| __timestamp | AerCap Holdings N.V. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 3810000000 |

| Thursday, January 1, 2015 | 381308000 | 3596000000 |

| Friday, January 1, 2016 | 351012000 | 3505000000 |

| Sunday, January 1, 2017 | 348291000 | 3565000000 |

| Monday, January 1, 2018 | 305226000 | 3548000000 |

| Tuesday, January 1, 2019 | 267458000 | 3583000000 |

| Wednesday, January 1, 2020 | 242161000 | 3075000000 |

| Friday, January 1, 2021 | 317888000 | 3256000000 |

| Saturday, January 1, 2022 | 399530000 | 3227000000 |

| Sunday, January 1, 2023 | 464128000 | 3795000000 |

| Monday, January 1, 2024 | 4077000000 |

Cracking the code

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Eaton Corporation plc and AerCap Holdings N.V. have demonstrated contrasting strategies in optimizing these costs. From 2014 to 2023, Eaton consistently maintained higher SG&A expenses, averaging around 3.5 billion annually. However, AerCap's expenses were significantly lower, averaging approximately 338 million, reflecting a leaner operational model.

Eaton's SG&A expenses peaked in 2014, while AerCap saw a notable increase in 2023, reaching its highest at 464 million. This suggests a strategic shift or expansion in AerCap's operations. Despite Eaton's higher expenses, their trend shows a slight decrease, indicating efforts to streamline operations. In contrast, AerCap's expenses have grown by about 55% since 2014, possibly reflecting strategic investments or market expansion.

Eaton Corporation plc vs AerCap Holdings N.V.: Efficiency in Cost of Revenue Explored

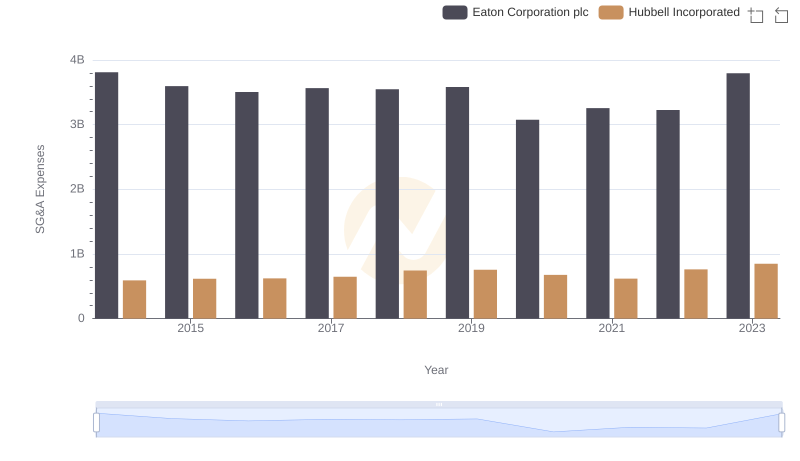

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Hubbell Incorporated

Operational Costs Compared: SG&A Analysis of Eaton Corporation plc and Lennox International Inc.

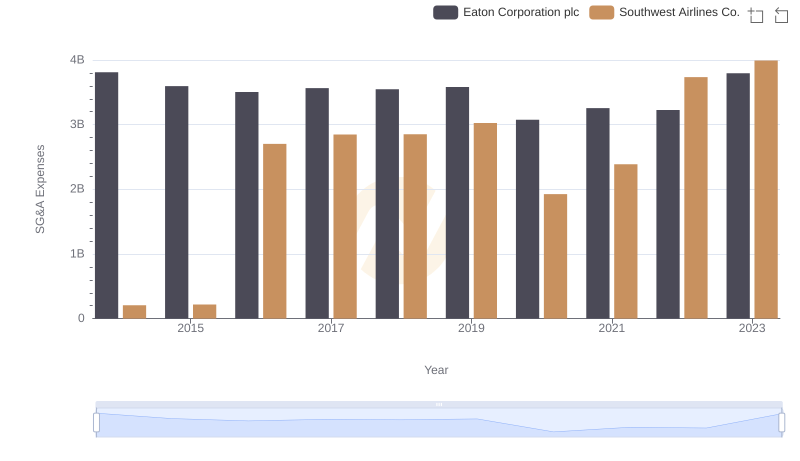

Eaton Corporation plc or Southwest Airlines Co.: Who Manages SG&A Costs Better?

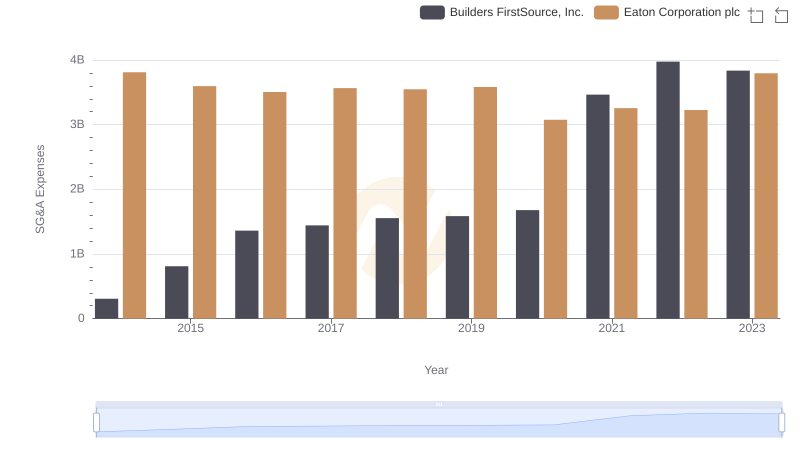

Cost Management Insights: SG&A Expenses for Eaton Corporation plc and Builders FirstSource, Inc.

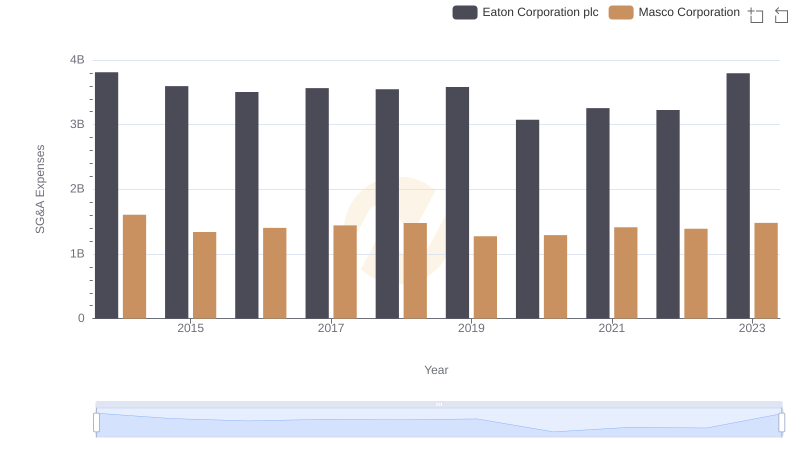

SG&A Efficiency Analysis: Comparing Eaton Corporation plc and Masco Corporation