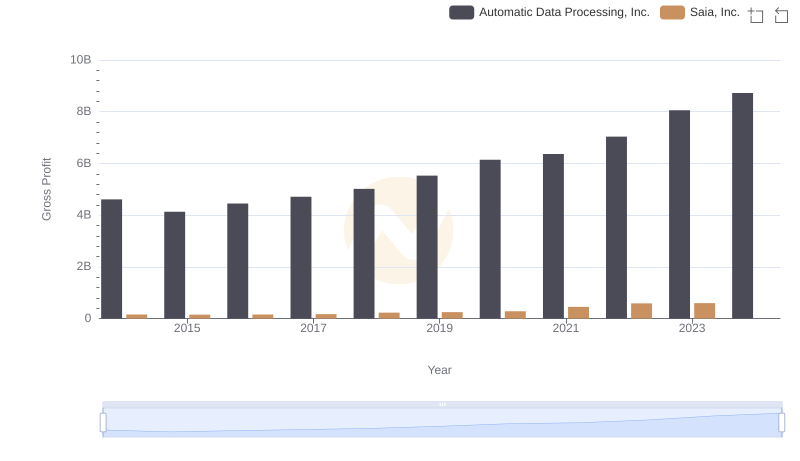

| __timestamp | Automatic Data Processing, Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 1113053000 |

| Thursday, January 1, 2015 | 6427600000 | 1067191000 |

| Friday, January 1, 2016 | 6840300000 | 1058979000 |

| Sunday, January 1, 2017 | 7269800000 | 1203464000 |

| Monday, January 1, 2018 | 7842600000 | 1423779000 |

| Tuesday, January 1, 2019 | 8086600000 | 1537082000 |

| Wednesday, January 1, 2020 | 8445100000 | 1538518000 |

| Friday, January 1, 2021 | 8640300000 | 1837017000 |

| Saturday, January 1, 2022 | 9461900000 | 2201094000 |

| Sunday, January 1, 2023 | 9953400000 | 2282501000 |

| Monday, January 1, 2024 | 10476700000 |

Infusing magic into the data realm

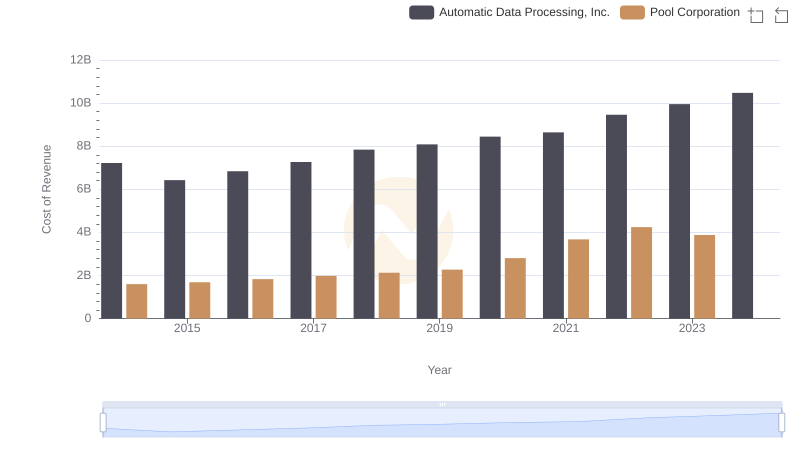

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. Automatic Data Processing, Inc. (ADP) and Saia, Inc. offer a fascinating study in contrasts. From 2014 to 2023, ADP's cost of revenue has surged by approximately 45%, reflecting its robust growth and strategic investments. In 2014, ADP's cost of revenue was around $7.2 billion, climbing to nearly $10 billion by 2023. This upward trend underscores ADP's expanding operational scale and market reach.

Conversely, Saia, Inc. has demonstrated a remarkable 105% increase in its cost of revenue over the same period, from about $1.1 billion in 2014 to over $2.2 billion in 2023. This growth trajectory highlights Saia's aggressive expansion in the logistics sector. Notably, data for 2024 is incomplete, suggesting potential shifts in financial strategies. These insights provide a window into the dynamic financial strategies of these industry leaders.

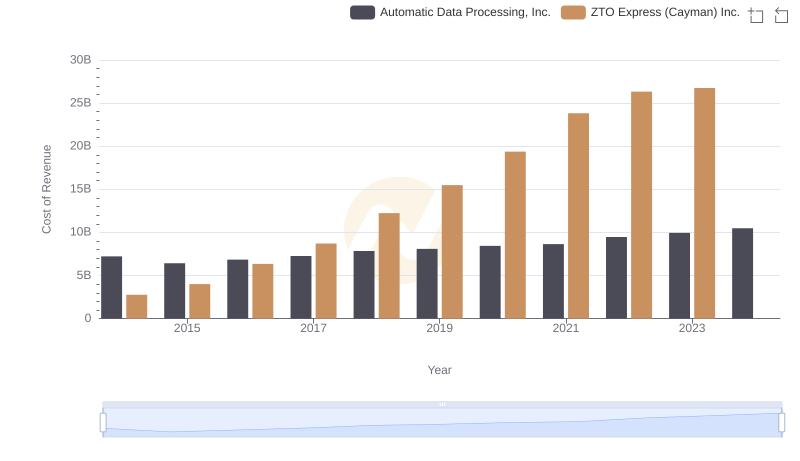

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc.

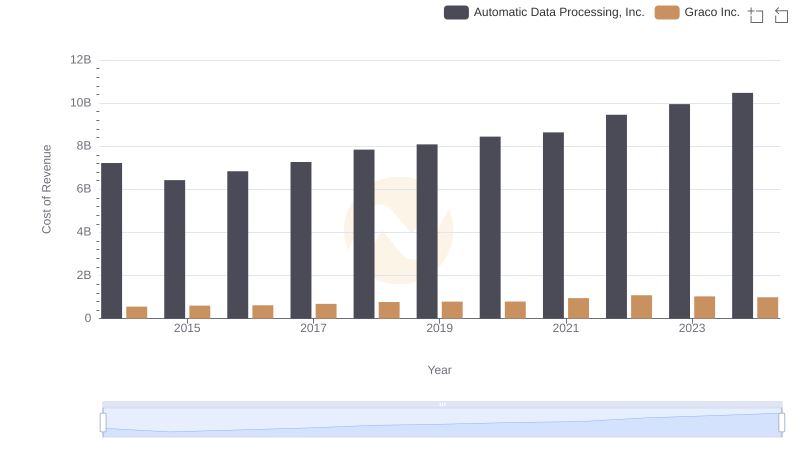

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Graco Inc.

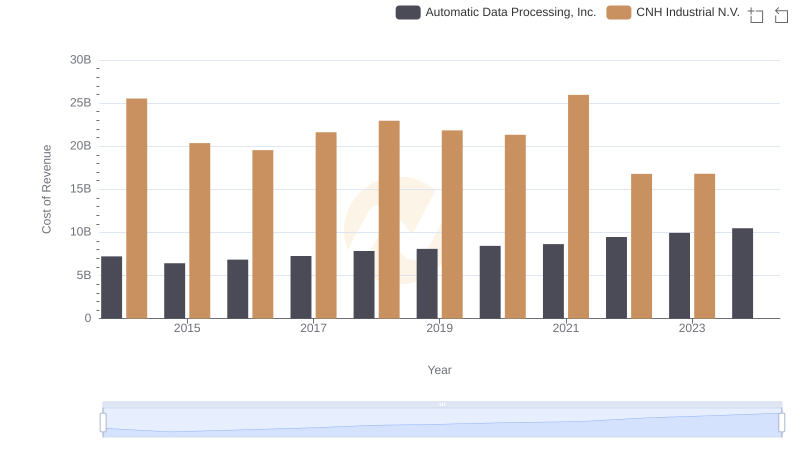

Automatic Data Processing, Inc. vs CNH Industrial N.V.: Efficiency in Cost of Revenue Explored

Automatic Data Processing, Inc. vs Saia, Inc.: Annual Revenue Growth Compared

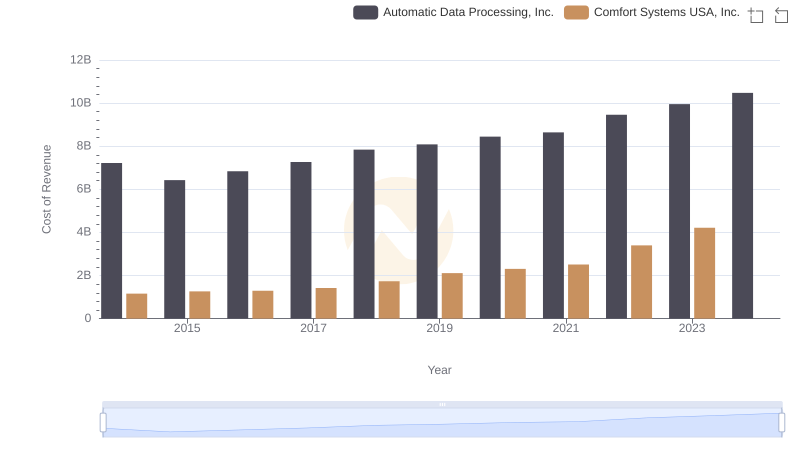

Automatic Data Processing, Inc. vs Comfort Systems USA, Inc.: Efficiency in Cost of Revenue Explored

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Pool Corporation

Automatic Data Processing, Inc. and Saia, Inc.: A Detailed Gross Profit Analysis

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs Saia, Inc.

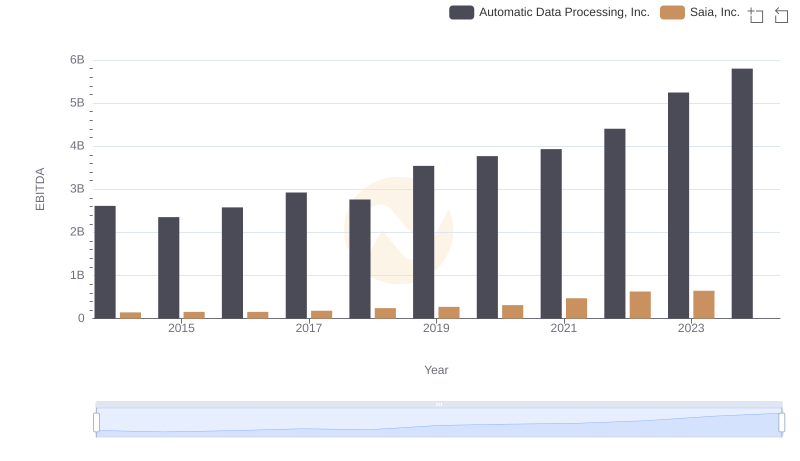

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.