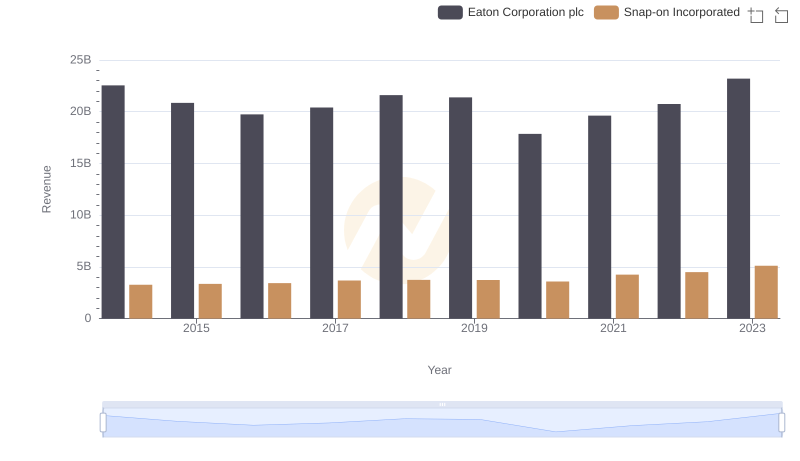

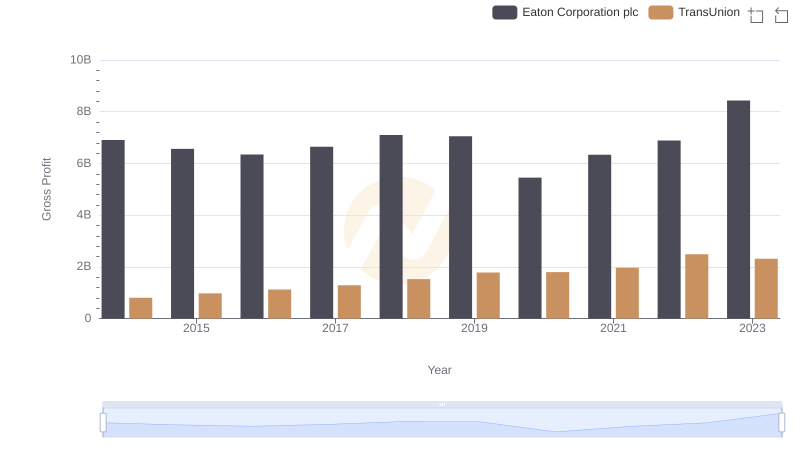

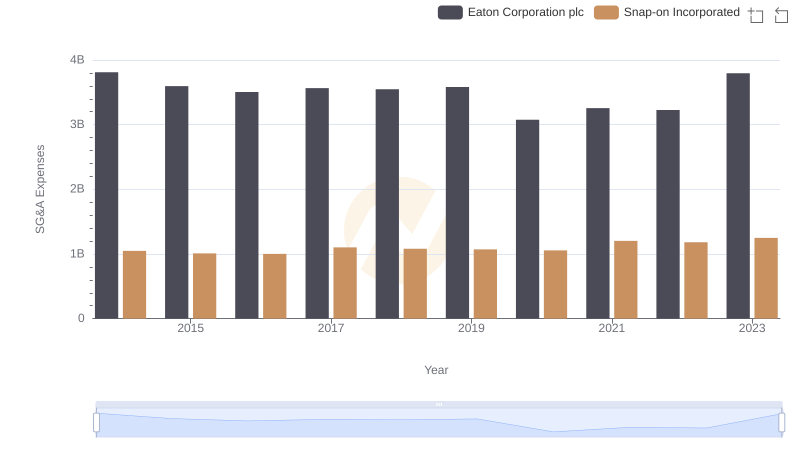

| __timestamp | Eaton Corporation plc | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 6906000000 | 1584300000 |

| Thursday, January 1, 2015 | 6563000000 | 1648300000 |

| Friday, January 1, 2016 | 6347000000 | 1709600000 |

| Sunday, January 1, 2017 | 6648000000 | 1824900000 |

| Monday, January 1, 2018 | 7098000000 | 1870000000 |

| Tuesday, January 1, 2019 | 7052000000 | 1844000000 |

| Wednesday, January 1, 2020 | 5450000000 | 1748500000 |

| Friday, January 1, 2021 | 6335000000 | 2110800000 |

| Saturday, January 1, 2022 | 6887000000 | 2181100000 |

| Sunday, January 1, 2023 | 8433000000 | 2619800000 |

| Monday, January 1, 2024 | 9503000000 | 2377900000 |

Data in motion

In the ever-evolving landscape of industrial manufacturing, Eaton Corporation plc and Snap-on Incorporated have emerged as formidable players. Over the past decade, Eaton's gross profit has seen a remarkable journey, peaking in 2023 with an impressive 25% increase from its 2014 figures. Meanwhile, Snap-on has steadily climbed, achieving a 65% growth in the same period.

Eaton's performance, despite a dip in 2020, showcases its resilience and strategic prowess. The company rebounded strongly, culminating in a gross profit surge in 2023, reflecting its adaptability and market acumen.

Snap-on, on the other hand, has demonstrated consistent growth, with its gross profit nearly doubling since 2014. This steady ascent underscores its robust business model and commitment to innovation.

Both companies exemplify the dynamic nature of the industrial sector, each carving its path to success.

Breaking Down Revenue Trends: Eaton Corporation plc vs Snap-on Incorporated

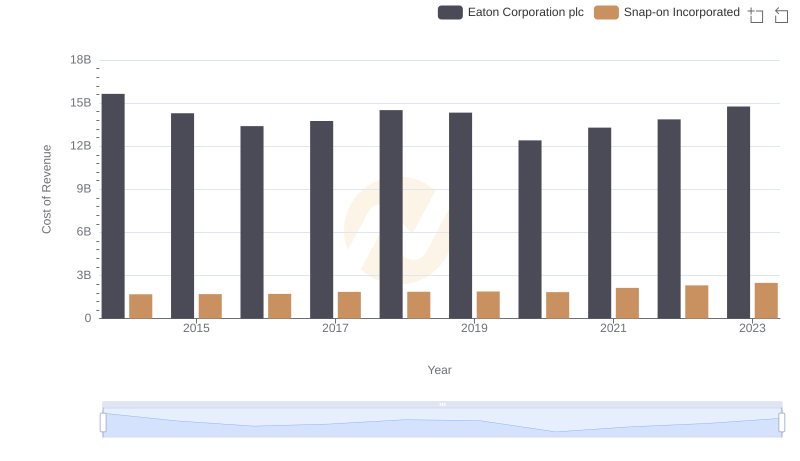

Cost of Revenue: Key Insights for Eaton Corporation plc and Snap-on Incorporated

Gross Profit Trends Compared: Eaton Corporation plc vs TransUnion

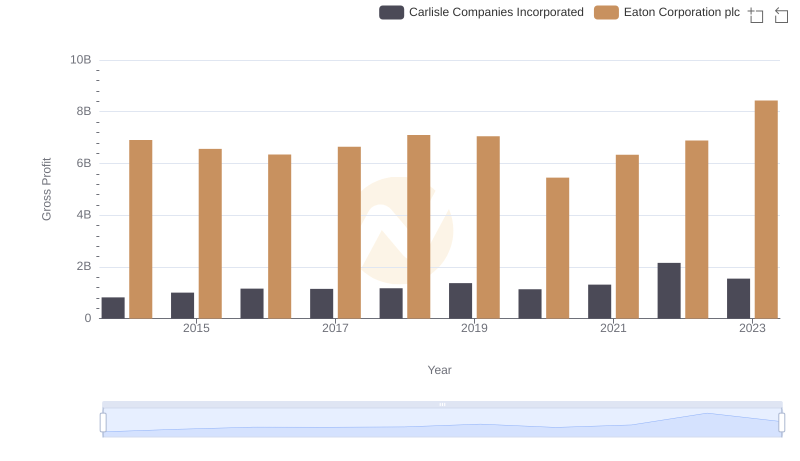

Gross Profit Comparison: Eaton Corporation plc and Carlisle Companies Incorporated Trends

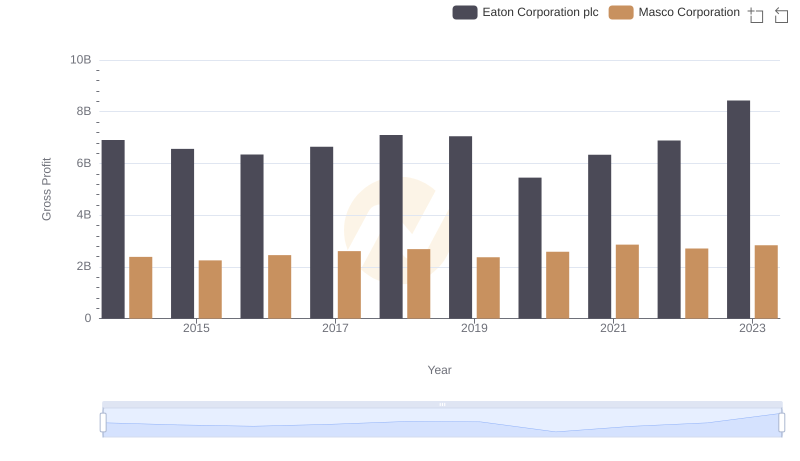

Eaton Corporation plc and Masco Corporation: A Detailed Gross Profit Analysis

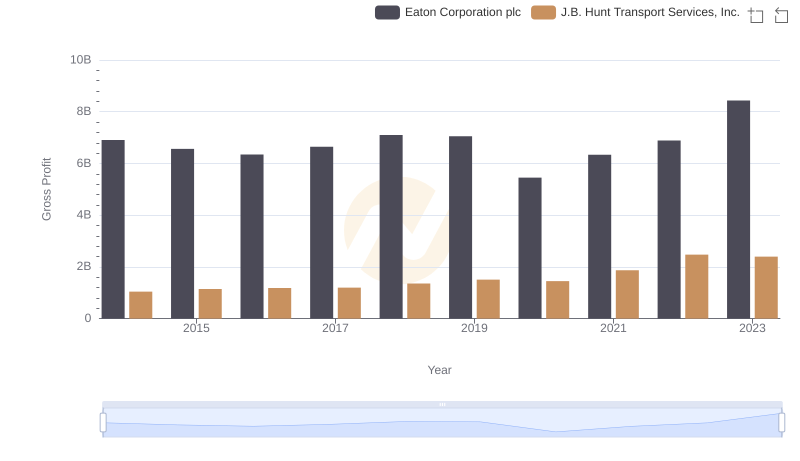

Gross Profit Comparison: Eaton Corporation plc and J.B. Hunt Transport Services, Inc. Trends

SG&A Efficiency Analysis: Comparing Eaton Corporation plc and Snap-on Incorporated