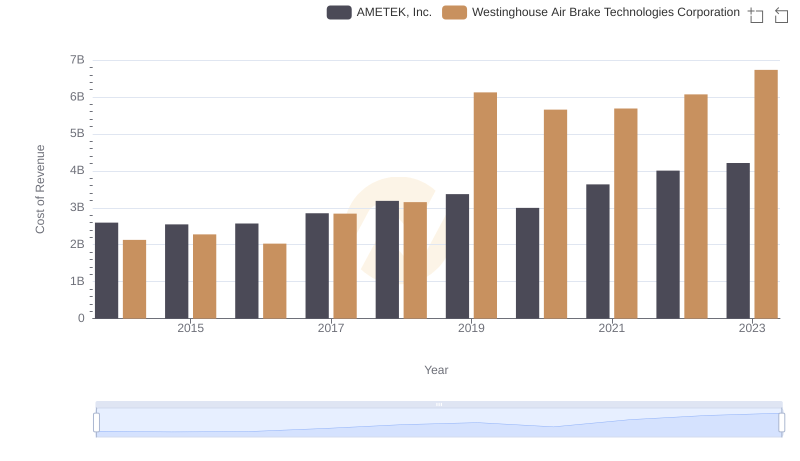

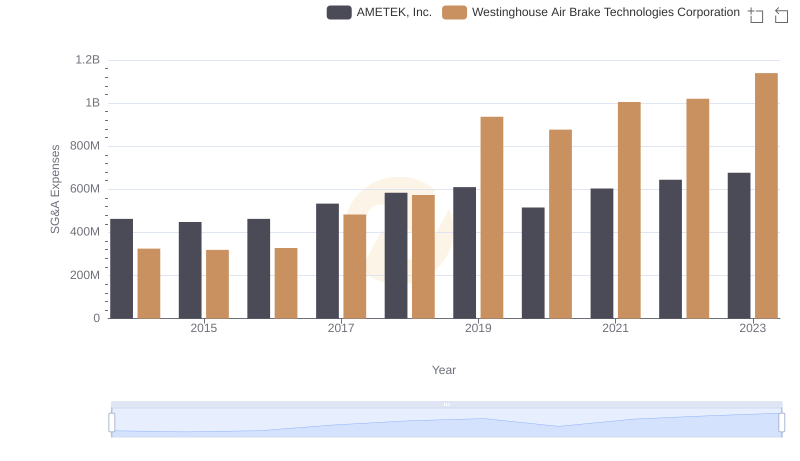

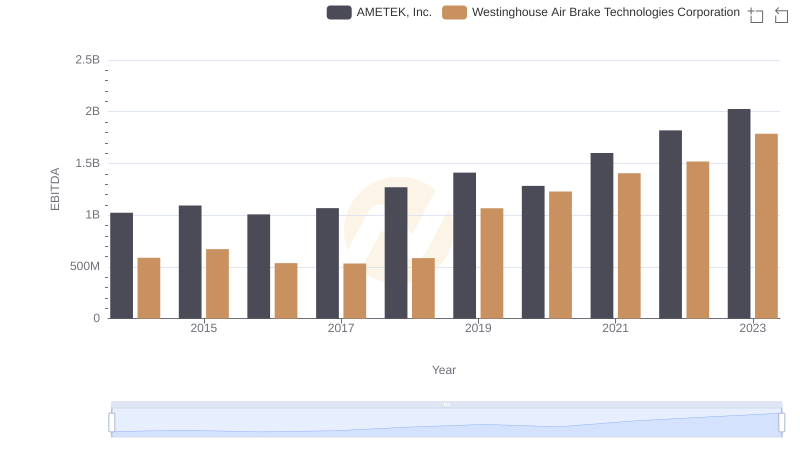

| __timestamp | AMETEK, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1424947000 | 913534000 |

| Thursday, January 1, 2015 | 1425015000 | 1026153000 |

| Friday, January 1, 2016 | 1264867000 | 901541000 |

| Sunday, January 1, 2017 | 1448739000 | 1040597000 |

| Monday, January 1, 2018 | 1659562000 | 1211731000 |

| Tuesday, January 1, 2019 | 1787660000 | 2077600000 |

| Wednesday, January 1, 2020 | 1543514000 | 1898700000 |

| Friday, January 1, 2021 | 1912614000 | 2135000000 |

| Saturday, January 1, 2022 | 2145269000 | 2292000000 |

| Sunday, January 1, 2023 | 2384465001 | 2944000000 |

| Monday, January 1, 2024 | 6941180000 | 3366000000 |

Unleashing insights

In the world of industrial manufacturing, AMETEK, Inc. and Westinghouse Air Brake Technologies Corporation (Wabtec) have been formidable players. Over the past decade, their gross profit trends reveal a fascinating narrative of growth and resilience. From 2014 to 2023, AMETEK's gross profit surged by approximately 67%, while Wabtec's increased by an impressive 222%. This period saw AMETEK's profits rise steadily, peaking in 2023, while Wabtec experienced a more volatile journey, with a significant leap in 2019. By 2023, Wabtec's gross profit outpaced AMETEK's by about 23%, highlighting its robust expansion strategy. These trends underscore the dynamic nature of the industrial sector, where strategic decisions and market conditions can dramatically alter financial trajectories. As these companies continue to innovate, their financial performances will be closely watched by investors and industry analysts alike.

Cost Insights: Breaking Down AMETEK, Inc. and Westinghouse Air Brake Technologies Corporation's Expenses

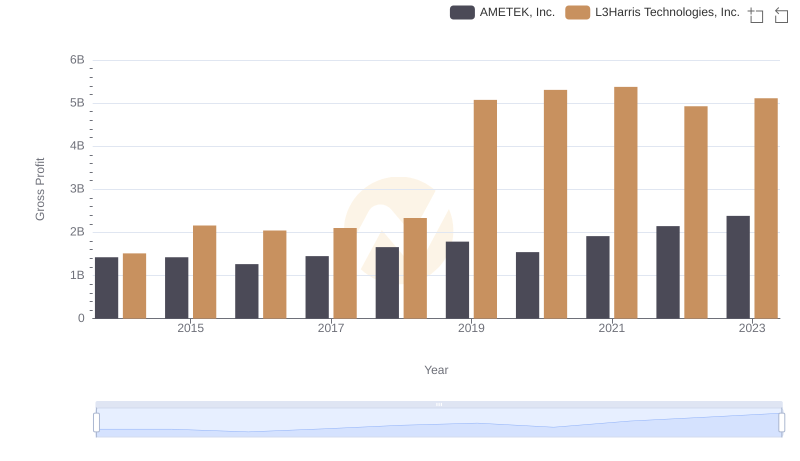

AMETEK, Inc. vs L3Harris Technologies, Inc.: A Gross Profit Performance Breakdown

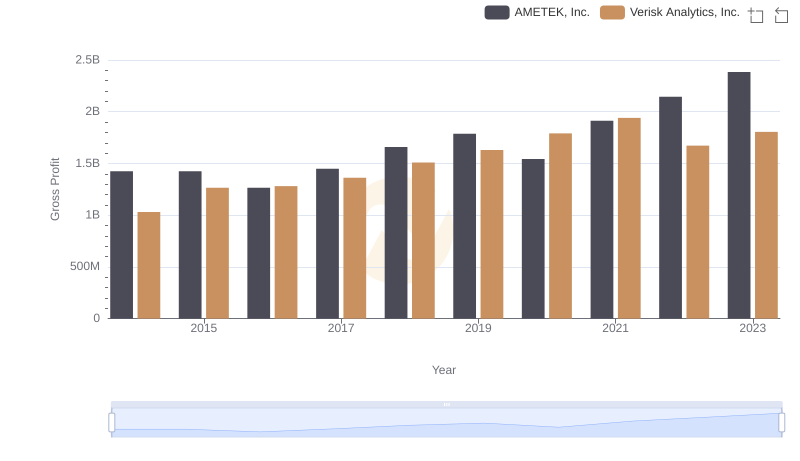

AMETEK, Inc. and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

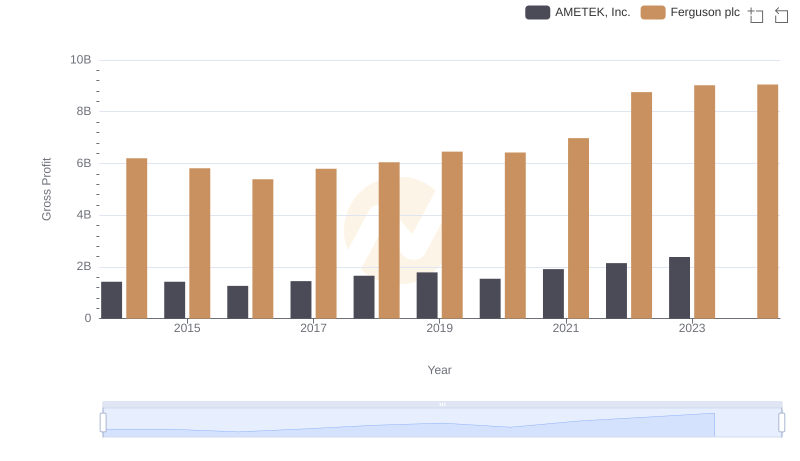

Key Insights on Gross Profit: AMETEK, Inc. vs Ferguson plc

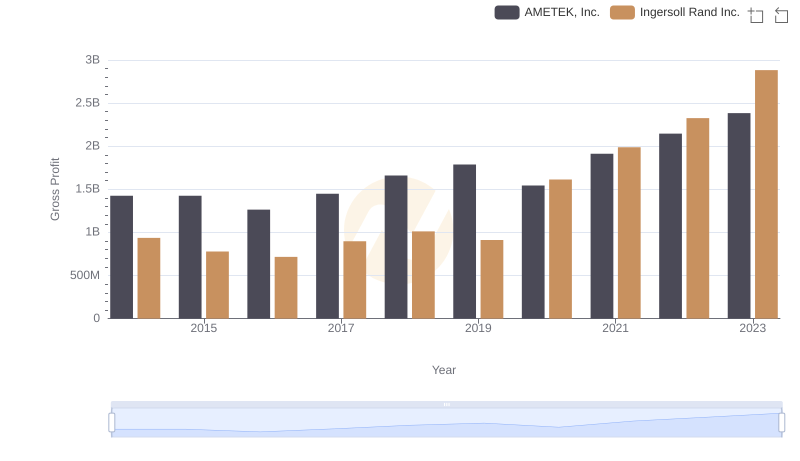

Gross Profit Comparison: AMETEK, Inc. and Ingersoll Rand Inc. Trends

Selling, General, and Administrative Costs: AMETEK, Inc. vs Westinghouse Air Brake Technologies Corporation

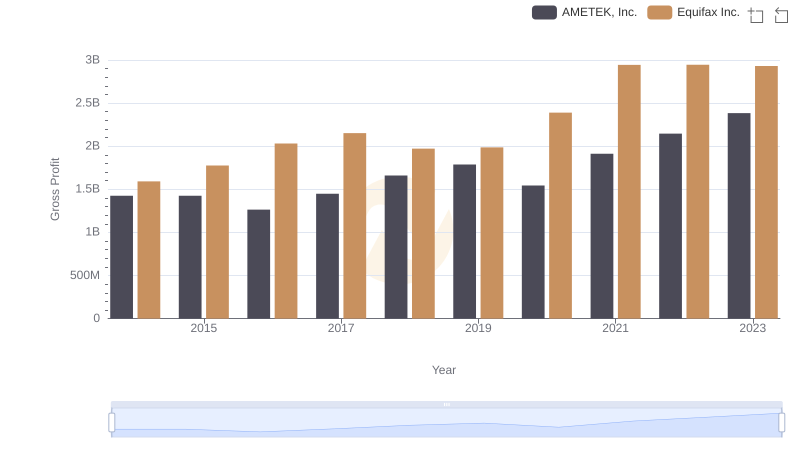

Gross Profit Trends Compared: AMETEK, Inc. vs Equifax Inc.

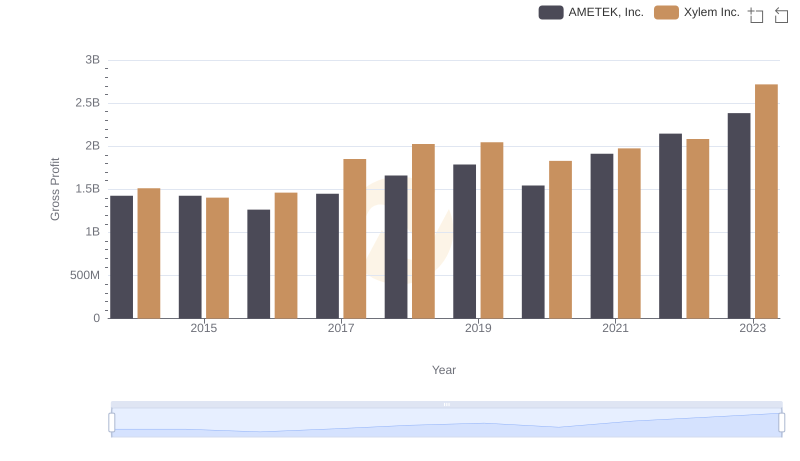

AMETEK, Inc. vs Xylem Inc.: A Gross Profit Performance Breakdown

Key Insights on Gross Profit: AMETEK, Inc. vs Ferrovial SE

A Professional Review of EBITDA: AMETEK, Inc. Compared to Westinghouse Air Brake Technologies Corporation