| __timestamp | Cisco Systems, Inc. | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 12709000000 | 1069000000 |

| Thursday, January 1, 2015 | 14209000000 | 887000000 |

| Friday, January 1, 2016 | 15678000000 | 1001000000 |

| Sunday, January 1, 2017 | 15383000000 | 1655000000 |

| Monday, January 1, 2018 | 16172000000 | 2197000000 |

| Tuesday, January 1, 2019 | 17334000000 | 2040000000 |

| Wednesday, January 1, 2020 | 16363000000 | 2266000000 |

| Friday, January 1, 2021 | 15558000000 | 3611000000 |

| Saturday, January 1, 2022 | 16794000000 | 6397000000 |

| Sunday, January 1, 2023 | 17471000000 | 6379000000 |

| Monday, January 1, 2024 | 15747000000 |

Unleashing the power of data

In the ever-evolving tech industry, understanding financial health is crucial. This analysis delves into the EBITDA performance of two giants: Cisco Systems, Inc. and STMicroelectronics N.V., from 2014 to 2023. Cisco consistently outperformed STMicroelectronics, with an average EBITDA nearly six times higher. Notably, Cisco's EBITDA peaked in 2023, showing a 37% increase from 2014, reflecting its robust market position and strategic growth initiatives.

Conversely, STMicroelectronics demonstrated significant growth, with its EBITDA surging by nearly 500% from 2014 to 2022, highlighting its aggressive expansion and innovation strategies. However, data for 2024 is missing, leaving room for speculation on future trends. This financial journey underscores the dynamic nature of the tech sector, where strategic decisions and market adaptability define success.

Stay tuned for more insights into the financial trajectories of leading tech companies.

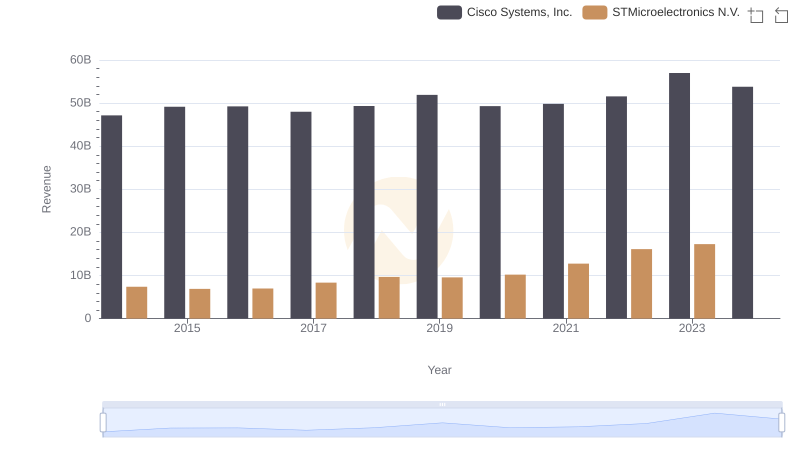

Cisco Systems, Inc. vs STMicroelectronics N.V.: Annual Revenue Growth Compared

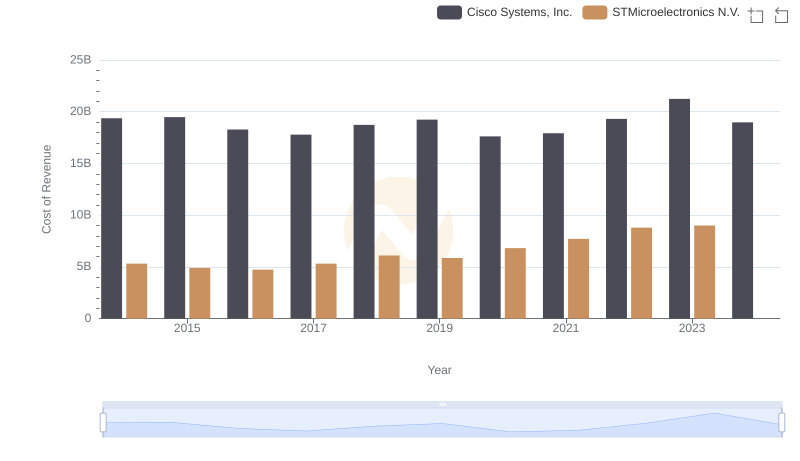

Cisco Systems, Inc. vs STMicroelectronics N.V.: Efficiency in Cost of Revenue Explored

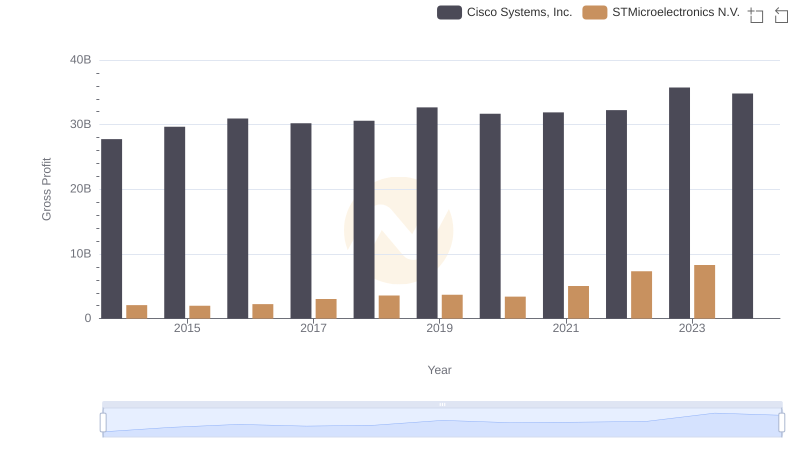

Cisco Systems, Inc. and STMicroelectronics N.V.: A Detailed Gross Profit Analysis

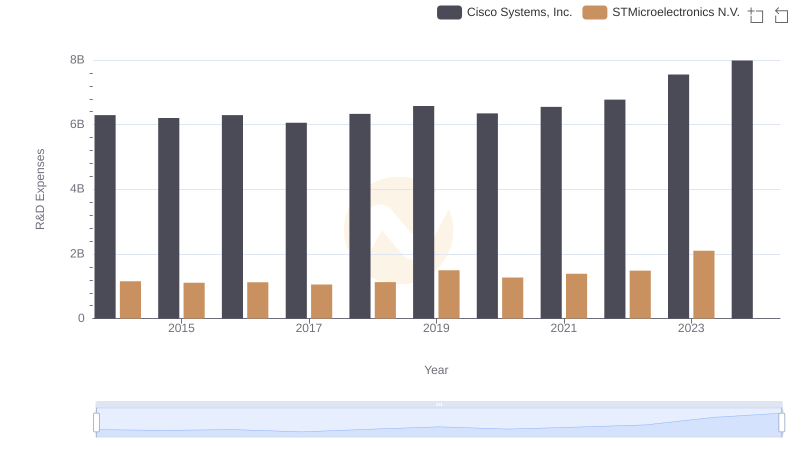

Analyzing R&D Budgets: Cisco Systems, Inc. vs STMicroelectronics N.V.

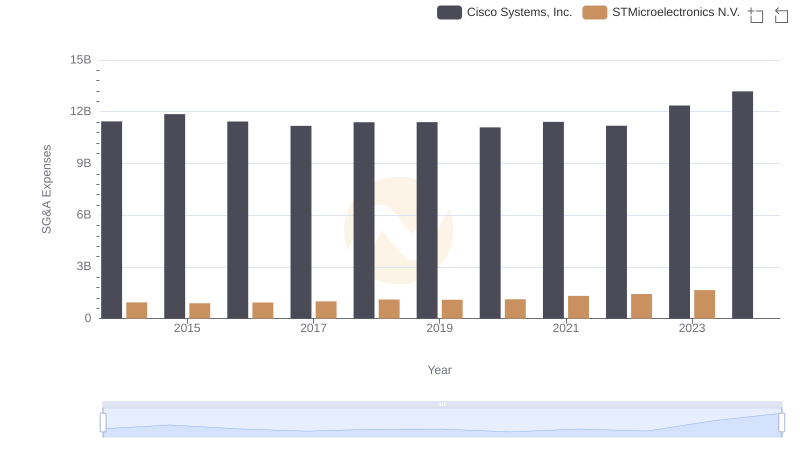

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and STMicroelectronics N.V.

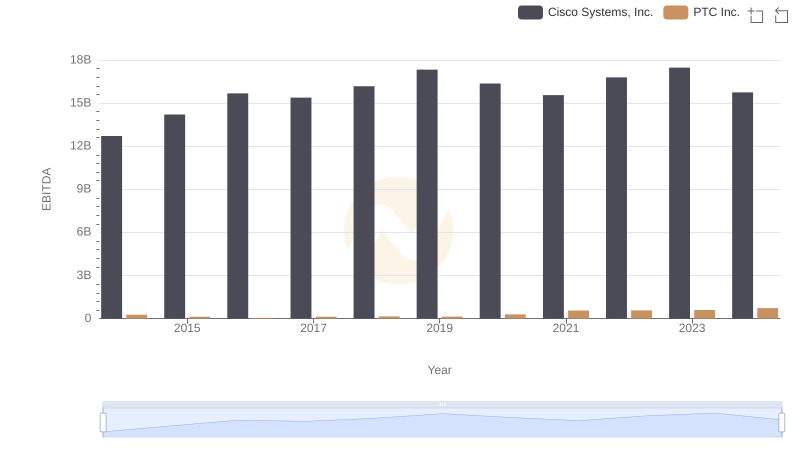

A Professional Review of EBITDA: Cisco Systems, Inc. Compared to PTC Inc.

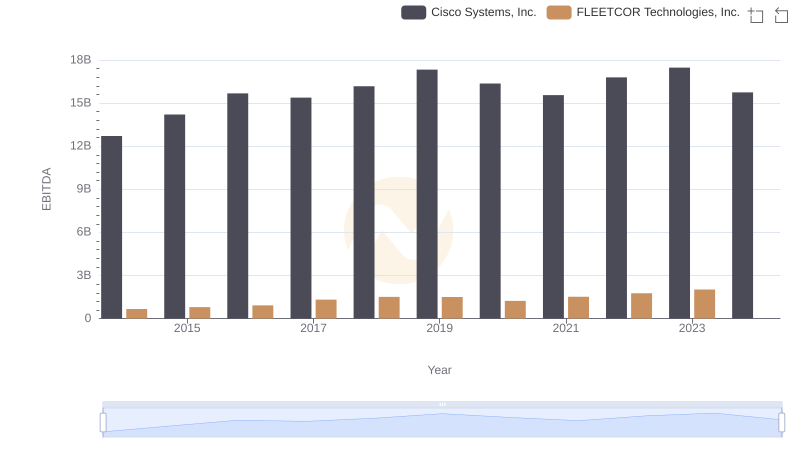

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs FLEETCOR Technologies, Inc.

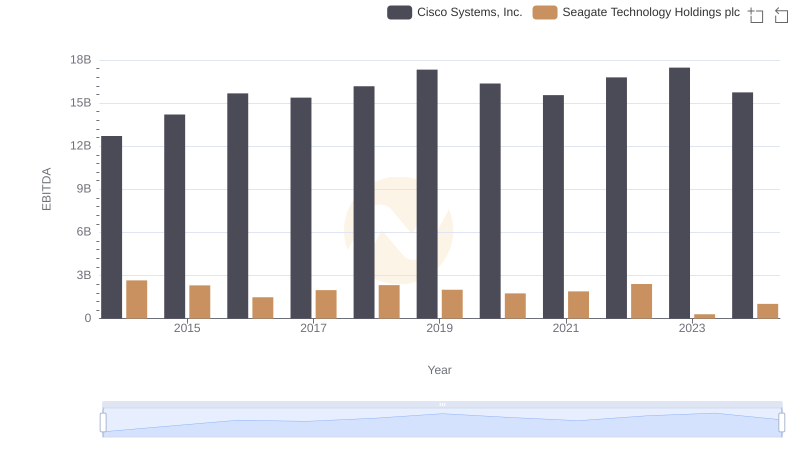

Cisco Systems, Inc. and Seagate Technology Holdings plc: A Detailed Examination of EBITDA Performance

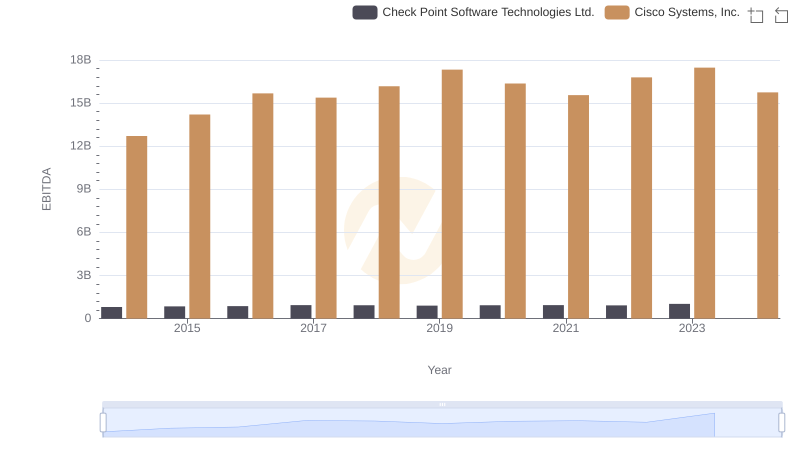

Comparative EBITDA Analysis: Cisco Systems, Inc. vs Check Point Software Technologies Ltd.

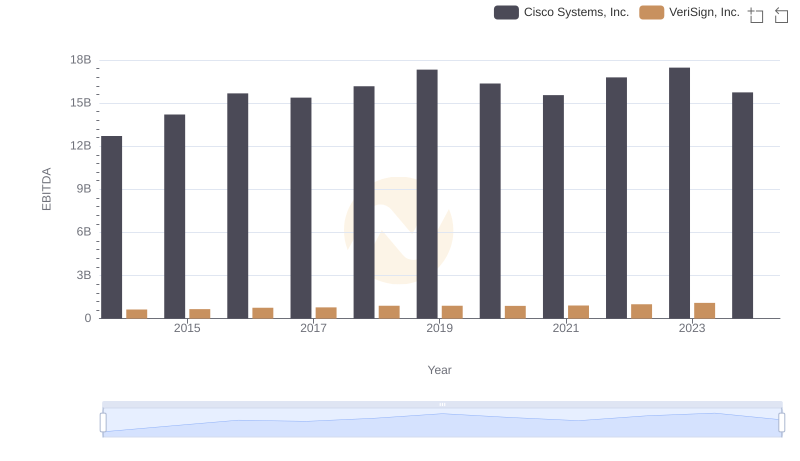

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs VeriSign, Inc.

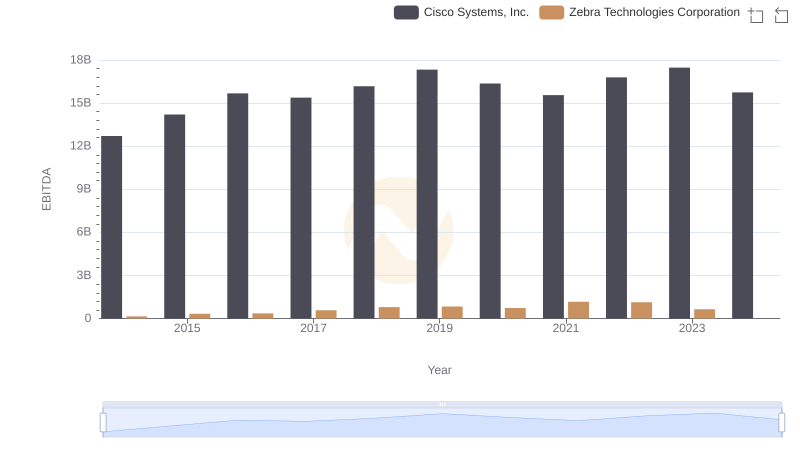

EBITDA Performance Review: Cisco Systems, Inc. vs Zebra Technologies Corporation

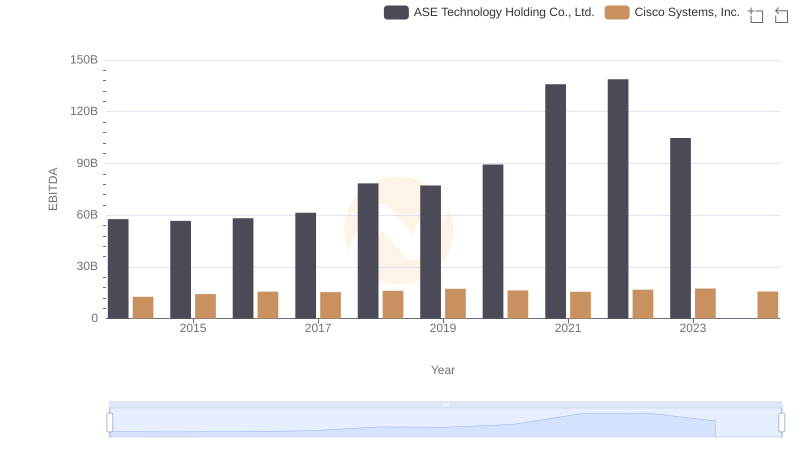

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against ASE Technology Holding Co., Ltd.