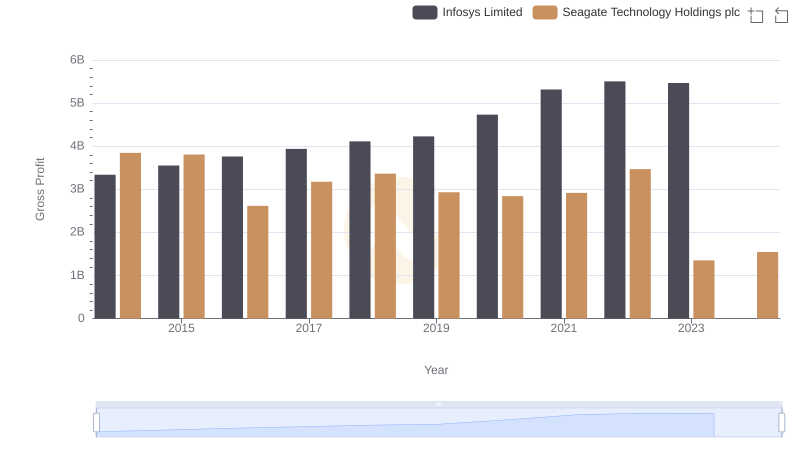

| __timestamp | Infosys Limited | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2258000000 | 2665000000 |

| Thursday, January 1, 2015 | 2590000000 | 2312000000 |

| Friday, January 1, 2016 | 2765000000 | 1488000000 |

| Sunday, January 1, 2017 | 2936000000 | 1981000000 |

| Monday, January 1, 2018 | 2984000000 | 2328000000 |

| Tuesday, January 1, 2019 | 3053000000 | 2006000000 |

| Wednesday, January 1, 2020 | 4053342784 | 1761000000 |

| Friday, January 1, 2021 | 4116000000 | 1897000000 |

| Saturday, January 1, 2022 | 4707334610 | 2409000000 |

| Sunday, January 1, 2023 | 4206000000 | 301000000 |

| Monday, January 1, 2024 | 1030000000 |

Data in motion

In the ever-evolving landscape of global technology, the financial performance of industry giants like Infosys Limited and Seagate Technology Holdings plc offers a fascinating glimpse into their strategic maneuvers. Over the past decade, Infosys has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 86% from 2014 to 2023. This growth underscores Infosys's resilience and adaptability in a competitive market.

Conversely, Seagate's EBITDA journey reflects a more volatile path, with a notable dip in 2023, where it plummeted to just 11% of its 2014 value. This decline highlights the challenges faced by hardware-centric companies in an increasingly software-driven world.

While Infosys's consistent upward trend showcases its strategic prowess, Seagate's fluctuating performance calls for a deeper analysis of its market strategies. As we look to the future, these insights provide valuable lessons for investors and industry watchers alike.

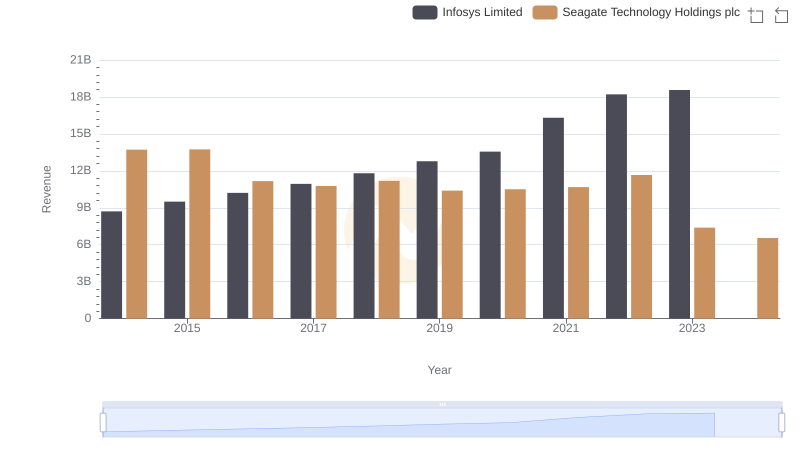

Infosys Limited or Seagate Technology Holdings plc: Who Leads in Yearly Revenue?

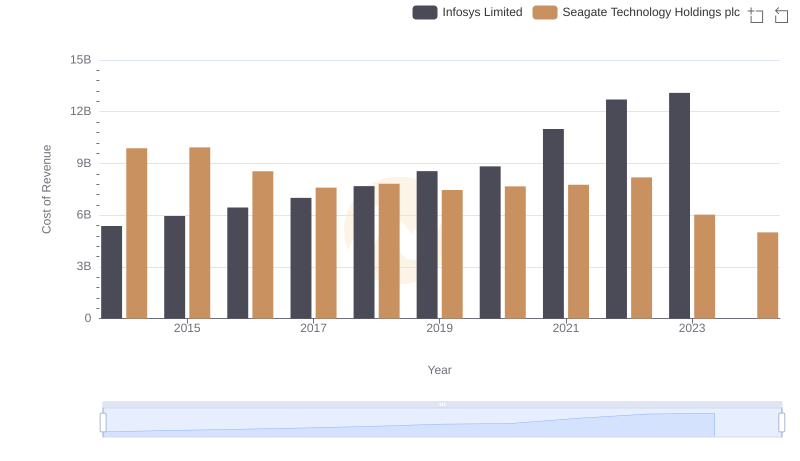

Infosys Limited vs Seagate Technology Holdings plc: Efficiency in Cost of Revenue Explored

Gross Profit Comparison: Infosys Limited and Seagate Technology Holdings plc Trends

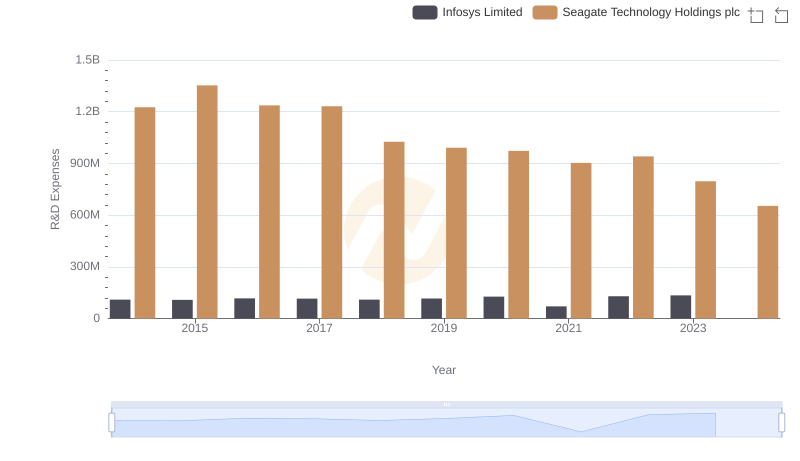

Who Prioritizes Innovation? R&D Spending Compared for Infosys Limited and Seagate Technology Holdings plc

A Professional Review of EBITDA: Infosys Limited Compared to ON Semiconductor Corporation

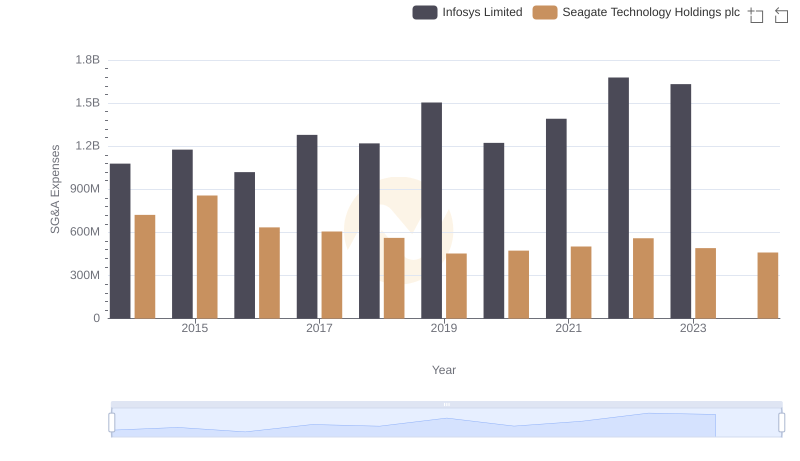

Infosys Limited or Seagate Technology Holdings plc: Who Manages SG&A Costs Better?

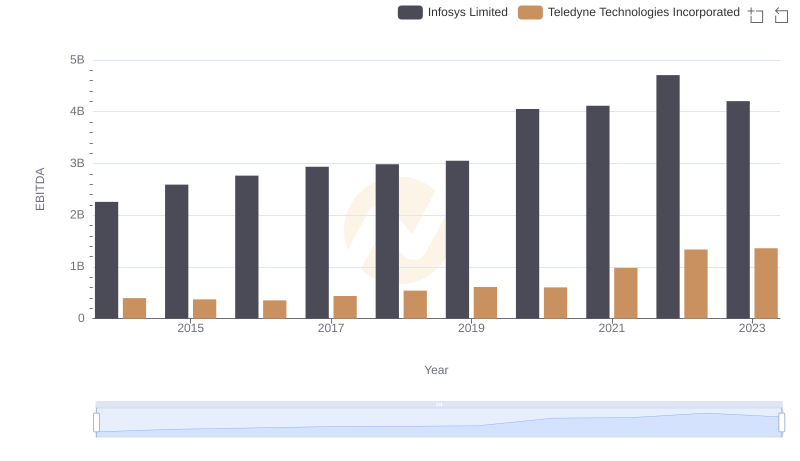

EBITDA Performance Review: Infosys Limited vs Teledyne Technologies Incorporated

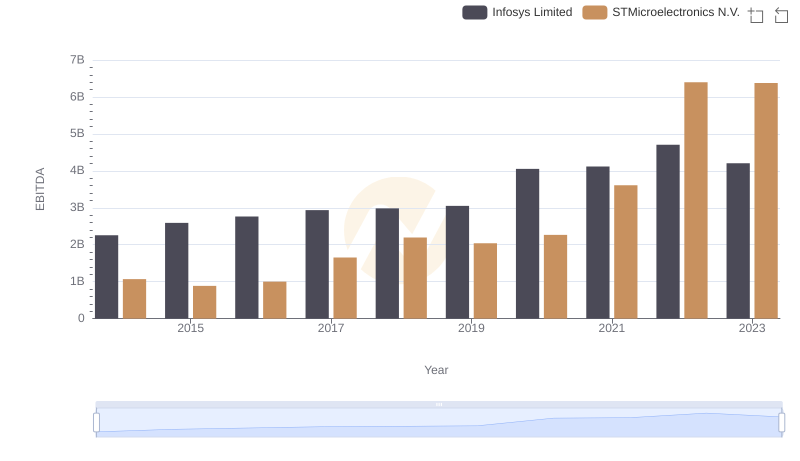

Professional EBITDA Benchmarking: Infosys Limited vs STMicroelectronics N.V.

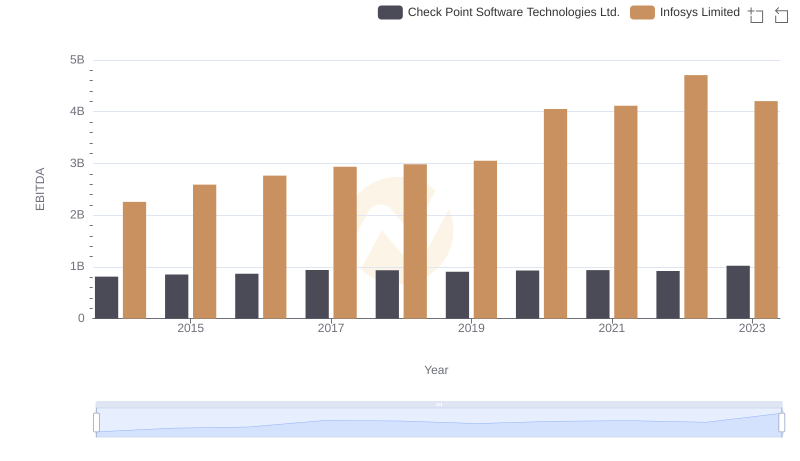

EBITDA Analysis: Evaluating Infosys Limited Against Check Point Software Technologies Ltd.

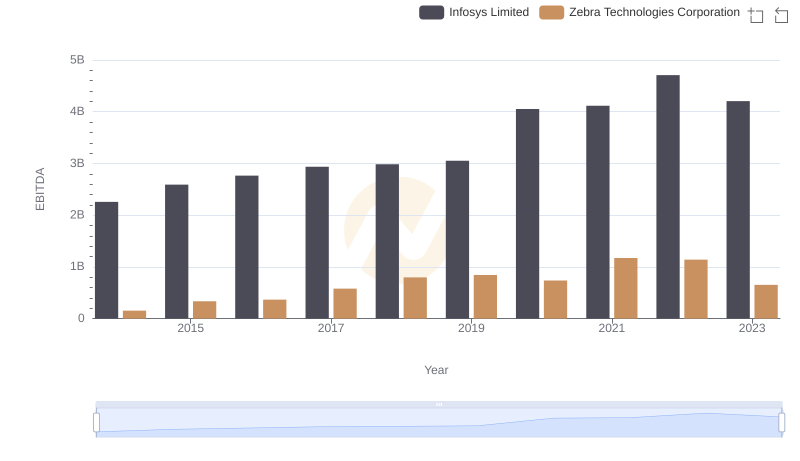

Comprehensive EBITDA Comparison: Infosys Limited vs Zebra Technologies Corporation

Infosys Limited and ASE Technology Holding Co., Ltd.: A Detailed Examination of EBITDA Performance

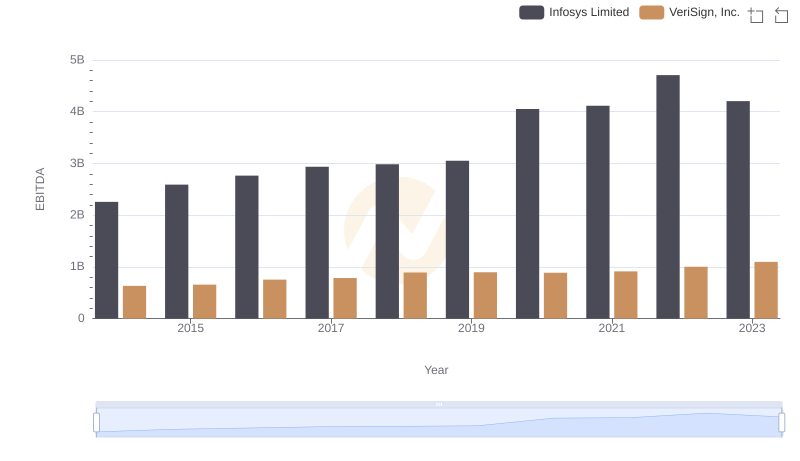

EBITDA Analysis: Evaluating Infosys Limited Against VeriSign, Inc.