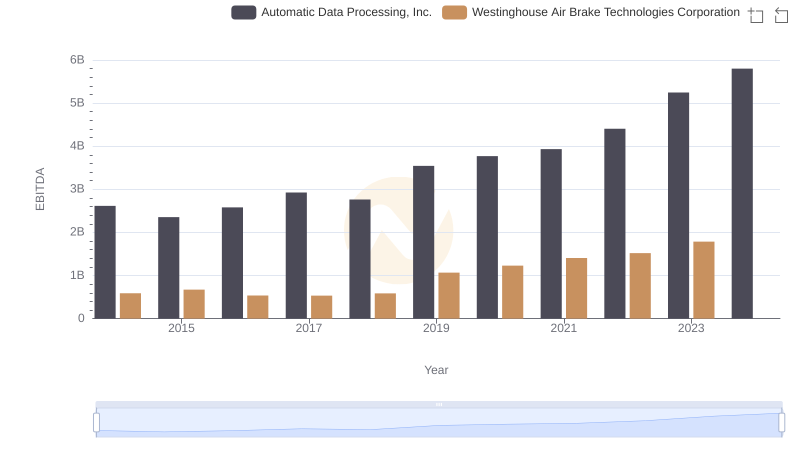

| __timestamp | Automatic Data Processing, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 913534000 |

| Thursday, January 1, 2015 | 4133200000 | 1026153000 |

| Friday, January 1, 2016 | 4450200000 | 901541000 |

| Sunday, January 1, 2017 | 4712600000 | 1040597000 |

| Monday, January 1, 2018 | 5016700000 | 1211731000 |

| Tuesday, January 1, 2019 | 5526700000 | 2077600000 |

| Wednesday, January 1, 2020 | 6144700000 | 1898700000 |

| Friday, January 1, 2021 | 6365100000 | 2135000000 |

| Saturday, January 1, 2022 | 7036400000 | 2292000000 |

| Sunday, January 1, 2023 | 8058800000 | 2944000000 |

| Monday, January 1, 2024 | 8725900000 | 3366000000 |

Infusing magic into the data realm

In the ever-evolving landscape of American industry, Automatic Data Processing, Inc. (ADP) and Westinghouse Air Brake Technologies Corporation (WAB) stand as titans in their respective fields. Over the past decade, ADP has demonstrated a remarkable growth trajectory, with its gross profit surging by approximately 89% from 2014 to 2023. This growth reflects ADP's strategic expansion and innovation in the human resources and payroll services sector.

Conversely, WAB, a leader in the rail industry, has experienced a more modest yet steady increase in gross profit, growing by around 222% over the same period. This growth underscores WAB's resilience and adaptability in a challenging market. However, data for 2024 remains elusive, leaving room for speculation on future trends.

As these two giants continue to navigate their respective markets, their financial performances offer valuable insights into the broader economic landscape.

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Ingersoll Rand Inc.

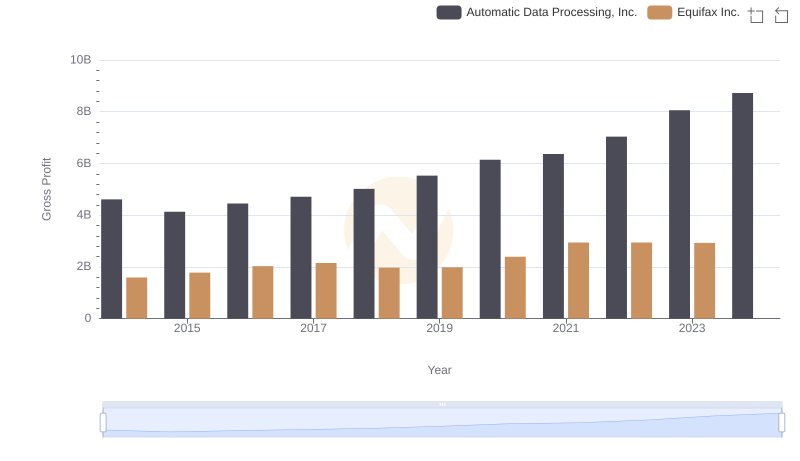

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Equifax Inc.

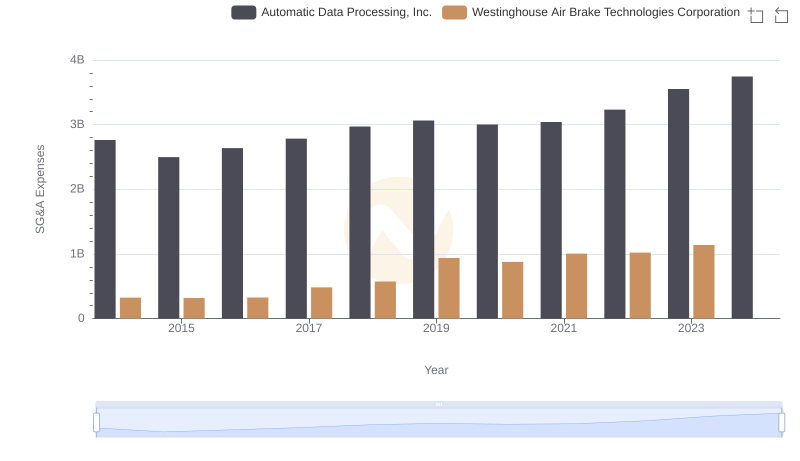

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

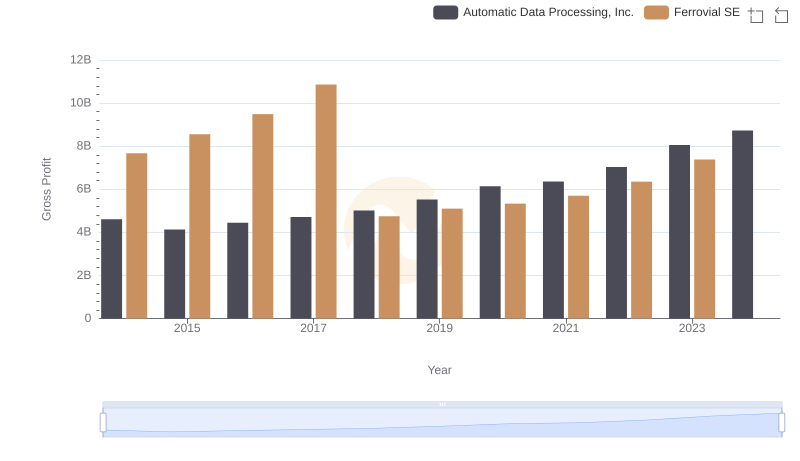

Gross Profit Comparison: Automatic Data Processing, Inc. and Ferrovial SE Trends

Gross Profit Comparison: Automatic Data Processing, Inc. and Dover Corporation Trends

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation