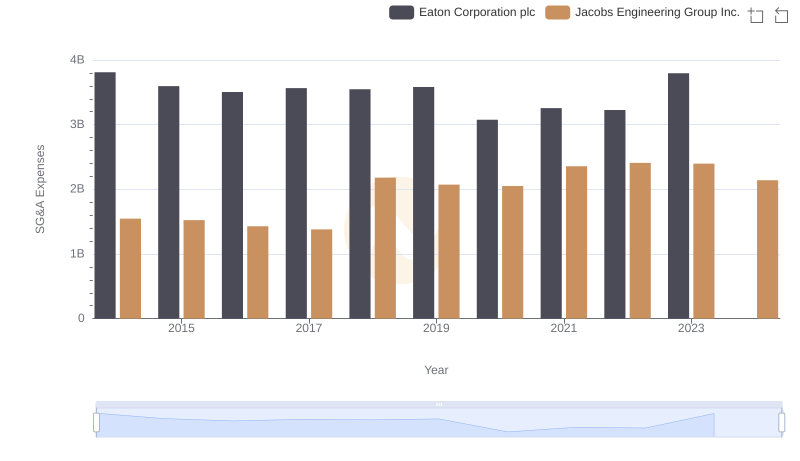

| __timestamp | Eaton Corporation plc | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 1047900000 |

| Thursday, January 1, 2015 | 3596000000 | 1009100000 |

| Friday, January 1, 2016 | 3505000000 | 1001400000 |

| Sunday, January 1, 2017 | 3565000000 | 1101300000 |

| Monday, January 1, 2018 | 3548000000 | 1080700000 |

| Tuesday, January 1, 2019 | 3583000000 | 1071500000 |

| Wednesday, January 1, 2020 | 3075000000 | 1054800000 |

| Friday, January 1, 2021 | 3256000000 | 1202300000 |

| Saturday, January 1, 2022 | 3227000000 | 1181200000 |

| Sunday, January 1, 2023 | 3795000000 | 1249000000 |

| Monday, January 1, 2024 | 4077000000 | 0 |

Data in motion

In the world of industrial giants, Eaton Corporation plc and Snap-on Incorporated have long been recognized for their operational prowess. Over the past decade, from 2014 to 2023, these companies have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. Eaton's SG&A expenses have fluctuated, peaking in 2014 and 2023, with a notable dip in 2020, reflecting a strategic tightening during challenging times. In contrast, Snap-on has shown a steady increase, with a 19% rise from 2014 to 2023, indicating a consistent investment in administrative efficiency. This comparison highlights Eaton's adaptive approach versus Snap-on's steady growth strategy. As businesses navigate the complexities of modern markets, understanding these trends offers valuable insights into corporate efficiency and strategic planning.

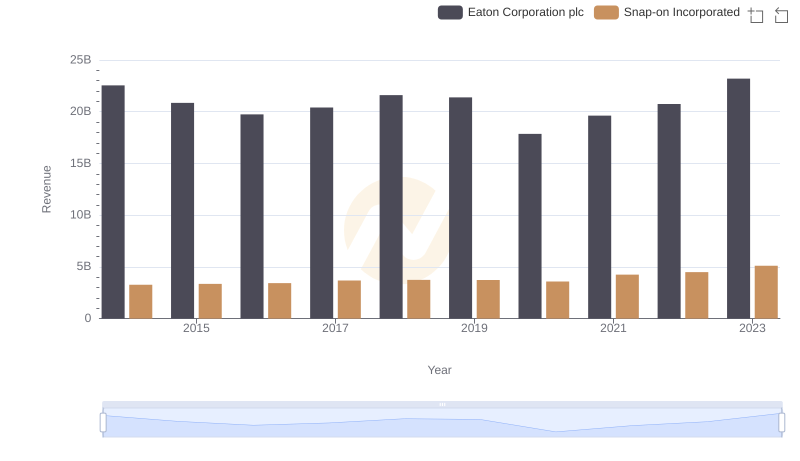

Breaking Down Revenue Trends: Eaton Corporation plc vs Snap-on Incorporated

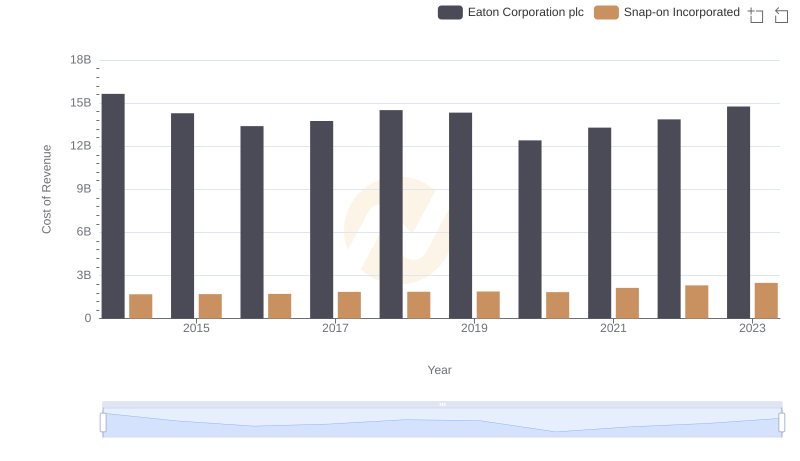

Cost of Revenue: Key Insights for Eaton Corporation plc and Snap-on Incorporated

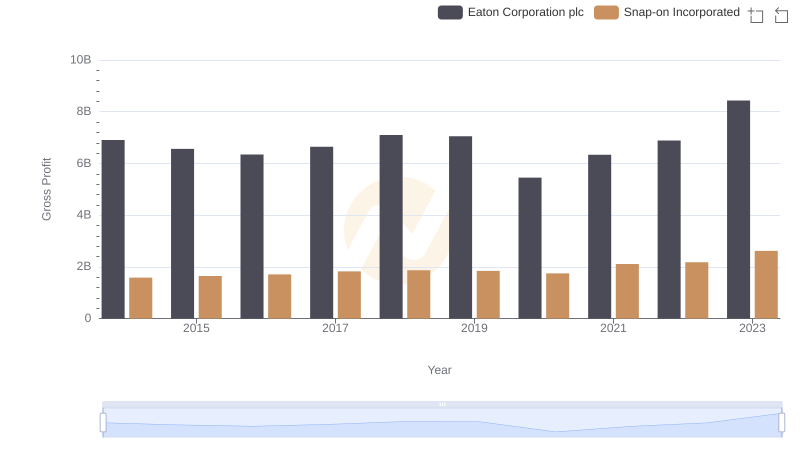

Eaton Corporation plc vs Snap-on Incorporated: A Gross Profit Performance Breakdown

Eaton Corporation plc vs Jacobs Engineering Group Inc.: SG&A Expense Trends

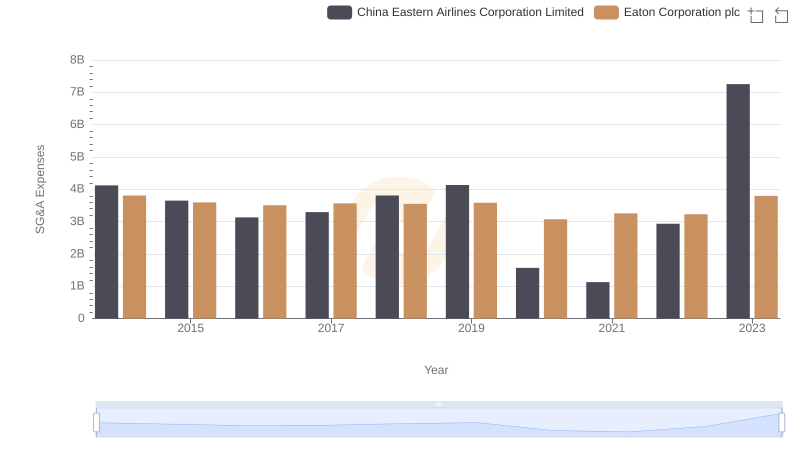

Eaton Corporation plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

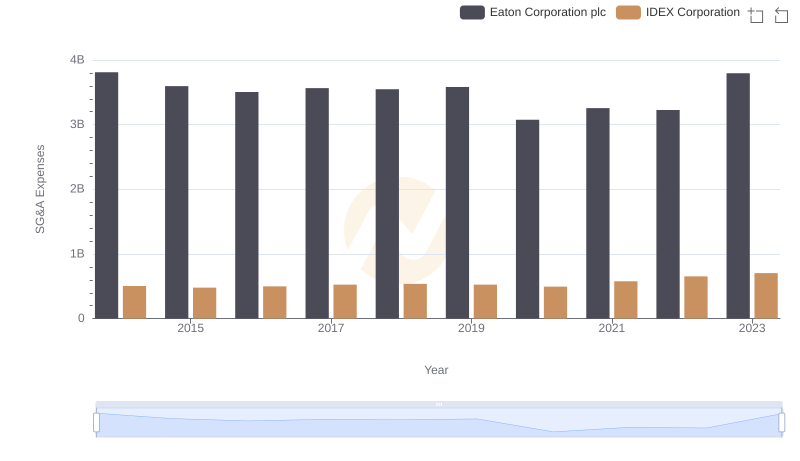

Selling, General, and Administrative Costs: Eaton Corporation plc vs IDEX Corporation