| __timestamp | CSX Corporation | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4740000000 | 144715000 |

| Thursday, January 1, 2015 | 4890000000 | 154995000 |

| Friday, January 1, 2016 | 4640000000 | 156092000 |

| Sunday, January 1, 2017 | 5113000000 | 181629000 |

| Monday, January 1, 2018 | 6274000000 | 243709000 |

| Tuesday, January 1, 2019 | 6402000000 | 271318000 |

| Wednesday, January 1, 2020 | 5764000000 | 312448000 |

| Friday, January 1, 2021 | 6653000000 | 472947000 |

| Saturday, January 1, 2022 | 7390000000 | 627741000 |

| Sunday, January 1, 2023 | 7340000000 | 647607000 |

Unlocking the unknown

In the ever-evolving landscape of the transportation industry, CSX Corporation and Saia, Inc. have demonstrated remarkable EBITDA growth over the past decade. From 2014 to 2023, CSX Corporation's EBITDA surged by approximately 55%, peaking in 2022 with a robust performance. This growth underscores CSX's strategic initiatives and operational efficiencies, positioning it as a leader in the rail transportation sector.

Conversely, Saia, Inc., a prominent player in the trucking industry, showcased an impressive EBITDA growth of over 340% during the same period. This exponential increase highlights Saia's successful expansion strategies and adaptability in a competitive market.

While CSX's EBITDA consistently outperformed Saia's in absolute terms, the latter's rapid growth trajectory is noteworthy. As the transportation sector continues to evolve, these companies' financial performances offer valuable insights into their strategic directions and market positioning.

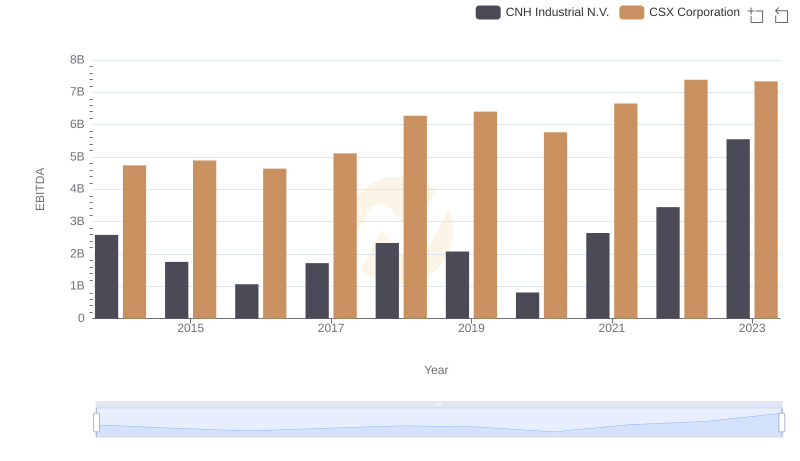

CSX Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance

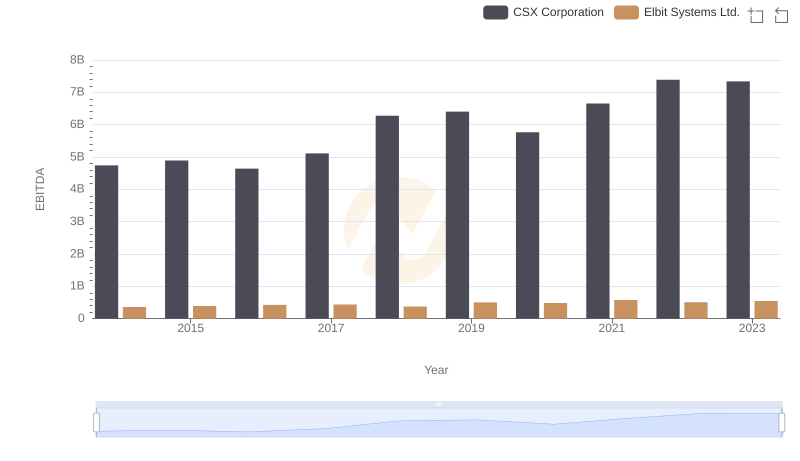

CSX Corporation vs Elbit Systems Ltd.: In-Depth EBITDA Performance Comparison

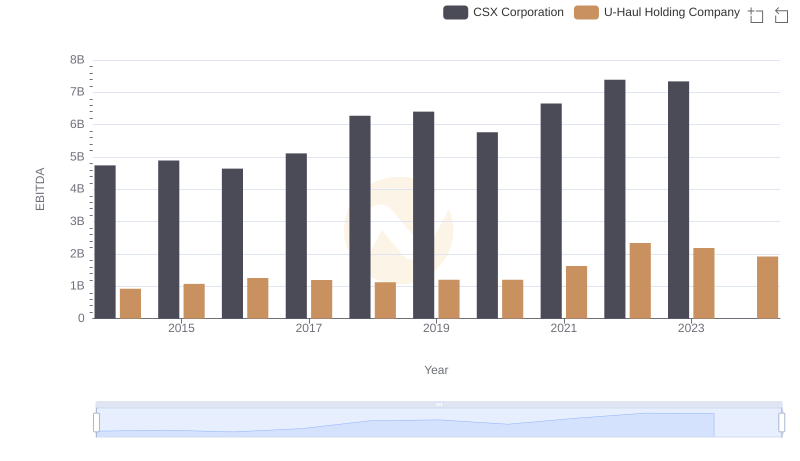

CSX Corporation vs U-Haul Holding Company: In-Depth EBITDA Performance Comparison

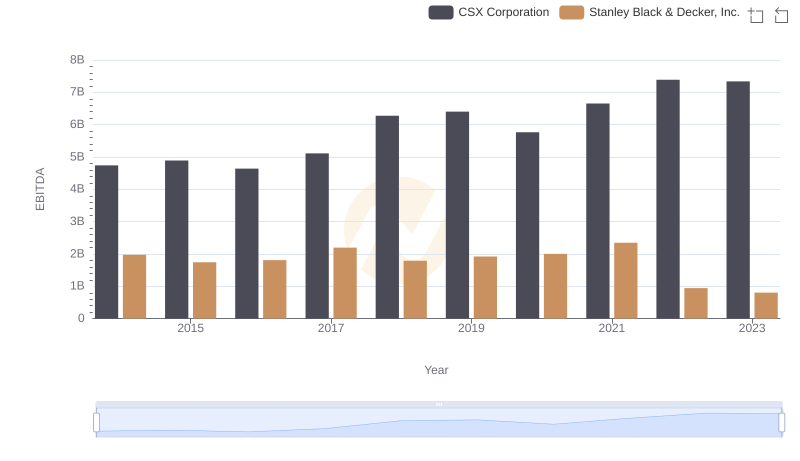

A Professional Review of EBITDA: CSX Corporation Compared to Stanley Black & Decker, Inc.

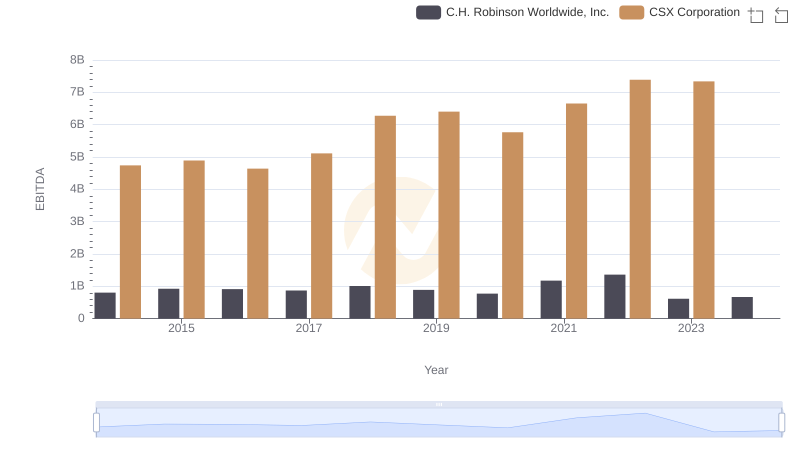

A Professional Review of EBITDA: CSX Corporation Compared to C.H. Robinson Worldwide, Inc.

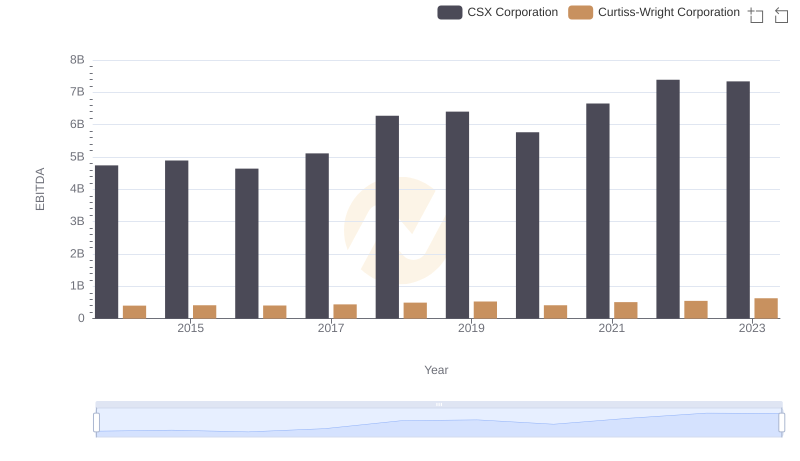

CSX Corporation and Curtiss-Wright Corporation: A Detailed Examination of EBITDA Performance

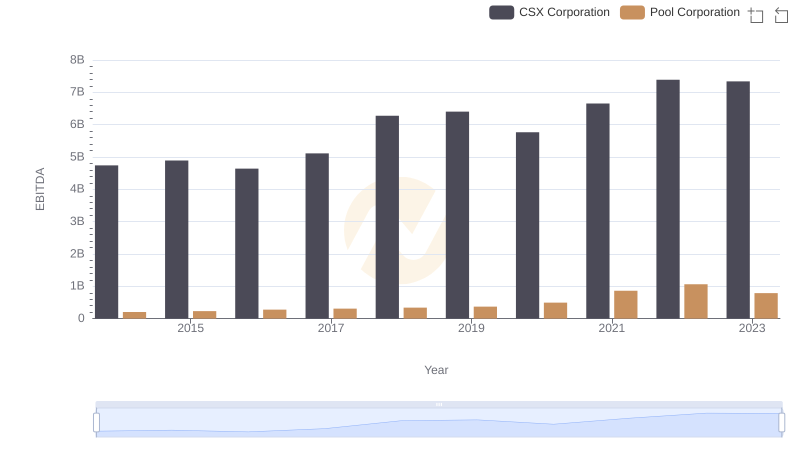

EBITDA Performance Review: CSX Corporation vs Pool Corporation