| __timestamp | Eaton Corporation plc | Southwest Airlines Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 207000000 |

| Thursday, January 1, 2015 | 3596000000 | 218000000 |

| Friday, January 1, 2016 | 3505000000 | 2703000000 |

| Sunday, January 1, 2017 | 3565000000 | 2847000000 |

| Monday, January 1, 2018 | 3548000000 | 2852000000 |

| Tuesday, January 1, 2019 | 3583000000 | 3026000000 |

| Wednesday, January 1, 2020 | 3075000000 | 1926000000 |

| Friday, January 1, 2021 | 3256000000 | 2388000000 |

| Saturday, January 1, 2022 | 3227000000 | 3735000000 |

| Sunday, January 1, 2023 | 3795000000 | 3992000000 |

| Monday, January 1, 2024 | 4077000000 | 0 |

Data in motion

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Eaton Corporation plc and Southwest Airlines Co. offer a fascinating comparison in this regard. From 2014 to 2023, Eaton consistently maintained higher SG&A expenses, peaking at approximately $3.8 billion in 2014 and 2023. In contrast, Southwest Airlines started with a modest $207 million in 2014, but saw a dramatic increase, reaching nearly $4 billion by 2023.

Eaton's SG&A expenses showed a relatively stable trend, with a slight dip in 2020, likely due to pandemic-related cost-cutting measures. Meanwhile, Southwest's expenses surged, particularly from 2016 onwards, reflecting its aggressive expansion and operational scaling. This data highlights Eaton's steady cost management against Southwest's dynamic growth strategy. Understanding these trends provides valuable insights into how these companies navigate financial challenges and opportunities.

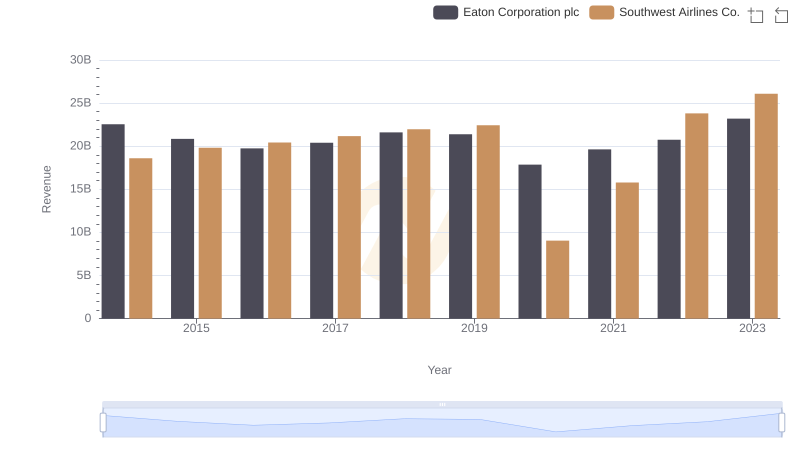

Revenue Insights: Eaton Corporation plc and Southwest Airlines Co. Performance Compared

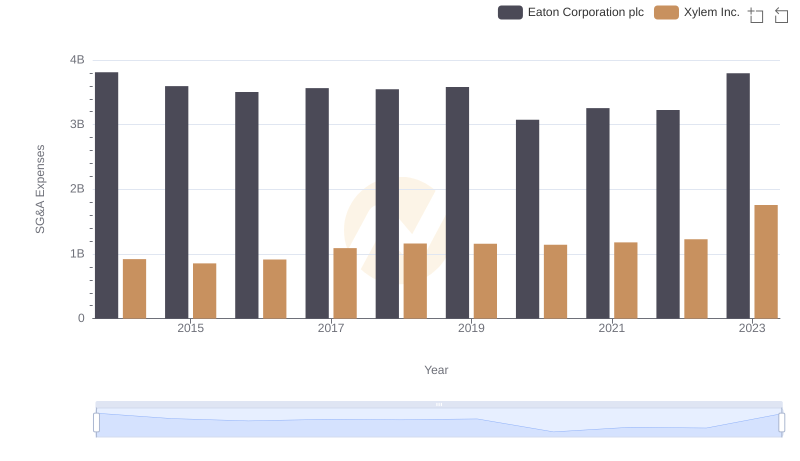

Breaking Down SG&A Expenses: Eaton Corporation plc vs Xylem Inc.

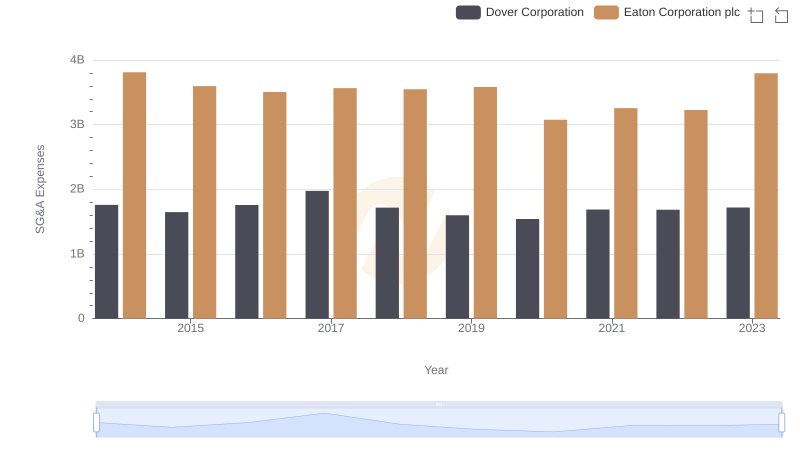

Comparing SG&A Expenses: Eaton Corporation plc vs Dover Corporation Trends and Insights

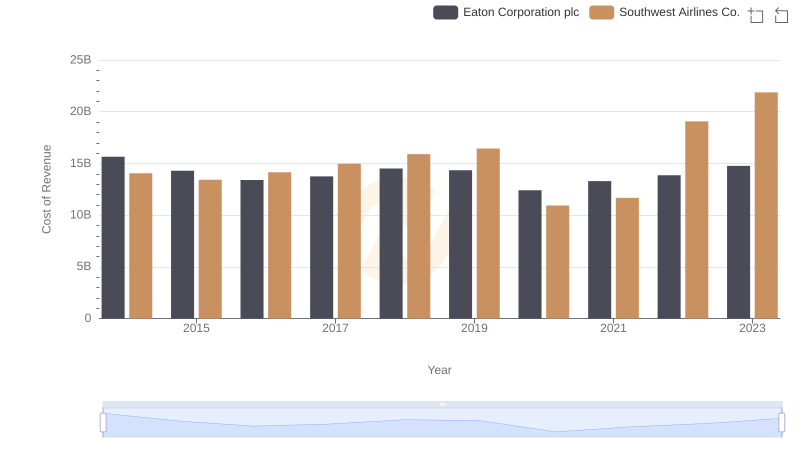

Analyzing Cost of Revenue: Eaton Corporation plc and Southwest Airlines Co.

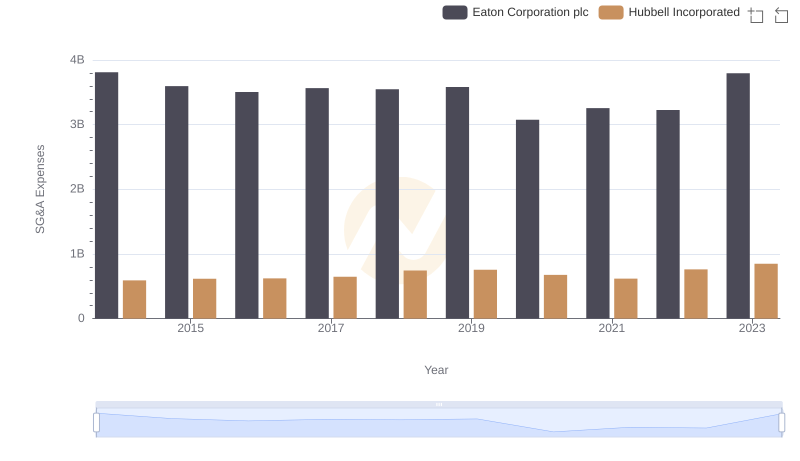

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Hubbell Incorporated

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Lennox International Inc.

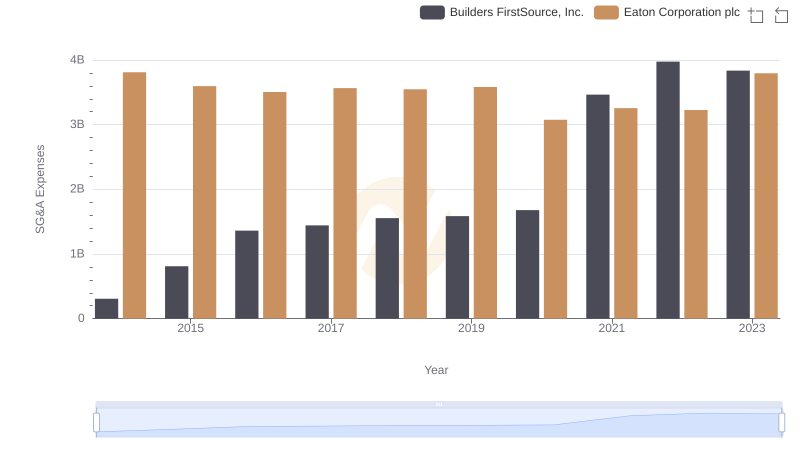

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and Builders FirstSource, Inc.

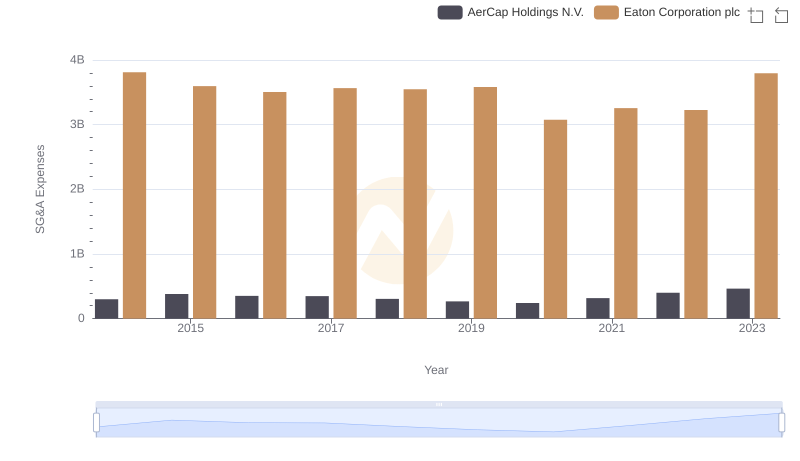

Who Optimizes SG&A Costs Better? Eaton Corporation plc or AerCap Holdings N.V.