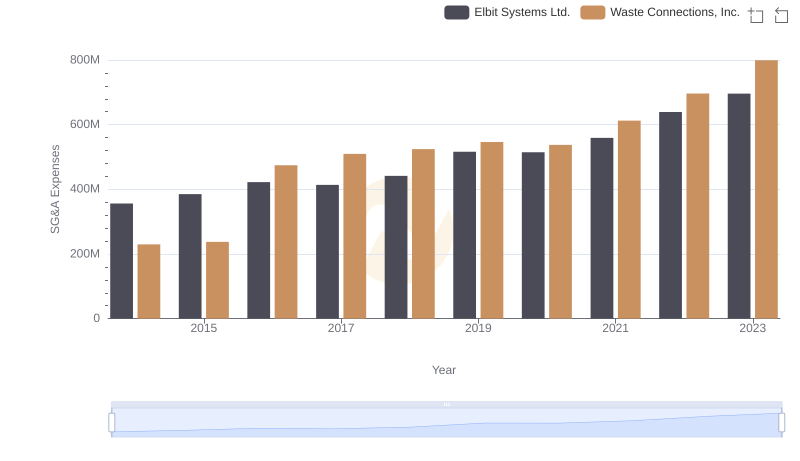

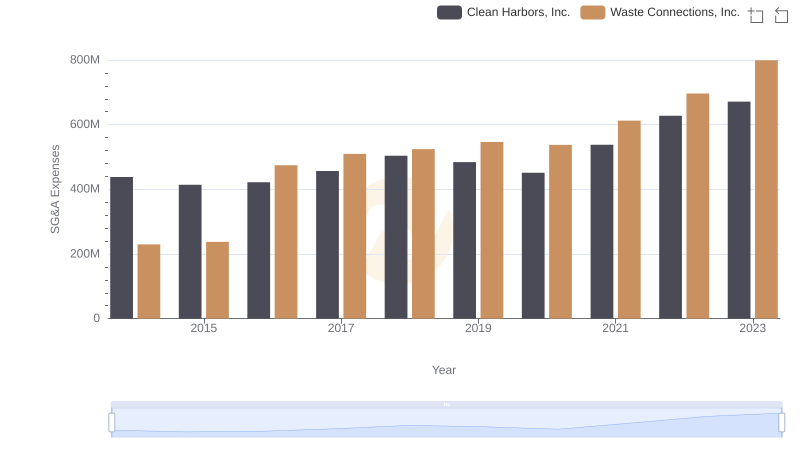

| __timestamp | ITT Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 519500000 | 229474000 |

| Thursday, January 1, 2015 | 441500000 | 237484000 |

| Friday, January 1, 2016 | 444100000 | 474263000 |

| Sunday, January 1, 2017 | 433700000 | 509638000 |

| Monday, January 1, 2018 | 427300000 | 524388000 |

| Tuesday, January 1, 2019 | 420000000 | 546278000 |

| Wednesday, January 1, 2020 | 347200000 | 537632000 |

| Friday, January 1, 2021 | 365100000 | 612337000 |

| Saturday, January 1, 2022 | 368500000 | 696467000 |

| Sunday, January 1, 2023 | 476600000 | 799119000 |

| Monday, January 1, 2024 | 502300000 | 883445000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, effective cost management is crucial. Waste Connections, Inc. and ITT Inc. offer a compelling narrative of strategic financial stewardship over the past decade. From 2014 to 2023, Waste Connections, Inc. has seen a remarkable 248% increase in SG&A expenses, reflecting its aggressive expansion and operational scaling. In contrast, ITT Inc. experienced a 9% decline in these expenses, showcasing its commitment to lean operations and efficiency.

The year 2023 marked a pivotal point, with Waste Connections, Inc. reaching its highest SG&A expenses, nearly doubling since 2014. Meanwhile, ITT Inc. rebounded from a low in 2020, with a 37% increase by 2023. This divergence highlights the distinct strategic paths these companies have taken, offering valuable insights into their operational priorities and market positioning.

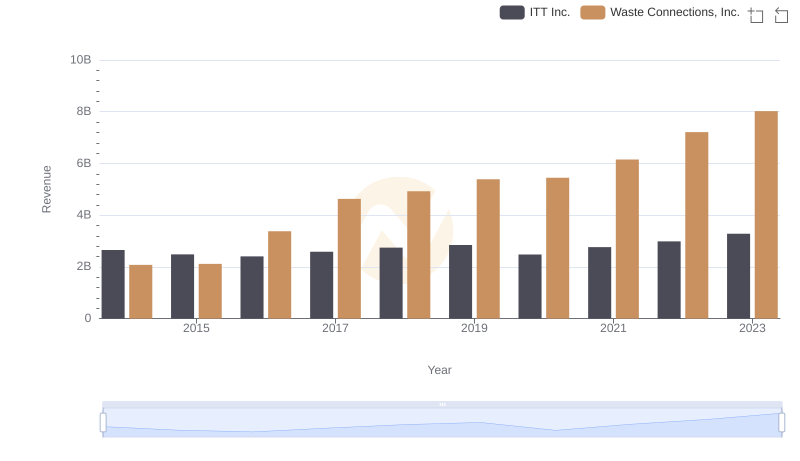

Revenue Showdown: Waste Connections, Inc. vs ITT Inc.

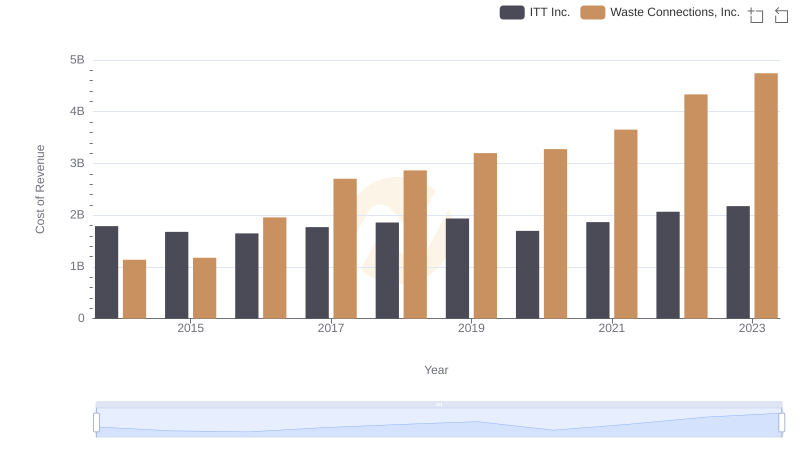

Cost of Revenue Trends: Waste Connections, Inc. vs ITT Inc.

Waste Connections, Inc. and Elbit Systems Ltd.: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Waste Connections, Inc. vs Clean Harbors, Inc.

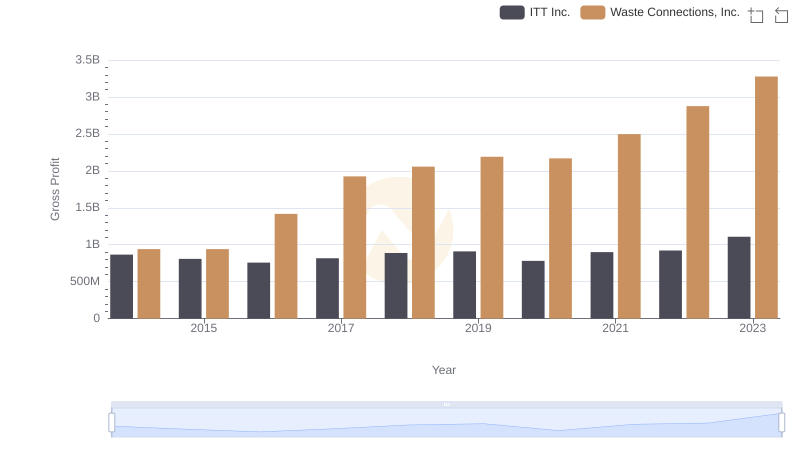

Waste Connections, Inc. vs ITT Inc.: A Gross Profit Performance Breakdown

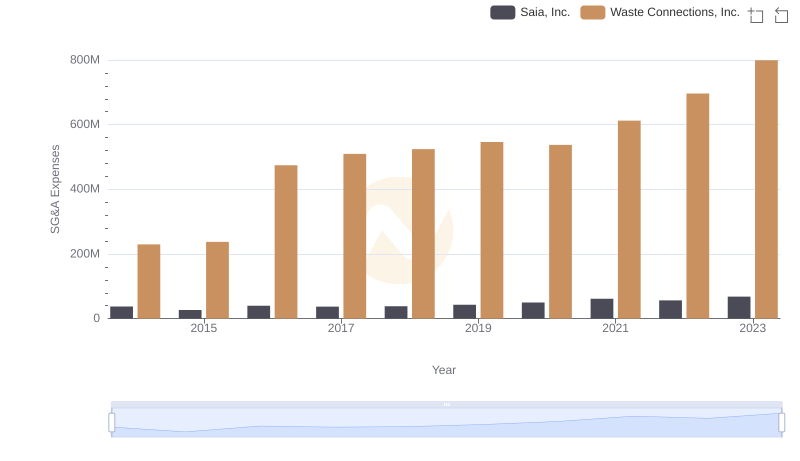

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Saia, Inc.

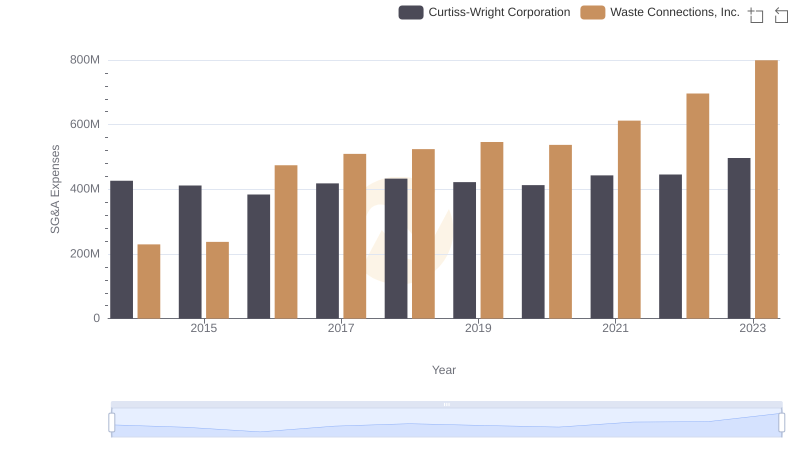

Waste Connections, Inc. vs Curtiss-Wright Corporation: SG&A Expense Trends

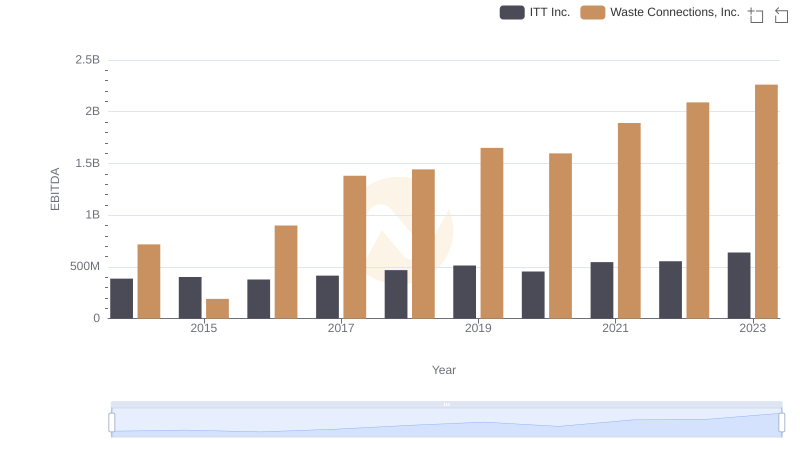

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs ITT Inc.

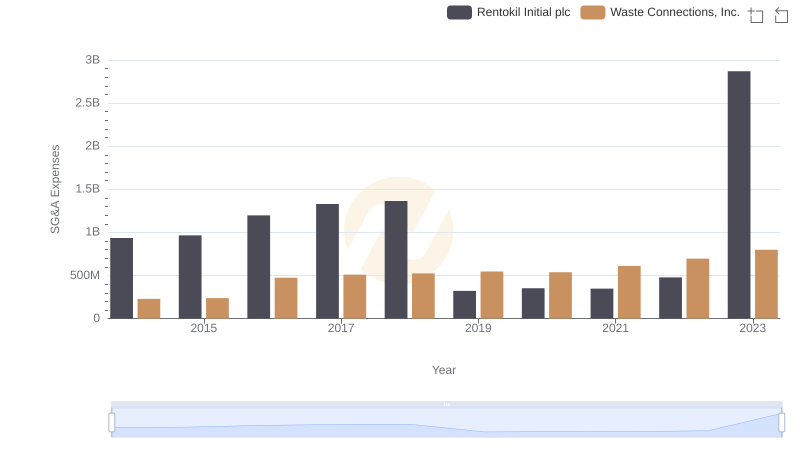

Comparing SG&A Expenses: Waste Connections, Inc. vs Rentokil Initial plc Trends and Insights