| __timestamp | EMCOR Group, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 355858000 | 876815000 |

| Thursday, January 1, 2015 | 362095000 | 1687285000 |

| Friday, January 1, 2016 | 395913000 | 3093956000 |

| Sunday, January 1, 2017 | 478459000 | 4308801000 |

| Monday, January 1, 2018 | 489954000 | 5185941000 |

| Tuesday, January 1, 2019 | 556055000 | 6727397000 |

| Wednesday, January 1, 2020 | 601449000 | 5197064000 |

| Friday, January 1, 2021 | 646861000 | 5866901000 |

| Saturday, January 1, 2022 | 682399000 | 11147519000 |

| Sunday, January 1, 2023 | 1009017000 | 13853443000 |

In pursuit of knowledge

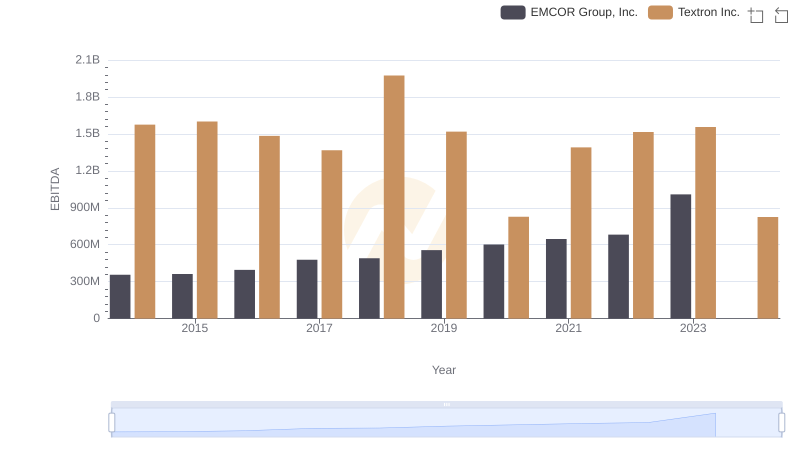

In the ever-evolving landscape of global business, the performance of companies like EMCOR Group, Inc. and ZTO Express (Cayman) Inc. offers a fascinating glimpse into industry dynamics. Over the past decade, from 2014 to 2023, these two companies have shown remarkable growth in their EBITDA, a key indicator of financial health.

EMCOR Group, a leader in mechanical and electrical construction services, has seen its EBITDA grow by approximately 183% over this period. This growth reflects the company's strategic expansion and operational efficiency.

Meanwhile, ZTO Express, a major player in the logistics sector, has experienced an astonishing 1,480% increase in EBITDA. This surge underscores the booming e-commerce market in China and ZTO's pivotal role in it.

Both companies exemplify resilience and adaptability, setting benchmarks in their respective industries.

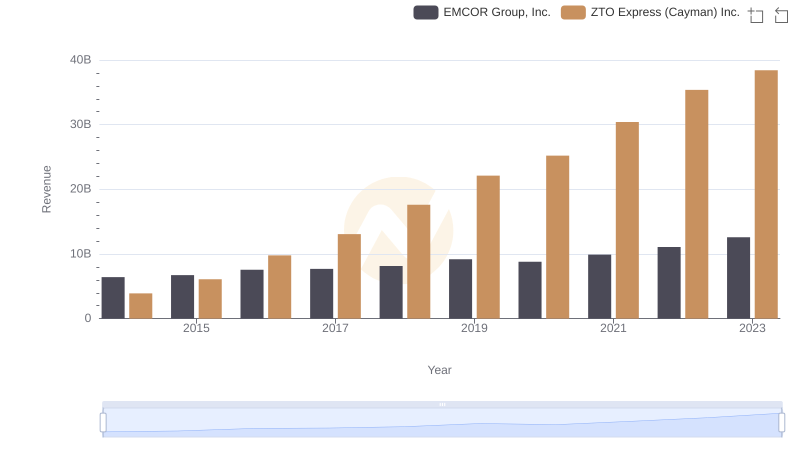

Breaking Down Revenue Trends: EMCOR Group, Inc. vs ZTO Express (Cayman) Inc.

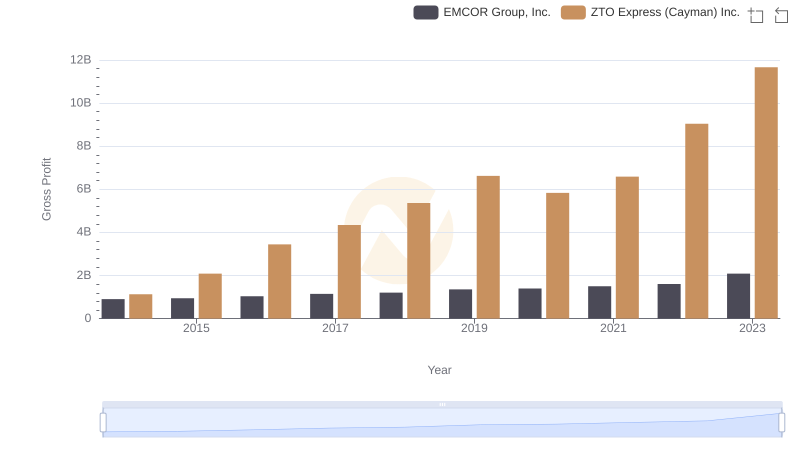

Gross Profit Comparison: EMCOR Group, Inc. and ZTO Express (Cayman) Inc. Trends

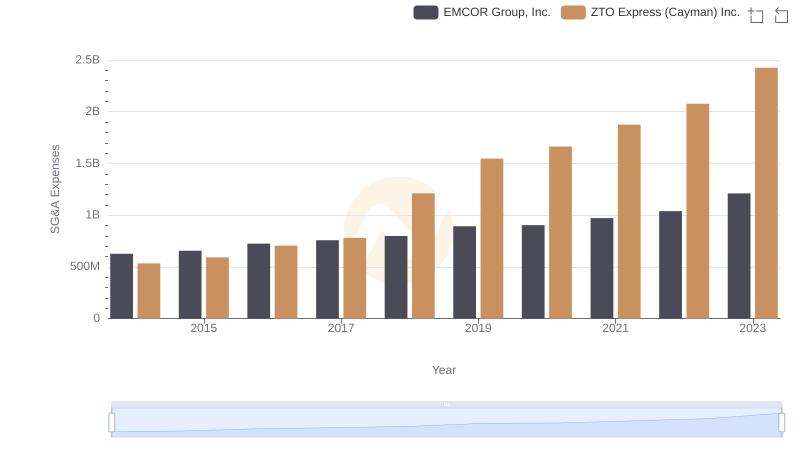

Comparing SG&A Expenses: EMCOR Group, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

EBITDA Analysis: Evaluating EMCOR Group, Inc. Against Textron Inc.

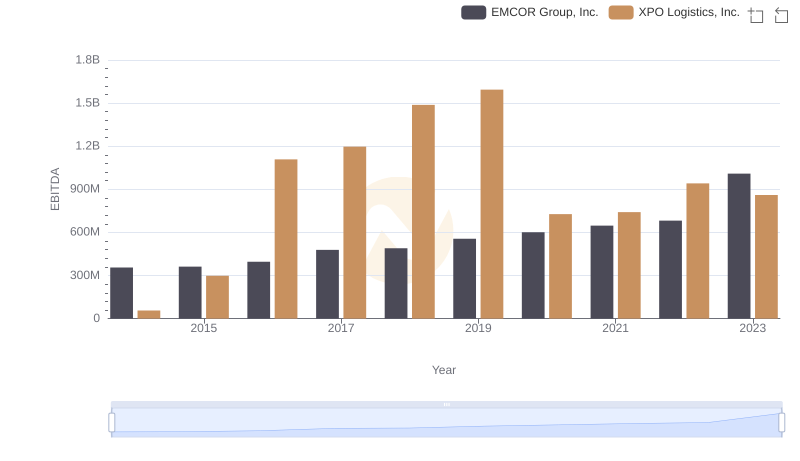

A Professional Review of EBITDA: EMCOR Group, Inc. Compared to XPO Logistics, Inc.

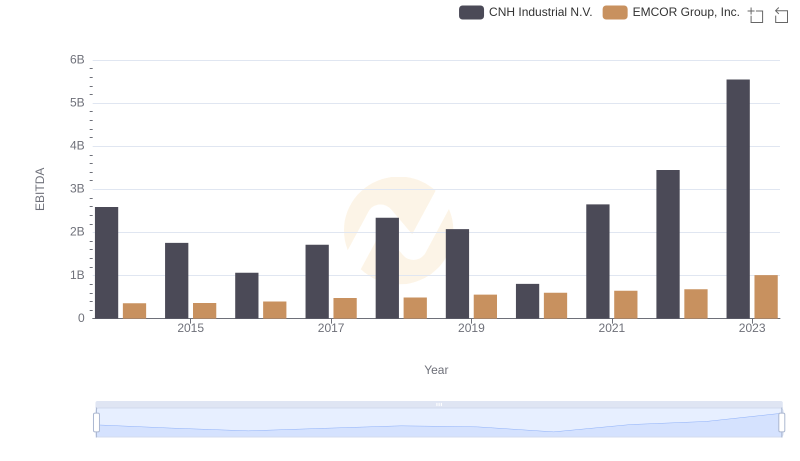

EBITDA Performance Review: EMCOR Group, Inc. vs CNH Industrial N.V.

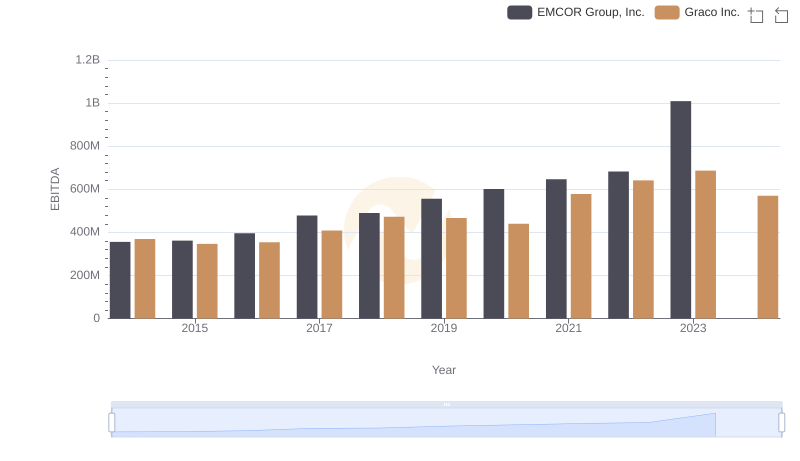

A Professional Review of EBITDA: EMCOR Group, Inc. Compared to Graco Inc.

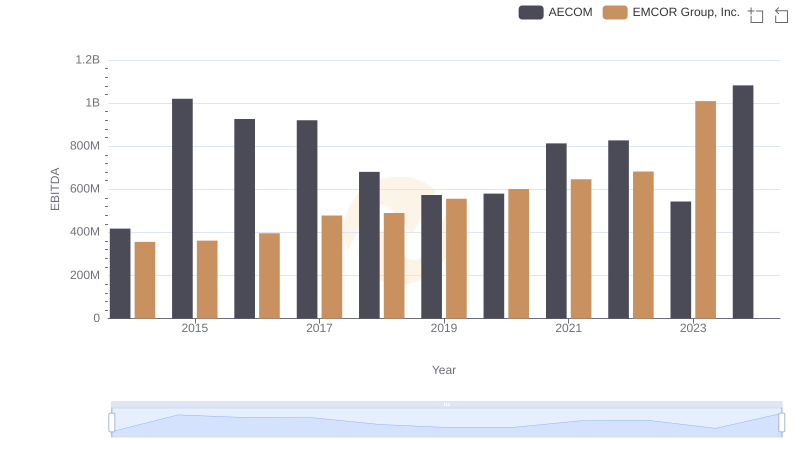

Comprehensive EBITDA Comparison: EMCOR Group, Inc. vs AECOM

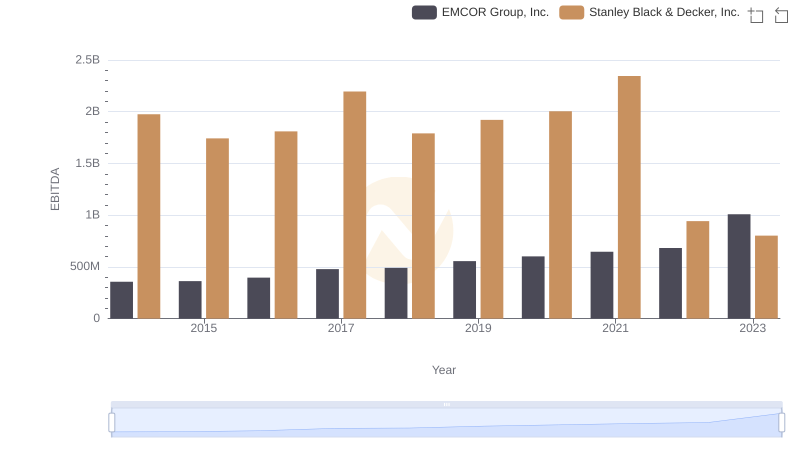

EMCOR Group, Inc. and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance