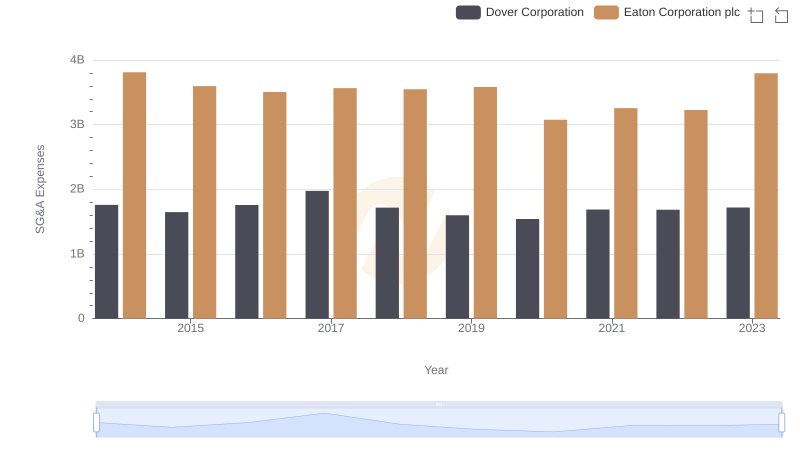

| __timestamp | Builders FirstSource, Inc. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 306508000 | 3810000000 |

| Thursday, January 1, 2015 | 810841000 | 3596000000 |

| Friday, January 1, 2016 | 1360412000 | 3505000000 |

| Sunday, January 1, 2017 | 1442288000 | 3565000000 |

| Monday, January 1, 2018 | 1553972000 | 3548000000 |

| Tuesday, January 1, 2019 | 1584523000 | 3583000000 |

| Wednesday, January 1, 2020 | 1678730000 | 3075000000 |

| Friday, January 1, 2021 | 3463532000 | 3256000000 |

| Saturday, January 1, 2022 | 3974173000 | 3227000000 |

| Sunday, January 1, 2023 | 3836015000 | 3795000000 |

| Monday, January 1, 2024 | 4077000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A trends of Eaton Corporation plc and Builders FirstSource, Inc. over the past decade, from 2014 to 2023.

Eaton Corporation has demonstrated remarkable consistency in its SG&A expenses, averaging around $3.5 billion annually. Despite a slight dip in 2020, Eaton's expenses have remained relatively stable, reflecting a disciplined approach to cost management.

In contrast, Builders FirstSource has experienced a dramatic increase in SG&A expenses, surging from approximately $306 million in 2014 to nearly $3.8 billion in 2023. This represents a staggering growth of over 1,100%, underscoring the company's rapid expansion and strategic investments.

These insights highlight the diverse strategies employed by these industry leaders in managing their operational costs.

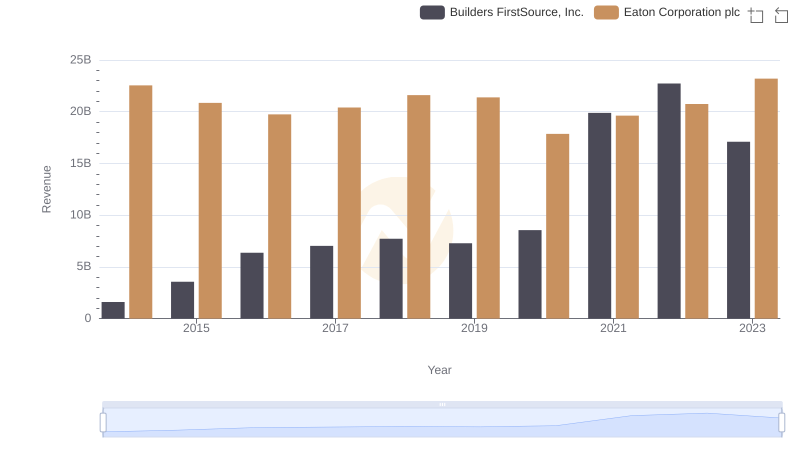

Eaton Corporation plc or Builders FirstSource, Inc.: Who Leads in Yearly Revenue?

Comparing SG&A Expenses: Eaton Corporation plc vs Dover Corporation Trends and Insights

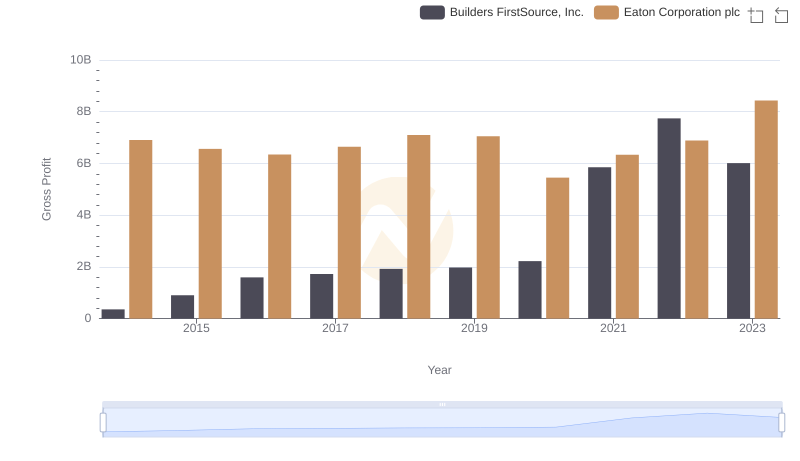

Eaton Corporation plc and Builders FirstSource, Inc.: A Detailed Gross Profit Analysis

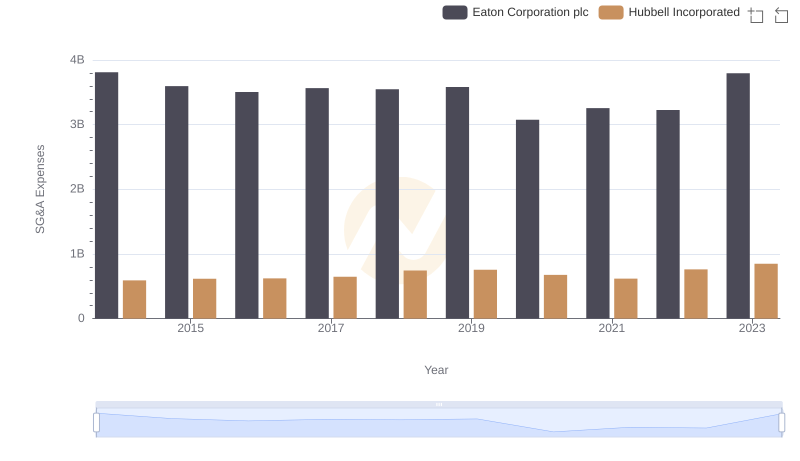

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Hubbell Incorporated

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Lennox International Inc.

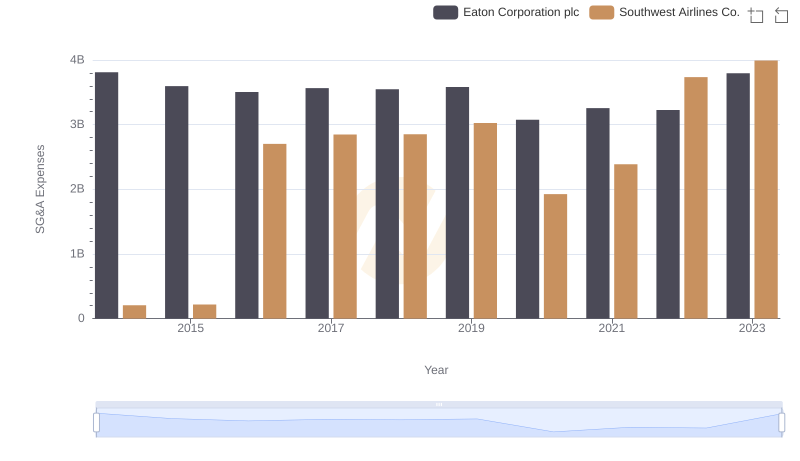

Eaton Corporation plc or Southwest Airlines Co.: Who Manages SG&A Costs Better?

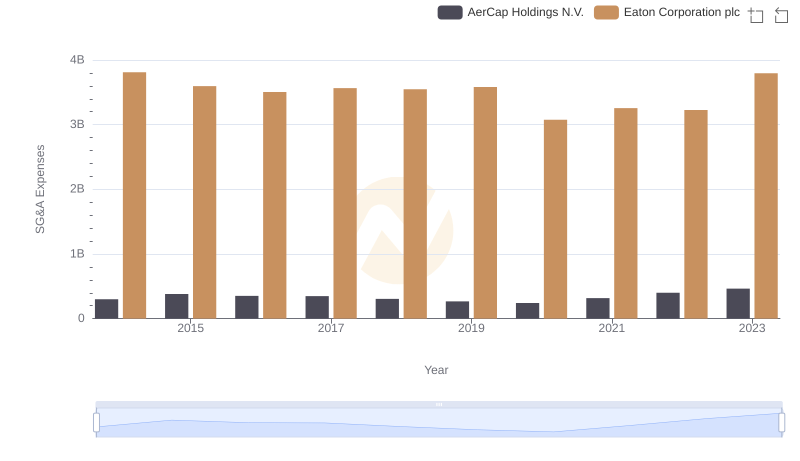

Who Optimizes SG&A Costs Better? Eaton Corporation plc or AerCap Holdings N.V.