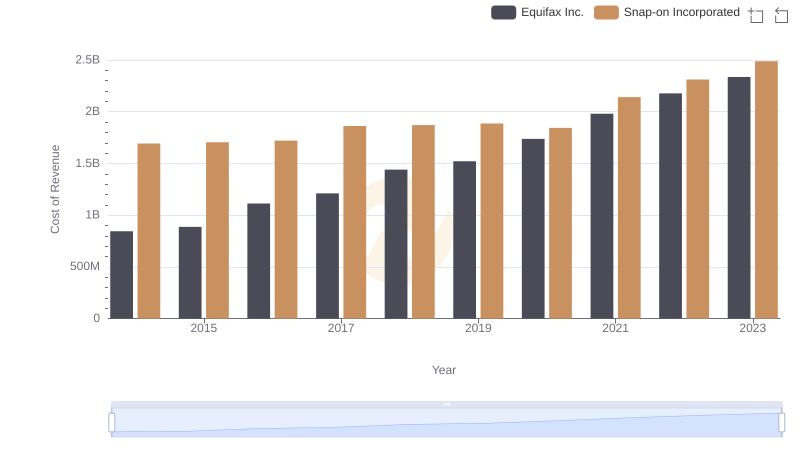

| __timestamp | Equifax Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2436400000 | 3277700000 |

| Thursday, January 1, 2015 | 2663600000 | 3352800000 |

| Friday, January 1, 2016 | 3144900000 | 3430400000 |

| Sunday, January 1, 2017 | 3362200000 | 3686900000 |

| Monday, January 1, 2018 | 3412100000 | 3740700000 |

| Tuesday, January 1, 2019 | 3507600000 | 3730000000 |

| Wednesday, January 1, 2020 | 4127500000 | 3592500000 |

| Friday, January 1, 2021 | 4923900000 | 4252000000 |

| Saturday, January 1, 2022 | 5122200000 | 4492800000 |

| Sunday, January 1, 2023 | 5265200000 | 5108300000 |

| Monday, January 1, 2024 | 5681100000 | 4707400000 |

Data in motion

In the ever-evolving landscape of American business, Equifax Inc. and Snap-on Incorporated have showcased intriguing revenue trajectories over the past decade. From 2014 to 2023, Equifax's revenue surged by approximately 116%, reflecting its robust growth strategy and market adaptability. Meanwhile, Snap-on Incorporated, a stalwart in the tool manufacturing industry, experienced a steady revenue increase of around 56% during the same period.

Equifax's revenue growth was particularly notable between 2020 and 2023, where it jumped by nearly 28%, underscoring its resilience amidst global economic challenges. Snap-on, on the other hand, saw a significant uptick in 2023, with revenues reaching their peak, marking a 15% increase from the previous year.

These trends highlight the dynamic nature of these industries and offer valuable insights into their strategic directions. As we look to the future, understanding these patterns will be crucial for investors and industry analysts alike.

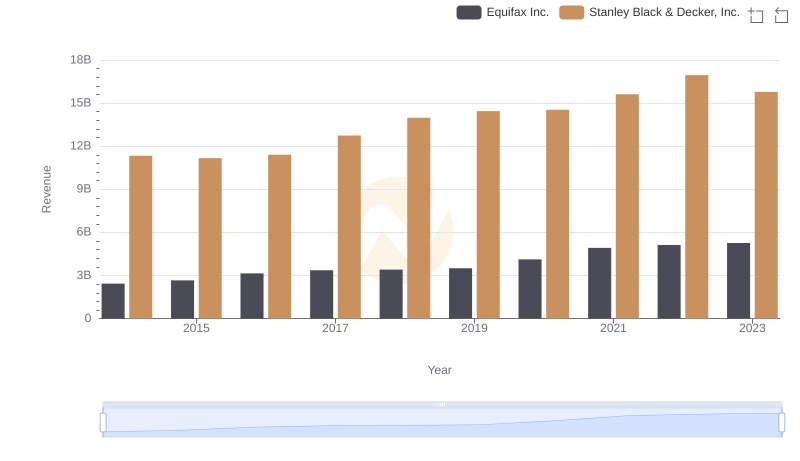

Equifax Inc. or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

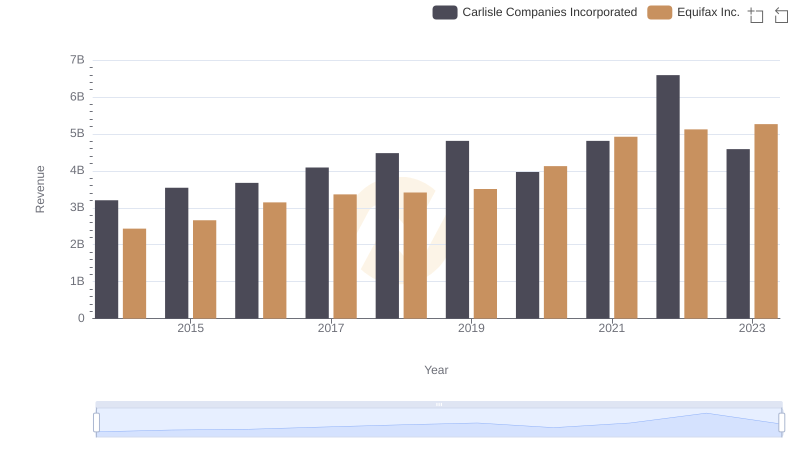

Breaking Down Revenue Trends: Equifax Inc. vs Carlisle Companies Incorporated

Equifax Inc. vs Snap-on Incorporated: Efficiency in Cost of Revenue Explored

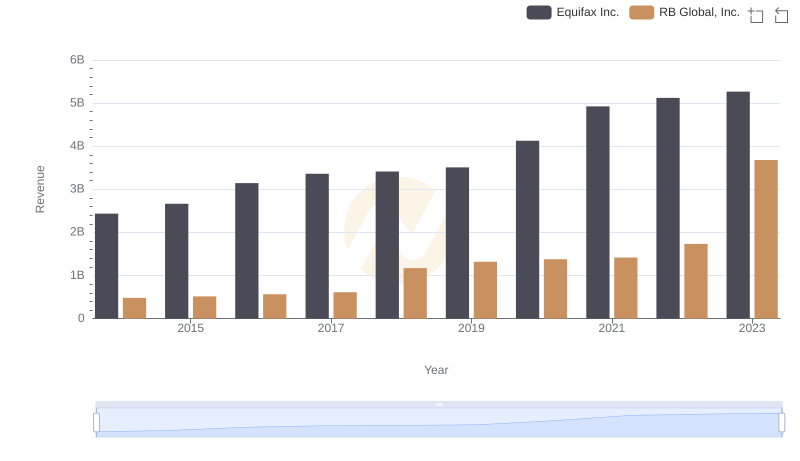

Equifax Inc. vs RB Global, Inc.: Examining Key Revenue Metrics

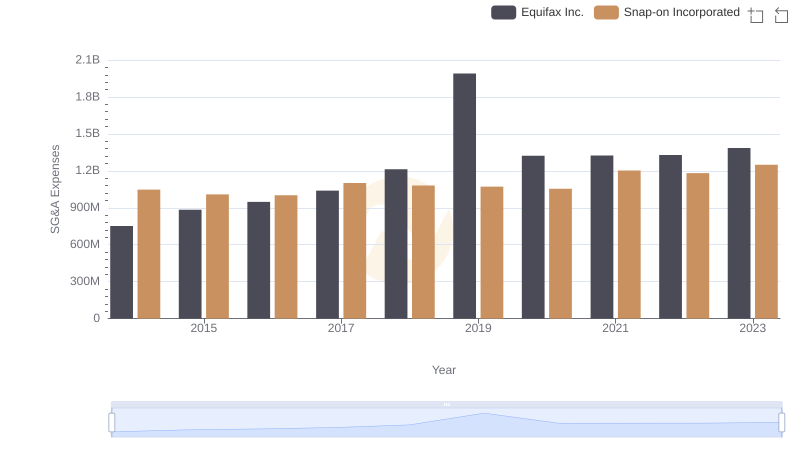

Breaking Down SG&A Expenses: Equifax Inc. vs Snap-on Incorporated

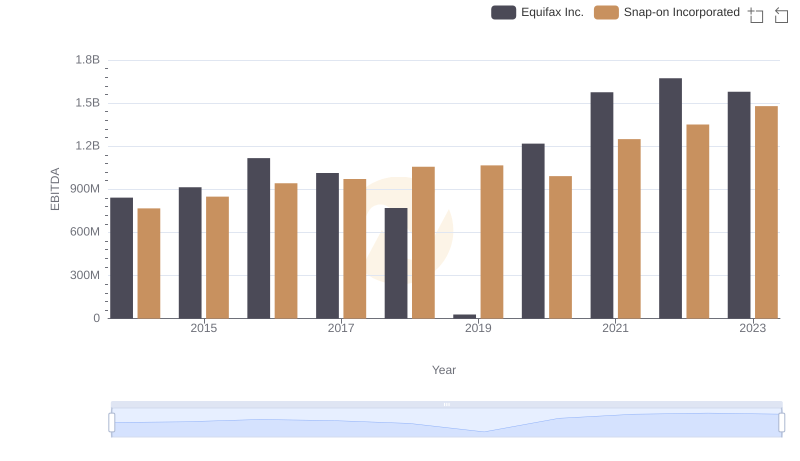

EBITDA Metrics Evaluated: Equifax Inc. vs Snap-on Incorporated