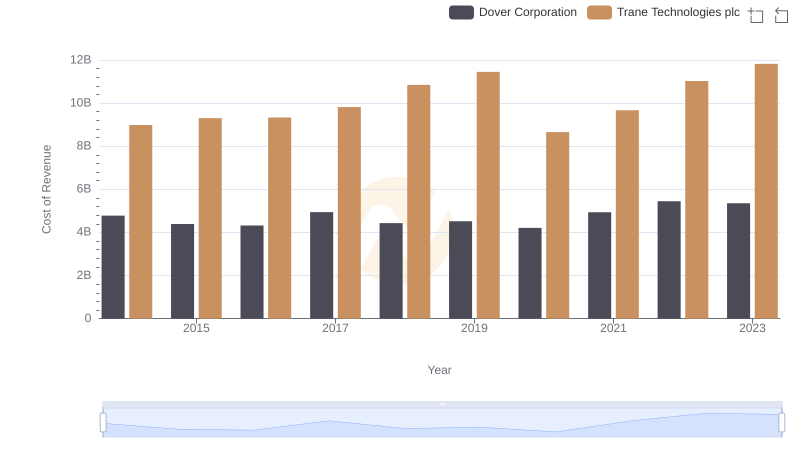

| __timestamp | Equifax Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 8982800000 |

| Thursday, January 1, 2015 | 887400000 | 9301600000 |

| Friday, January 1, 2016 | 1113400000 | 9329300000 |

| Sunday, January 1, 2017 | 1210700000 | 9811600000 |

| Monday, January 1, 2018 | 1440400000 | 10847600000 |

| Tuesday, January 1, 2019 | 1521700000 | 11451500000 |

| Wednesday, January 1, 2020 | 1737400000 | 8651300000 |

| Friday, January 1, 2021 | 1980900000 | 9666800000 |

| Saturday, January 1, 2022 | 2177200000 | 11026900000 |

| Sunday, January 1, 2023 | 2335100000 | 11820400000 |

| Monday, January 1, 2024 | 0 | 12757700000 |

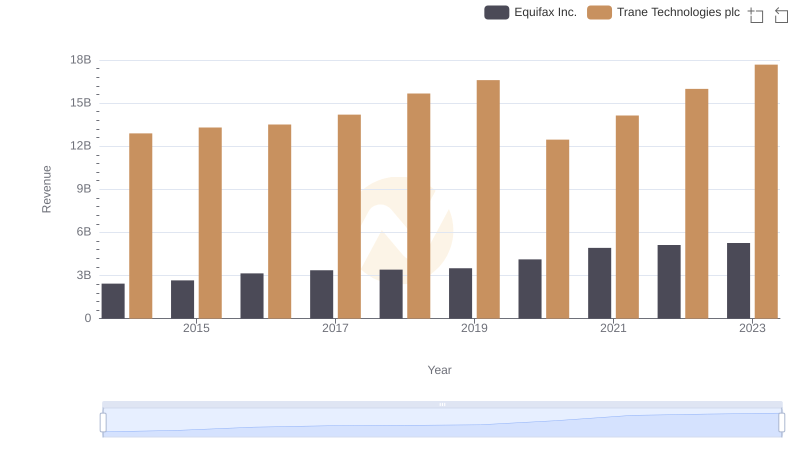

Unlocking the unknown

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This comparison between Trane Technologies plc and Equifax Inc. from 2014 to 2023 offers a fascinating glimpse into their financial strategies.

Trane Technologies has consistently demonstrated robust growth, with its cost of revenue increasing by approximately 32% over the decade. This steady rise reflects the company's strategic investments in innovation and sustainability, positioning it as a leader in the industrial sector.

Equifax Inc. has experienced a more dynamic trajectory, with its cost of revenue surging by nearly 176% during the same period. This significant increase underscores Equifax's expansion efforts and adaptation to the digital age, particularly in data analytics and cybersecurity.

Both companies showcase distinct paths to growth, offering valuable insights into their operational priorities and market positioning.

Comparing Revenue Performance: Trane Technologies plc or Equifax Inc.?

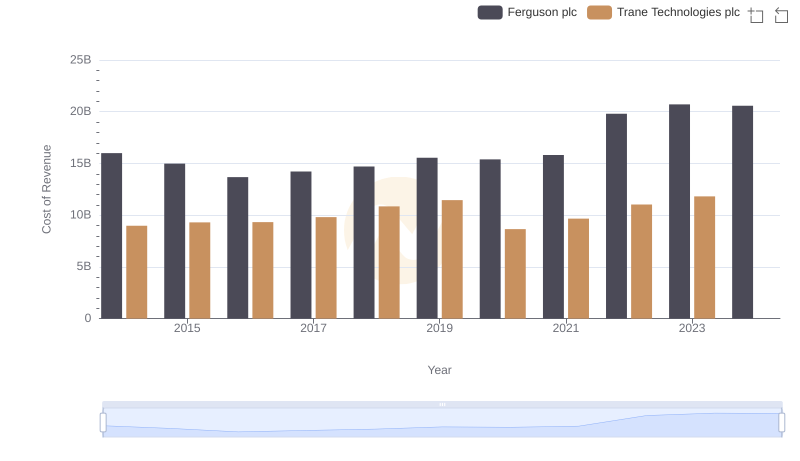

Analyzing Cost of Revenue: Trane Technologies plc and Ferguson plc

Cost of Revenue Comparison: Trane Technologies plc vs Westinghouse Air Brake Technologies Corporation

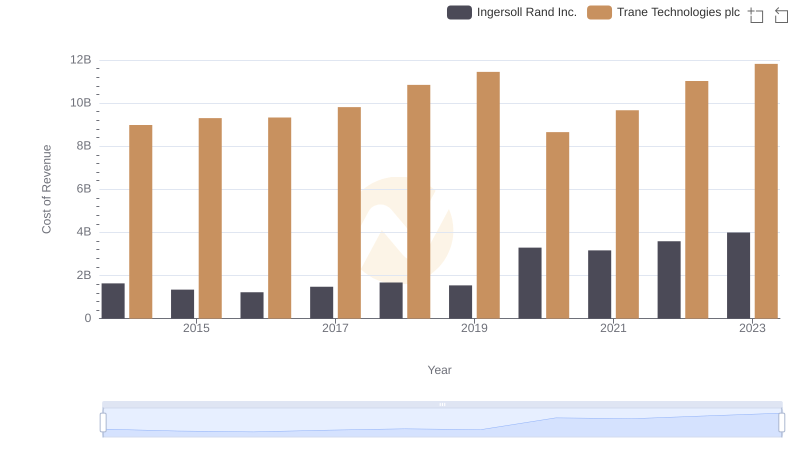

Cost of Revenue Comparison: Trane Technologies plc vs Ingersoll Rand Inc.

Comparing Cost of Revenue Efficiency: Trane Technologies plc vs United Airlines Holdings, Inc.

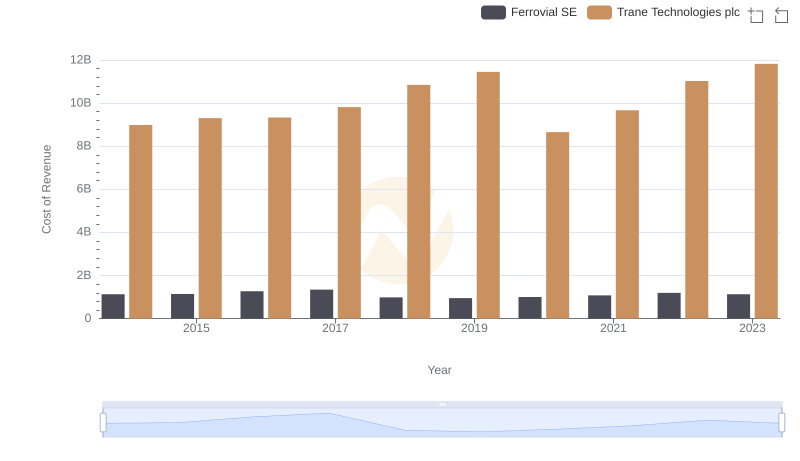

Cost of Revenue Comparison: Trane Technologies plc vs Ferrovial SE

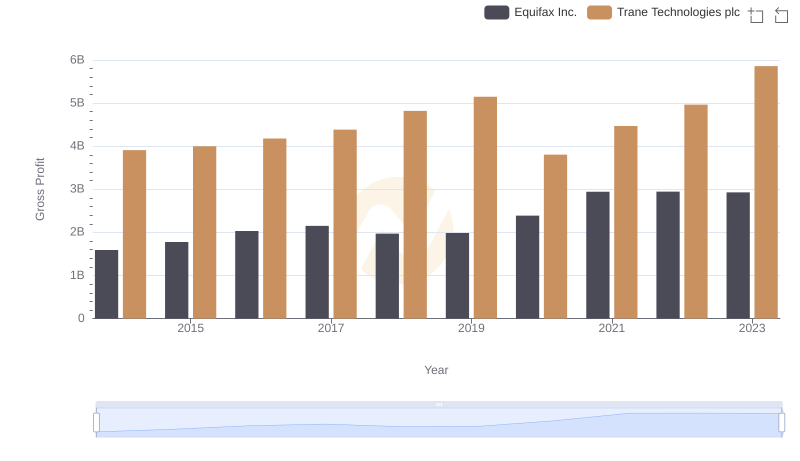

Trane Technologies plc and Equifax Inc.: A Detailed Gross Profit Analysis

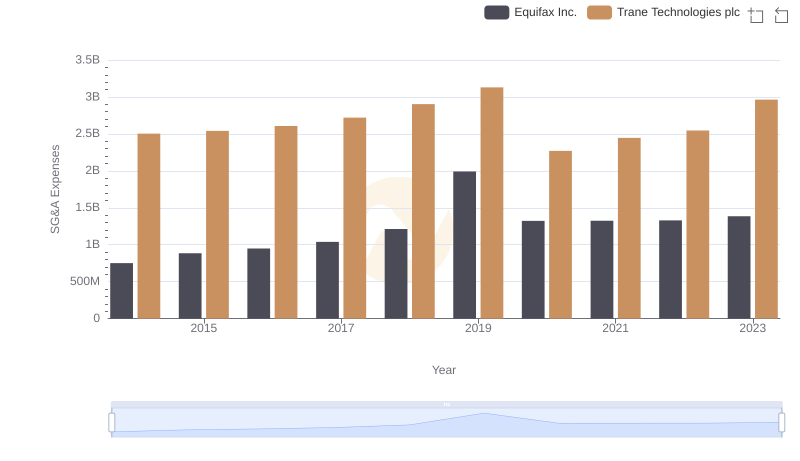

Breaking Down SG&A Expenses: Trane Technologies plc vs Equifax Inc.

Cost of Revenue: Key Insights for Trane Technologies plc and Dover Corporation