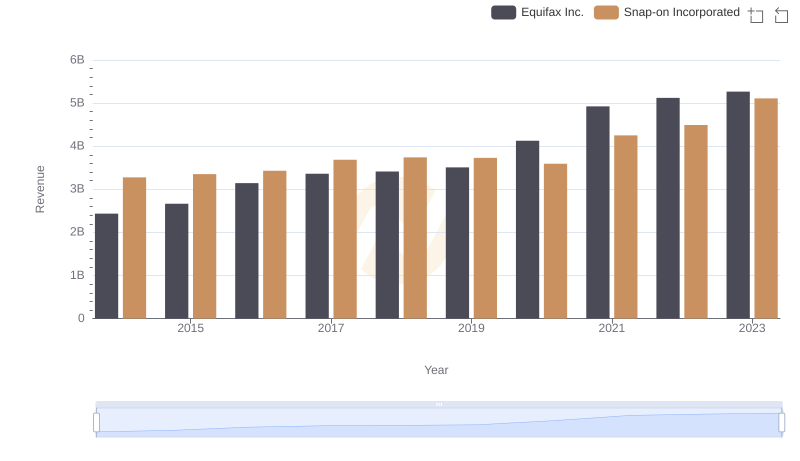

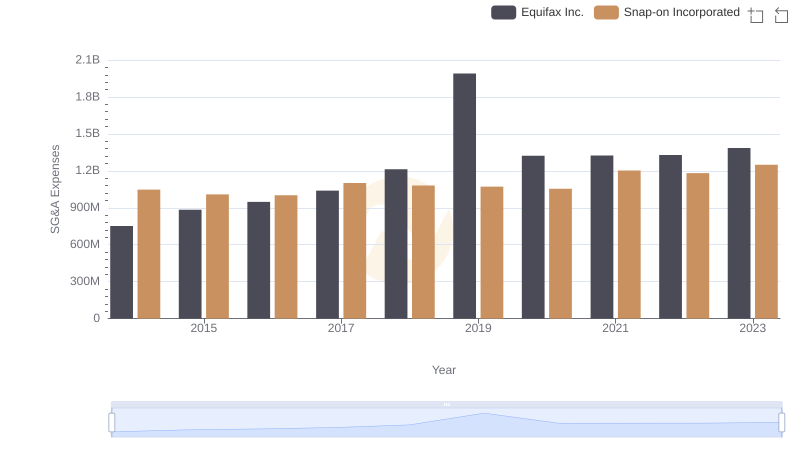

| __timestamp | Equifax Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 1693400000 |

| Thursday, January 1, 2015 | 887400000 | 1704500000 |

| Friday, January 1, 2016 | 1113400000 | 1720800000 |

| Sunday, January 1, 2017 | 1210700000 | 1862000000 |

| Monday, January 1, 2018 | 1440400000 | 1870700000 |

| Tuesday, January 1, 2019 | 1521700000 | 1886000000 |

| Wednesday, January 1, 2020 | 1737400000 | 1844000000 |

| Friday, January 1, 2021 | 1980900000 | 2141200000 |

| Saturday, January 1, 2022 | 2177200000 | 2311700000 |

| Sunday, January 1, 2023 | 2335100000 | 2488500000 |

| Monday, January 1, 2024 | 0 | 2329500000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for Equifax Inc. and Snap-on Incorporated from 2014 to 2023. Over this period, Snap-on consistently outperformed Equifax in managing its cost of revenue, with a notable 47% higher average cost efficiency. By 2023, Snap-on's cost of revenue reached approximately 2.49 billion, marking a 47% increase from 2014, while Equifax saw a 176% rise, reaching around 2.34 billion. This trend highlights Snap-on's superior cost management strategies, maintaining a steady growth trajectory. As businesses navigate the complexities of financial management, these insights underscore the importance of strategic cost control in achieving long-term success. The data reveals a compelling narrative of financial prudence and strategic foresight, offering valuable lessons for companies aiming to optimize their revenue streams.

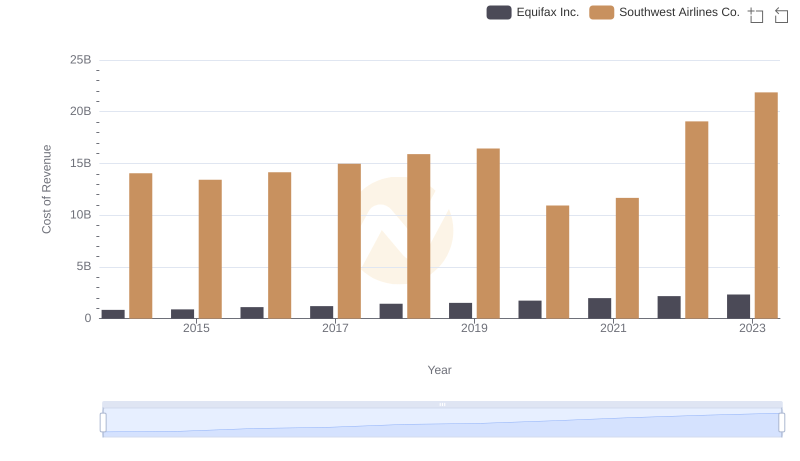

Equifax Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored

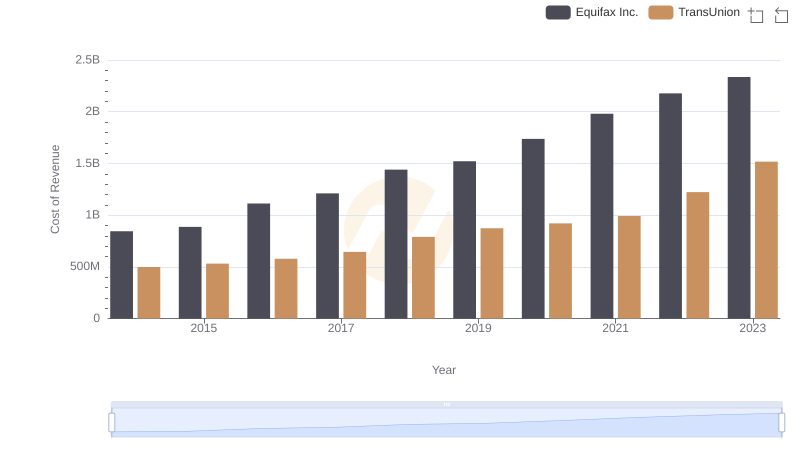

Analyzing Cost of Revenue: Equifax Inc. and TransUnion

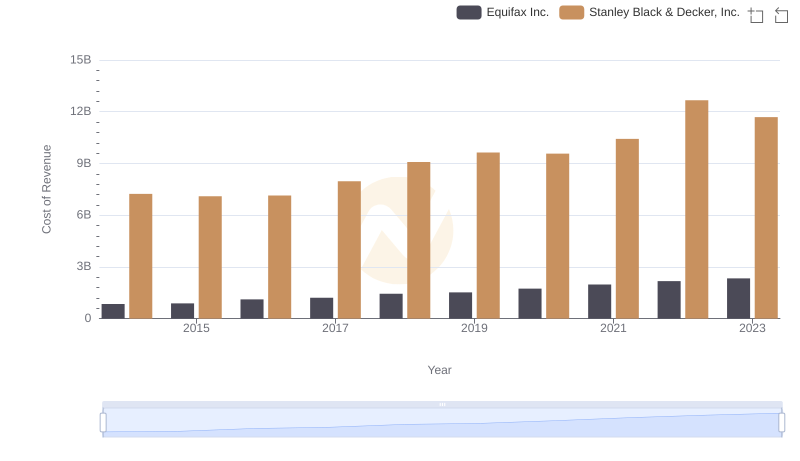

Cost Insights: Breaking Down Equifax Inc. and Stanley Black & Decker, Inc.'s Expenses

Breaking Down Revenue Trends: Equifax Inc. vs Snap-on Incorporated

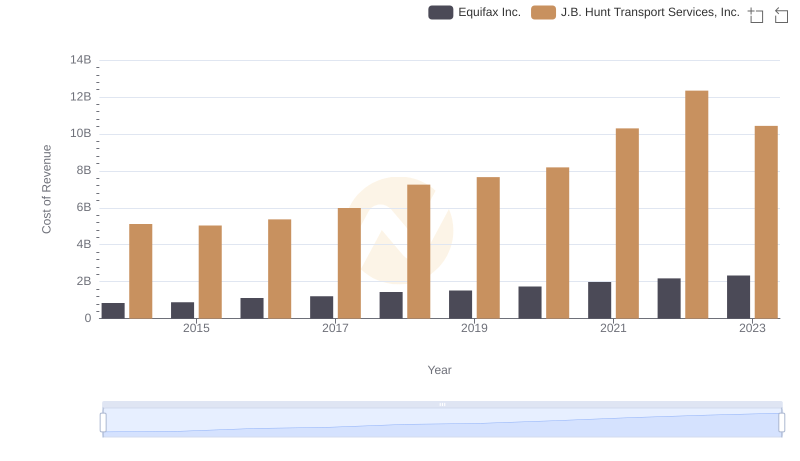

Cost of Revenue Trends: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

Breaking Down SG&A Expenses: Equifax Inc. vs Snap-on Incorporated

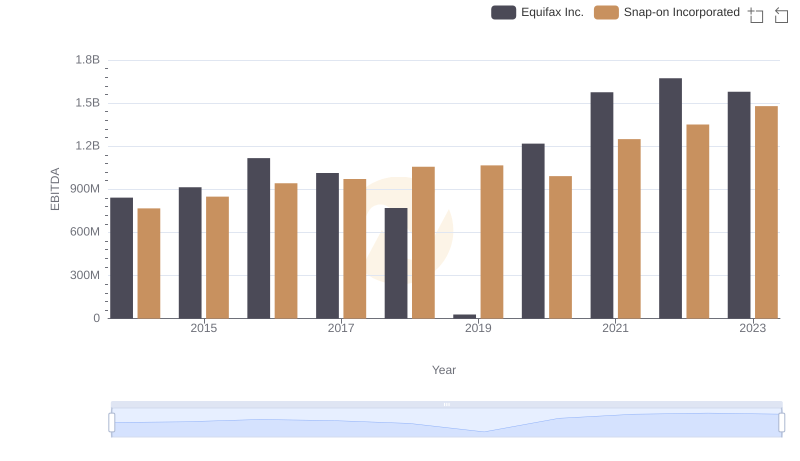

EBITDA Metrics Evaluated: Equifax Inc. vs Snap-on Incorporated