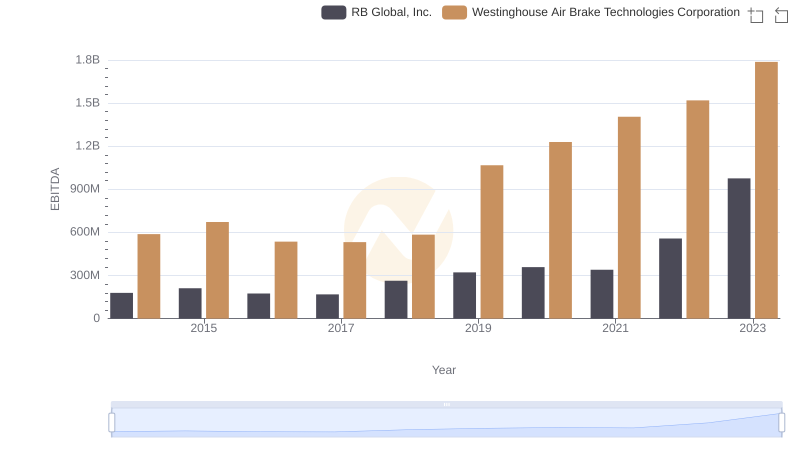

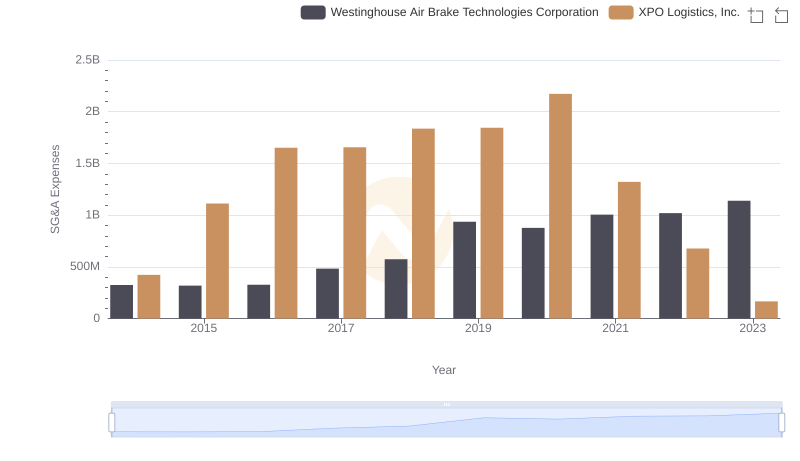

| __timestamp | Westinghouse Air Brake Technologies Corporation | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 588370000 | 56600000 |

| Thursday, January 1, 2015 | 672301000 | 298000000 |

| Friday, January 1, 2016 | 535893000 | 1108300000 |

| Sunday, January 1, 2017 | 532795000 | 1196700000 |

| Monday, January 1, 2018 | 584199000 | 1488000000 |

| Tuesday, January 1, 2019 | 1067300000 | 1594000000 |

| Wednesday, January 1, 2020 | 1229400000 | 727000000 |

| Friday, January 1, 2021 | 1405000000 | 741000000 |

| Saturday, January 1, 2022 | 1519000000 | 941000000 |

| Sunday, January 1, 2023 | 1787000000 | 860000000 |

| Monday, January 1, 2024 | 1609000000 | 1186000000 |

In pursuit of knowledge

In the competitive landscape of the transportation and logistics industry, Westinghouse Air Brake Technologies Corporation and XPO Logistics, Inc. have emerged as formidable players. Over the past decade, these companies have demonstrated remarkable resilience and growth in their EBITDA, a key indicator of financial health and operational efficiency.

From 2014 to 2023, Westinghouse Air Brake Technologies Corporation saw its EBITDA grow by approximately 204%, peaking in 2023. Meanwhile, XPO Logistics, Inc. experienced a more volatile journey, with a significant surge in 2018, reaching its highest EBITDA in 2019. However, by 2023, XPO's EBITDA had decreased by around 46% from its peak.

This data not only highlights the dynamic nature of the industry but also underscores the strategic maneuvers these companies have employed to navigate economic challenges and capitalize on growth opportunities.

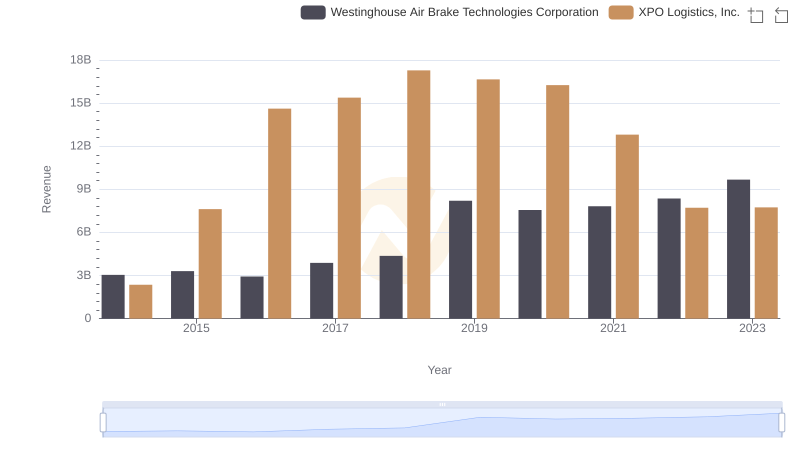

Comparing Revenue Performance: Westinghouse Air Brake Technologies Corporation or XPO Logistics, Inc.?

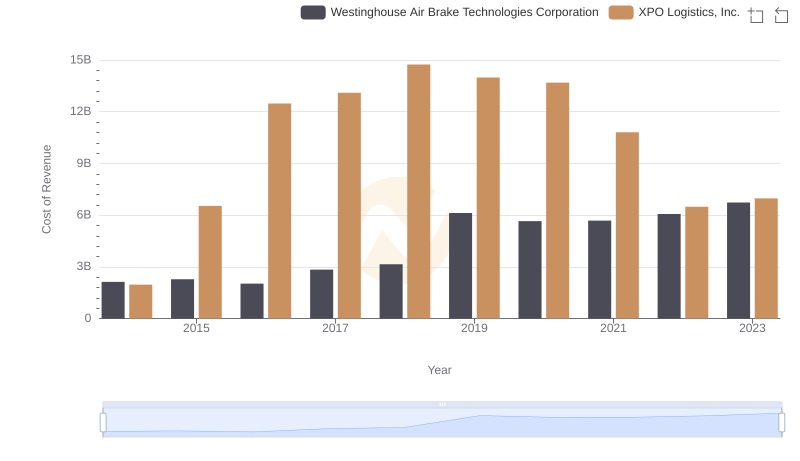

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

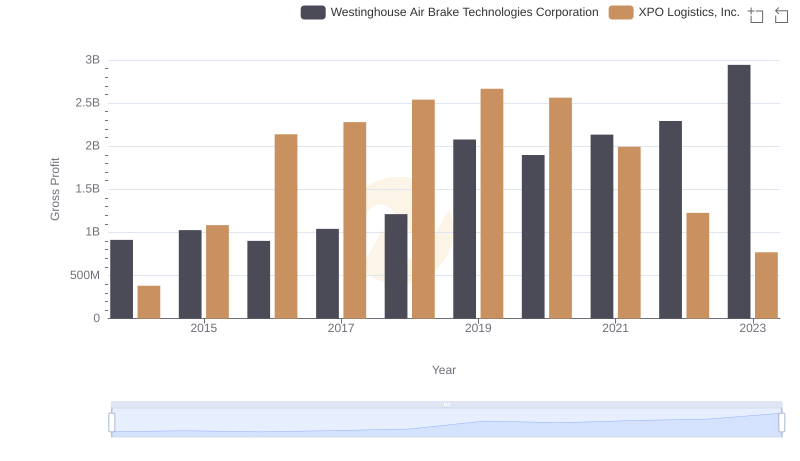

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or XPO Logistics, Inc.

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against RB Global, Inc.

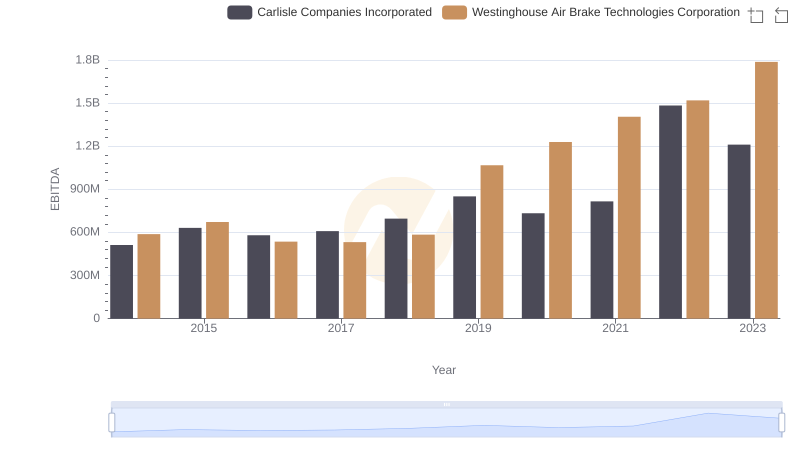

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Carlisle Companies Incorporated

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

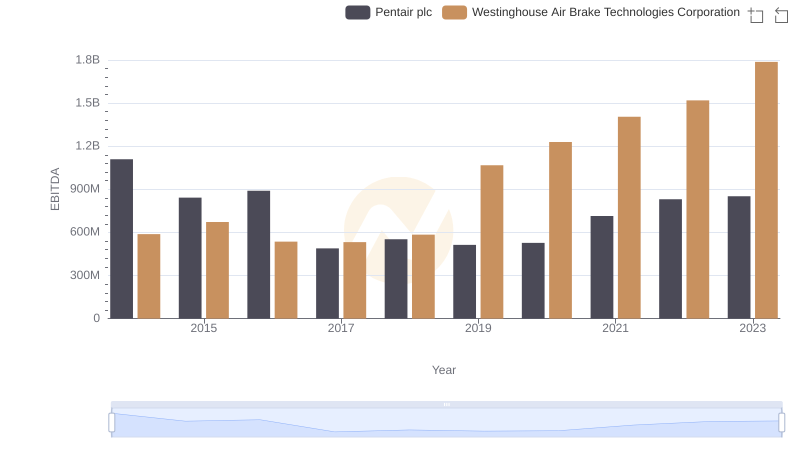

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc

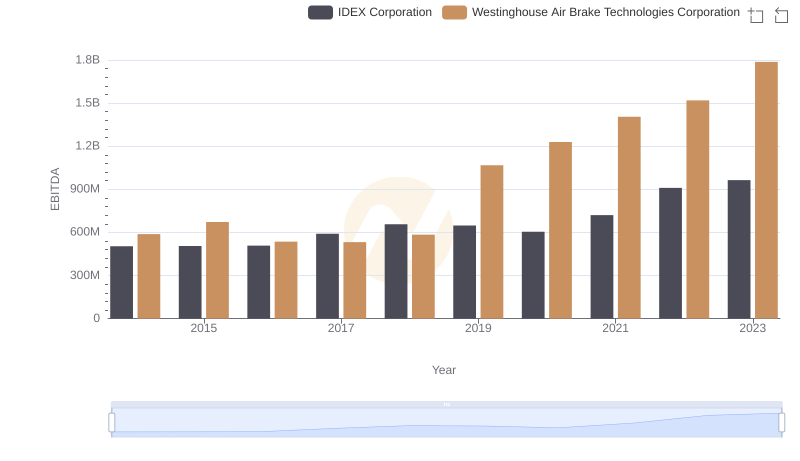

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to IDEX Corporation

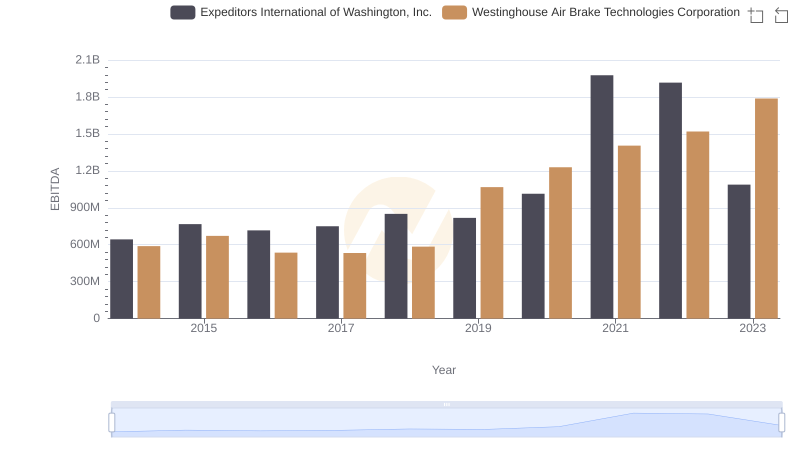

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Expeditors International of Washington, Inc.

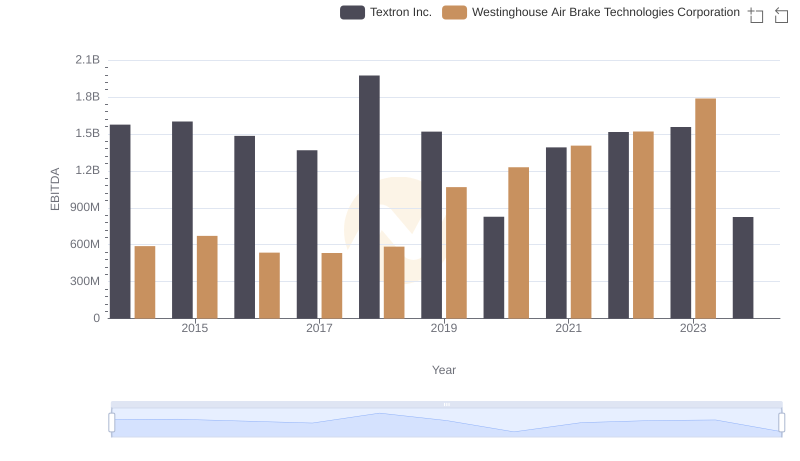

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Textron Inc.

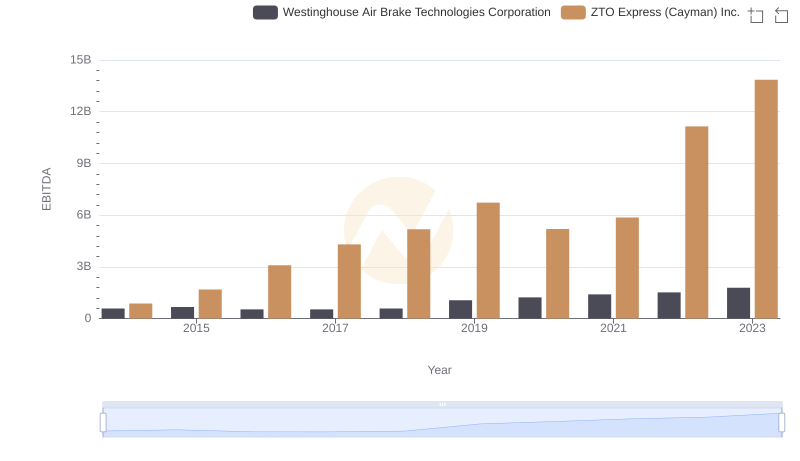

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

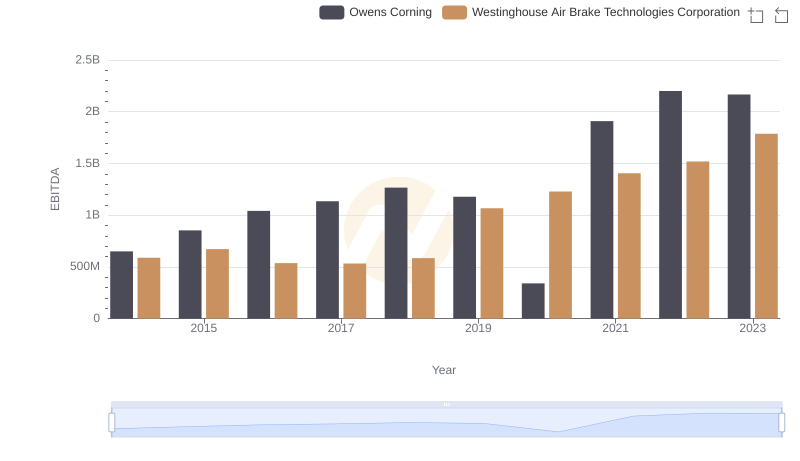

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Owens Corning