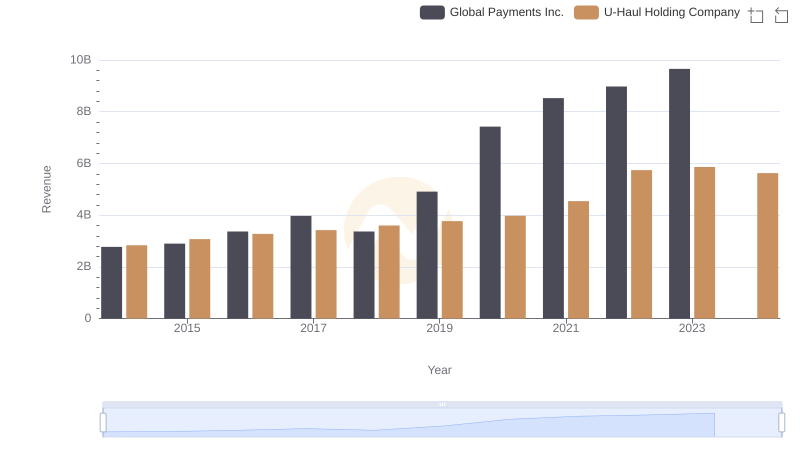

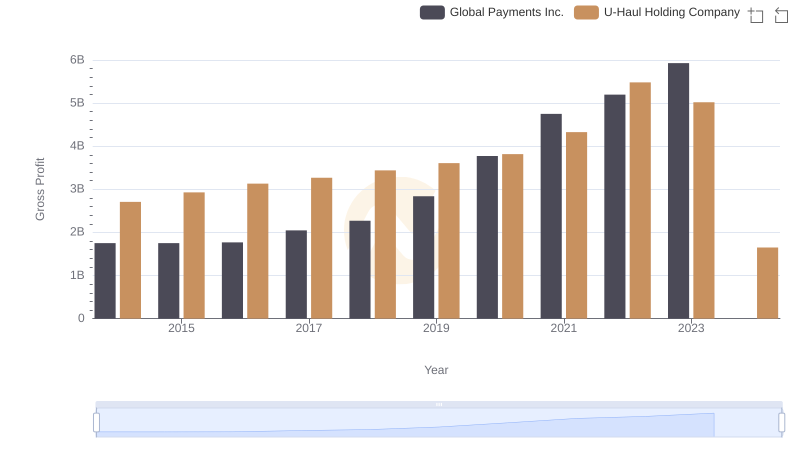

| __timestamp | Global Payments Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 127270000 |

| Thursday, January 1, 2015 | 1147639000 | 146072000 |

| Friday, January 1, 2016 | 1603532000 | 144990000 |

| Sunday, January 1, 2017 | 1928037000 | 152485000 |

| Monday, January 1, 2018 | 1095014000 | 160489000 |

| Tuesday, January 1, 2019 | 2073803000 | 162142000 |

| Wednesday, January 1, 2020 | 3650727000 | 164018000 |

| Friday, January 1, 2021 | 3773725000 | 214059000 |

| Saturday, January 1, 2022 | 3778617000 | 259585000 |

| Sunday, January 1, 2023 | 3727521000 | 844894000 |

| Monday, January 1, 2024 | 3760116000 | 3976040000 |

Unlocking the unknown

In the ever-evolving landscape of American business, Global Payments Inc. and U-Haul Holding Company stand as intriguing case studies in cost management. Over the past decade, Global Payments Inc. has seen its cost of revenue soar by approximately 270%, peaking in 2022. This reflects the company's aggressive expansion and adaptation to the digital economy. In contrast, U-Haul Holding Company, a stalwart in the moving and storage industry, has maintained a more conservative growth trajectory, with costs increasing by about 213% over the same period. Notably, 2023 marked a significant leap for U-Haul, with costs nearly tripling from the previous year, hinting at strategic investments or market shifts. While Global Payments' data for 2024 remains elusive, U-Haul's continued rise suggests a dynamic year ahead. This analysis underscores the diverse strategies companies employ to navigate financial landscapes.

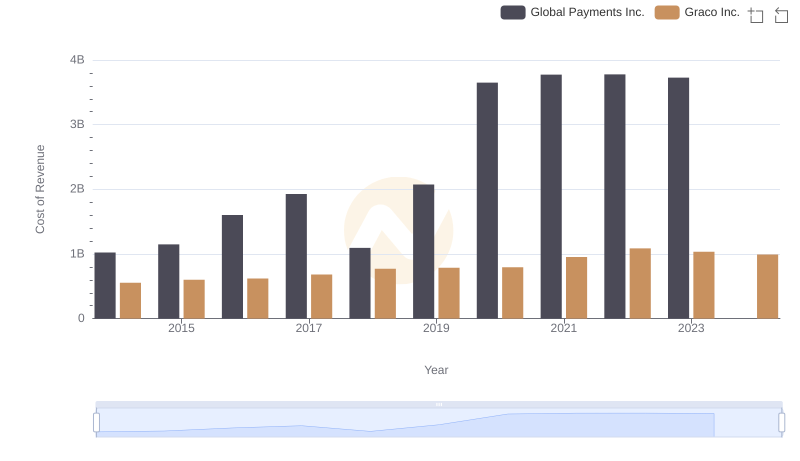

Analyzing Cost of Revenue: Global Payments Inc. and Graco Inc.

Cost of Revenue Trends: Global Payments Inc. vs Stanley Black & Decker, Inc.

Comparing Revenue Performance: Global Payments Inc. or U-Haul Holding Company?

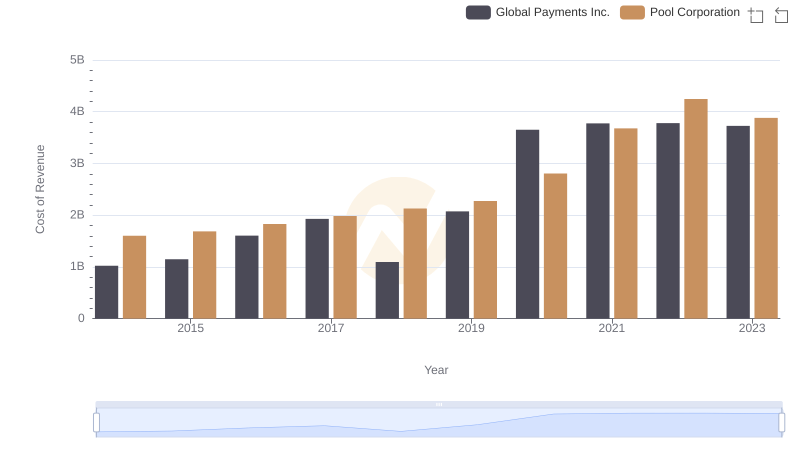

Global Payments Inc. vs Pool Corporation: Efficiency in Cost of Revenue Explored

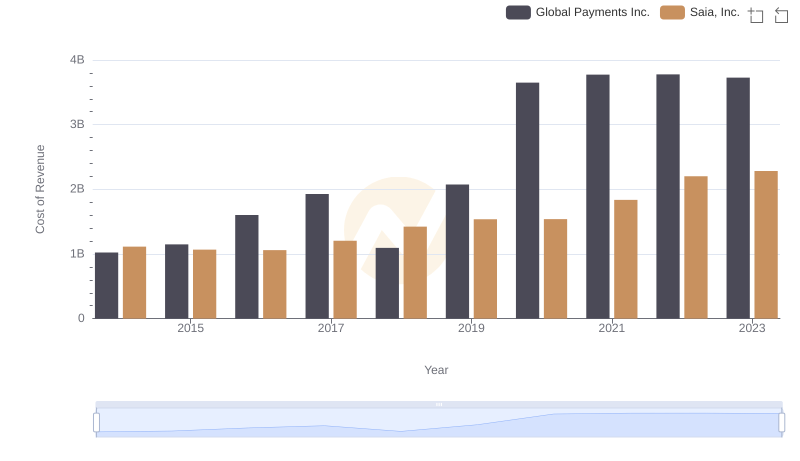

Global Payments Inc. vs Saia, Inc.: Efficiency in Cost of Revenue Explored

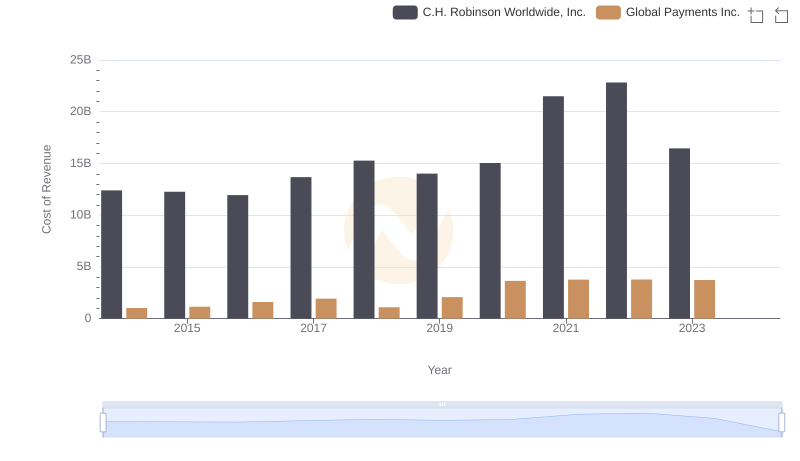

Cost of Revenue Trends: Global Payments Inc. vs C.H. Robinson Worldwide, Inc.

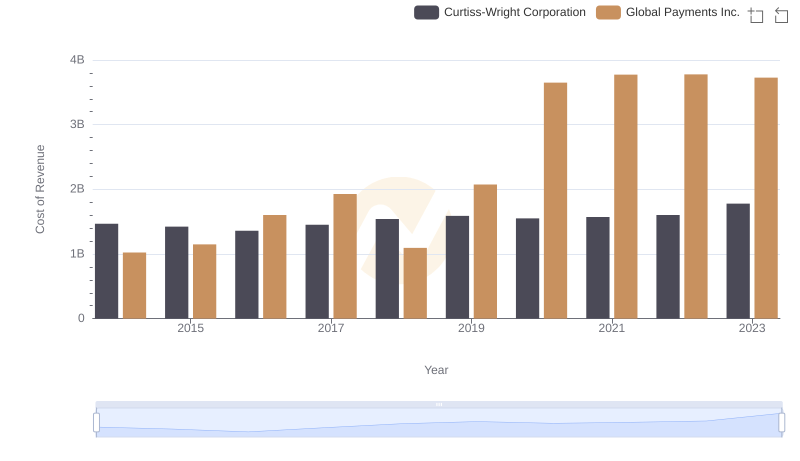

Analyzing Cost of Revenue: Global Payments Inc. and Curtiss-Wright Corporation

Gross Profit Comparison: Global Payments Inc. and U-Haul Holding Company Trends

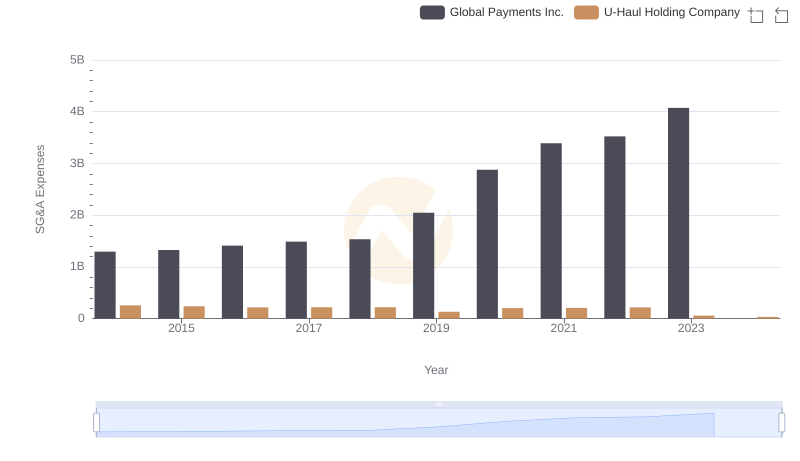

Cost Management Insights: SG&A Expenses for Global Payments Inc. and U-Haul Holding Company