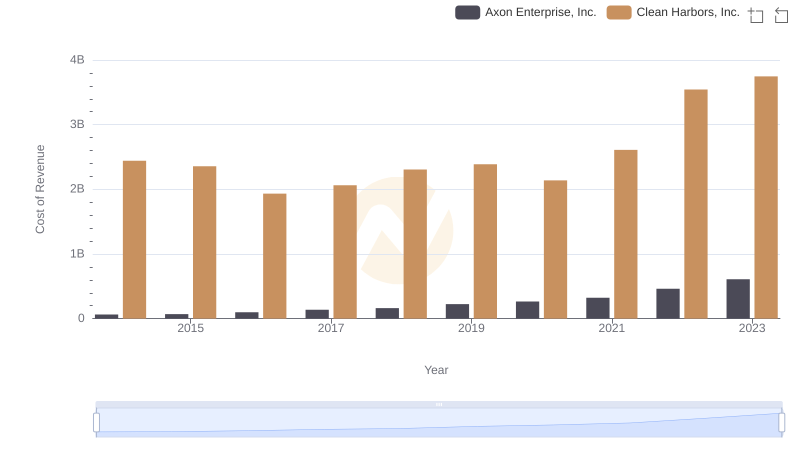

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Clean Harbors, Inc.

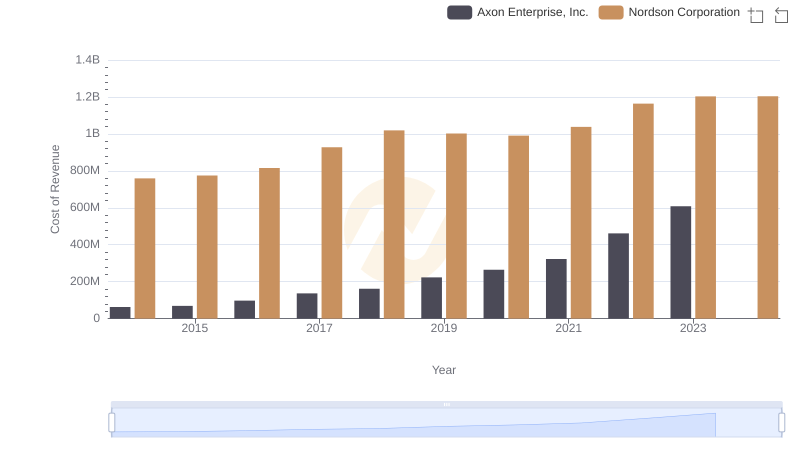

Cost of Revenue Trends: Axon Enterprise, Inc. vs Nordson Corporation

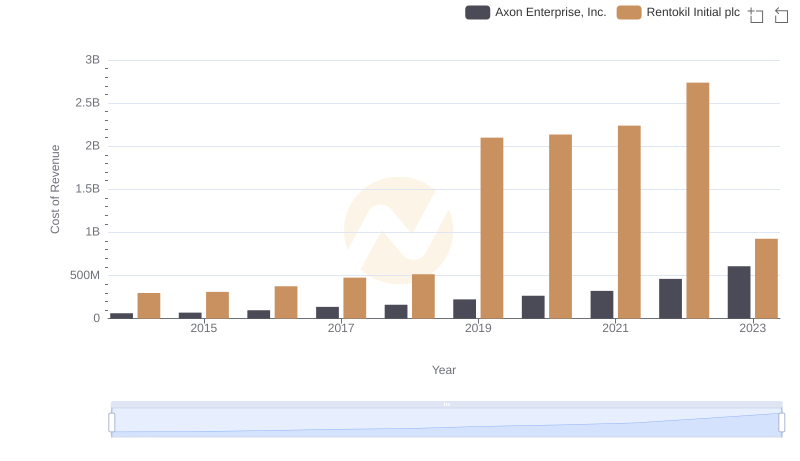

Axon Enterprise, Inc. vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

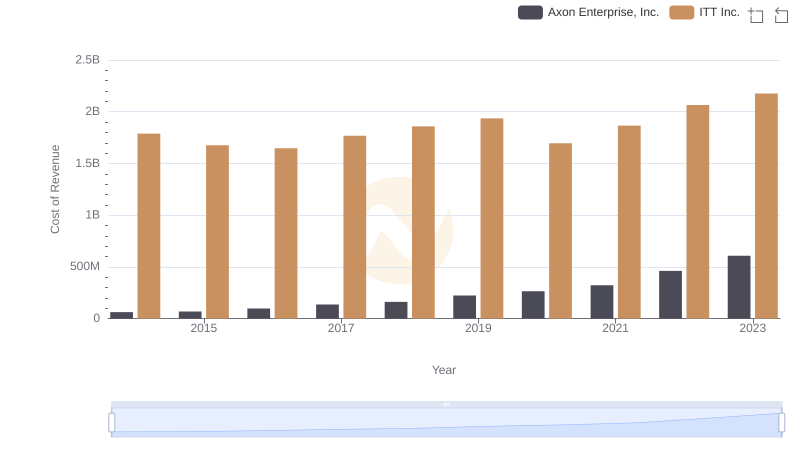

Analyzing Cost of Revenue: Axon Enterprise, Inc. and ITT Inc.

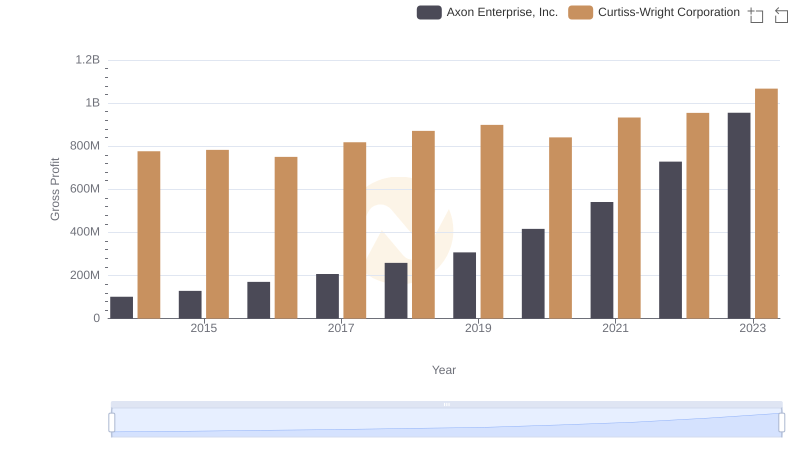

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

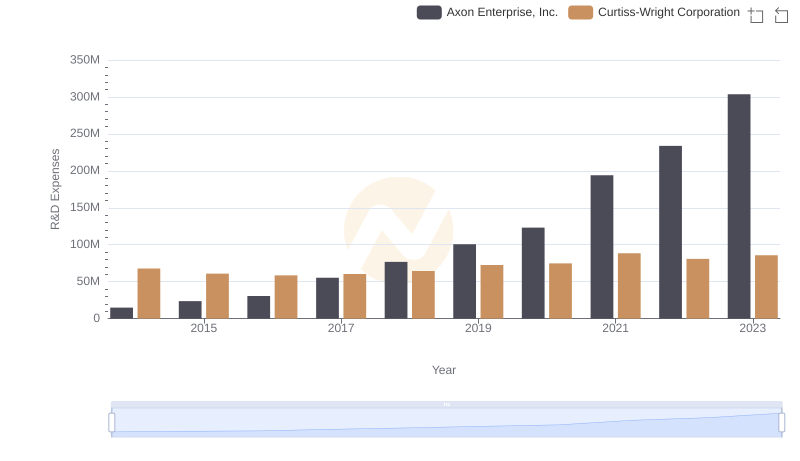

Research and Development Expenses Breakdown: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

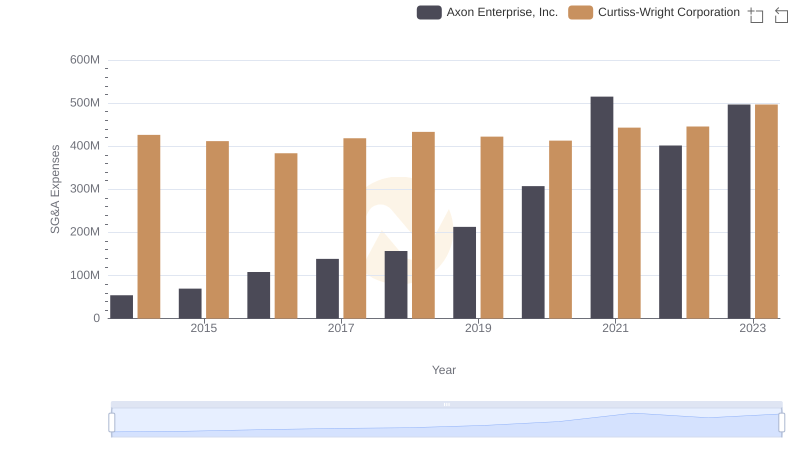

Comparing SG&A Expenses: Axon Enterprise, Inc. vs Curtiss-Wright Corporation Trends and Insights