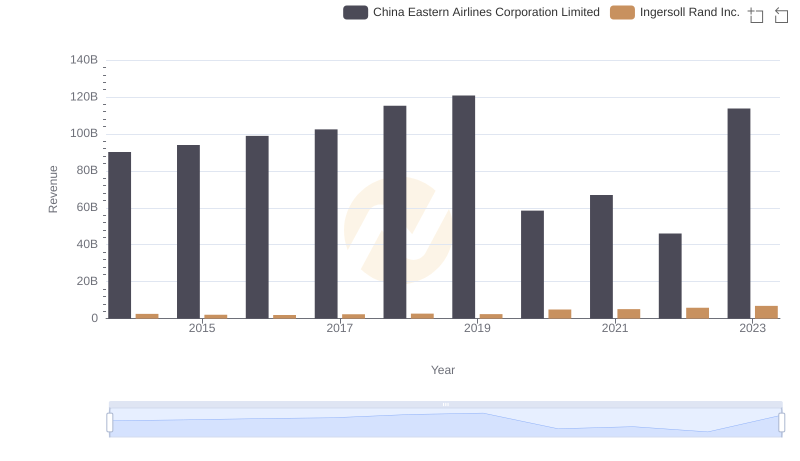

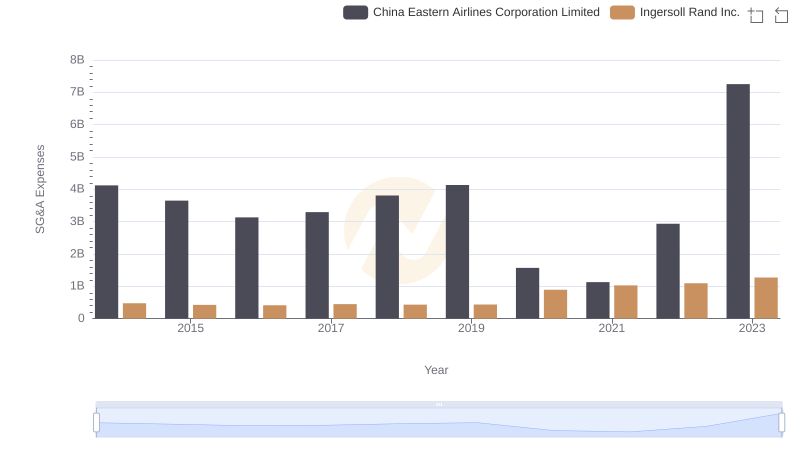

| __timestamp | China Eastern Airlines Corporation Limited | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 1633224000 |

| Thursday, January 1, 2015 | 77237000000 | 1347800000 |

| Friday, January 1, 2016 | 82676000000 | 1222705000 |

| Sunday, January 1, 2017 | 91592000000 | 1477500000 |

| Monday, January 1, 2018 | 103476000000 | 1677300000 |

| Tuesday, January 1, 2019 | 108865000000 | 1540200000 |

| Wednesday, January 1, 2020 | 72523000000 | 3296800000 |

| Friday, January 1, 2021 | 81828000000 | 3163900000 |

| Saturday, January 1, 2022 | 74599000000 | 3590700000 |

| Sunday, January 1, 2023 | 112461000000 | 3993900000 |

| Monday, January 1, 2024 | 0 |

Data in motion

In the ever-evolving landscape of global business, understanding cost structures is crucial for strategic decision-making. This analysis delves into the cost of revenue trends for two industry giants: Ingersoll Rand Inc., a leader in industrial manufacturing, and China Eastern Airlines Corporation Limited, a major player in the aviation sector.

From 2014 to 2023, China Eastern Airlines consistently reported a cost of revenue that was approximately 40 times higher than that of Ingersoll Rand. Notably, in 2023, China Eastern Airlines' cost of revenue peaked at over 112 billion, marking a significant 50% increase from its 2020 low. In contrast, Ingersoll Rand's cost of revenue showed a steady upward trend, reaching nearly 4 billion in 2023, a 145% increase from 2016.

These insights highlight the contrasting financial dynamics and operational scales of these two companies, offering a window into their strategic priorities and market challenges.

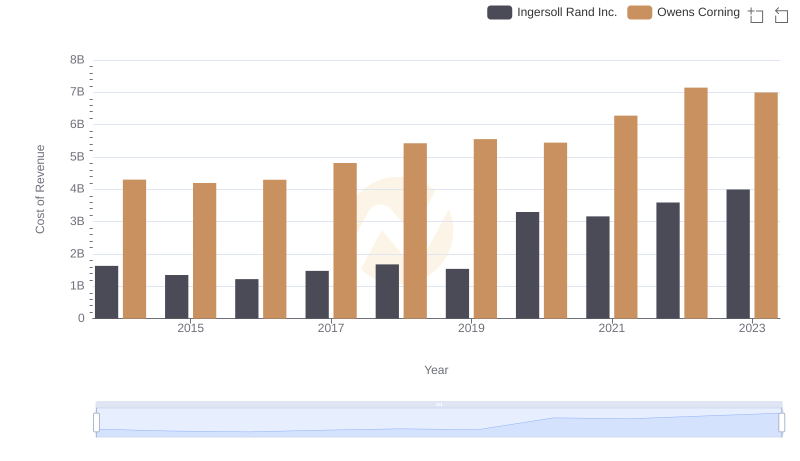

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Owens Corning

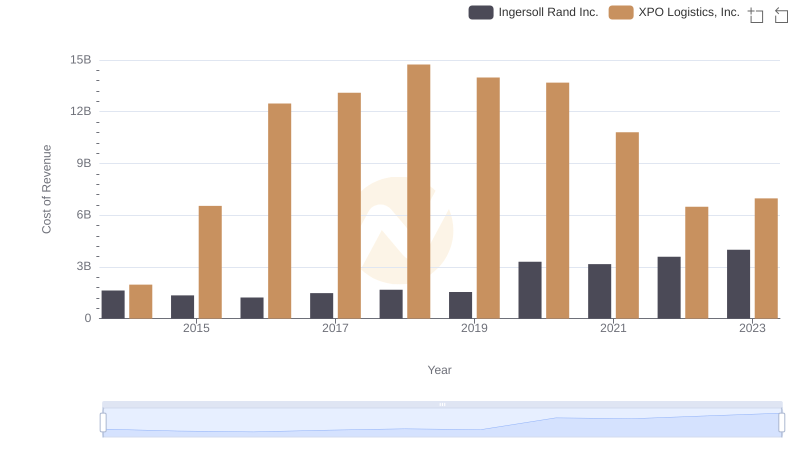

Cost of Revenue Trends: Ingersoll Rand Inc. vs XPO Logistics, Inc.

Who Generates More Revenue? Ingersoll Rand Inc. or China Eastern Airlines Corporation Limited

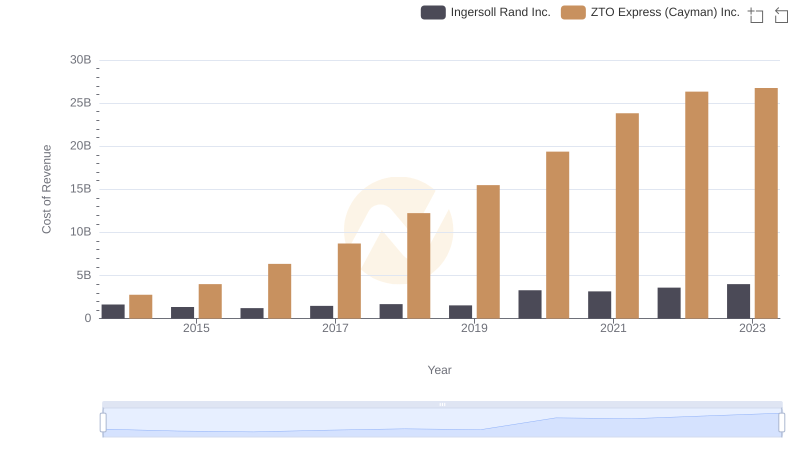

Ingersoll Rand Inc. vs ZTO Express (Cayman) Inc.: Efficiency in Cost of Revenue Explored

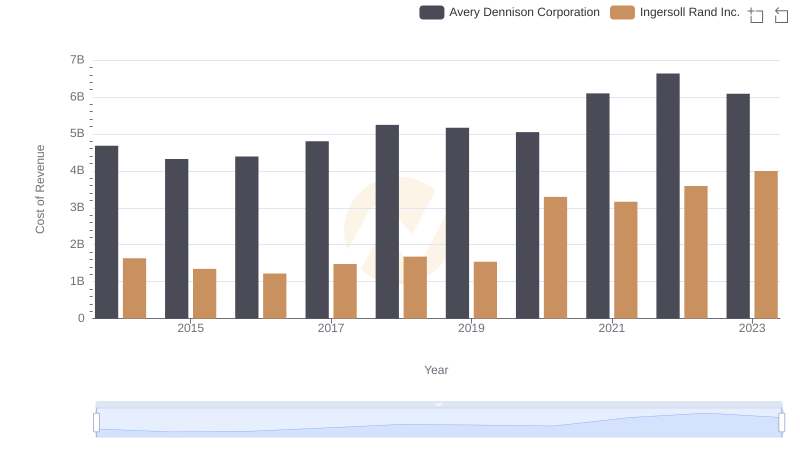

Analyzing Cost of Revenue: Ingersoll Rand Inc. and Avery Dennison Corporation

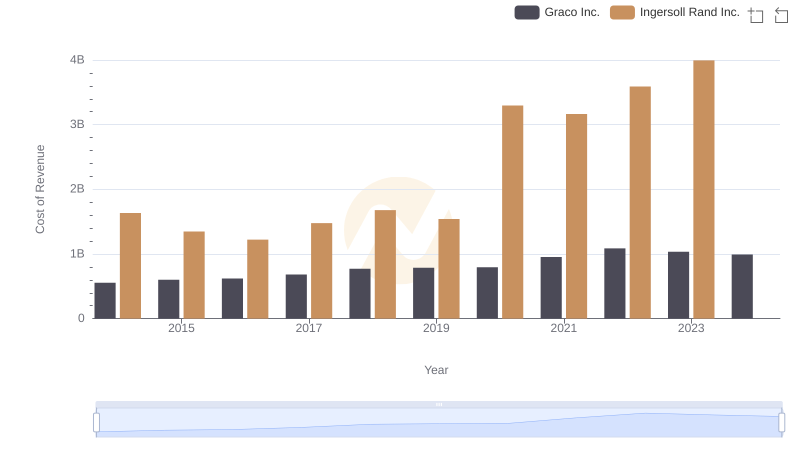

Cost of Revenue Comparison: Ingersoll Rand Inc. vs Graco Inc.

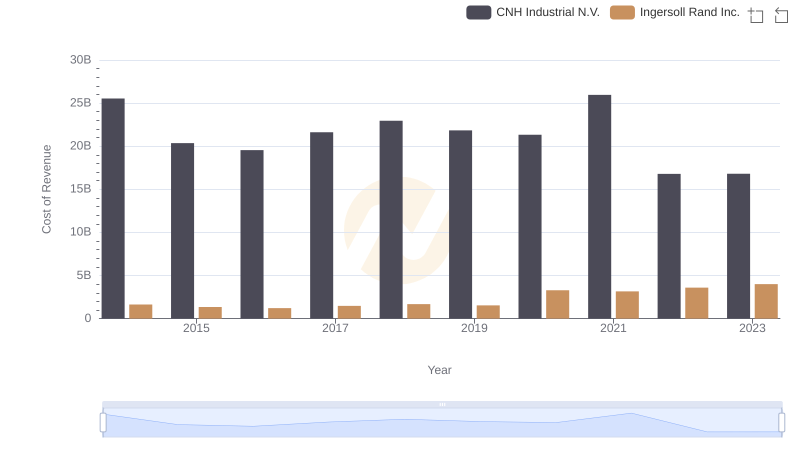

Cost of Revenue Trends: Ingersoll Rand Inc. vs CNH Industrial N.V.

Selling, General, and Administrative Costs: Ingersoll Rand Inc. vs China Eastern Airlines Corporation Limited

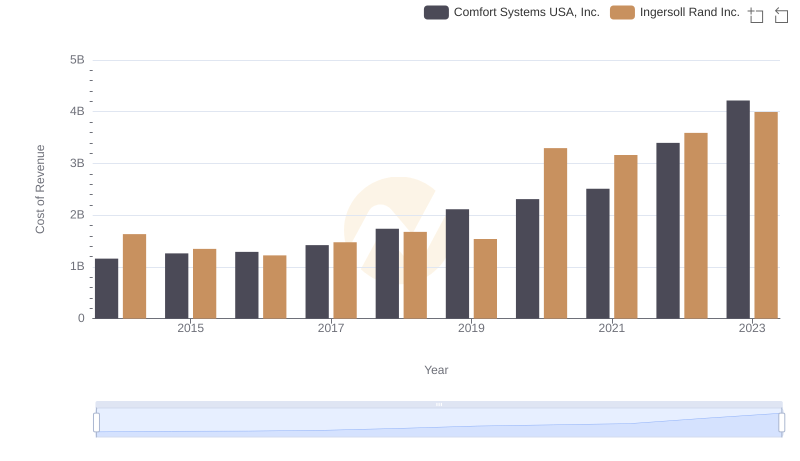

Analyzing Cost of Revenue: Ingersoll Rand Inc. and Comfort Systems USA, Inc.

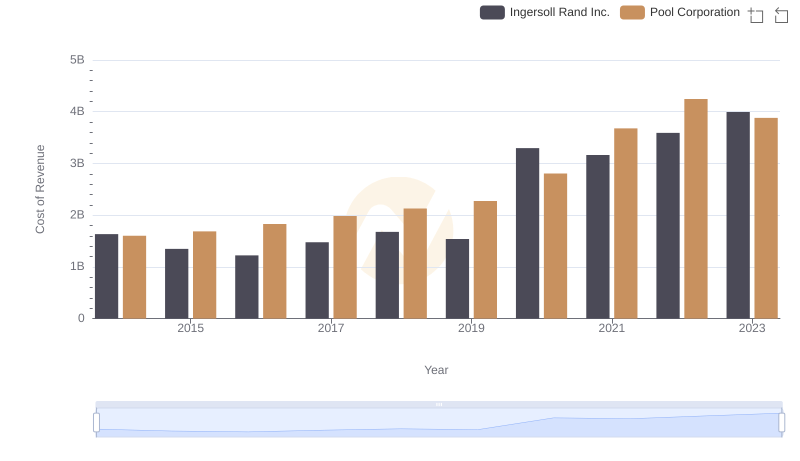

Cost Insights: Breaking Down Ingersoll Rand Inc. and Pool Corporation's Expenses

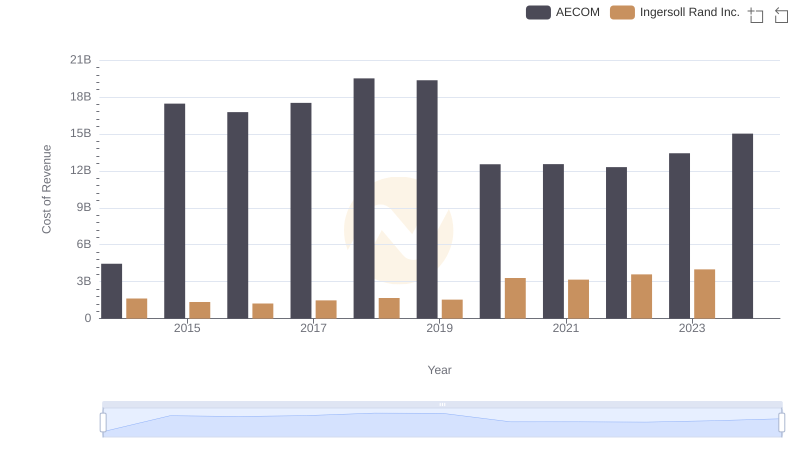

Cost Insights: Breaking Down Ingersoll Rand Inc. and AECOM's Expenses