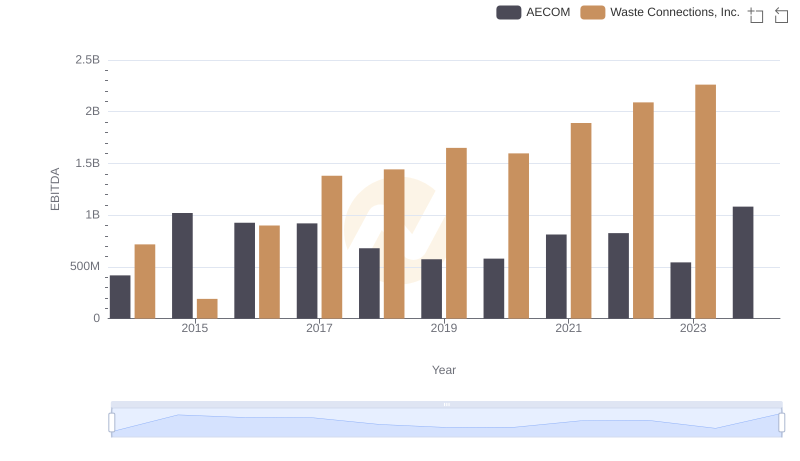

| __timestamp | ITT Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 386700000 | 717805000 |

| Thursday, January 1, 2015 | 402700000 | 191002871 |

| Friday, January 1, 2016 | 378000000 | 900371894 |

| Sunday, January 1, 2017 | 415000000 | 1380632000 |

| Monday, January 1, 2018 | 469000000 | 1442229014 |

| Tuesday, January 1, 2019 | 513900000 | 1650754605 |

| Wednesday, January 1, 2020 | 455000000 | 1597555000 |

| Friday, January 1, 2021 | 545600000 | 1891001000 |

| Saturday, January 1, 2022 | 554500000 | 2090554149 |

| Sunday, January 1, 2023 | 639100000 | 2261354000 |

| Monday, January 1, 2024 | 821500000 | 2389779000 |

In pursuit of knowledge

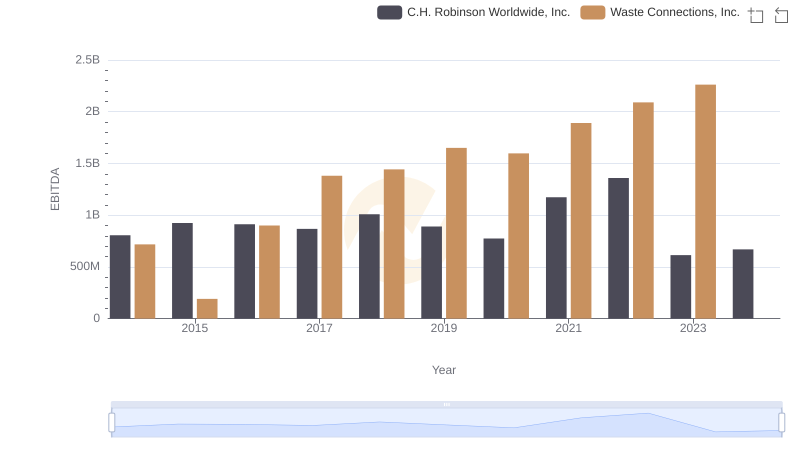

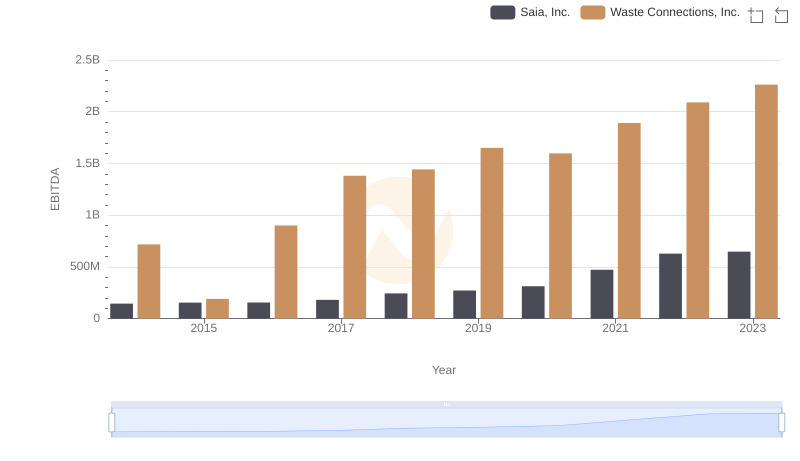

In the ever-evolving landscape of industrial services, Waste Connections, Inc. and ITT Inc. have emerged as formidable players. Over the past decade, Waste Connections, Inc. has consistently outperformed ITT Inc. in terms of EBITDA growth. From 2014 to 2023, Waste Connections, Inc. saw its EBITDA surge by approximately 215%, reaching a peak in 2023. In contrast, ITT Inc. experienced a more modest growth of around 65% during the same period.

This comparison highlights the dynamic nature of the industry and the strategic prowess of Waste Connections, Inc. in capitalizing on market opportunities.

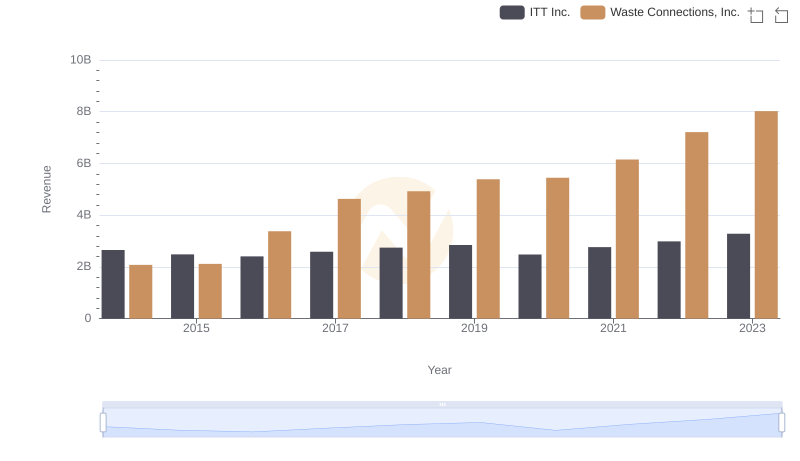

Revenue Showdown: Waste Connections, Inc. vs ITT Inc.

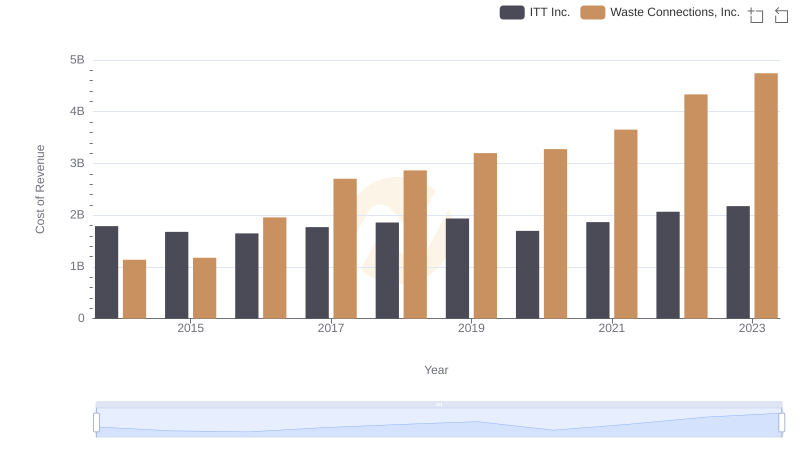

Cost of Revenue Trends: Waste Connections, Inc. vs ITT Inc.

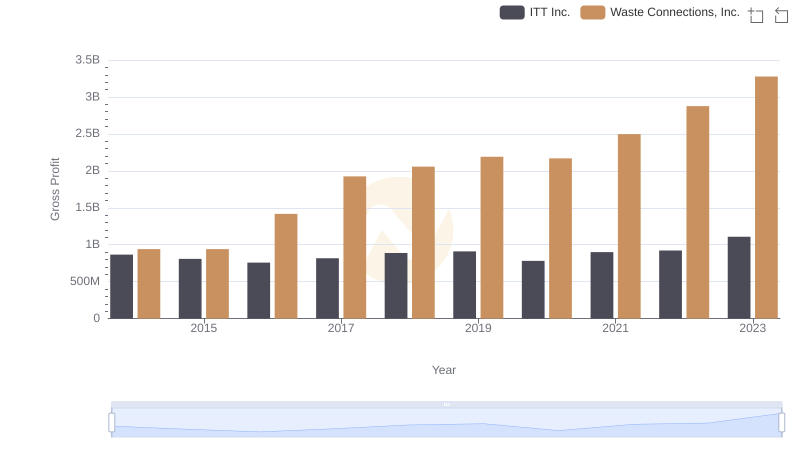

Waste Connections, Inc. vs ITT Inc.: A Gross Profit Performance Breakdown

Professional EBITDA Benchmarking: Waste Connections, Inc. vs AECOM

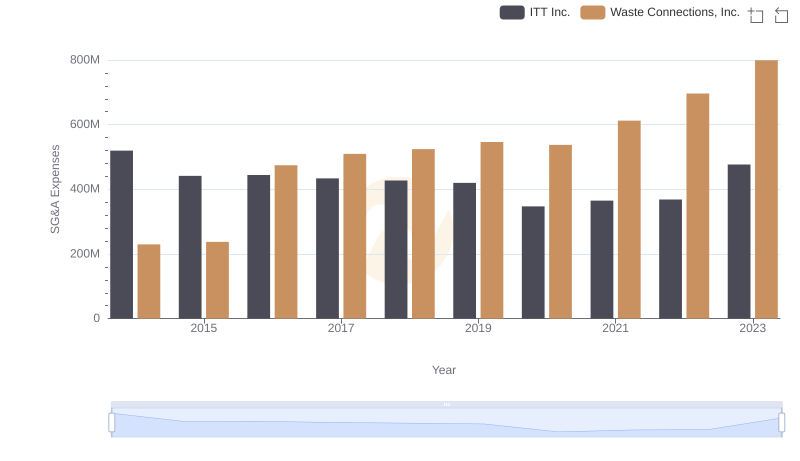

Cost Management Insights: SG&A Expenses for Waste Connections, Inc. and ITT Inc.

A Professional Review of EBITDA: Waste Connections, Inc. Compared to C.H. Robinson Worldwide, Inc.

EBITDA Performance Review: Waste Connections, Inc. vs Saia, Inc.

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs Nordson Corporation