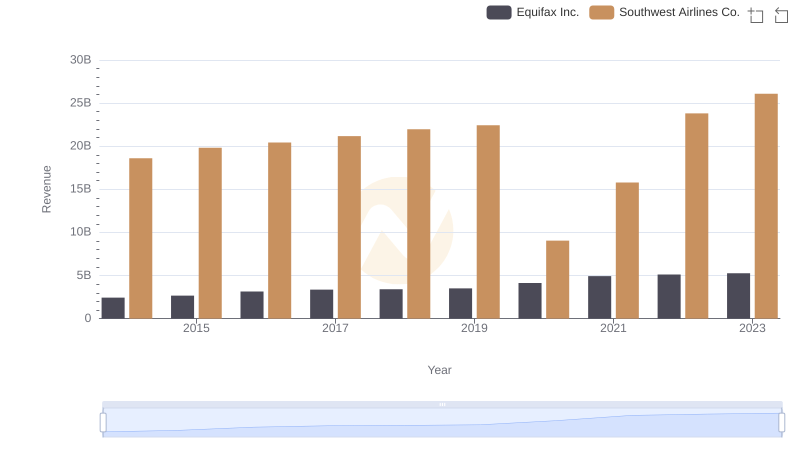

| __timestamp | Equifax Inc. | Southwest Airlines Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 14049000000 |

| Thursday, January 1, 2015 | 887400000 | 13423000000 |

| Friday, January 1, 2016 | 1113400000 | 14151000000 |

| Sunday, January 1, 2017 | 1210700000 | 14968000000 |

| Monday, January 1, 2018 | 1440400000 | 15907000000 |

| Tuesday, January 1, 2019 | 1521700000 | 16445000000 |

| Wednesday, January 1, 2020 | 1737400000 | 10938000000 |

| Friday, January 1, 2021 | 1980900000 | 11675000000 |

| Saturday, January 1, 2022 | 2177200000 | 19062000000 |

| Sunday, January 1, 2023 | 2335100000 | 21868000000 |

| Monday, January 1, 2024 | 0 | 23024000000 |

Unleashing insights

In the ever-evolving landscape of corporate efficiency, the cost of revenue is a critical metric. From 2014 to 2023, Equifax Inc. and Southwest Airlines Co. have demonstrated contrasting trajectories in managing this crucial expense. Equifax's cost of revenue has surged by approximately 176%, from $844 million in 2014 to $2.34 billion in 2023. Meanwhile, Southwest Airlines Co. has seen a more modest increase of around 56%, from $14.05 billion to $21.87 billion over the same period.

This data highlights the distinct operational challenges faced by a credit reporting agency versus an airline. While Equifax's costs have grown significantly, reflecting perhaps an investment in technology and data security, Southwest's steadier increase may indicate a focus on operational efficiency and cost control. Understanding these trends offers valuable insights into the strategic priorities and market pressures influencing these industry giants.

Equifax Inc. vs Southwest Airlines Co.: Annual Revenue Growth Compared

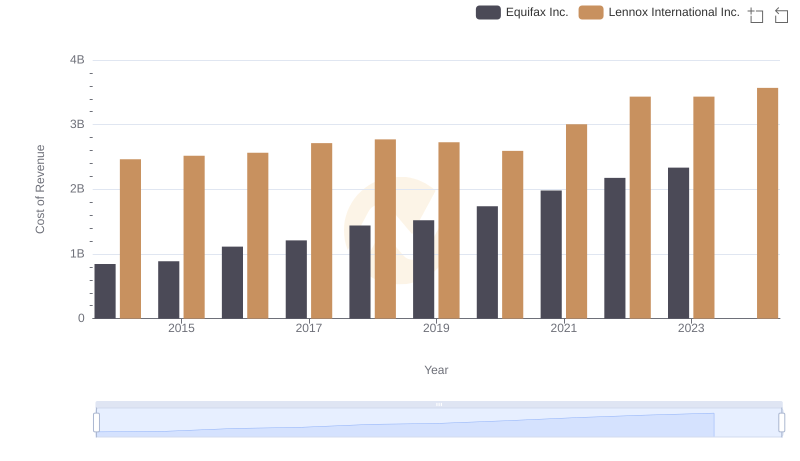

Cost of Revenue Comparison: Equifax Inc. vs Lennox International Inc.

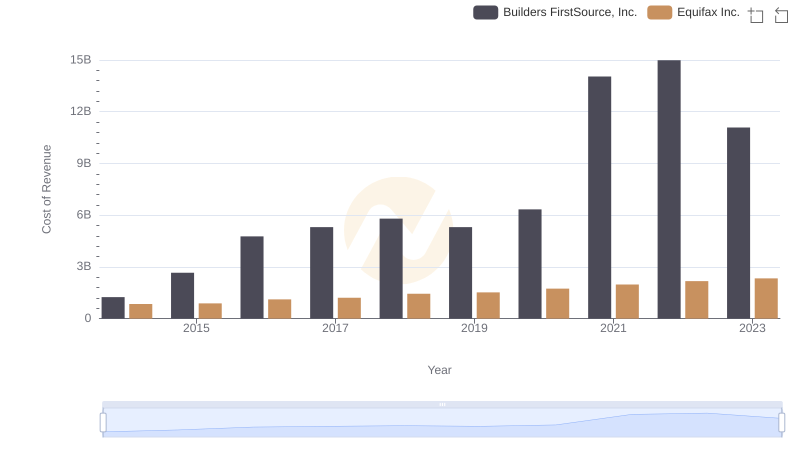

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

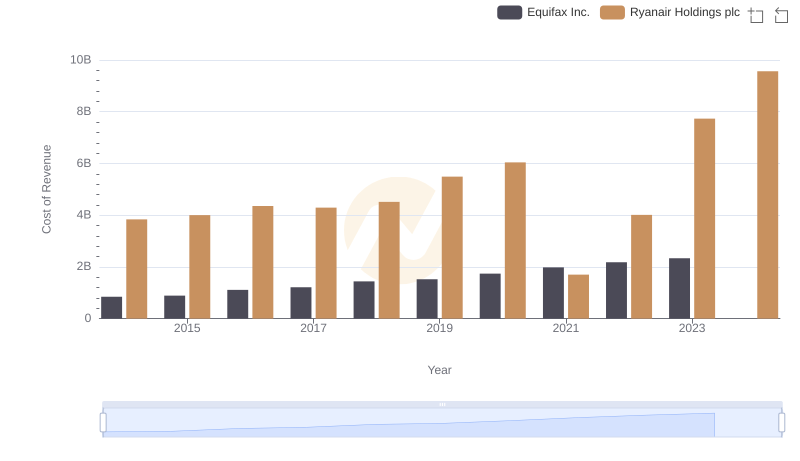

Equifax Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

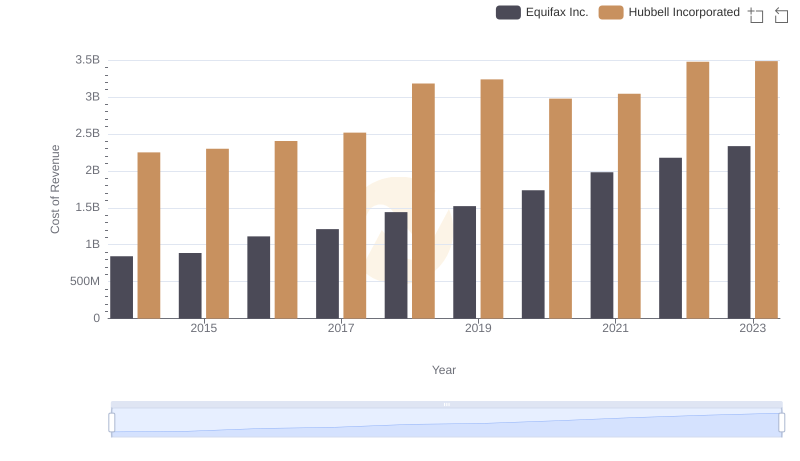

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

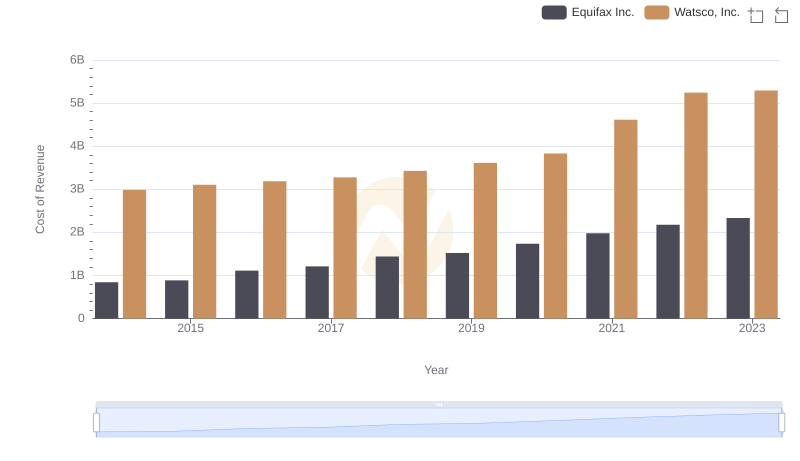

Cost of Revenue: Key Insights for Equifax Inc. and Watsco, Inc.

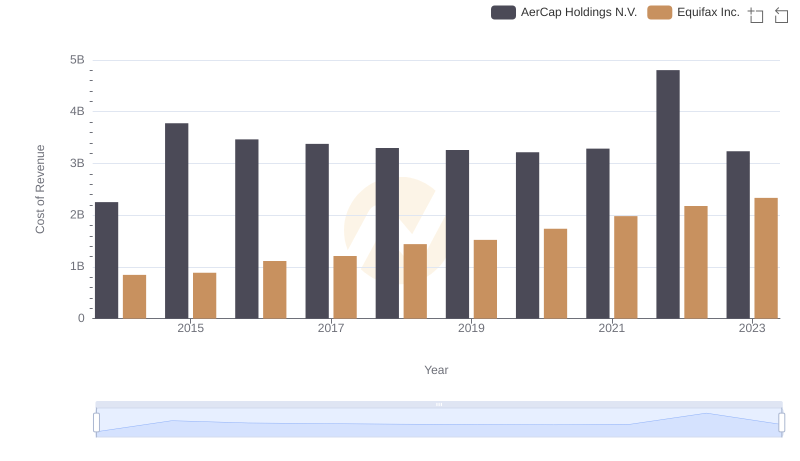

Analyzing Cost of Revenue: Equifax Inc. and AerCap Holdings N.V.

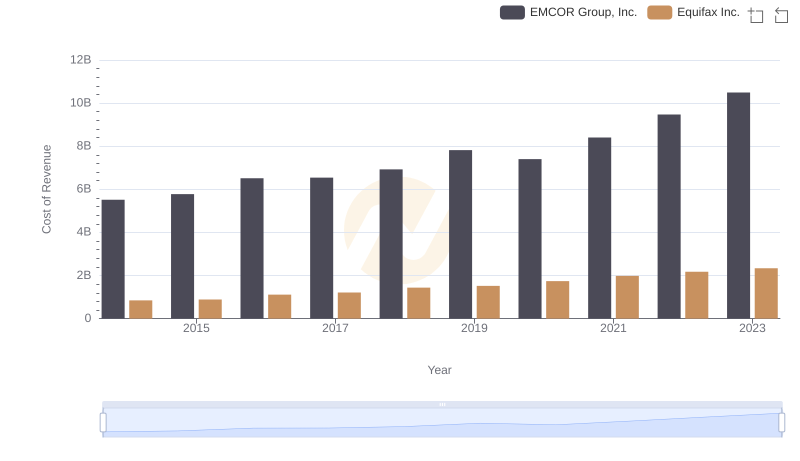

Equifax Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

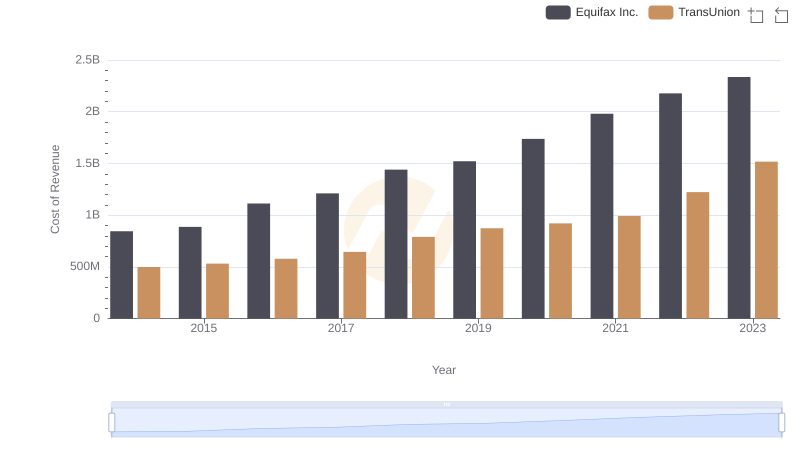

Analyzing Cost of Revenue: Equifax Inc. and TransUnion

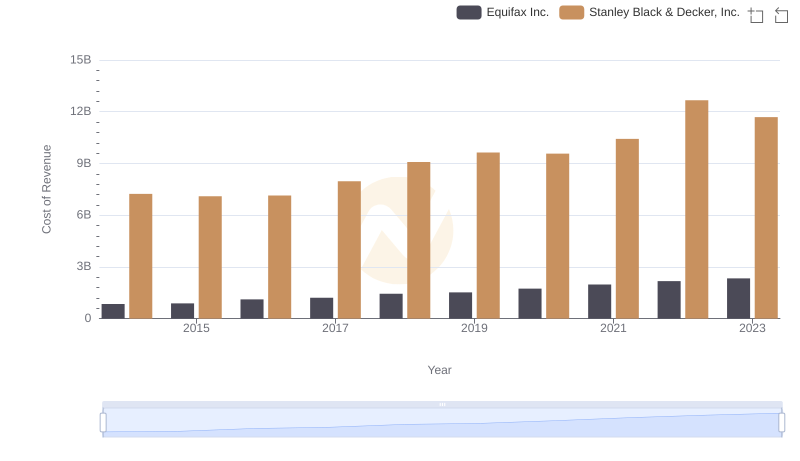

Cost Insights: Breaking Down Equifax Inc. and Stanley Black & Decker, Inc.'s Expenses