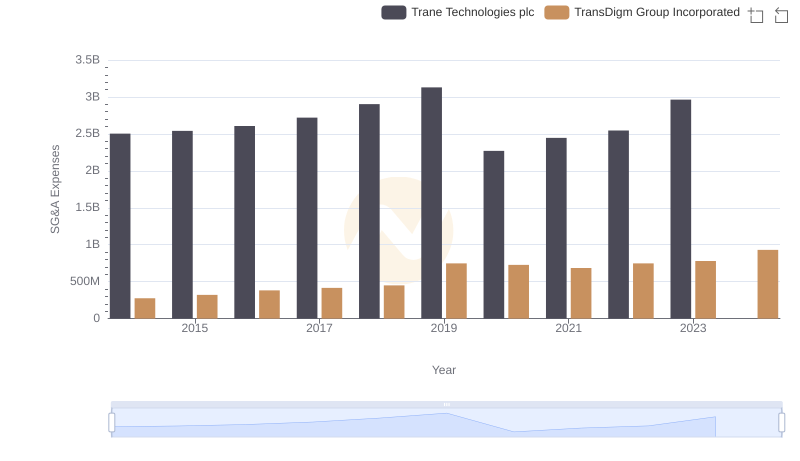

| __timestamp | Republic Services, Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 896300000 | 2503900000 |

| Thursday, January 1, 2015 | 960400000 | 2541100000 |

| Friday, January 1, 2016 | 949400000 | 2606500000 |

| Sunday, January 1, 2017 | 1026800000 | 2720700000 |

| Monday, January 1, 2018 | 1059500000 | 2903200000 |

| Tuesday, January 1, 2019 | 1042000000 | 3129800000 |

| Wednesday, January 1, 2020 | 1025200000 | 2270600000 |

| Friday, January 1, 2021 | 1175900000 | 2446300000 |

| Saturday, January 1, 2022 | 1335800000 | 2545900000 |

| Sunday, January 1, 2023 | 1522000000 | 2963200000 |

| Monday, January 1, 2024 | 1647000000 | 3580400000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Trane Technologies plc and Republic Services, Inc. offer a fascinating case study in cost management from 2014 to 2023. Over this period, Trane Technologies consistently reported higher SG&A expenses, peaking at nearly $3 billion in 2019, before a slight dip in 2020. In contrast, Republic Services saw a steady increase, culminating in a 70% rise from 2014 to 2023. This divergence highlights differing strategic priorities: Trane's focus on innovation and expansion, and Republic's emphasis on operational efficiency. As businesses navigate post-pandemic recovery, understanding these trends offers valuable insights into effective cost management strategies.

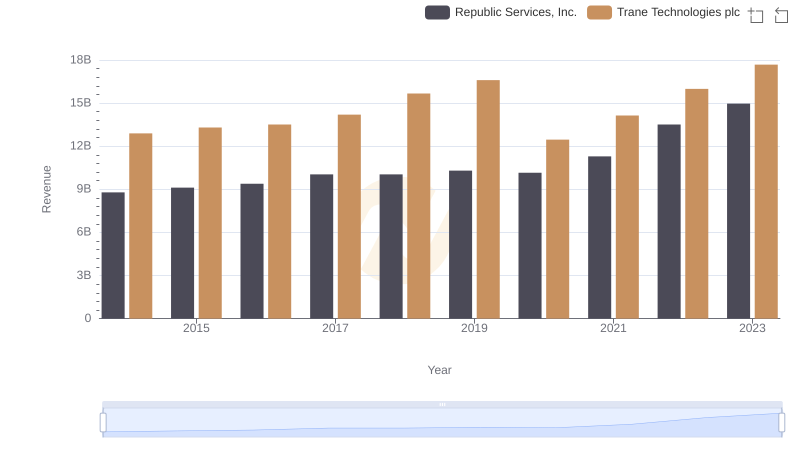

Revenue Insights: Trane Technologies plc and Republic Services, Inc. Performance Compared

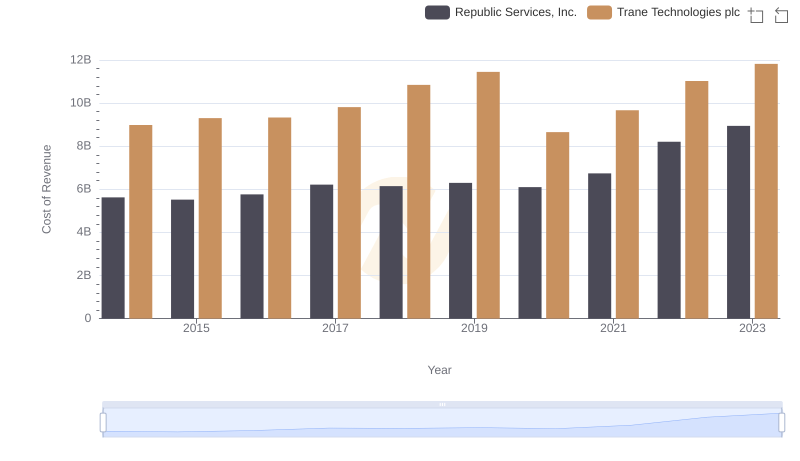

Analyzing Cost of Revenue: Trane Technologies plc and Republic Services, Inc.

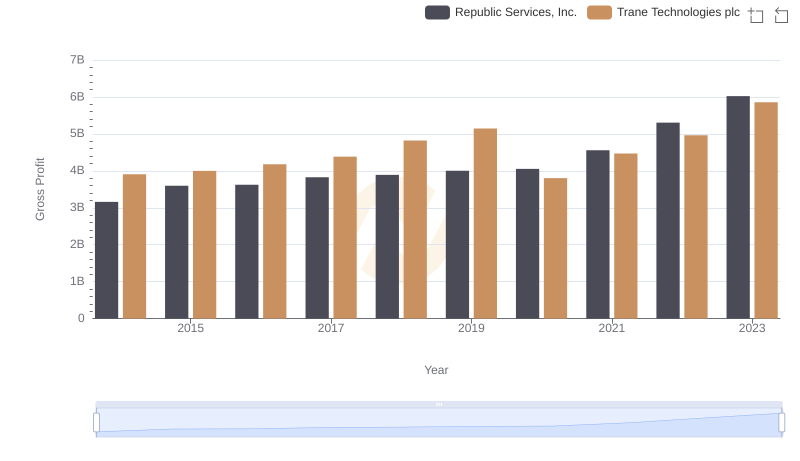

Key Insights on Gross Profit: Trane Technologies plc vs Republic Services, Inc.

Breaking Down SG&A Expenses: Trane Technologies plc vs 3M Company

Trane Technologies plc and TransDigm Group Incorporated: SG&A Spending Patterns Compared

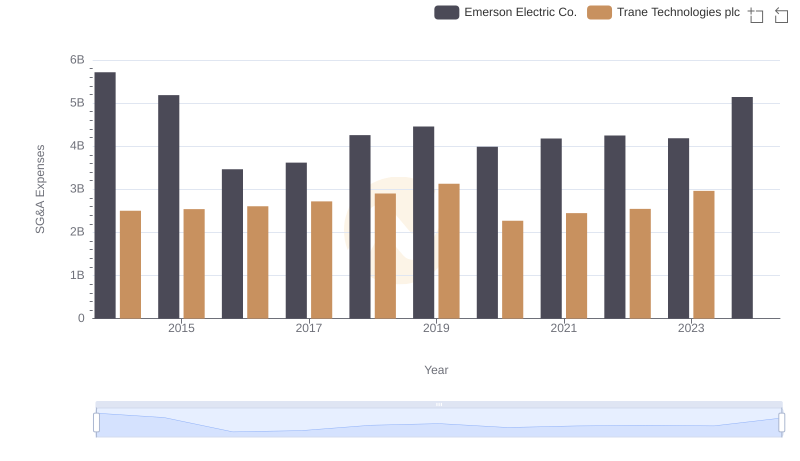

Operational Costs Compared: SG&A Analysis of Trane Technologies plc and Emerson Electric Co.

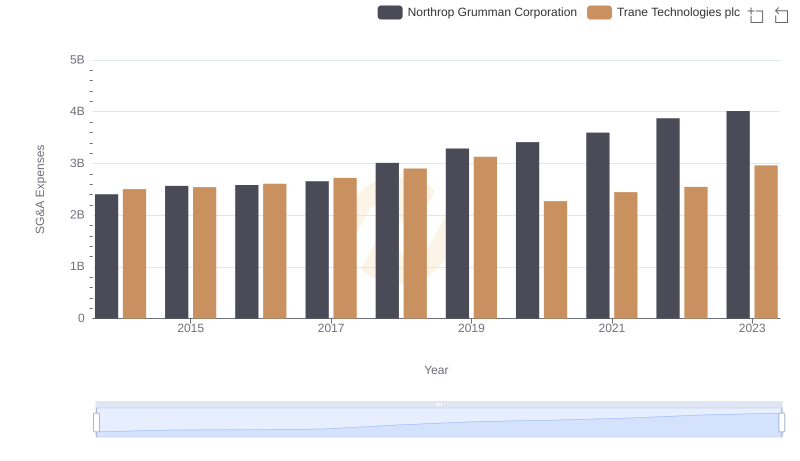

Trane Technologies plc vs Northrop Grumman Corporation: SG&A Expense Trends

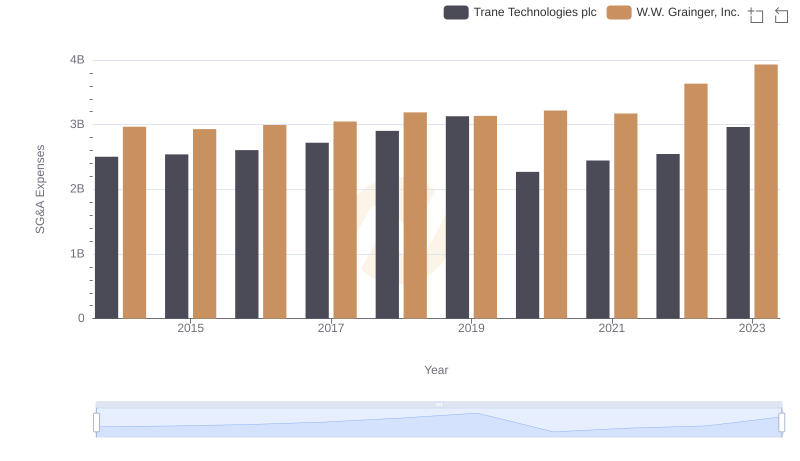

Who Optimizes SG&A Costs Better? Trane Technologies plc or W.W. Grainger, Inc.