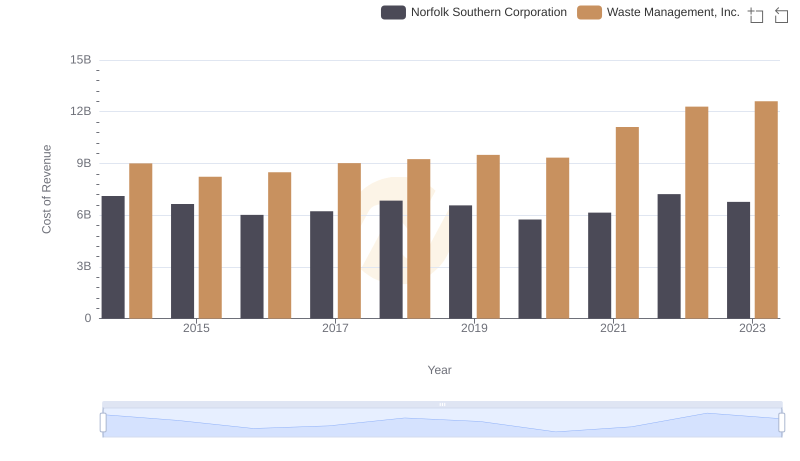

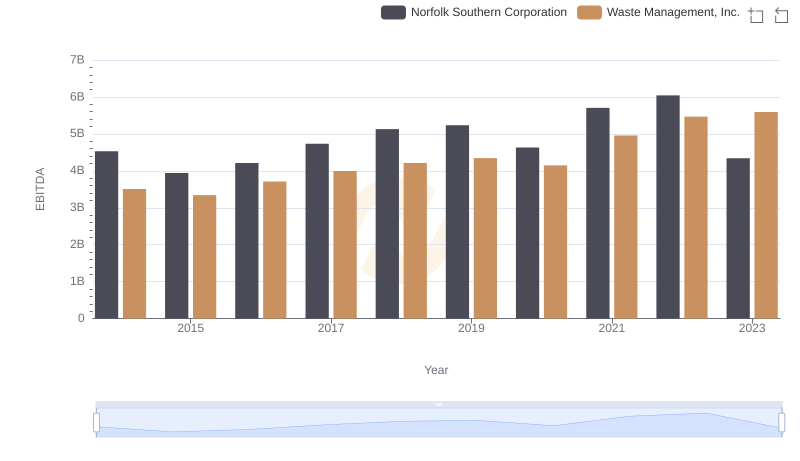

| __timestamp | Norfolk Southern Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4515000000 | 4994000000 |

| Thursday, January 1, 2015 | 3860000000 | 4730000000 |

| Friday, January 1, 2016 | 3873000000 | 5123000000 |

| Sunday, January 1, 2017 | 4327000000 | 5464000000 |

| Monday, January 1, 2018 | 4614000000 | 5665000000 |

| Tuesday, January 1, 2019 | 4729000000 | 5959000000 |

| Wednesday, January 1, 2020 | 4040000000 | 5877000000 |

| Friday, January 1, 2021 | 4994000000 | 6820000000 |

| Saturday, January 1, 2022 | 5522000000 | 7404000000 |

| Sunday, January 1, 2023 | 5382000000 | 7820000000 |

| Monday, January 1, 2024 | 4543000000 | 8680000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of American industry, Waste Management, Inc. and Norfolk Southern Corporation stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Waste Management, Inc. has consistently outperformed Norfolk Southern, with an average gross profit approximately 30% higher. Notably, Waste Management's gross profit surged by 57% from 2014 to 2023, peaking at $7.82 billion in 2023. This growth underscores the increasing demand for sustainable waste solutions.

Conversely, Norfolk Southern experienced a more modest growth of 19% over the same period, reaching $5.38 billion in 2023. This reflects the challenges faced by the rail industry amidst fluctuating economic conditions.

These trends highlight the dynamic nature of these industries and the strategic decisions that drive their financial success.

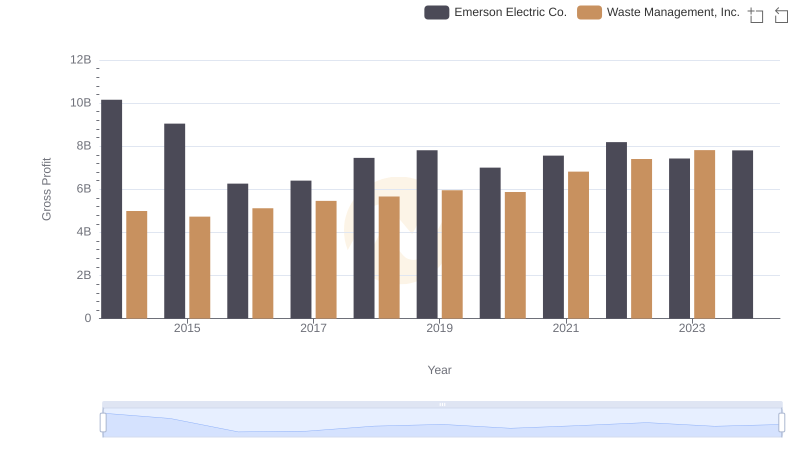

Who Generates Higher Gross Profit? Waste Management, Inc. or Emerson Electric Co.

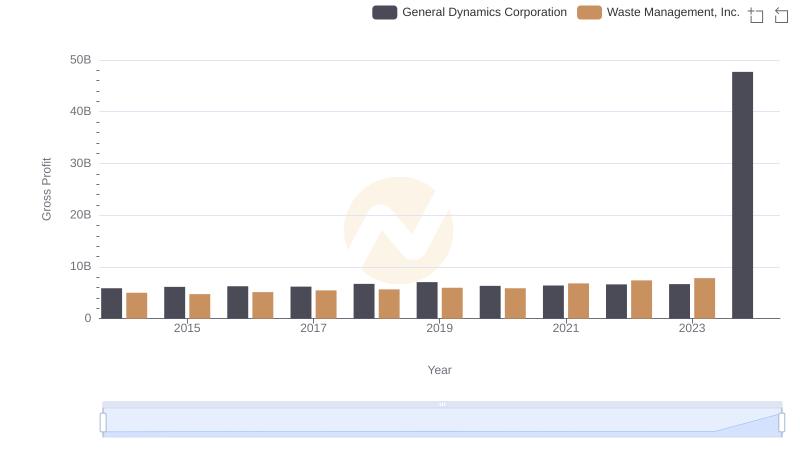

Gross Profit Trends Compared: Waste Management, Inc. vs General Dynamics Corporation

Analyzing Cost of Revenue: Waste Management, Inc. and Norfolk Southern Corporation

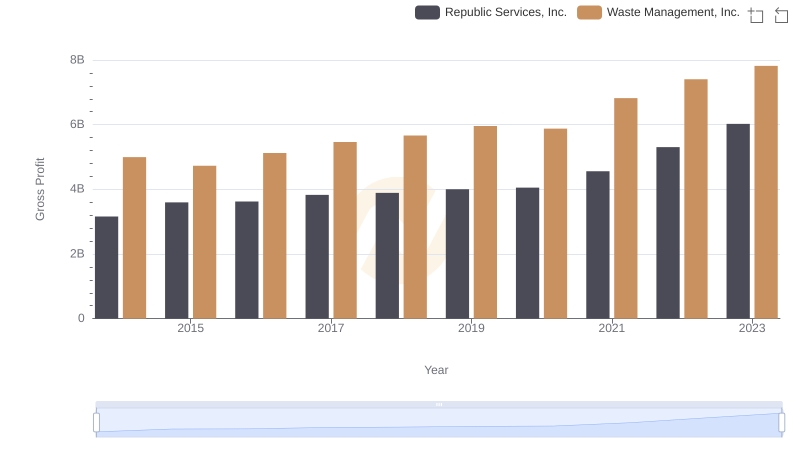

Waste Management, Inc. vs Republic Services, Inc.: A Gross Profit Performance Breakdown

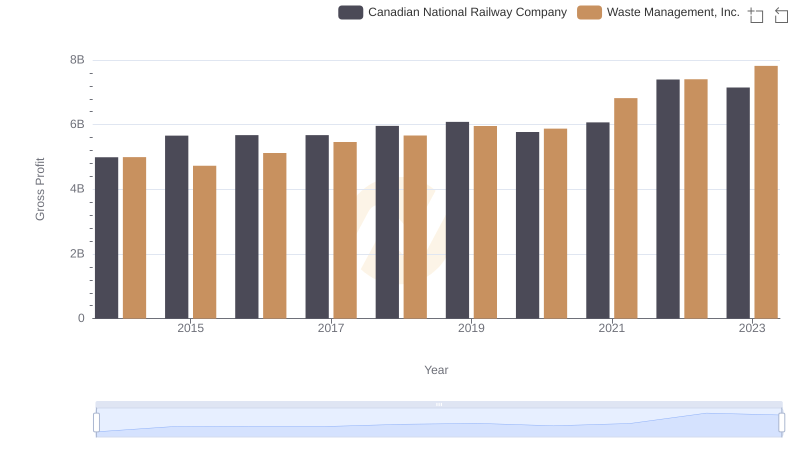

Who Generates Higher Gross Profit? Waste Management, Inc. or Canadian National Railway Company

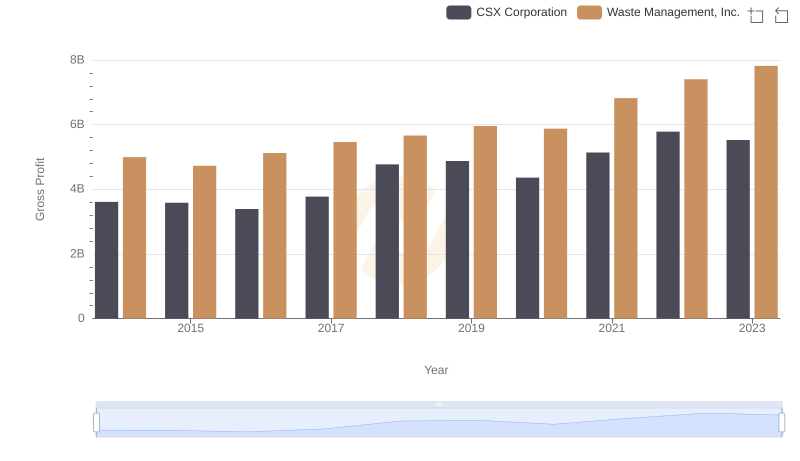

Waste Management, Inc. vs CSX Corporation: A Gross Profit Performance Breakdown

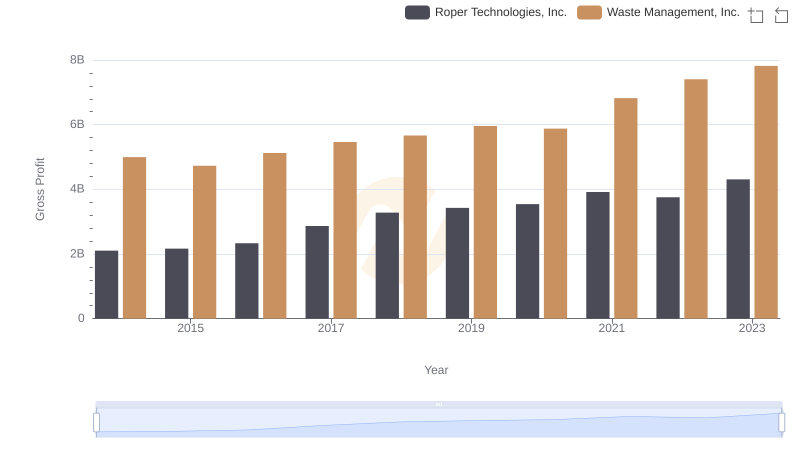

Who Generates Higher Gross Profit? Waste Management, Inc. or Roper Technologies, Inc.

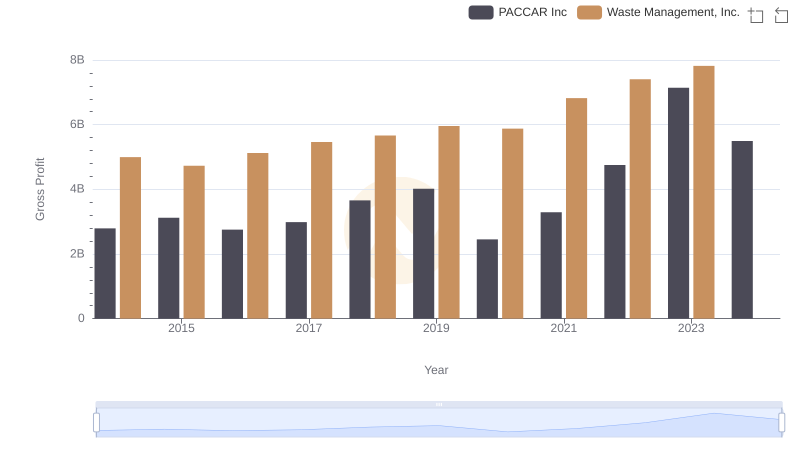

Key Insights on Gross Profit: Waste Management, Inc. vs PACCAR Inc

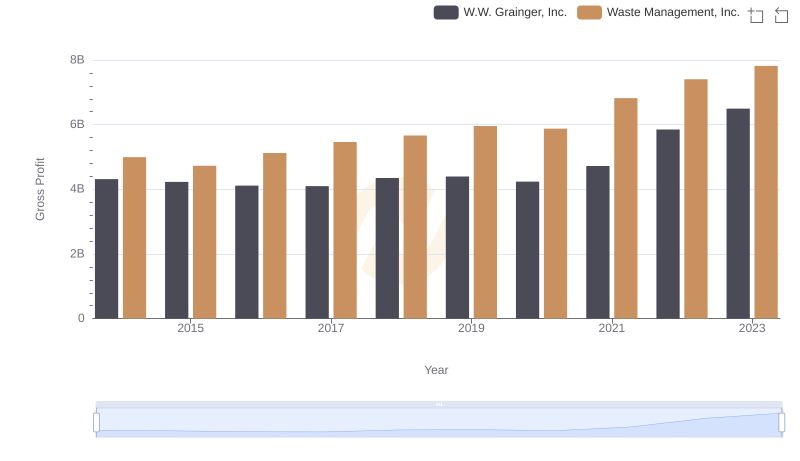

Gross Profit Trends Compared: Waste Management, Inc. vs W.W. Grainger, Inc.

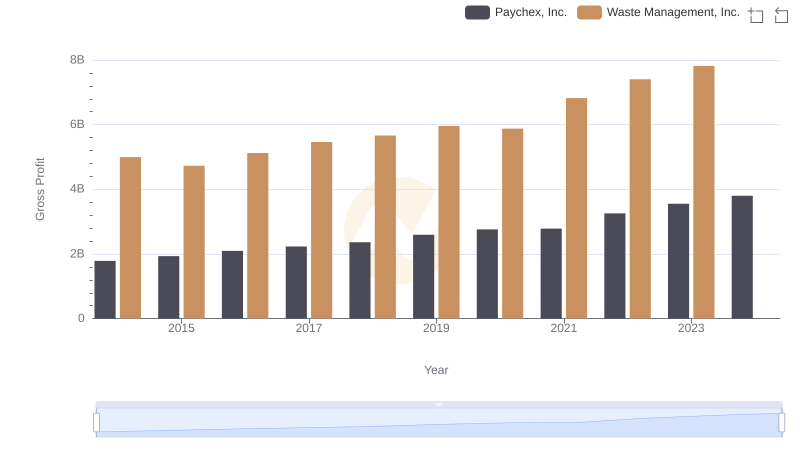

Gross Profit Comparison: Waste Management, Inc. and Paychex, Inc. Trends

Waste Management, Inc. and Norfolk Southern Corporation: A Detailed Examination of EBITDA Performance