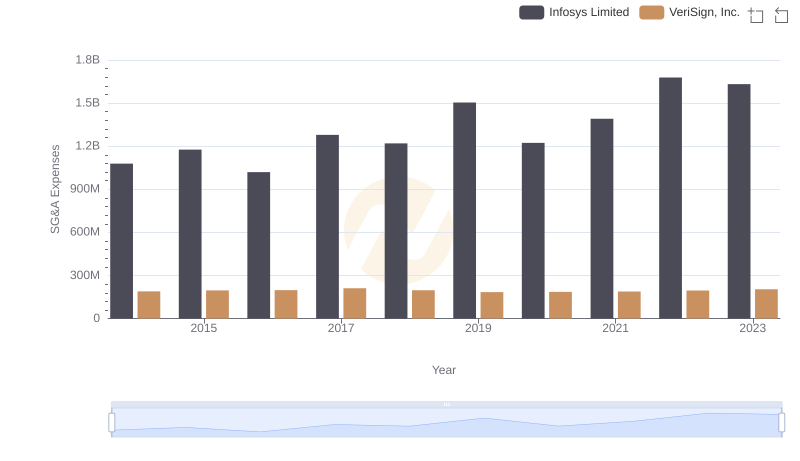

| __timestamp | Infosys Limited | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2258000000 | 632995000 |

| Thursday, January 1, 2015 | 2590000000 | 656772000 |

| Friday, January 1, 2016 | 2765000000 | 754904000 |

| Sunday, January 1, 2017 | 2936000000 | 785226000 |

| Monday, January 1, 2018 | 2984000000 | 892728000 |

| Tuesday, January 1, 2019 | 3053000000 | 895717000 |

| Wednesday, January 1, 2020 | 4053342784 | 886740000 |

| Friday, January 1, 2021 | 4116000000 | 913414000 |

| Saturday, January 1, 2022 | 4707334610 | 1002400000 |

| Sunday, January 1, 2023 | 4206000000 | 1095900000 |

| Monday, January 1, 2024 | 1134100000 |

Cracking the code

In the ever-evolving landscape of global technology, Infosys Limited and VeriSign, Inc. have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Infosys has consistently outperformed VeriSign in terms of EBITDA, reflecting its robust operational efficiency and strategic growth initiatives.

Infosys has seen its EBITDA grow by approximately 86% from 2014 to 2023, peaking in 2022. This growth underscores Infosys's ability to adapt and thrive in a competitive market, leveraging its expertise in IT services and consulting.

VeriSign, while maintaining a steady EBITDA growth of around 73% over the same period, highlights its stable position in the domain name registry and internet security sectors. Despite its smaller scale compared to Infosys, VeriSign's consistent performance is noteworthy.

This analysis provides a compelling snapshot of how these two tech giants have navigated the financial landscape, offering valuable insights for investors and industry enthusiasts alike.

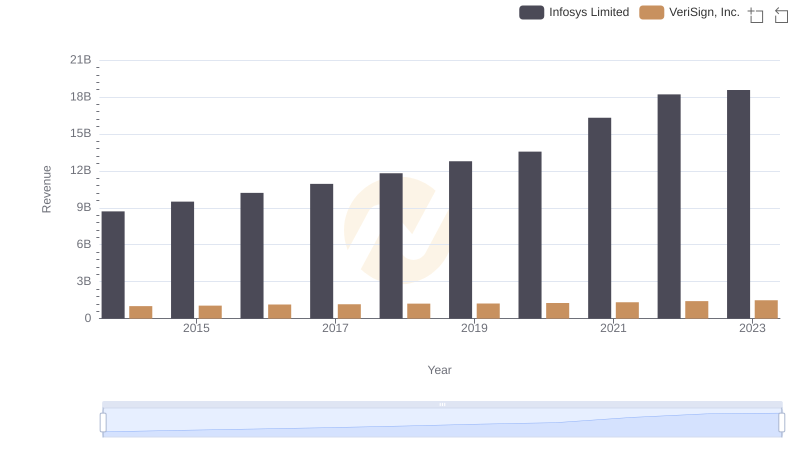

Infosys Limited and VeriSign, Inc.: A Comprehensive Revenue Analysis

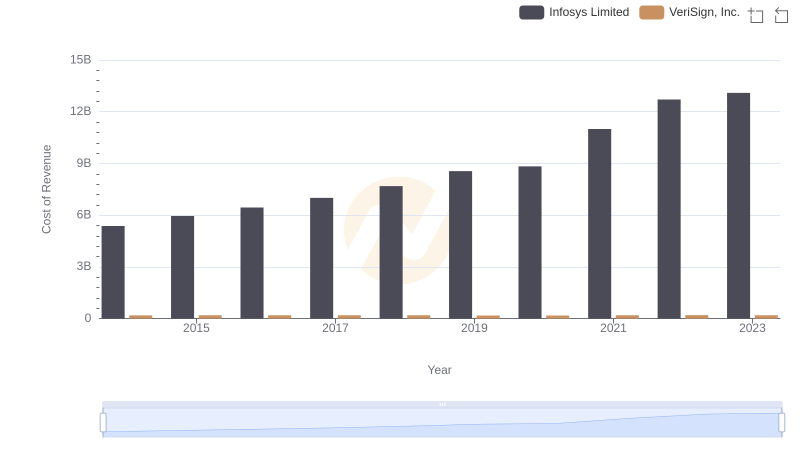

Cost of Revenue: Key Insights for Infosys Limited and VeriSign, Inc.

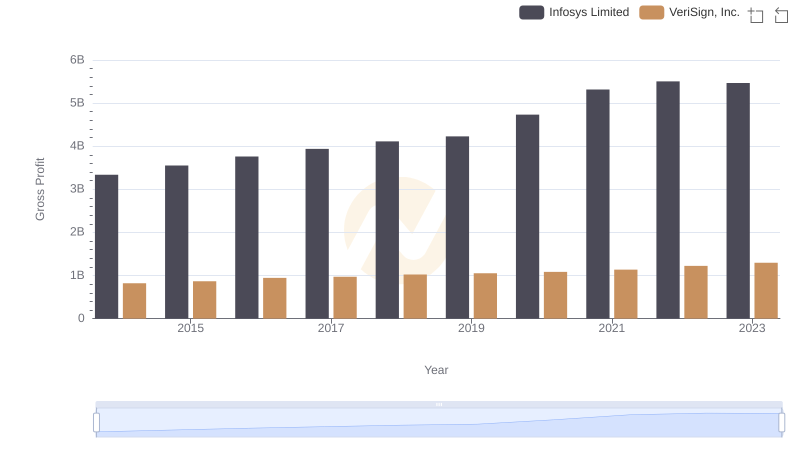

Key Insights on Gross Profit: Infosys Limited vs VeriSign, Inc.

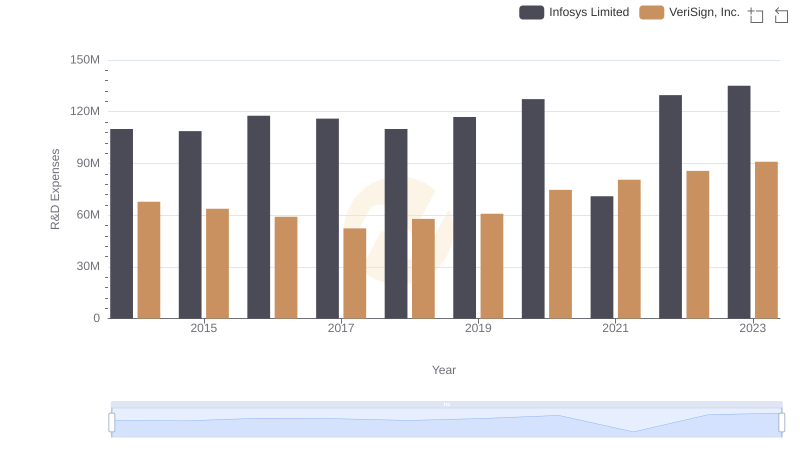

Infosys Limited or VeriSign, Inc.: Who Invests More in Innovation?

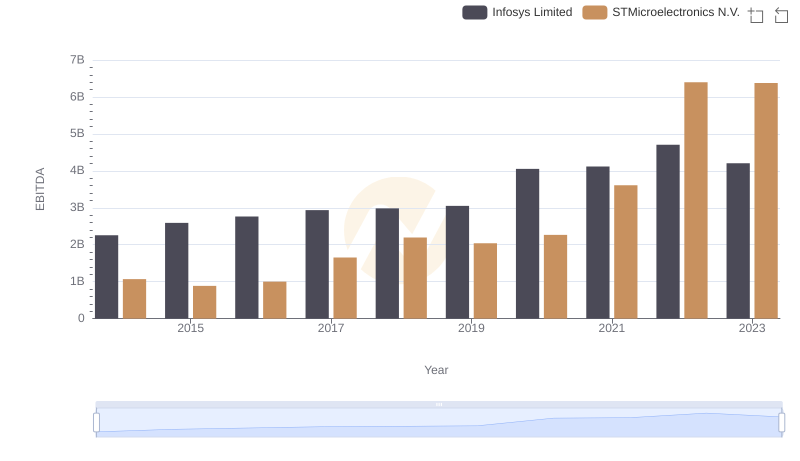

Professional EBITDA Benchmarking: Infosys Limited vs STMicroelectronics N.V.

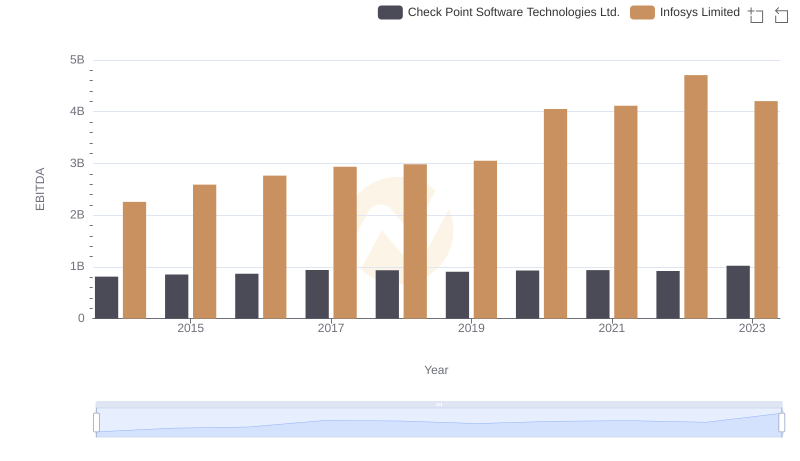

EBITDA Analysis: Evaluating Infosys Limited Against Check Point Software Technologies Ltd.

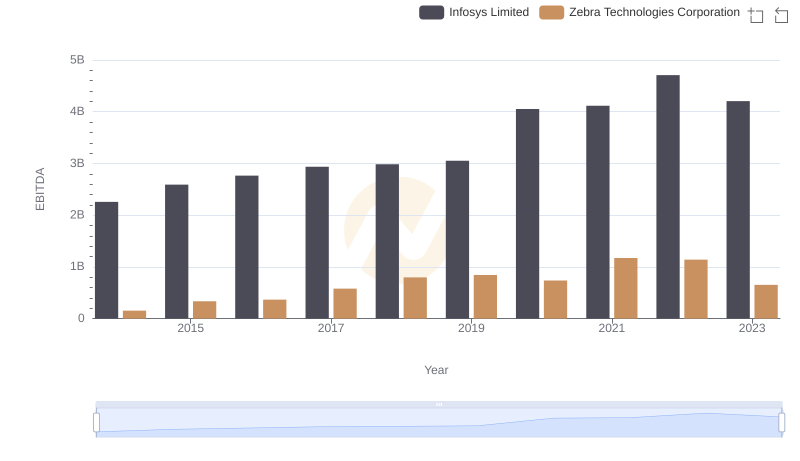

Comprehensive EBITDA Comparison: Infosys Limited vs Zebra Technologies Corporation

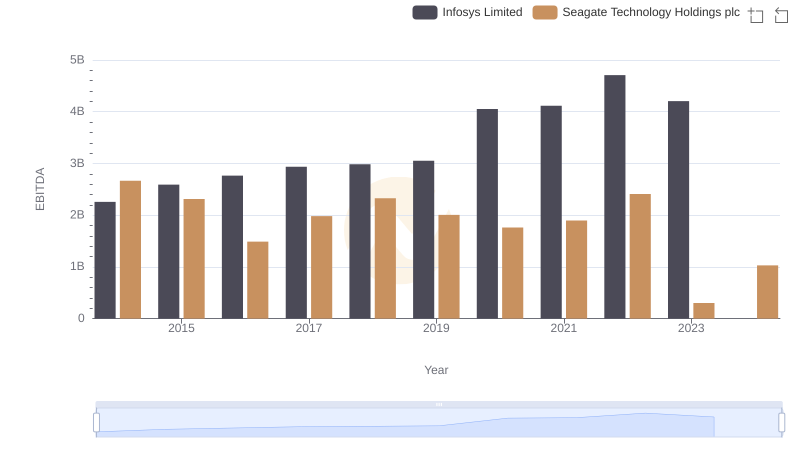

Comparative EBITDA Analysis: Infosys Limited vs Seagate Technology Holdings plc

Cost Management Insights: SG&A Expenses for Infosys Limited and VeriSign, Inc.

Infosys Limited and ASE Technology Holding Co., Ltd.: A Detailed Examination of EBITDA Performance

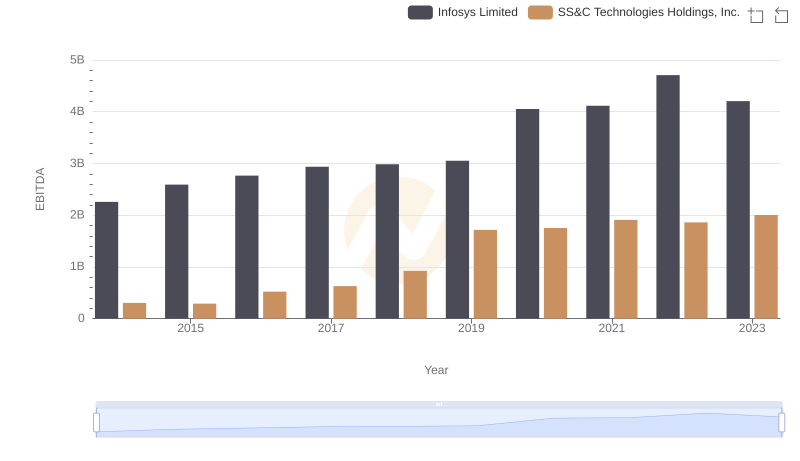

Comparative EBITDA Analysis: Infosys Limited vs SS&C Technologies Holdings, Inc.

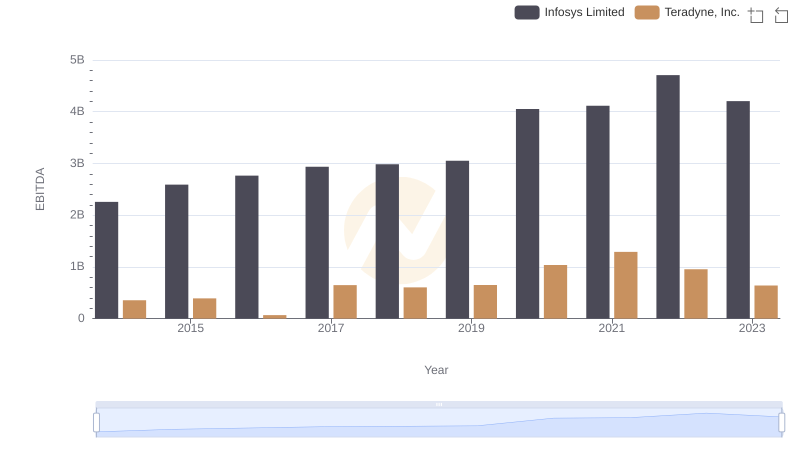

EBITDA Metrics Evaluated: Infosys Limited vs Teradyne, Inc.