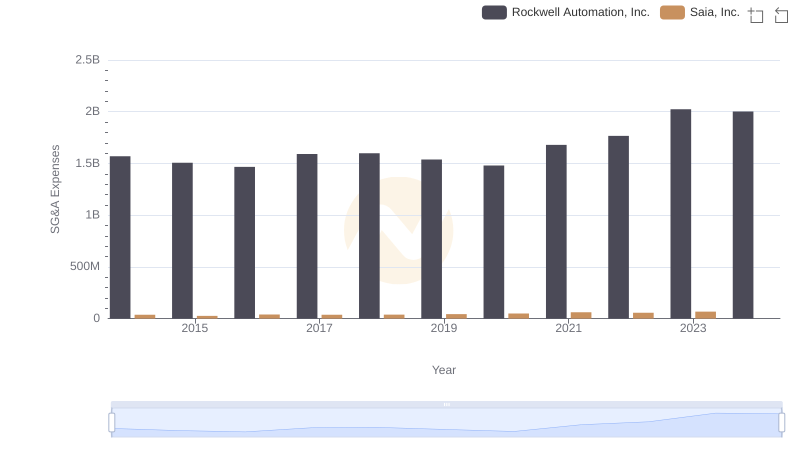

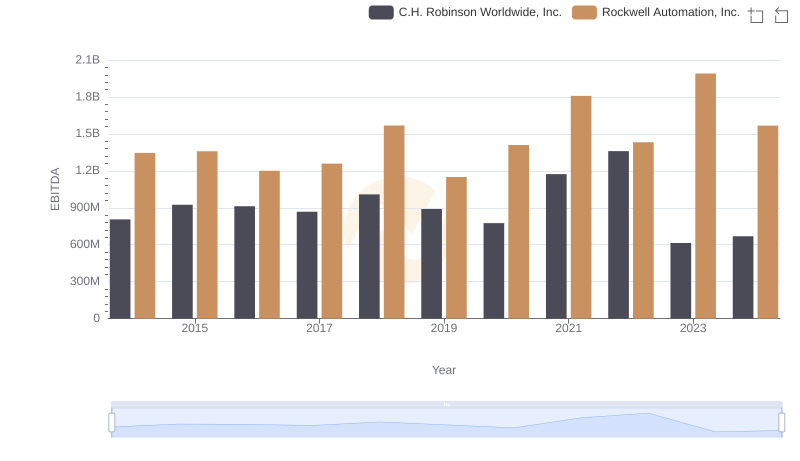

| __timestamp | C.H. Robinson Worldwide, Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 1570100000 |

| Thursday, January 1, 2015 | 358760000 | 1506400000 |

| Friday, January 1, 2016 | 375061000 | 1467400000 |

| Sunday, January 1, 2017 | 413404000 | 1591500000 |

| Monday, January 1, 2018 | 449610000 | 1599000000 |

| Tuesday, January 1, 2019 | 497806000 | 1538500000 |

| Wednesday, January 1, 2020 | 496122000 | 1479800000 |

| Friday, January 1, 2021 | 526371000 | 1680000000 |

| Saturday, January 1, 2022 | 603415000 | 1766700000 |

| Sunday, January 1, 2023 | 624266000 | 2023700000 |

| Monday, January 1, 2024 | 639624000 | 2002600000 |

Unleashing insights

In the ever-evolving landscape of industrial automation and logistics, cost management remains a pivotal focus. Rockwell Automation, Inc. and C.H. Robinson Worldwide, Inc. have demonstrated contrasting trends in their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2024, Rockwell Automation's SG&A expenses have surged by approximately 28%, peaking in 2023. This reflects their strategic investments in innovation and expansion. Meanwhile, C.H. Robinson Worldwide has seen a 100% increase in SG&A expenses, indicating a robust growth strategy in the logistics sector. The data reveals a fascinating narrative of how these industry leaders manage their operational costs amidst market dynamics. As we delve into these insights, it becomes clear that effective cost management is not just about cutting expenses but strategically investing in growth opportunities.

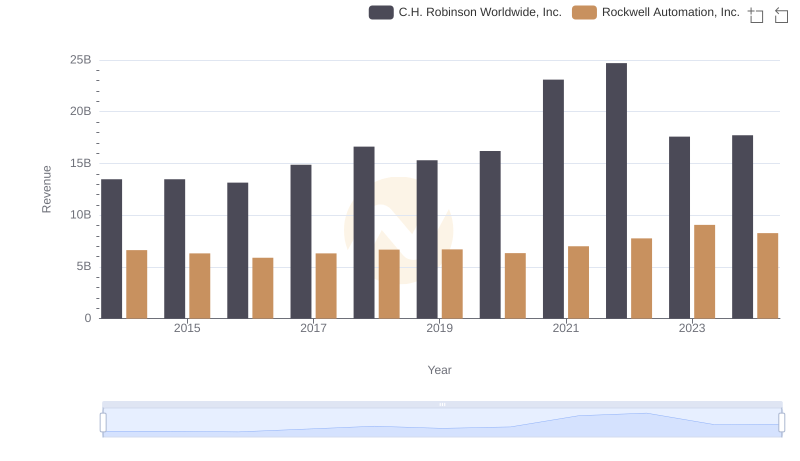

Rockwell Automation, Inc. vs C.H. Robinson Worldwide, Inc.: Annual Revenue Growth Compared

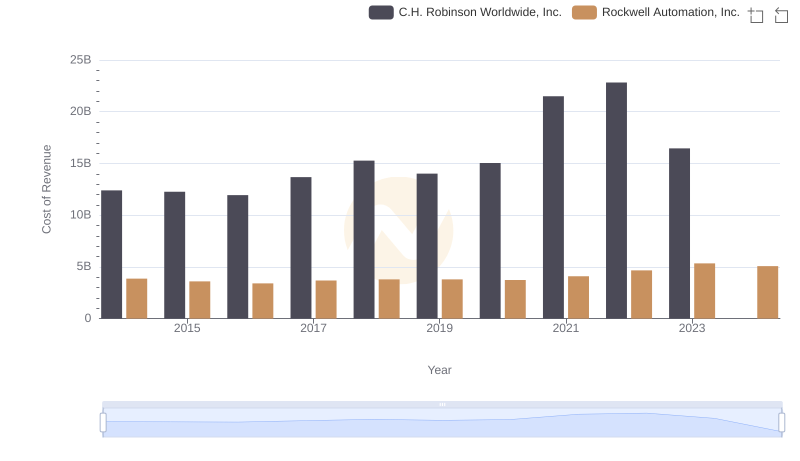

Analyzing Cost of Revenue: Rockwell Automation, Inc. and C.H. Robinson Worldwide, Inc.

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Pool Corporation Trends and Insights

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Saia, Inc. Trends and Insights

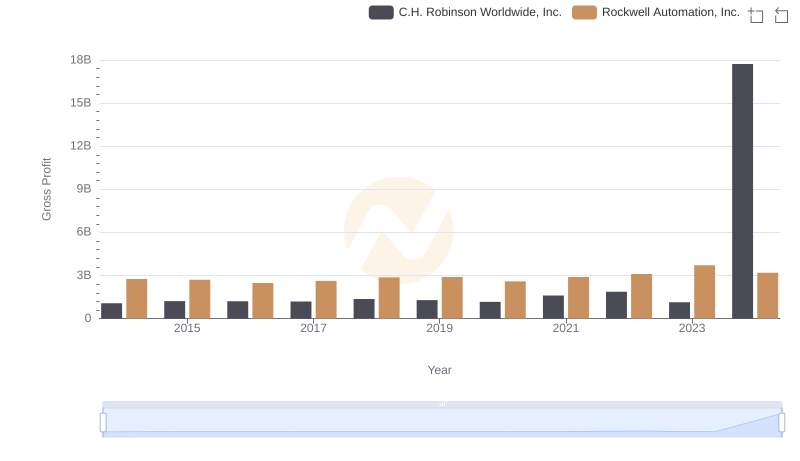

Key Insights on Gross Profit: Rockwell Automation, Inc. vs C.H. Robinson Worldwide, Inc.

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

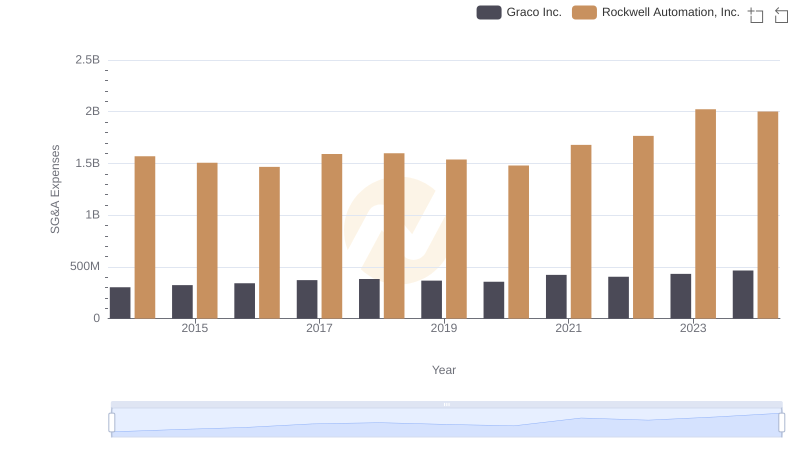

Rockwell Automation, Inc. and Graco Inc.: SG&A Spending Patterns Compared

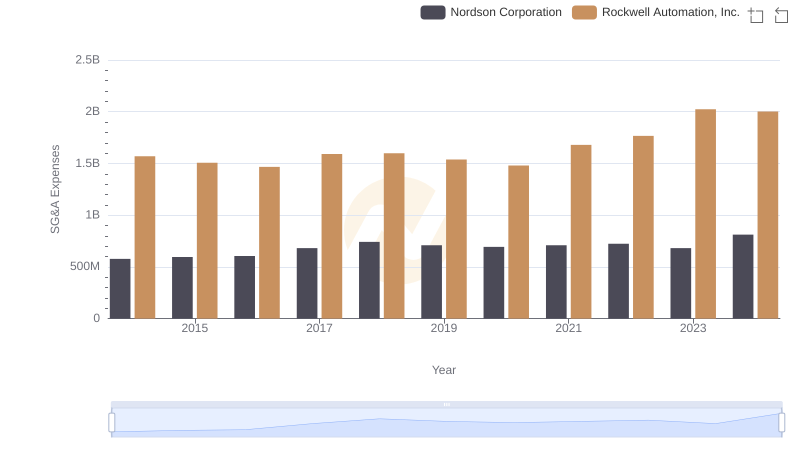

Selling, General, and Administrative Costs: Rockwell Automation, Inc. vs Nordson Corporation

Rockwell Automation, Inc. and C.H. Robinson Worldwide, Inc.: A Detailed Examination of EBITDA Performance