| __timestamp | Automatic Data Processing, Inc. | Ferrovial SE |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 7671000000 |

| Thursday, January 1, 2015 | 4133200000 | 8556000000 |

| Friday, January 1, 2016 | 4450200000 | 9491000000 |

| Sunday, January 1, 2017 | 4712600000 | 10864000000 |

| Monday, January 1, 2018 | 5016700000 | 4752000000 |

| Tuesday, January 1, 2019 | 5526700000 | 5105000000 |

| Wednesday, January 1, 2020 | 6144700000 | 5336000000 |

| Friday, January 1, 2021 | 6365100000 | 5701000000 |

| Saturday, January 1, 2022 | 7036400000 | 6354000000 |

| Sunday, January 1, 2023 | 8058800000 | 7385000000 |

| Monday, January 1, 2024 | 8725900000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, Automatic Data Processing, Inc. (ADP) and Ferrovial SE stand as titans in their respective industries. Over the past decade, these companies have showcased remarkable trends in gross profit, reflecting their strategic prowess and market adaptability.

From 2014 to 2023, ADP's gross profit surged by approximately 89%, highlighting its robust growth trajectory in the payroll and human resources sector. In contrast, Ferrovial SE, a leader in infrastructure and mobility, experienced a more volatile journey, with a notable dip in 2018 but a resilient recovery thereafter.

Interestingly, while ADP's profits consistently climbed, Ferrovial's figures reveal a more cyclical pattern, underscoring the diverse challenges and opportunities in infrastructure. As we look to 2024, ADP's data remains complete, whereas Ferrovial's is yet to be fully unveiled, leaving room for speculation and anticipation.

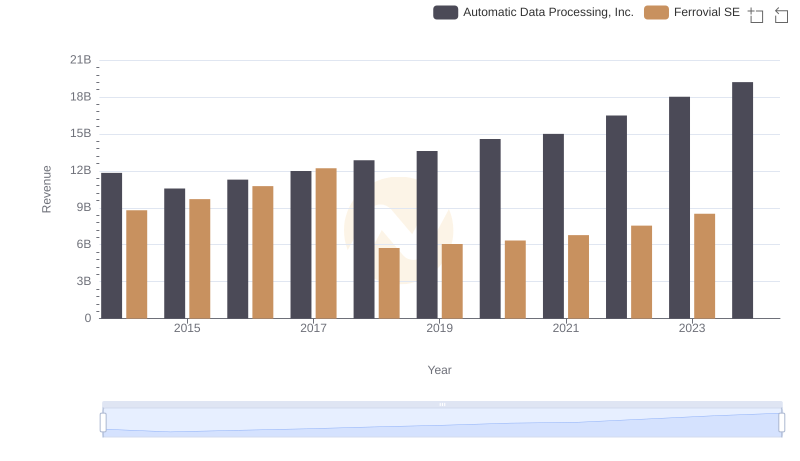

Revenue Insights: Automatic Data Processing, Inc. and Ferrovial SE Performance Compared

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Ingersoll Rand Inc.

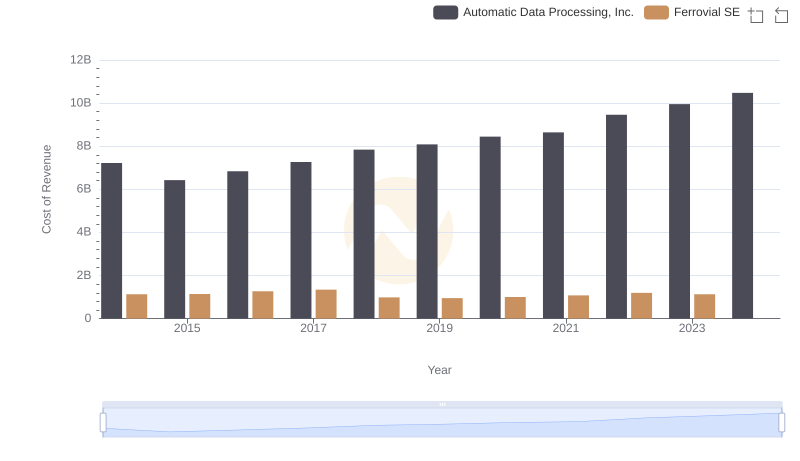

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Ferrovial SE

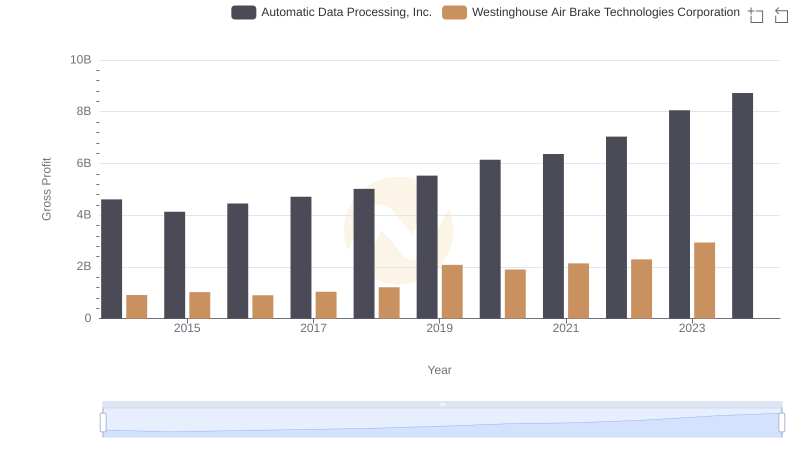

Gross Profit Comparison: Automatic Data Processing, Inc. and Westinghouse Air Brake Technologies Corporation Trends

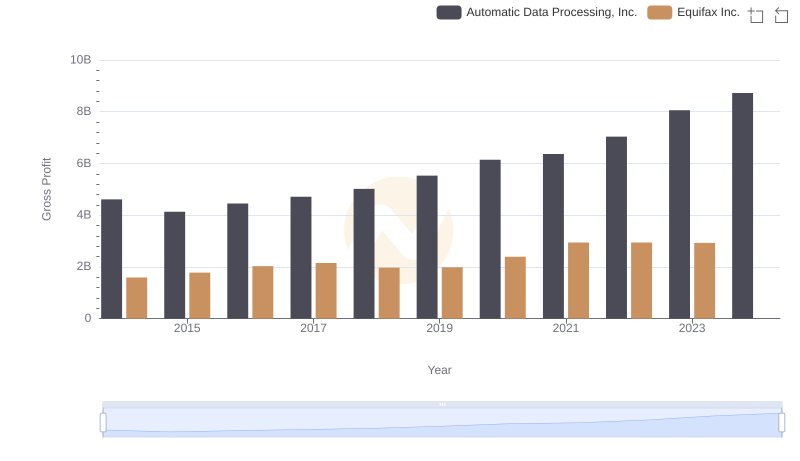

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Equifax Inc.

Gross Profit Comparison: Automatic Data Processing, Inc. and Dover Corporation Trends

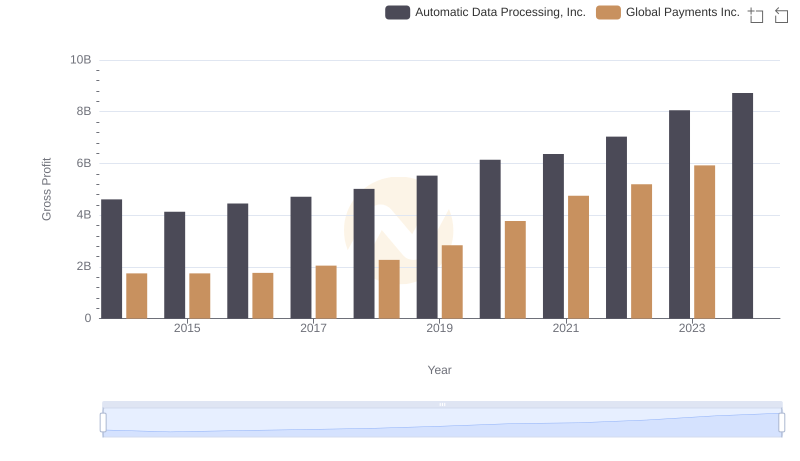

Automatic Data Processing, Inc. and Global Payments Inc.: A Detailed Gross Profit Analysis