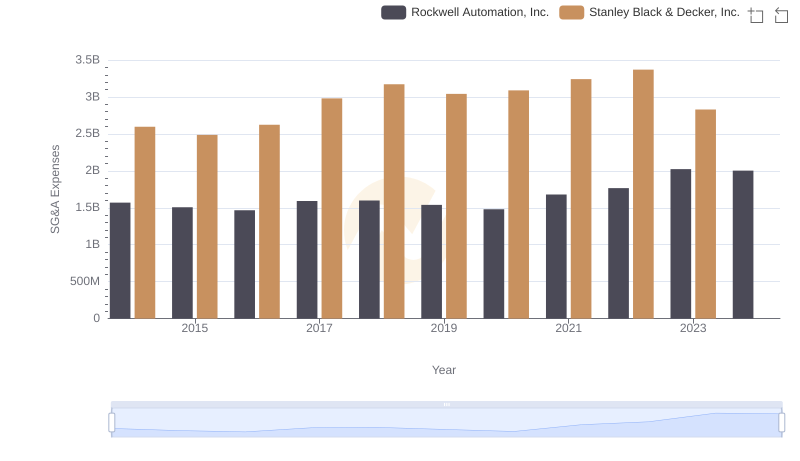

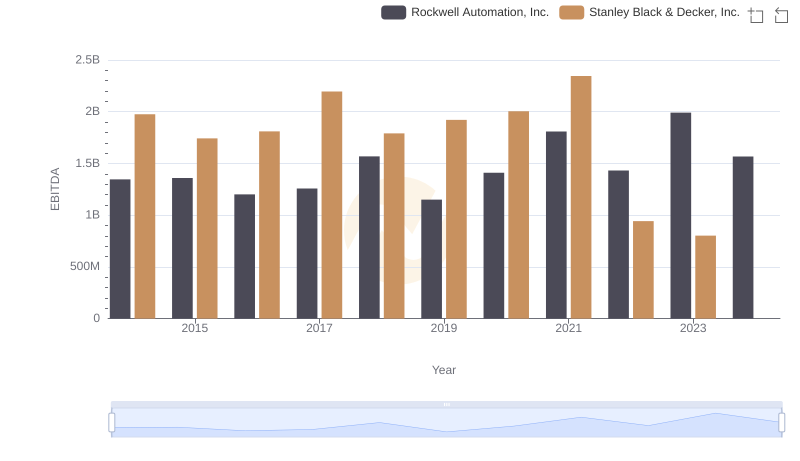

| __timestamp | Rockwell Automation, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 2595900000 |

| Thursday, January 1, 2015 | 1506400000 | 2486400000 |

| Friday, January 1, 2016 | 1467400000 | 2623900000 |

| Sunday, January 1, 2017 | 1591500000 | 2980100000 |

| Monday, January 1, 2018 | 1599000000 | 3171700000 |

| Tuesday, January 1, 2019 | 1538500000 | 3041000000 |

| Wednesday, January 1, 2020 | 1479800000 | 3089600000 |

| Friday, January 1, 2021 | 1680000000 | 3240400000 |

| Saturday, January 1, 2022 | 1766700000 | 3370000000 |

| Sunday, January 1, 2023 | 2023700000 | 2829300000 |

| Monday, January 1, 2024 | 2002600000 | 3310500000 |

Cracking the code

In the competitive landscape of industrial automation and tools, Rockwell Automation, Inc. and Stanley Black & Decker, Inc. have been pivotal players. Over the past decade, these companies have navigated the complexities of Selling, General, and Administrative (SG&A) expenses with varying strategies. From 2014 to 2023, Rockwell Automation demonstrated a steady control over its SG&A costs, maintaining an average of approximately $1.66 billion annually. In contrast, Stanley Black & Decker's SG&A expenses averaged around $2.94 billion, reflecting a more expansive operational scale.

Interestingly, 2023 marked a significant shift, with Rockwell's expenses peaking at $2.02 billion, while Stanley Black & Decker saw a reduction to $2.83 billion. This fluctuation highlights the dynamic nature of cost management strategies in response to market conditions. As we look to the future, the ability to optimize these costs will remain crucial for maintaining competitive advantage.

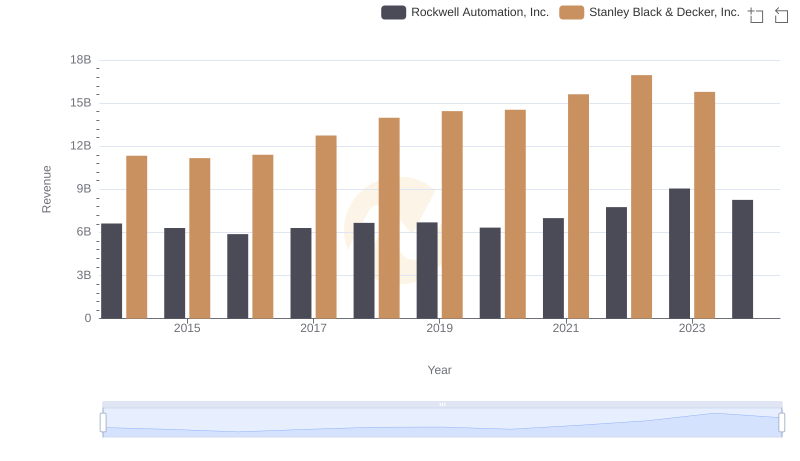

Who Generates More Revenue? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

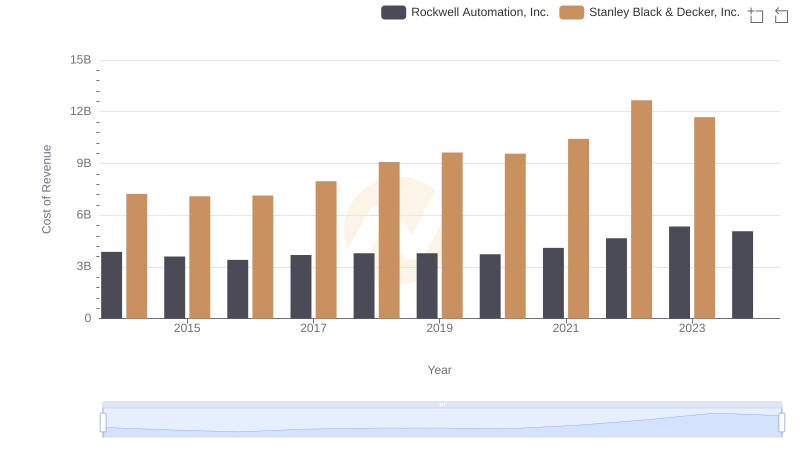

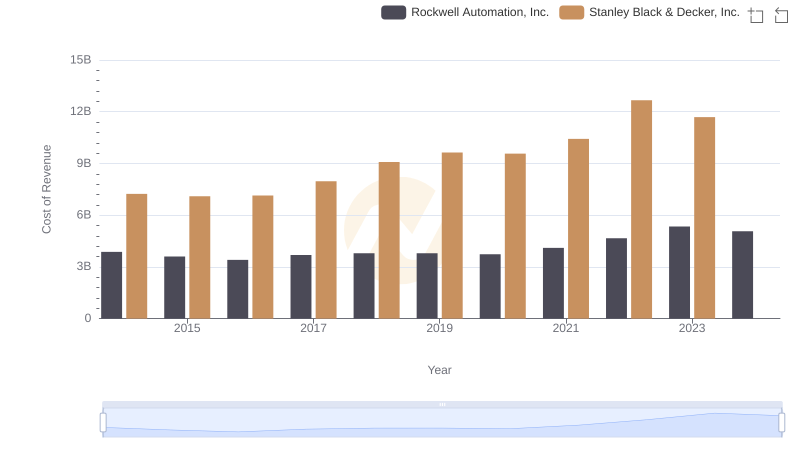

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

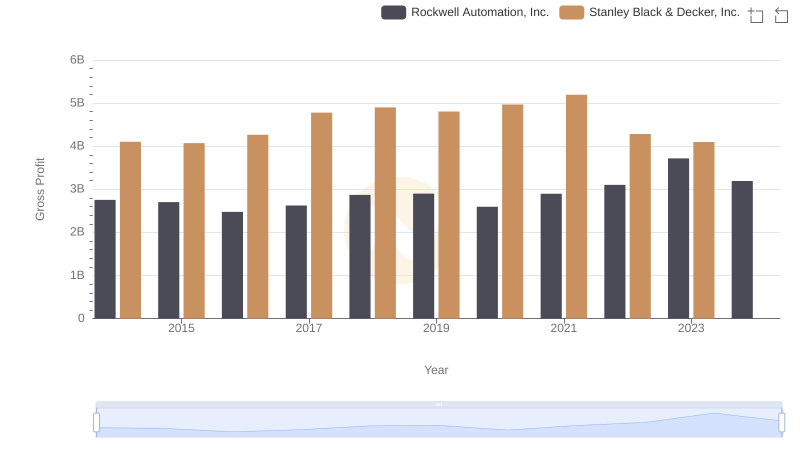

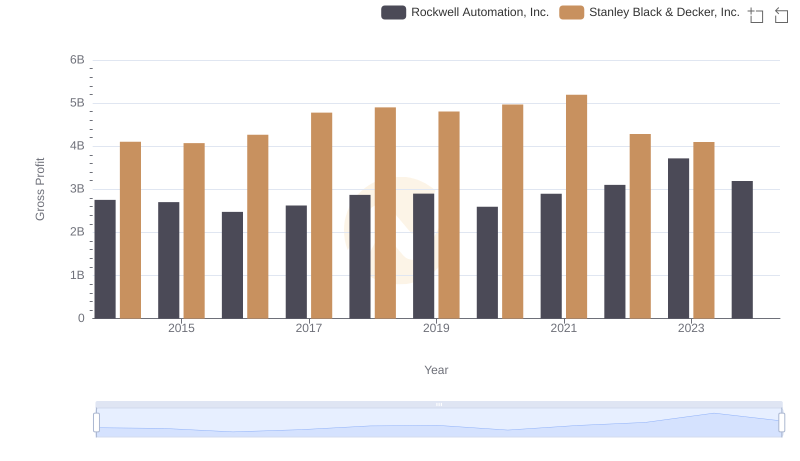

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

Selling, General, and Administrative Costs: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

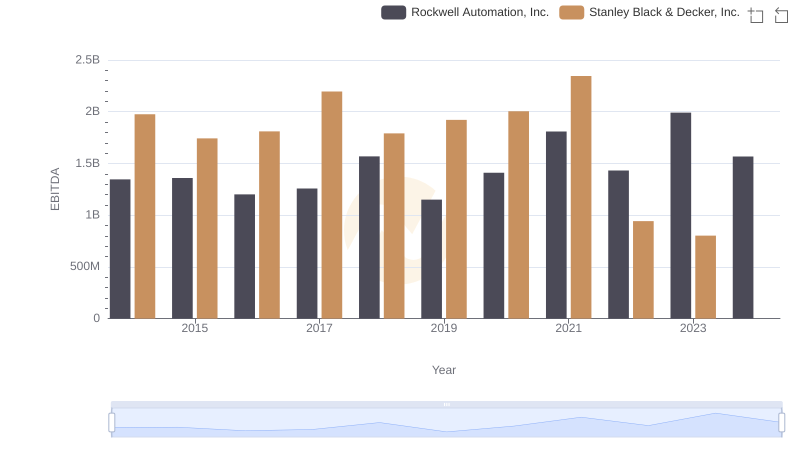

Rockwell Automation, Inc. and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

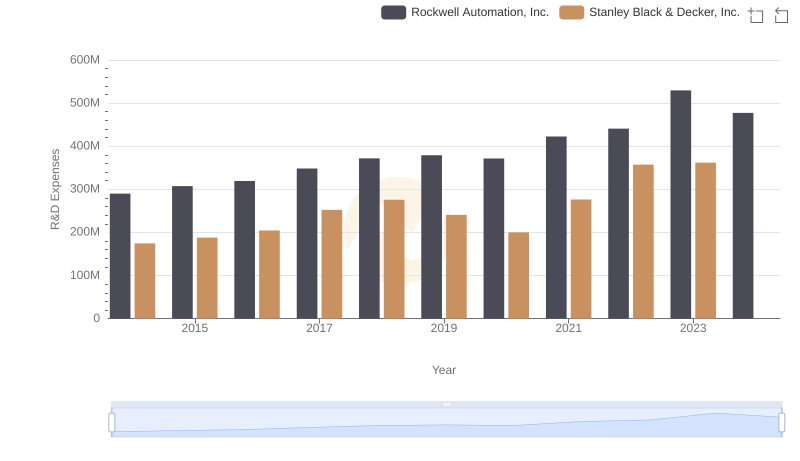

Rockwell Automation, Inc. or Stanley Black & Decker, Inc.: Who Invests More in Innovation?

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.