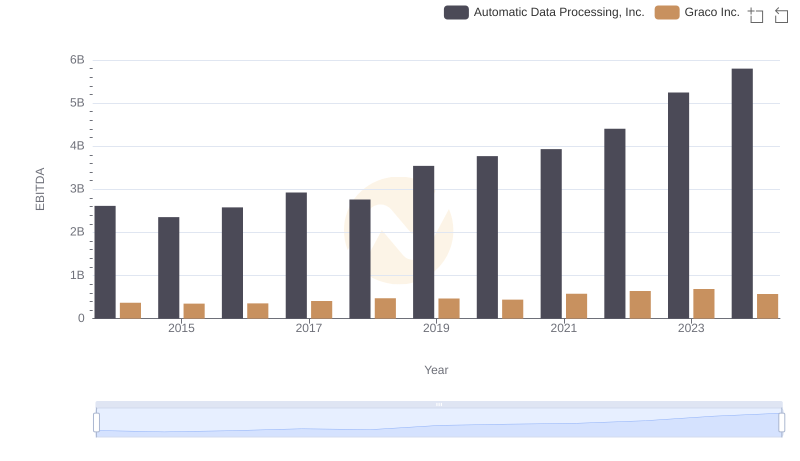

| __timestamp | Automatic Data Processing, Inc. | Graco Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 554394000 |

| Thursday, January 1, 2015 | 6427600000 | 601785000 |

| Friday, January 1, 2016 | 6840300000 | 621054000 |

| Sunday, January 1, 2017 | 7269800000 | 681695000 |

| Monday, January 1, 2018 | 7842600000 | 770753000 |

| Tuesday, January 1, 2019 | 8086600000 | 786289000 |

| Wednesday, January 1, 2020 | 8445100000 | 795178000 |

| Friday, January 1, 2021 | 8640300000 | 953659000 |

| Saturday, January 1, 2022 | 9461900000 | 1086082000 |

| Sunday, January 1, 2023 | 9953400000 | 1034585000 |

| Monday, January 1, 2024 | 10476700000 | 990855000 |

Igniting the spark of knowledge

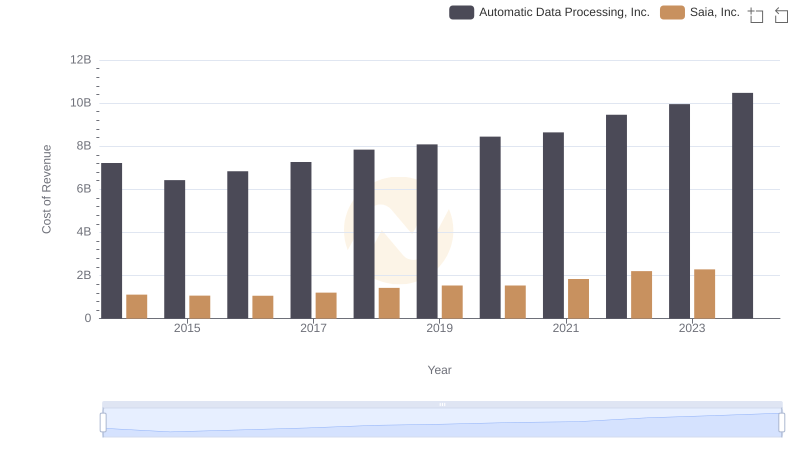

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for investors and analysts alike. This metric, which represents the direct costs attributable to the production of goods sold by a company, offers insights into operational efficiency and profitability.

From 2014 to 2024, Automatic Data Processing, Inc. (ADP) has shown a steady increase in its cost of revenue, growing by approximately 45% over the decade. This upward trend reflects ADP's expanding operations and market reach. In contrast, Graco Inc. has experienced a more modest increase of around 79% in the same period, indicating a more conservative growth strategy.

While both companies have seen growth, ADP's cost of revenue is significantly higher, suggesting a larger scale of operations. Investors should consider these trends when evaluating potential investment opportunities.

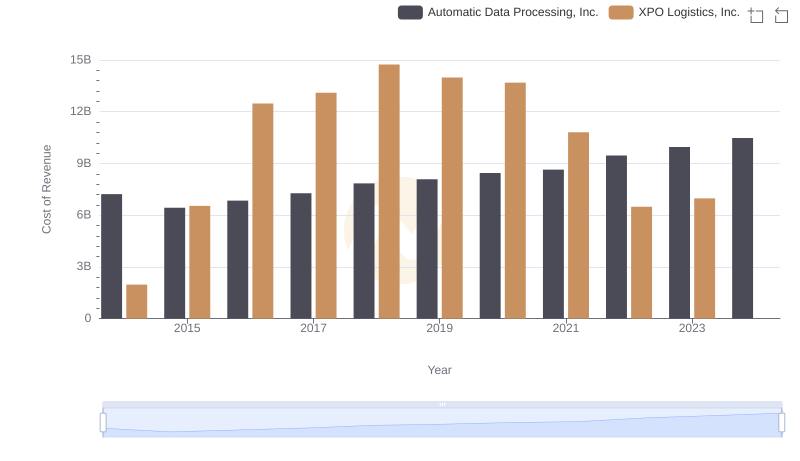

Cost Insights: Breaking Down Automatic Data Processing, Inc. and XPO Logistics, Inc.'s Expenses

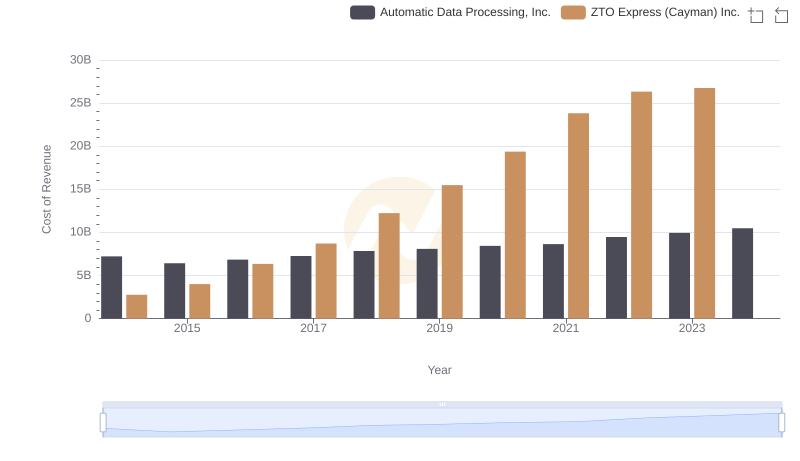

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc.

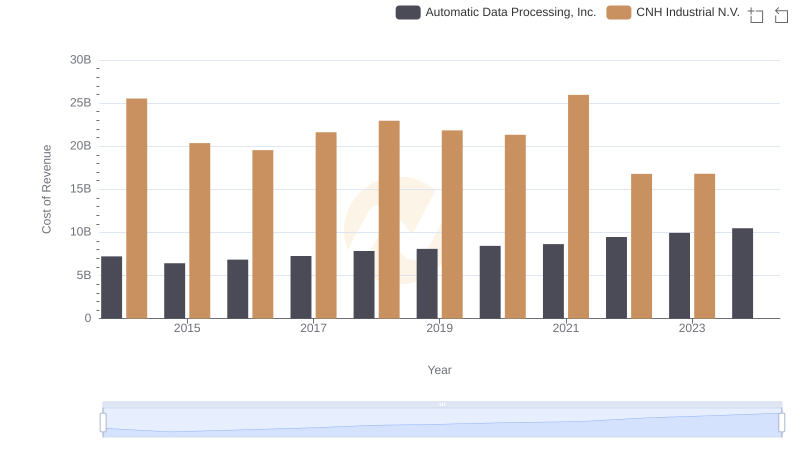

Automatic Data Processing, Inc. vs CNH Industrial N.V.: Efficiency in Cost of Revenue Explored

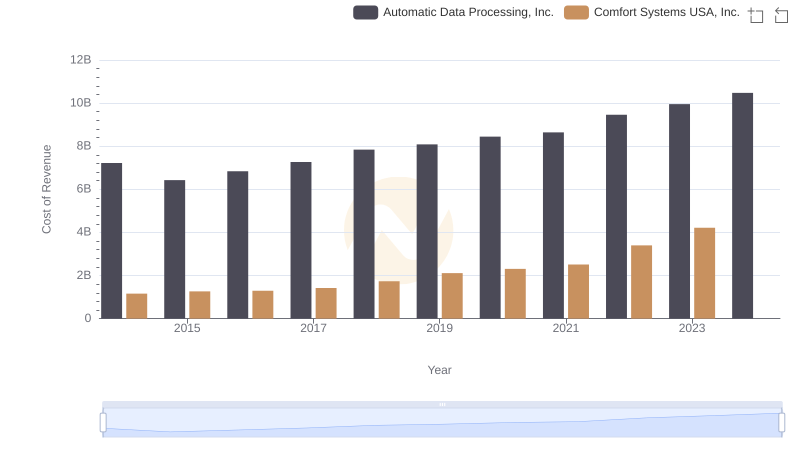

Automatic Data Processing, Inc. vs Comfort Systems USA, Inc.: Efficiency in Cost of Revenue Explored

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Saia, Inc.'s Expenses

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.