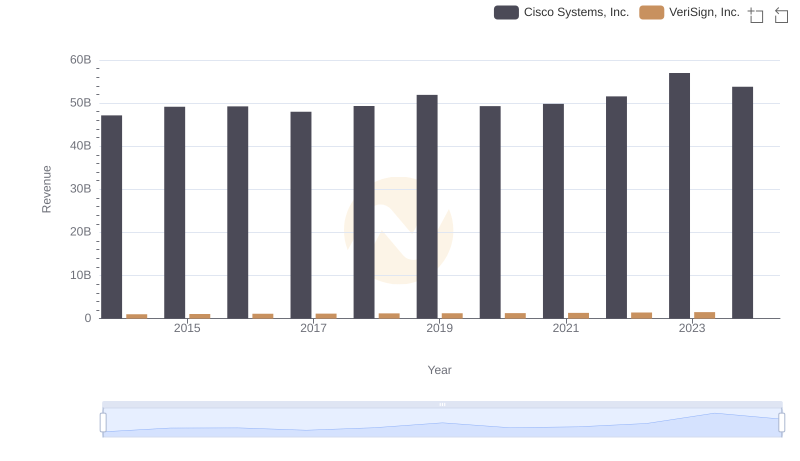

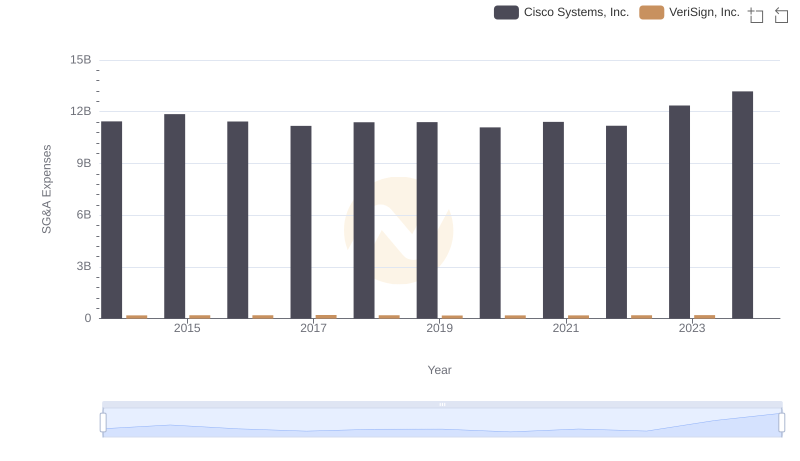

| __timestamp | Cisco Systems, Inc. | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 12709000000 | 632995000 |

| Thursday, January 1, 2015 | 14209000000 | 656772000 |

| Friday, January 1, 2016 | 15678000000 | 754904000 |

| Sunday, January 1, 2017 | 15383000000 | 785226000 |

| Monday, January 1, 2018 | 16172000000 | 892728000 |

| Tuesday, January 1, 2019 | 17334000000 | 895717000 |

| Wednesday, January 1, 2020 | 16363000000 | 886740000 |

| Friday, January 1, 2021 | 15558000000 | 913414000 |

| Saturday, January 1, 2022 | 16794000000 | 1002400000 |

| Sunday, January 1, 2023 | 17471000000 | 1095900000 |

| Monday, January 1, 2024 | 15747000000 | 1134100000 |

Data in motion

In the ever-evolving landscape of technology, Cisco Systems, Inc. and VeriSign, Inc. have carved out significant niches. From 2014 to 2023, Cisco's EBITDA has shown a robust upward trend, peaking in 2023 with a 37% increase from 2014. This growth underscores Cisco's resilience and adaptability in a competitive market. In contrast, VeriSign's EBITDA, while more modest, has grown by approximately 73% over the same period, reflecting its steady expansion in the domain registration and internet security sectors.

Cisco's EBITDA reached its zenith in 2023, while VeriSign's highest recorded EBITDA was in 2023, marking a 73% increase from its 2014 figures. Notably, data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. As these companies continue to innovate, their financial trajectories offer valuable insights into the broader tech industry's future.

Comparing Revenue Performance: Cisco Systems, Inc. or VeriSign, Inc.?

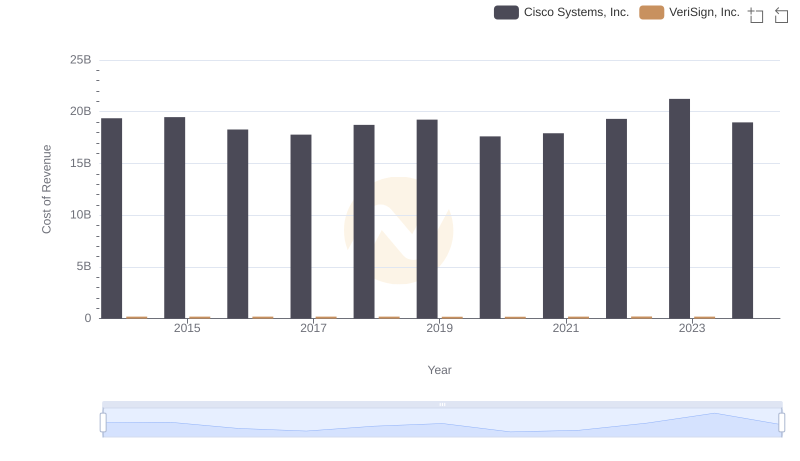

Cost of Revenue: Key Insights for Cisco Systems, Inc. and VeriSign, Inc.

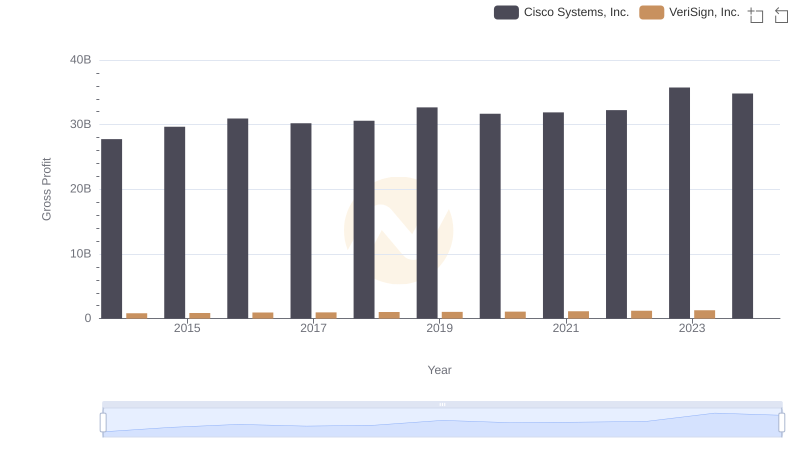

Cisco Systems, Inc. vs VeriSign, Inc.: A Gross Profit Performance Breakdown

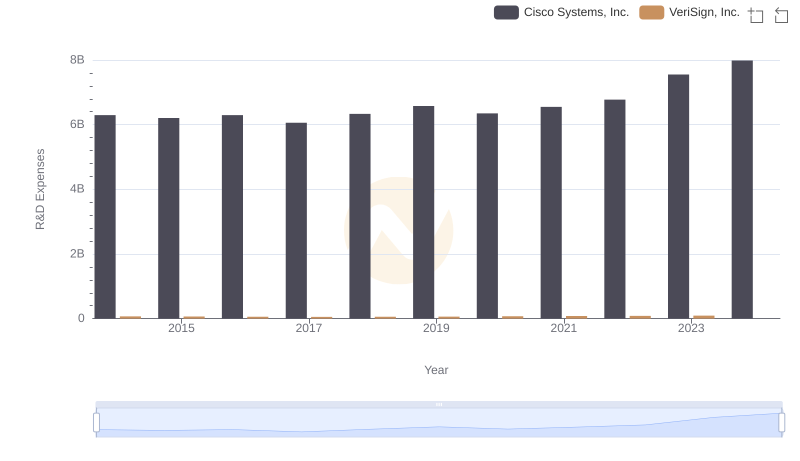

R&D Insights: How Cisco Systems, Inc. and VeriSign, Inc. Allocate Funds

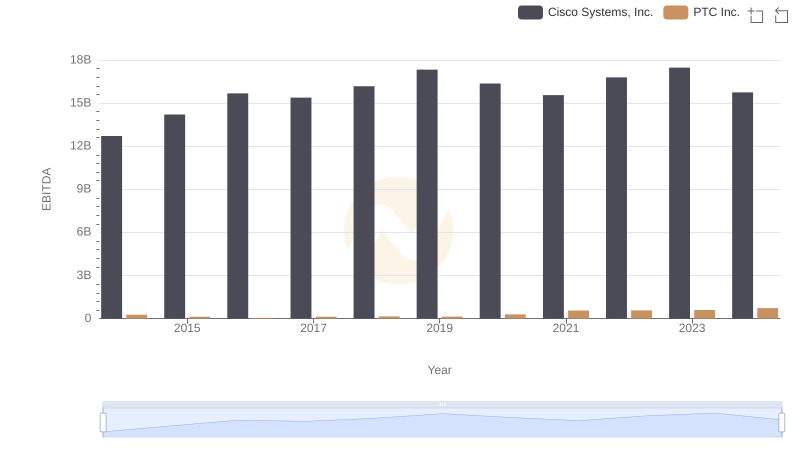

A Professional Review of EBITDA: Cisco Systems, Inc. Compared to PTC Inc.

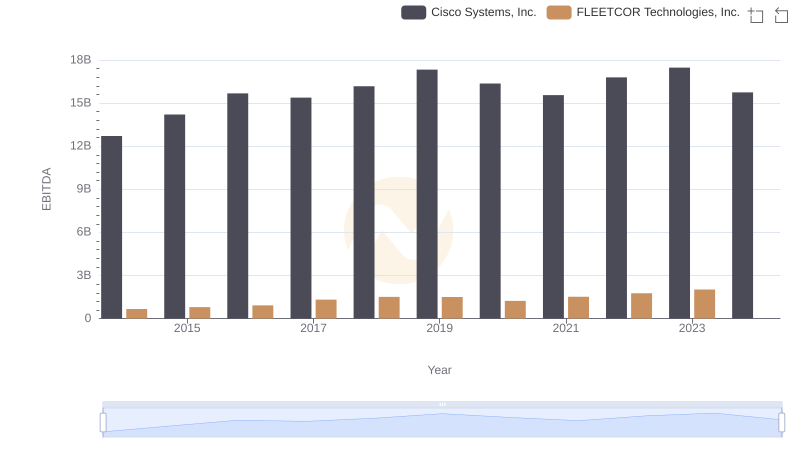

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs FLEETCOR Technologies, Inc.

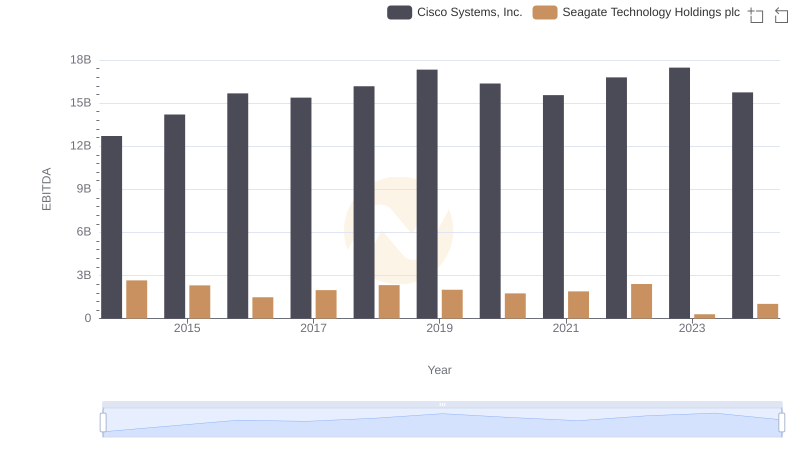

Cisco Systems, Inc. and Seagate Technology Holdings plc: A Detailed Examination of EBITDA Performance

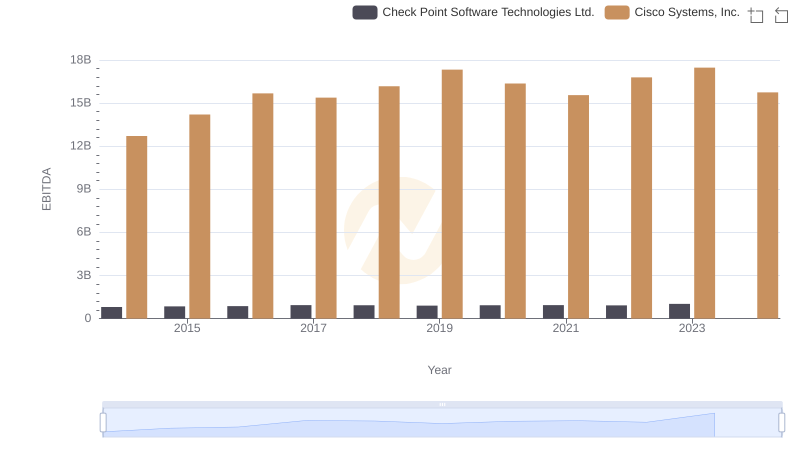

Comparative EBITDA Analysis: Cisco Systems, Inc. vs Check Point Software Technologies Ltd.

Cisco Systems, Inc. vs VeriSign, Inc.: SG&A Expense Trends

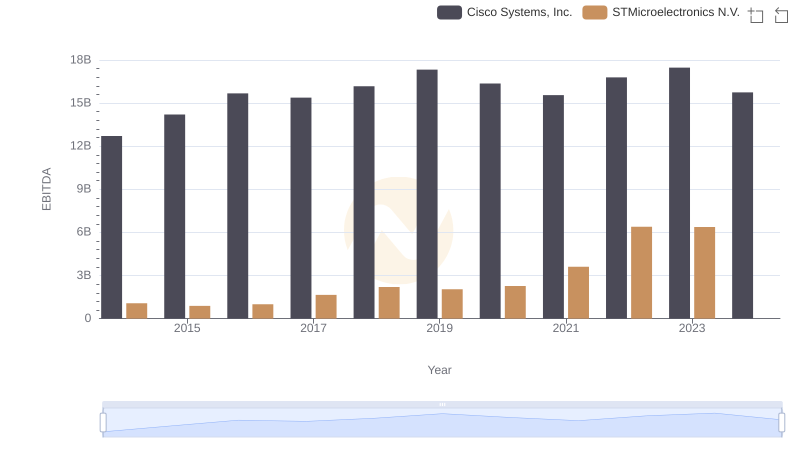

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against STMicroelectronics N.V.

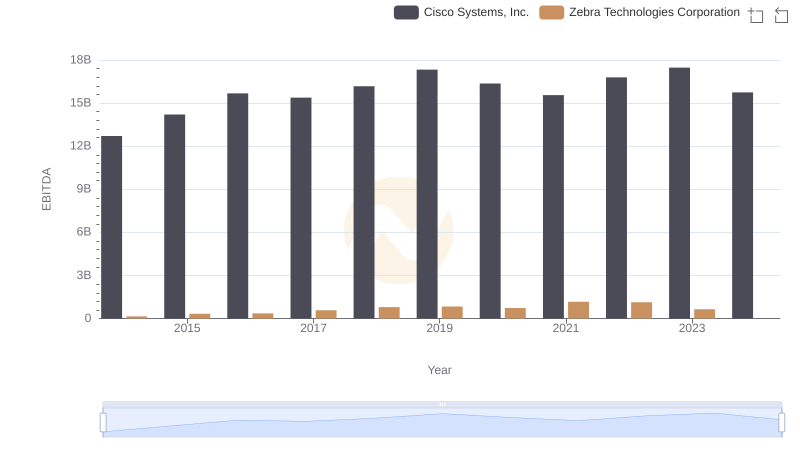

EBITDA Performance Review: Cisco Systems, Inc. vs Zebra Technologies Corporation

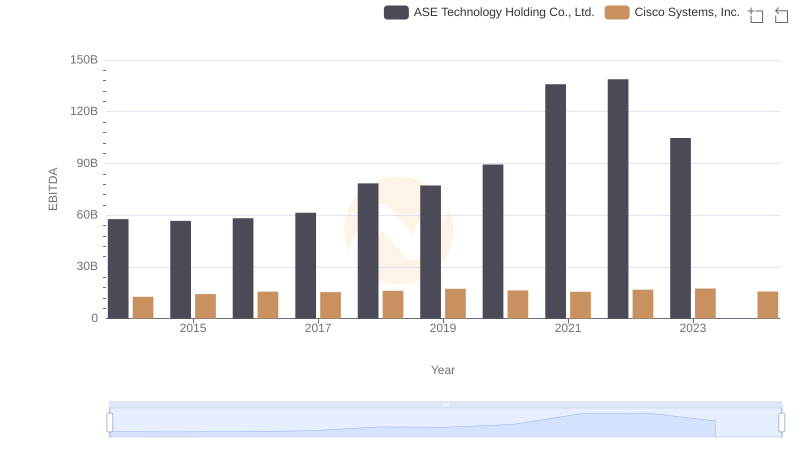

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against ASE Technology Holding Co., Ltd.