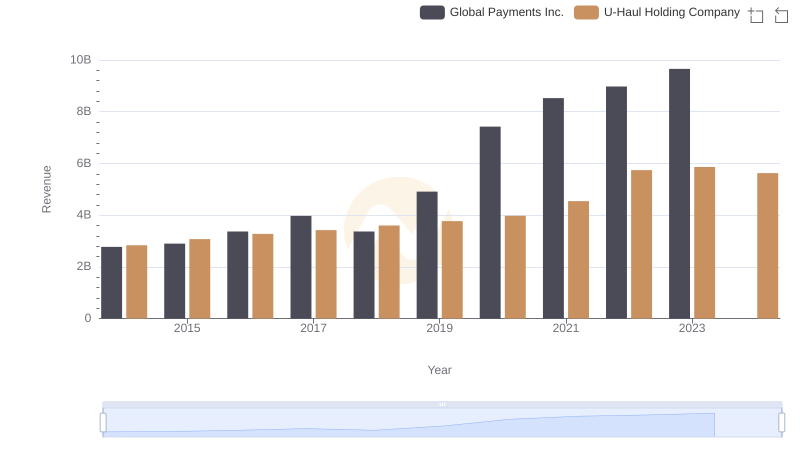

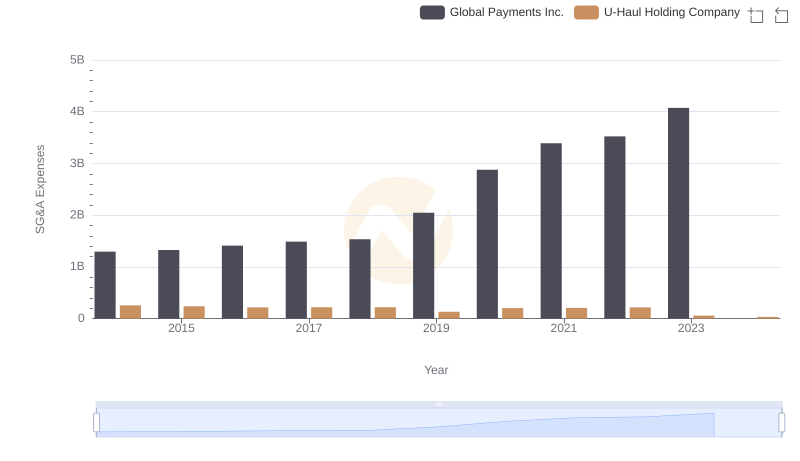

| __timestamp | Global Payments Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1751611000 | 2707982000 |

| Thursday, January 1, 2015 | 1750511000 | 2928459000 |

| Friday, January 1, 2016 | 1767444000 | 3130666000 |

| Sunday, January 1, 2017 | 2047126000 | 3269282000 |

| Monday, January 1, 2018 | 2271352000 | 3440625000 |

| Tuesday, January 1, 2019 | 2838089000 | 3606565000 |

| Wednesday, January 1, 2020 | 3772831000 | 3814850000 |

| Friday, January 1, 2021 | 4750037000 | 4327926000 |

| Saturday, January 1, 2022 | 5196898000 | 5480162000 |

| Sunday, January 1, 2023 | 5926898000 | 5019797000 |

| Monday, January 1, 2024 | 6345778000 | 1649634000 |

Unleashing the power of data

In the ever-evolving landscape of American business, Global Payments Inc. and U-Haul Holding Company stand as intriguing case studies in financial growth. Over the past decade, from 2014 to 2023, these companies have shown distinct trajectories in their gross profit margins.

Global Payments Inc. has experienced a remarkable upward trend, with gross profits soaring by approximately 238% from 2014 to 2023. This growth reflects the company's strategic expansion and adaptation to the digital payment revolution.

Conversely, U-Haul Holding Company, a stalwart in the moving and storage industry, has seen a more modest increase of around 85% in the same period. Despite a dip in 2023, U-Haul's steady growth underscores its resilience in a competitive market.

Both companies highlight the diverse paths to success in the American economy, with Global Payments capitalizing on technology and U-Haul maintaining its stronghold in traditional services.

Comparing Revenue Performance: Global Payments Inc. or U-Haul Holding Company?

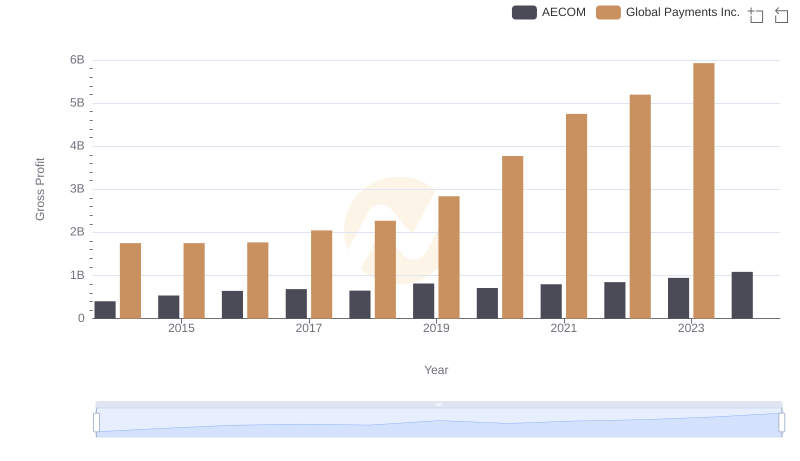

Global Payments Inc. and AECOM: A Detailed Gross Profit Analysis

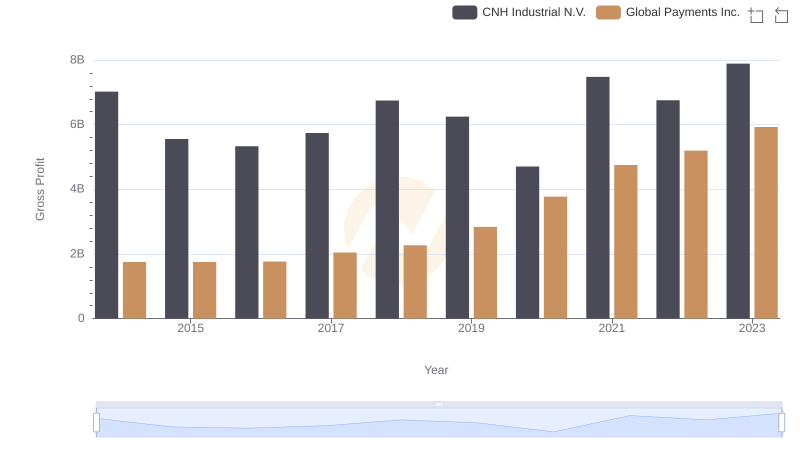

Key Insights on Gross Profit: Global Payments Inc. vs CNH Industrial N.V.

Analyzing Cost of Revenue: Global Payments Inc. and U-Haul Holding Company

Key Insights on Gross Profit: Global Payments Inc. vs Pool Corporation

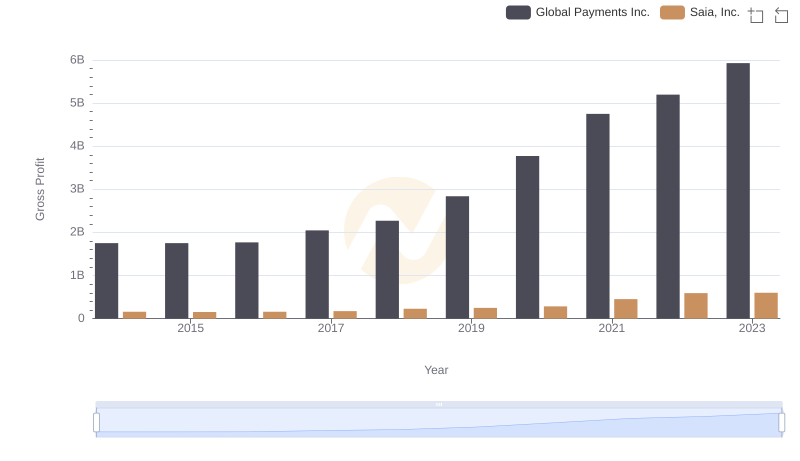

Who Generates Higher Gross Profit? Global Payments Inc. or Saia, Inc.

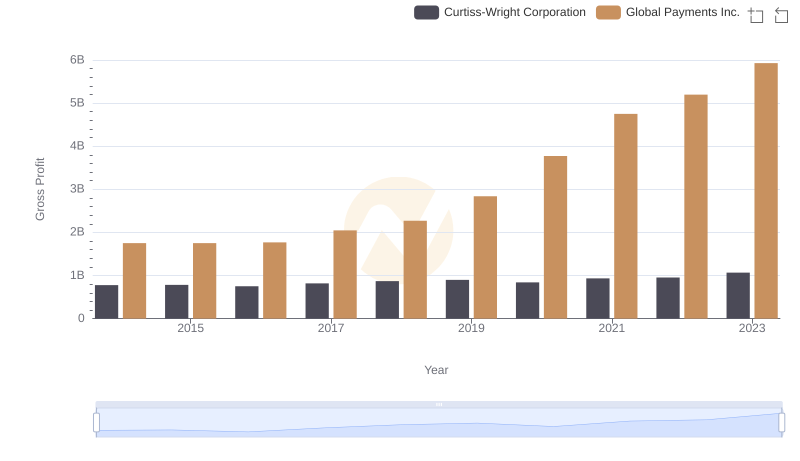

Global Payments Inc. vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

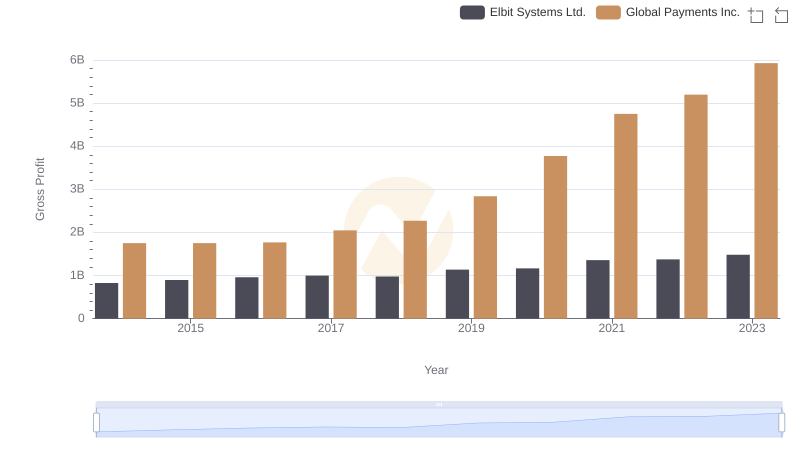

Gross Profit Analysis: Comparing Global Payments Inc. and Elbit Systems Ltd.

Cost Management Insights: SG&A Expenses for Global Payments Inc. and U-Haul Holding Company