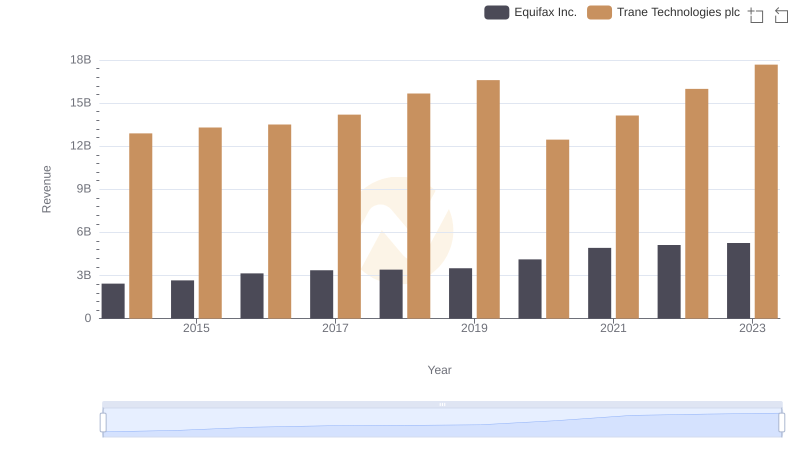

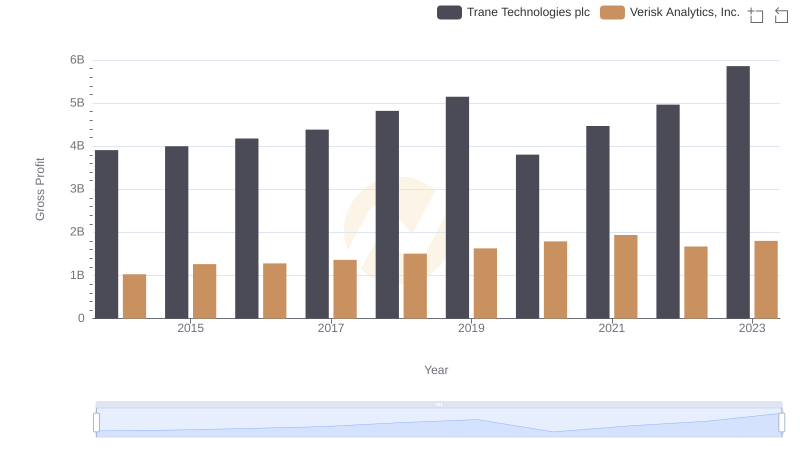

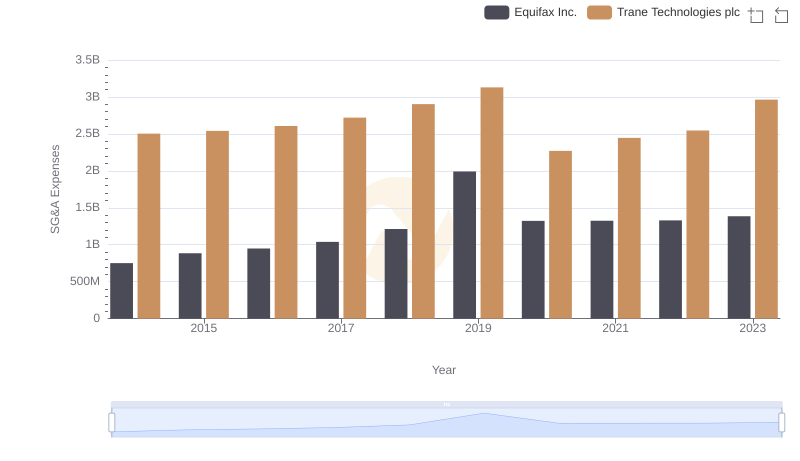

| __timestamp | Equifax Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 3908600000 |

| Thursday, January 1, 2015 | 1776200000 | 3999100000 |

| Friday, January 1, 2016 | 2031500000 | 4179600000 |

| Sunday, January 1, 2017 | 2151500000 | 4386000000 |

| Monday, January 1, 2018 | 1971700000 | 4820600000 |

| Tuesday, January 1, 2019 | 1985900000 | 5147400000 |

| Wednesday, January 1, 2020 | 2390100000 | 3803400000 |

| Friday, January 1, 2021 | 2943000000 | 4469600000 |

| Saturday, January 1, 2022 | 2945000000 | 4964800000 |

| Sunday, January 1, 2023 | 2930100000 | 5857200000 |

| Monday, January 1, 2024 | 5681100000 | 7080500000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the gross profit trends of industry leaders like Trane Technologies and Equifax offers invaluable insights. Over the past decade, Trane Technologies has consistently outperformed Equifax, with its gross profit peaking at approximately 5.86 billion in 2023, marking a remarkable 50% increase since 2014. In contrast, Equifax's gross profit, while showing a steady upward trajectory, reached its zenith at around 2.95 billion in 2022, reflecting an 85% growth from 2014.

These trends underscore the dynamic nature of financial performance and the strategic maneuvers companies must undertake to maintain competitive advantage.

Comparing Revenue Performance: Trane Technologies plc or Equifax Inc.?

Gross Profit Trends Compared: Trane Technologies plc vs Verisk Analytics, Inc.

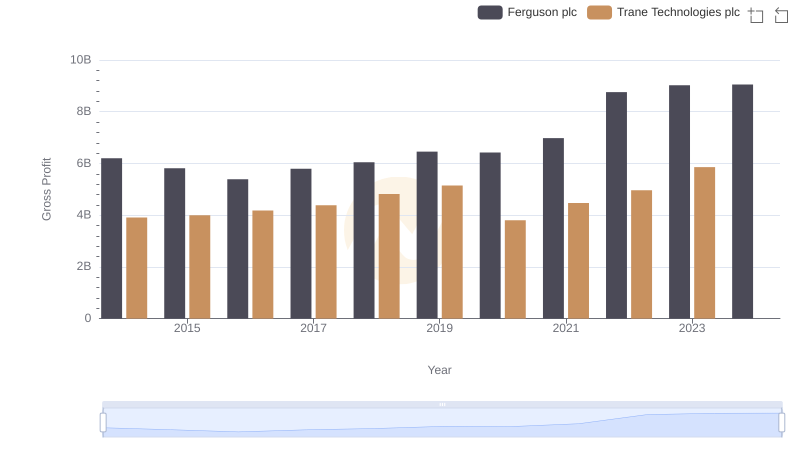

Trane Technologies plc vs Ferguson plc: A Gross Profit Performance Breakdown

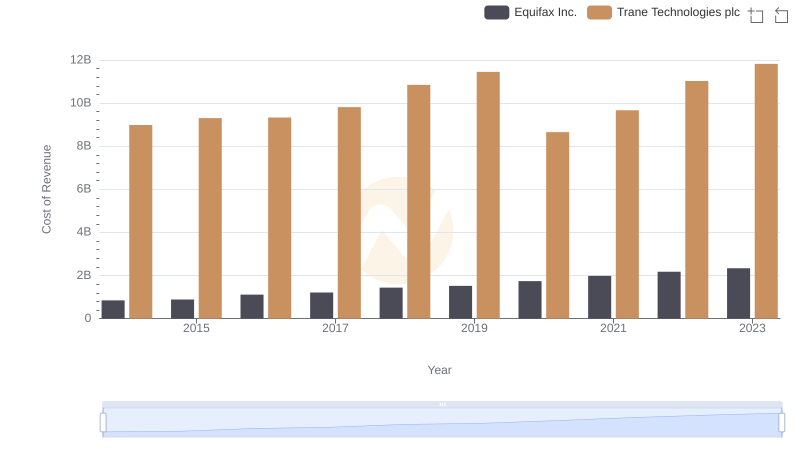

Cost of Revenue Comparison: Trane Technologies plc vs Equifax Inc.

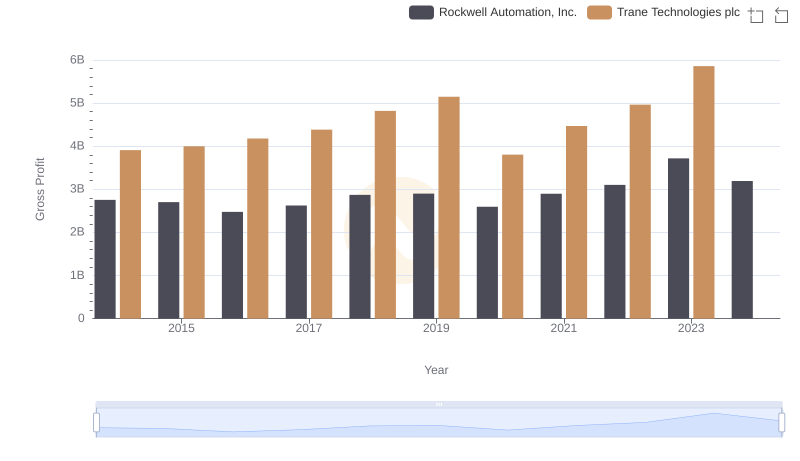

Who Generates Higher Gross Profit? Trane Technologies plc or Rockwell Automation, Inc.

Breaking Down SG&A Expenses: Trane Technologies plc vs Equifax Inc.

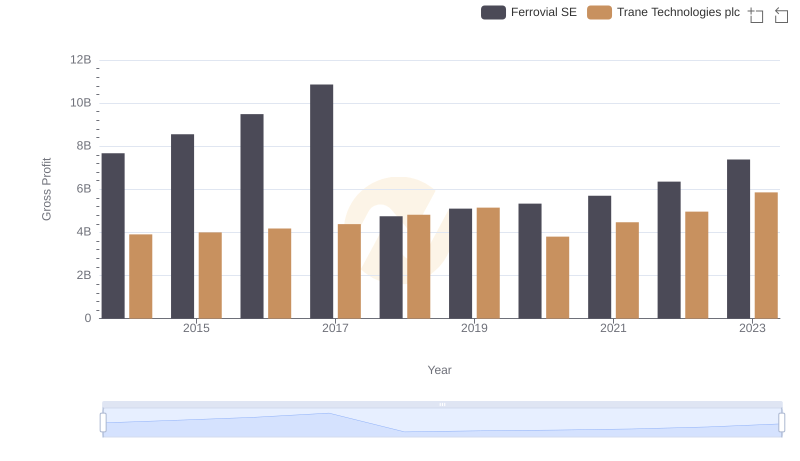

Trane Technologies plc vs Ferrovial SE: A Gross Profit Performance Breakdown

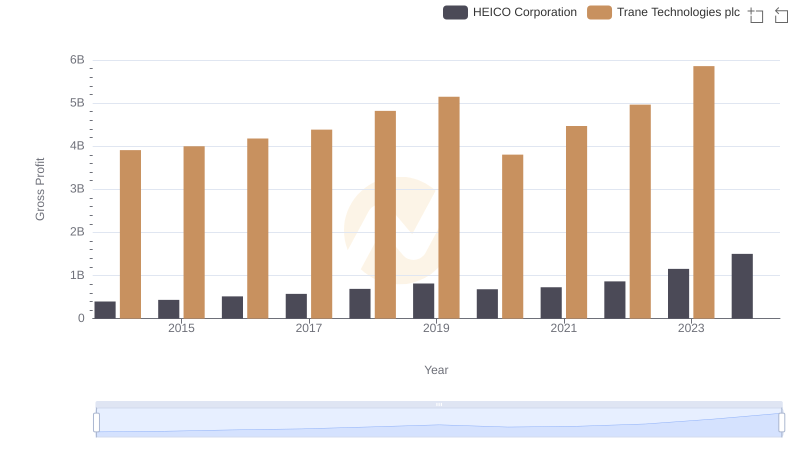

Who Generates Higher Gross Profit? Trane Technologies plc or HEICO Corporation