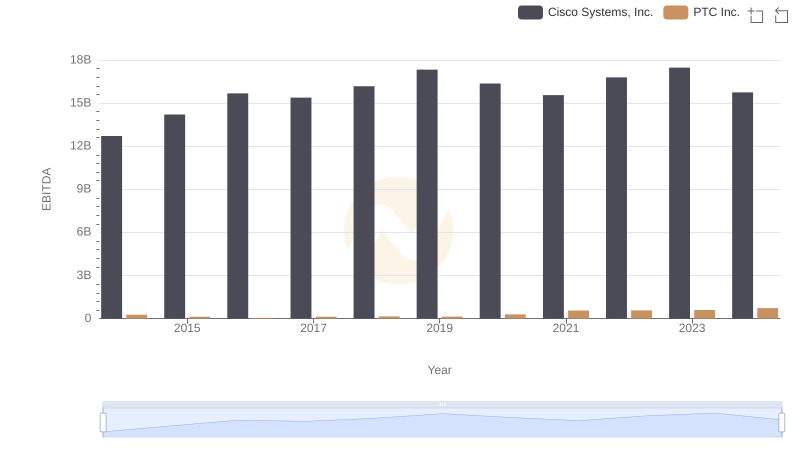

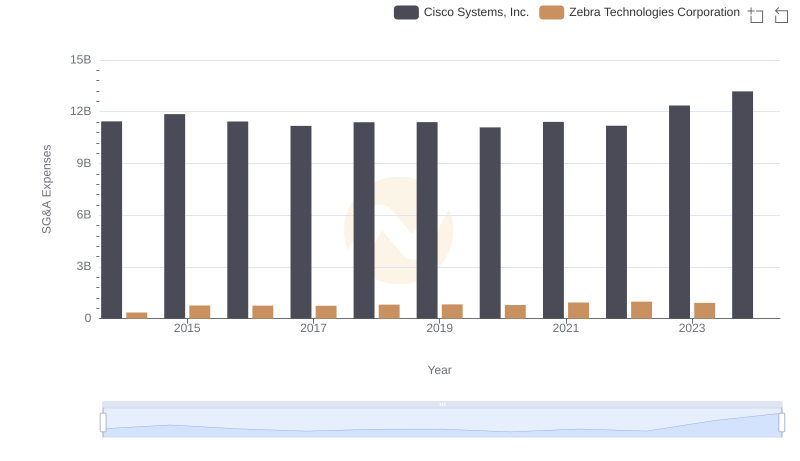

| __timestamp | Cisco Systems, Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 12709000000 | 154836000 |

| Thursday, January 1, 2015 | 14209000000 | 336000000 |

| Friday, January 1, 2016 | 15678000000 | 366000000 |

| Sunday, January 1, 2017 | 15383000000 | 580000000 |

| Monday, January 1, 2018 | 16172000000 | 798000000 |

| Tuesday, January 1, 2019 | 17334000000 | 843000000 |

| Wednesday, January 1, 2020 | 16363000000 | 736000000 |

| Friday, January 1, 2021 | 15558000000 | 1173000000 |

| Saturday, January 1, 2022 | 16794000000 | 1140000000 |

| Sunday, January 1, 2023 | 17471000000 | 652000000 |

| Monday, January 1, 2024 | 15747000000 | 937000000 |

Unleashing insights

In the ever-evolving tech landscape, Cisco Systems, Inc. and Zebra Technologies Corporation have showcased distinct EBITDA trajectories over the past decade. Cisco, a stalwart in networking, consistently demonstrated robust growth, with EBITDA peaking in 2023 at approximately 37% higher than in 2014. This growth underscores Cisco's strategic adaptability and market resilience.

Conversely, Zebra Technologies, a leader in enterprise asset intelligence, experienced more volatility. From a modest start in 2014, Zebra's EBITDA surged by over 650% by 2021, reflecting its aggressive expansion and innovation strategies. However, a notable dip in 2023 suggests potential market challenges or strategic pivots.

This comparative analysis highlights the dynamic nature of the tech industry, where strategic foresight and adaptability are key. As we look to the future, these trends offer valuable insights into the operational efficiencies and market strategies of these industry giants.

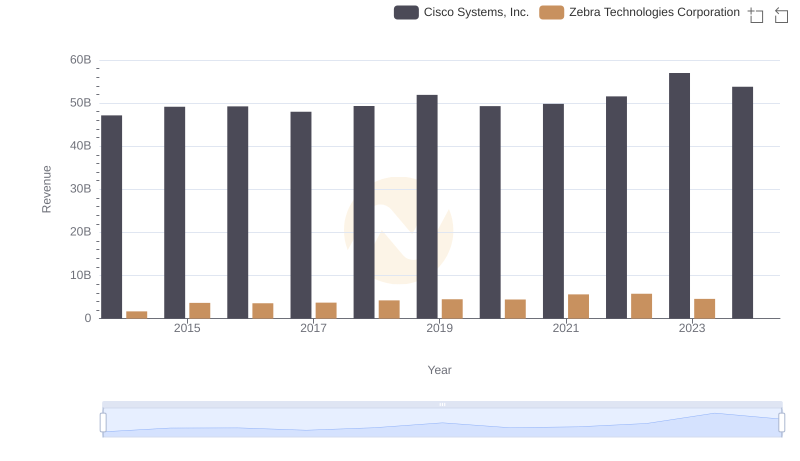

Cisco Systems, Inc. and Zebra Technologies Corporation: A Comprehensive Revenue Analysis

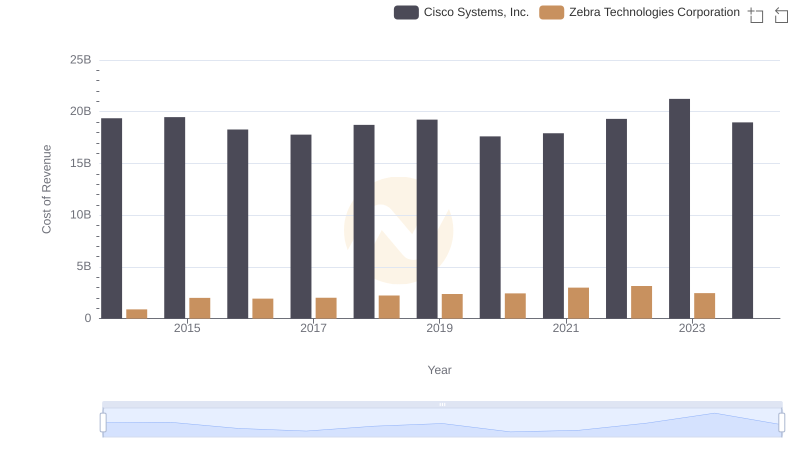

Cost Insights: Breaking Down Cisco Systems, Inc. and Zebra Technologies Corporation's Expenses

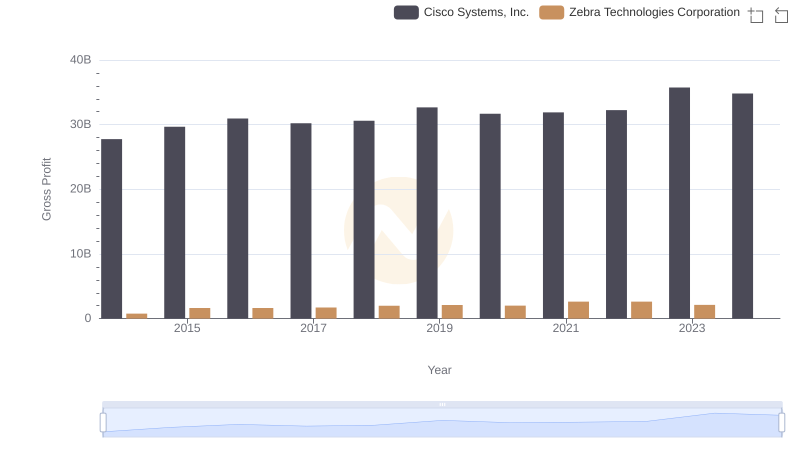

Key Insights on Gross Profit: Cisco Systems, Inc. vs Zebra Technologies Corporation

A Professional Review of EBITDA: Cisco Systems, Inc. Compared to PTC Inc.

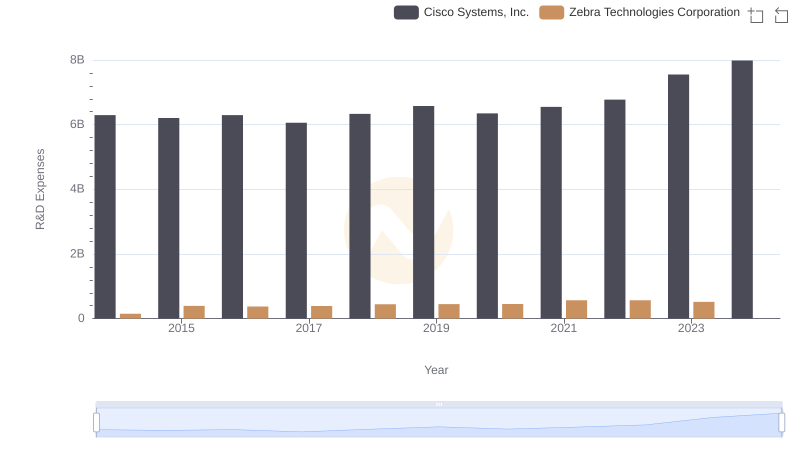

R&D Spending Showdown: Cisco Systems, Inc. vs Zebra Technologies Corporation

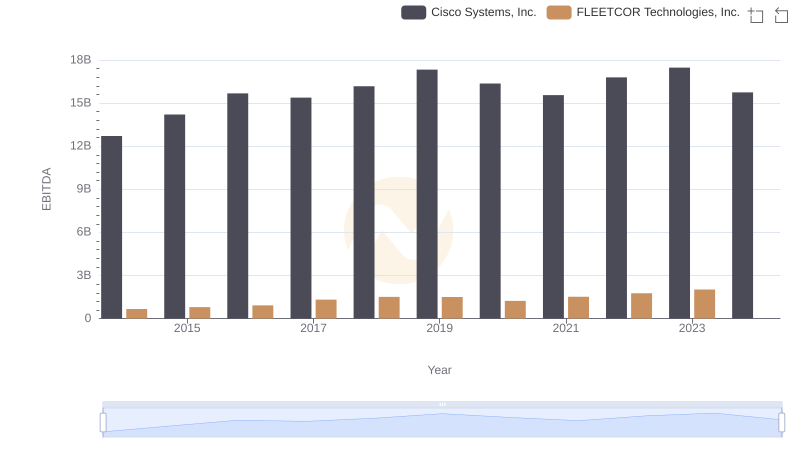

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs FLEETCOR Technologies, Inc.

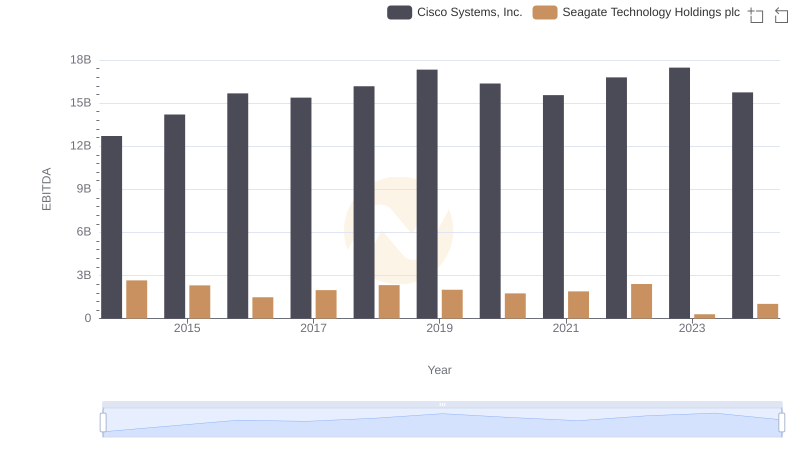

Cisco Systems, Inc. and Seagate Technology Holdings plc: A Detailed Examination of EBITDA Performance

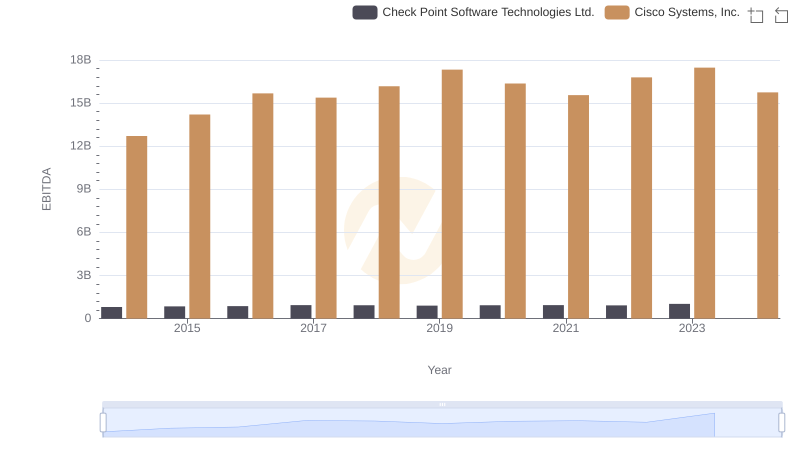

Comparative EBITDA Analysis: Cisco Systems, Inc. vs Check Point Software Technologies Ltd.

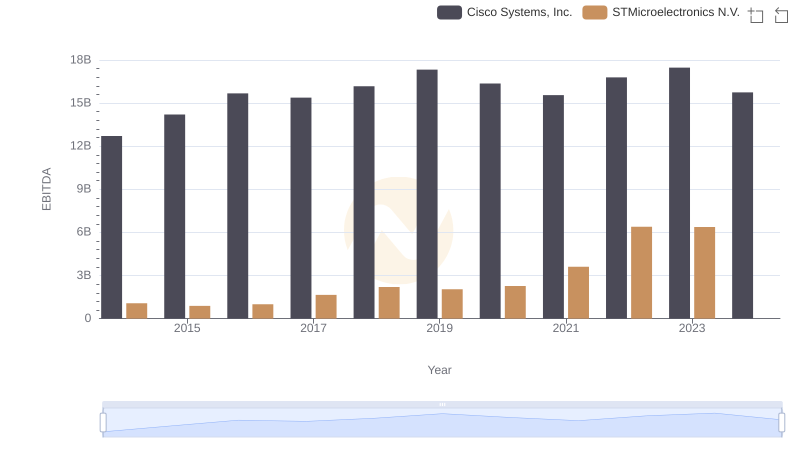

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against STMicroelectronics N.V.

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Zebra Technologies Corporation

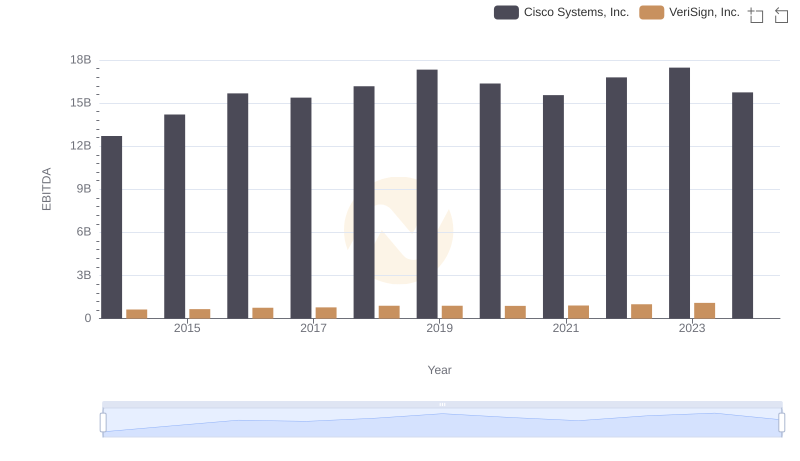

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs VeriSign, Inc.

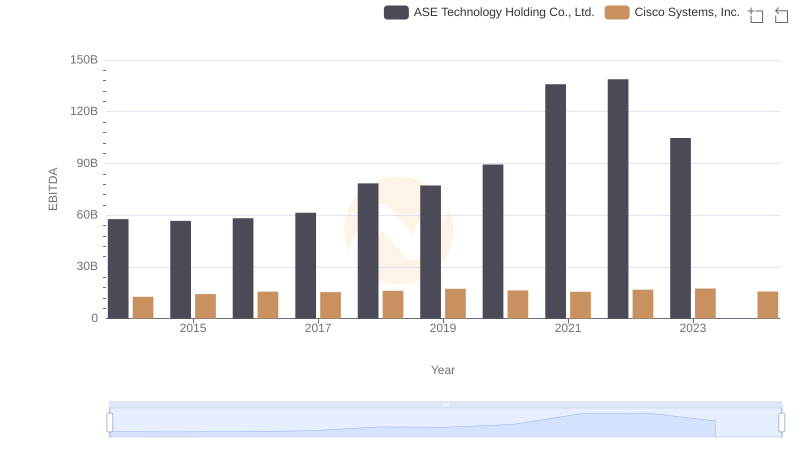

EBITDA Analysis: Evaluating Cisco Systems, Inc. Against ASE Technology Holding Co., Ltd.