| __timestamp | Intuit Inc. | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 761000000 |

| Thursday, January 1, 2015 | 1771000000 | 773000000 |

| Friday, January 1, 2016 | 1807000000 | 997000000 |

| Sunday, January 1, 2017 | 1973000000 | 1445000000 |

| Monday, January 1, 2018 | 2298000000 | 1473000000 |

| Tuesday, January 1, 2019 | 2524000000 | 1317000000 |

| Wednesday, January 1, 2020 | 2727000000 | 1153000000 |

| Friday, January 1, 2021 | 3626000000 | 1105000000 |

| Saturday, January 1, 2022 | 4986000000 | 1117000000 |

| Sunday, January 1, 2023 | 5062000000 | 970000000 |

| Monday, January 1, 2024 | 5730000000 | 828000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Intuit Inc. and Western Digital Corporation have demonstrated contrasting approaches to SG&A cost management. From 2014 to 2024, Intuit's SG&A expenses surged by over 225%, reflecting its aggressive growth strategy. In contrast, Western Digital's expenses increased by a modest 9%, showcasing a more conservative fiscal approach.

This analysis highlights the strategic differences between these tech giants, offering valuable insights for investors and industry analysts alike.

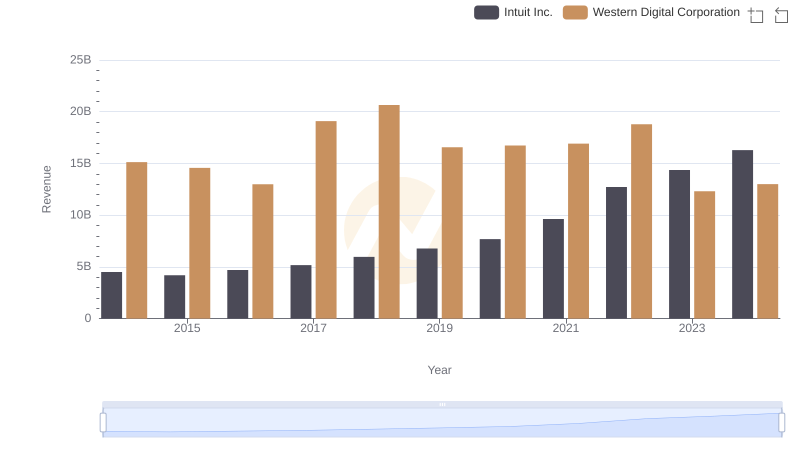

Intuit Inc. vs Western Digital Corporation: Annual Revenue Growth Compared

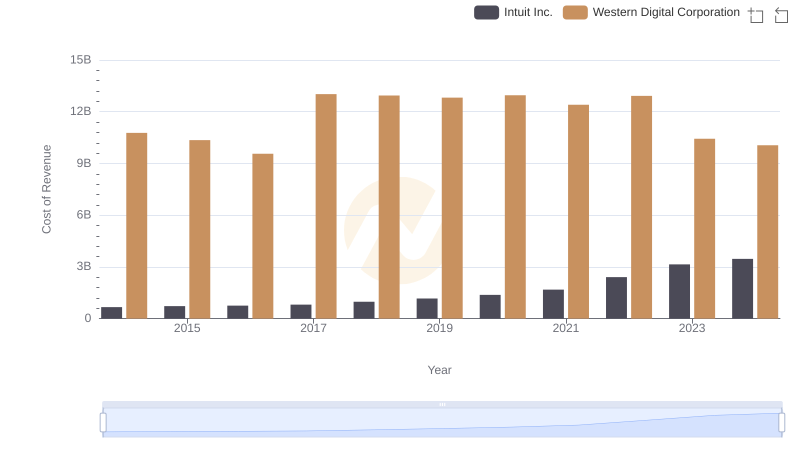

Cost of Revenue Trends: Intuit Inc. vs Western Digital Corporation

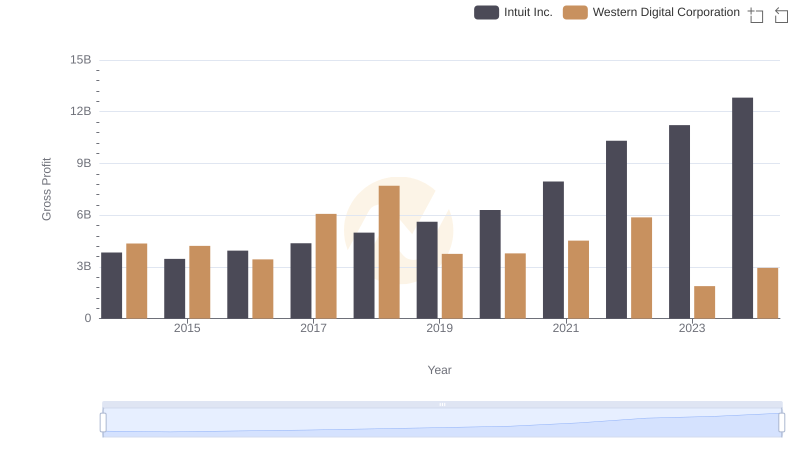

Intuit Inc. and Western Digital Corporation: A Detailed Gross Profit Analysis

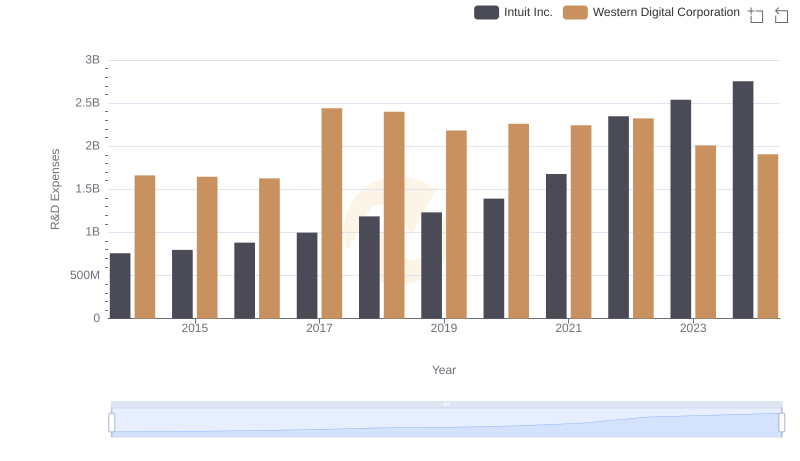

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

Intuit Inc. vs ON Semiconductor Corporation: SG&A Expense Trends

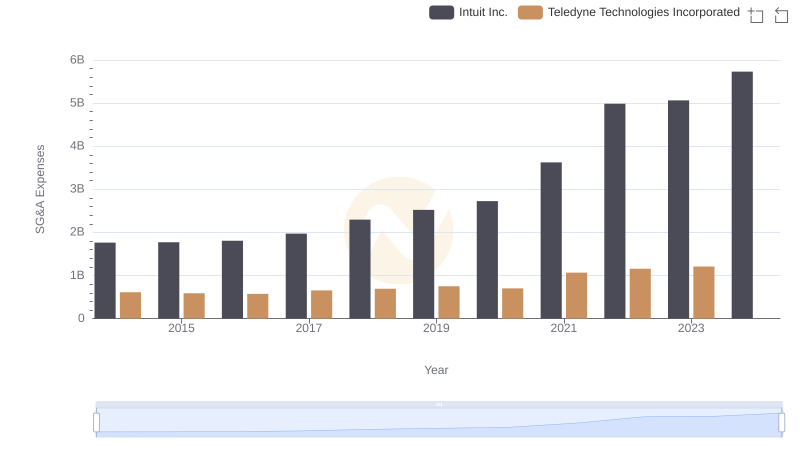

Breaking Down SG&A Expenses: Intuit Inc. vs Teledyne Technologies Incorporated

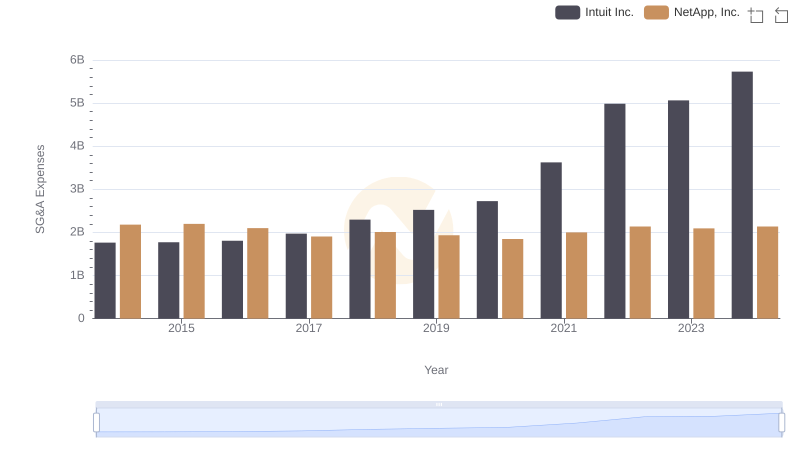

Intuit Inc. or NetApp, Inc.: Who Manages SG&A Costs Better?

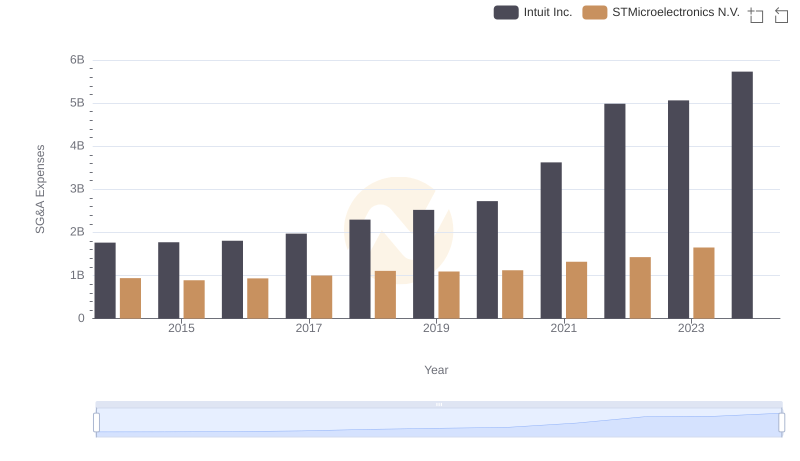

Cost Management Insights: SG&A Expenses for Intuit Inc. and STMicroelectronics N.V.

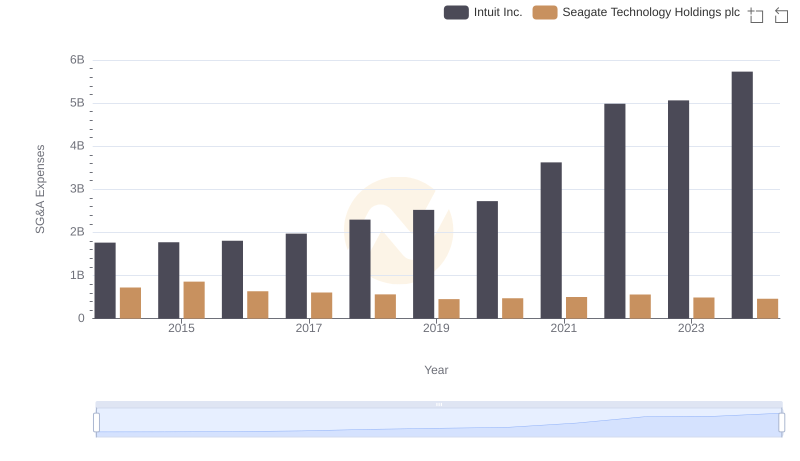

Cost Management Insights: SG&A Expenses for Intuit Inc. and Seagate Technology Holdings plc

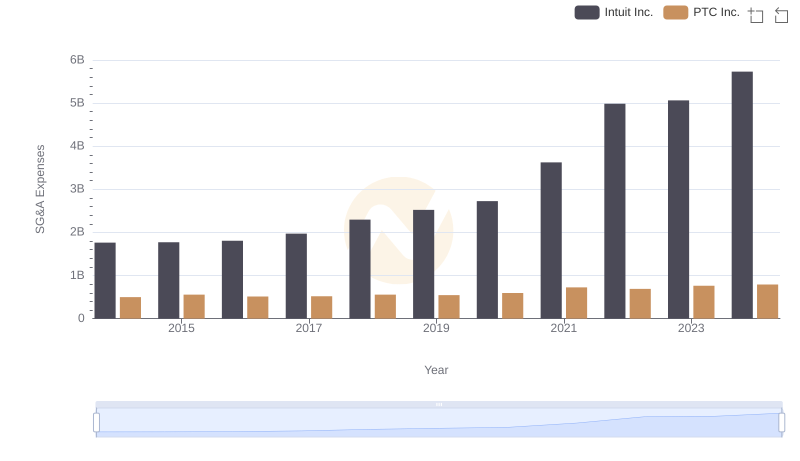

Selling, General, and Administrative Costs: Intuit Inc. vs PTC Inc.

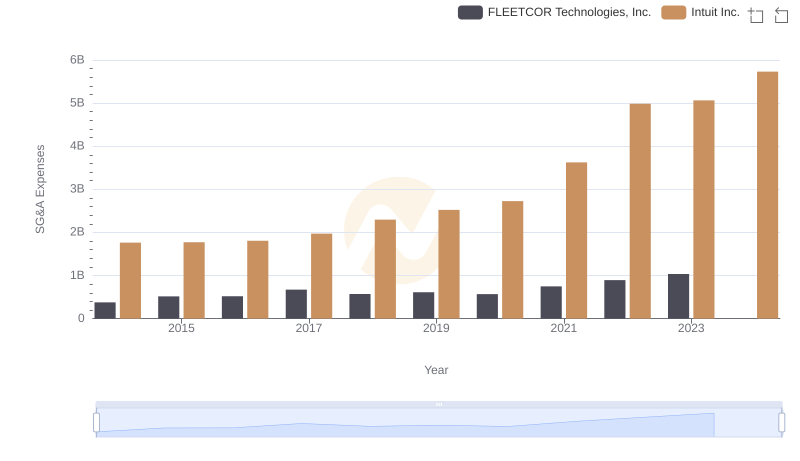

Comparing SG&A Expenses: Intuit Inc. vs FLEETCOR Technologies, Inc. Trends and Insights