| __timestamp | Canadian National Railway Company | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 3908600000 |

| Thursday, January 1, 2015 | 5660000000 | 3999100000 |

| Friday, January 1, 2016 | 5675000000 | 4179600000 |

| Sunday, January 1, 2017 | 5675000000 | 4386000000 |

| Monday, January 1, 2018 | 5962000000 | 4820600000 |

| Tuesday, January 1, 2019 | 6085000000 | 5147400000 |

| Wednesday, January 1, 2020 | 5771000000 | 3803400000 |

| Friday, January 1, 2021 | 6069000000 | 4469600000 |

| Saturday, January 1, 2022 | 7396000000 | 4964800000 |

| Sunday, January 1, 2023 | 7151000000 | 5857200000 |

| Monday, January 1, 2024 | 7080500000 |

Unlocking the unknown

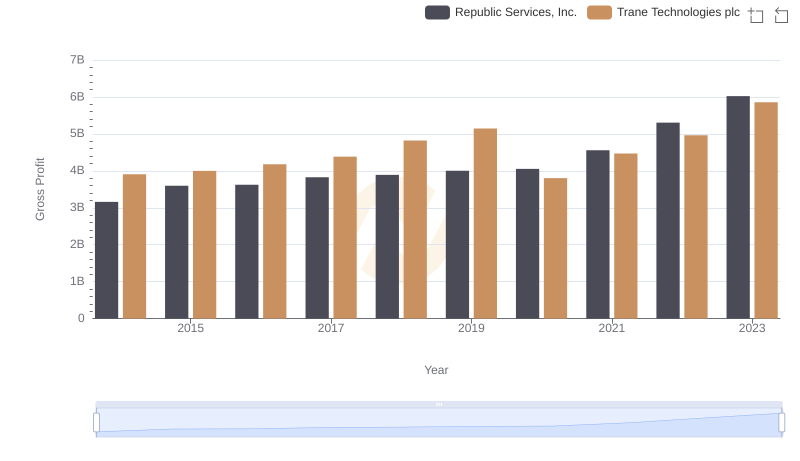

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. This analysis delves into the gross profit trends of Trane Technologies plc and Canadian National Railway Company from 2014 to 2023. Over this period, Canadian National Railway consistently outperformed Trane Technologies, with an average gross profit approximately 33% higher. Notably, Canadian National Railway's gross profit peaked in 2022, reaching a remarkable 7.4 billion, a 48% increase from 2014. Meanwhile, Trane Technologies showed a steady upward trajectory, culminating in a 50% rise in gross profit by 2023. This growth reflects the resilience and strategic prowess of both companies in navigating economic challenges. As we look to the future, these trends offer valuable insights into the competitive dynamics of the transportation and technology sectors.

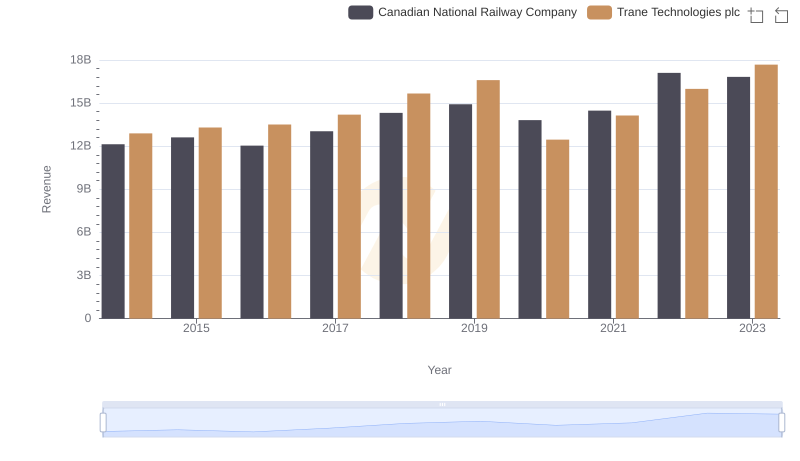

Trane Technologies plc and Canadian National Railway Company: A Comprehensive Revenue Analysis

Trane Technologies plc vs General Dynamics Corporation: A Gross Profit Performance Breakdown

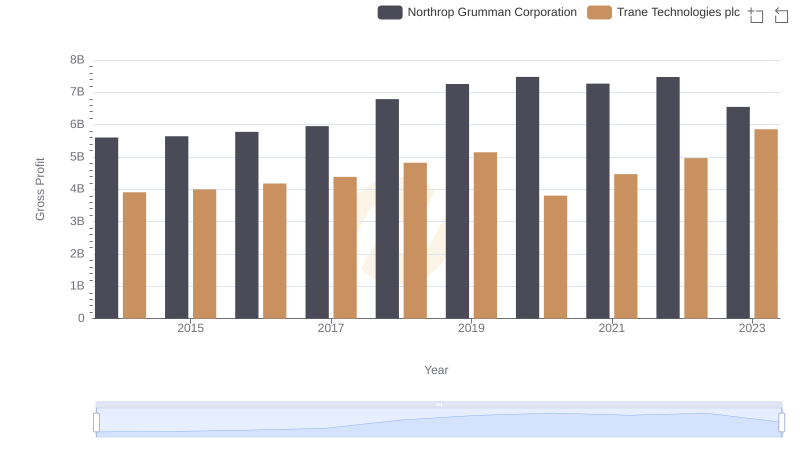

Trane Technologies plc and Northrop Grumman Corporation: A Detailed Gross Profit Analysis

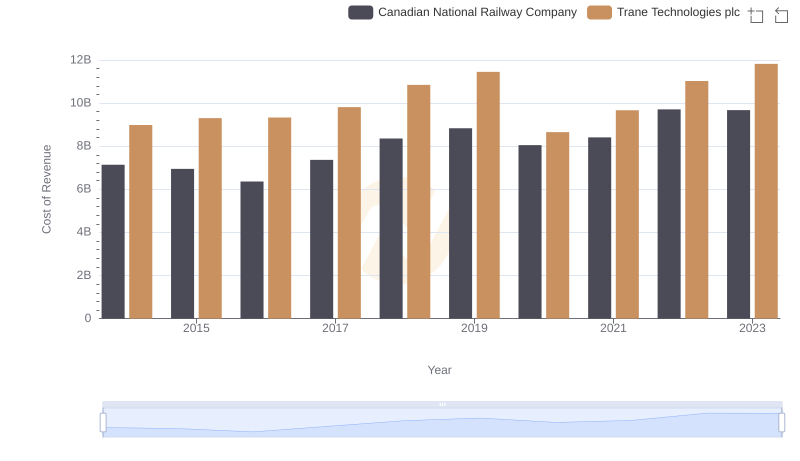

Cost of Revenue Comparison: Trane Technologies plc vs Canadian National Railway Company

Key Insights on Gross Profit: Trane Technologies plc vs Republic Services, Inc.

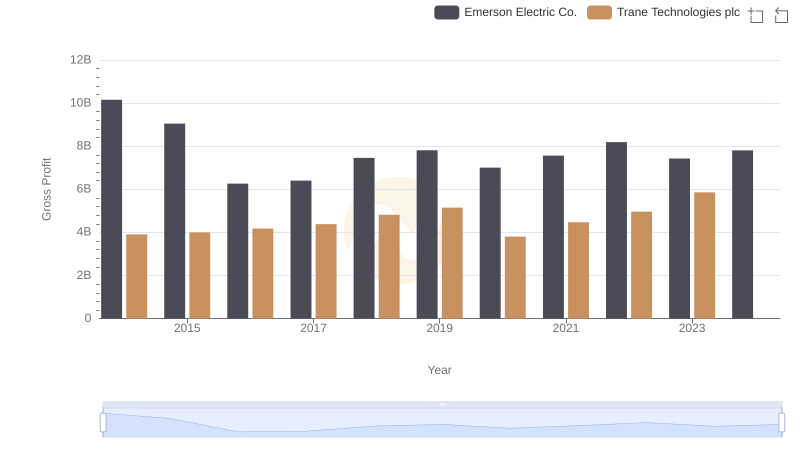

Gross Profit Trends Compared: Trane Technologies plc vs Emerson Electric Co.

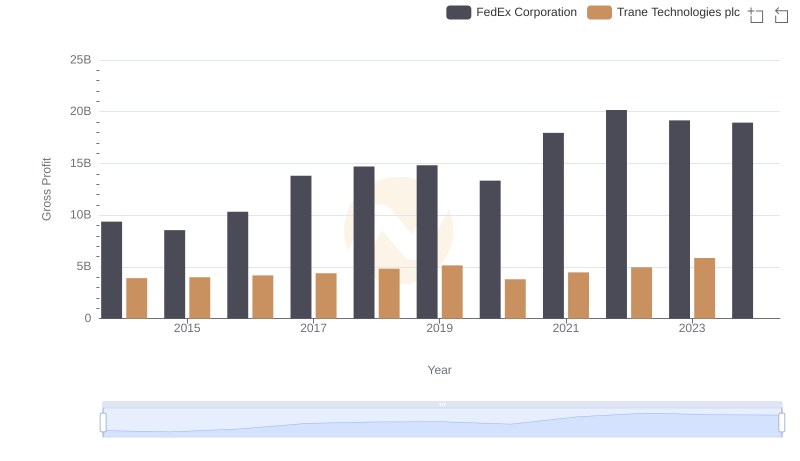

Gross Profit Trends Compared: Trane Technologies plc vs FedEx Corporation

Key Insights on Gross Profit: Trane Technologies plc vs Thomson Reuters Corporation

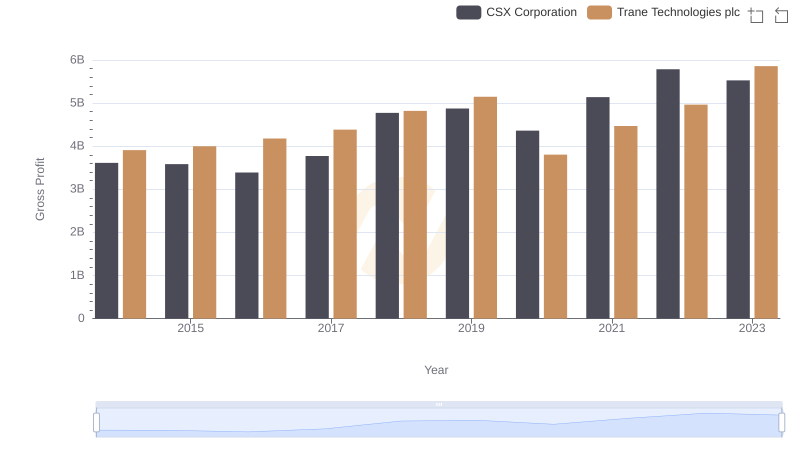

Gross Profit Trends Compared: Trane Technologies plc vs CSX Corporation

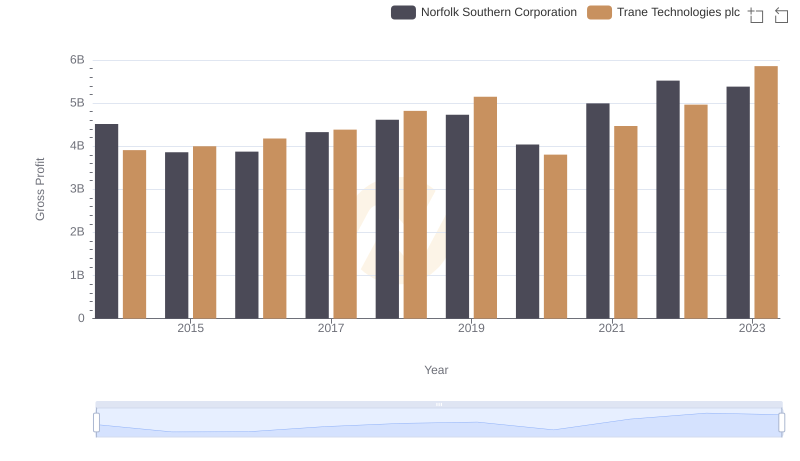

Trane Technologies plc and Norfolk Southern Corporation: A Detailed Gross Profit Analysis

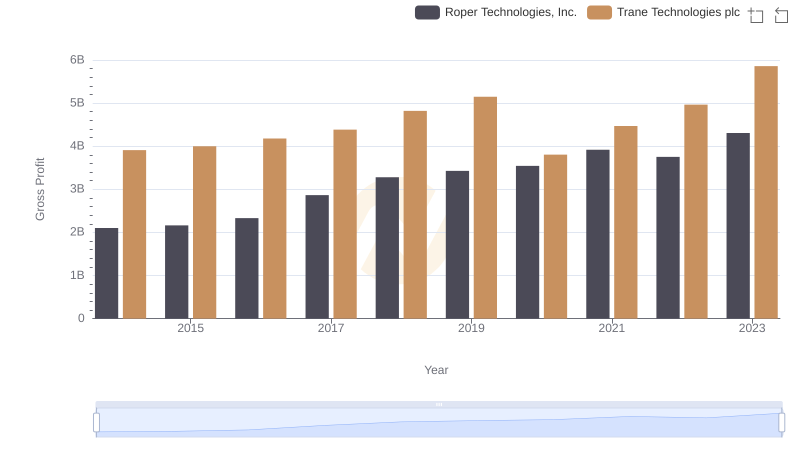

Trane Technologies plc vs Roper Technologies, Inc.: A Gross Profit Performance Breakdown

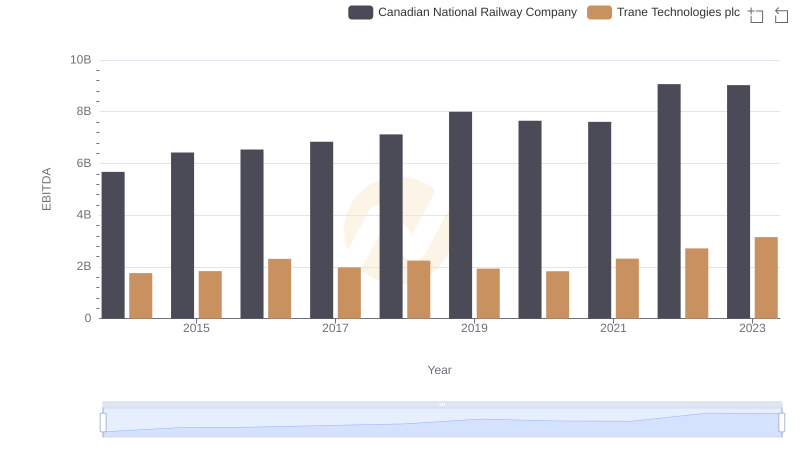

A Professional Review of EBITDA: Trane Technologies plc Compared to Canadian National Railway Company