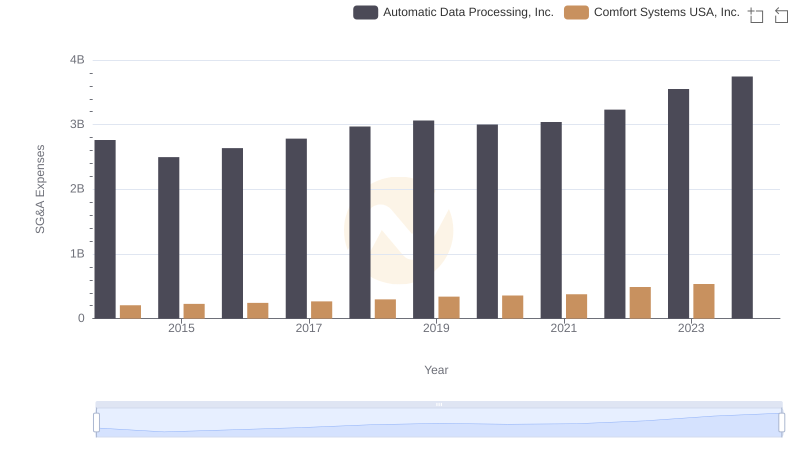

| __timestamp | Automatic Data Processing, Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 37563000 |

| Thursday, January 1, 2015 | 2496900000 | 26832000 |

| Friday, January 1, 2016 | 2637000000 | 39625000 |

| Sunday, January 1, 2017 | 2783200000 | 37162000 |

| Monday, January 1, 2018 | 2971500000 | 38425000 |

| Tuesday, January 1, 2019 | 3064200000 | 43073000 |

| Wednesday, January 1, 2020 | 3003000000 | 49761000 |

| Friday, January 1, 2021 | 3040500000 | 61345000 |

| Saturday, January 1, 2022 | 3233200000 | 56601000 |

| Sunday, January 1, 2023 | 3551400000 | 67984000 |

| Monday, January 1, 2024 | 3778900000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Automatic Data Processing, Inc. (ADP) and Saia, Inc. have showcased contrasting trajectories in their SG&A expenditures. From 2014 to 2023, ADP's SG&A expenses have surged by approximately 36%, reflecting its expansive growth and strategic investments. In contrast, Saia, Inc. has experienced a more modest increase of around 81%, indicative of its focused operational scaling.

The data reveals that ADP consistently outpaces Saia, with its SG&A expenses being nearly 65 times higher on average. This disparity underscores the differing scales and operational strategies of these two industry players. Notably, the data for 2024 is incomplete, highlighting the dynamic nature of financial reporting and the need for continuous analysis.

Automatic Data Processing, Inc. vs Saia, Inc.: Annual Revenue Growth Compared

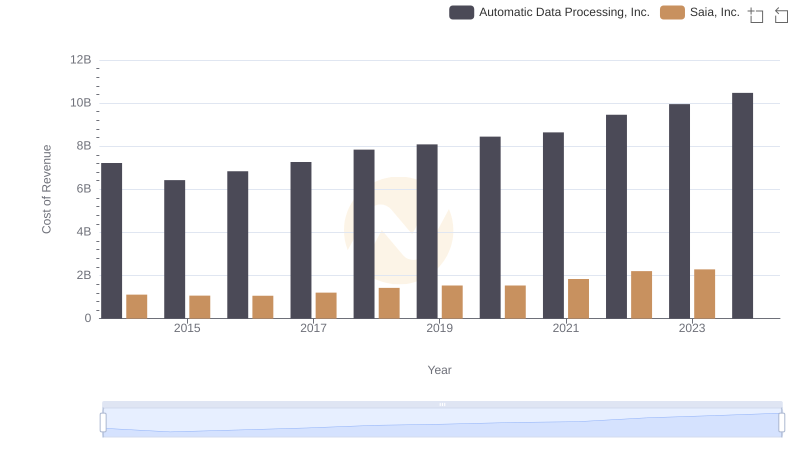

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Saia, Inc.'s Expenses

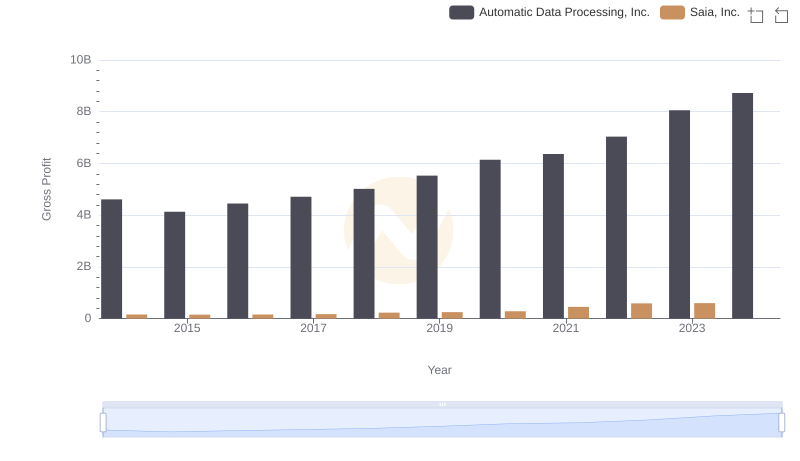

Automatic Data Processing, Inc. and Saia, Inc.: A Detailed Gross Profit Analysis

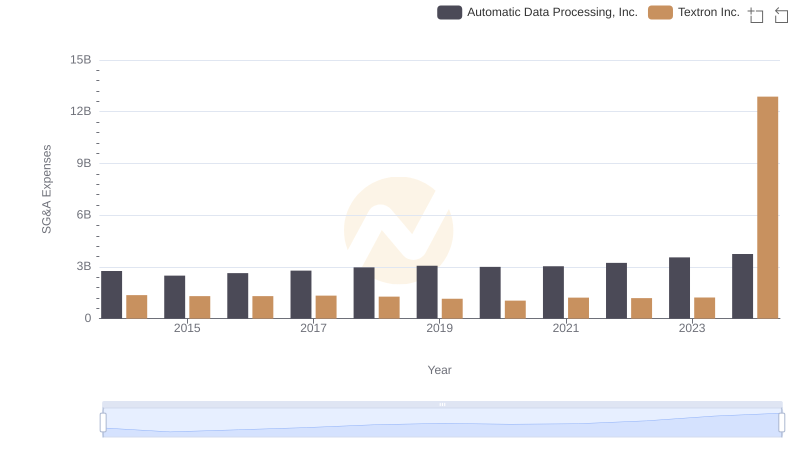

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Textron Inc.

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

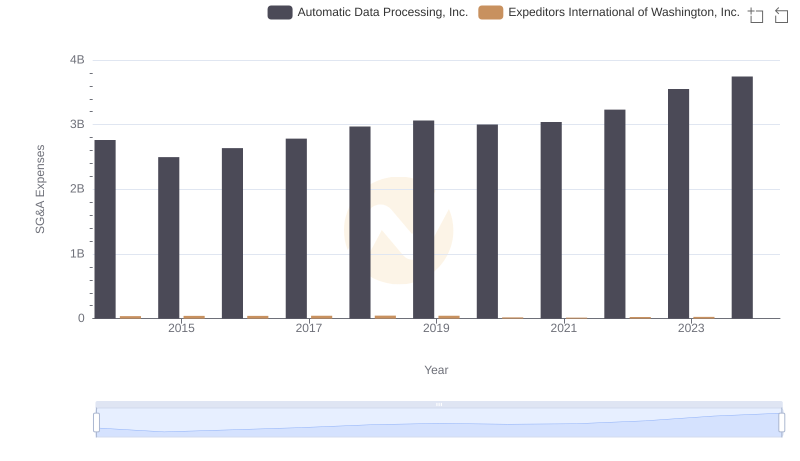

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc. Trends and Insights

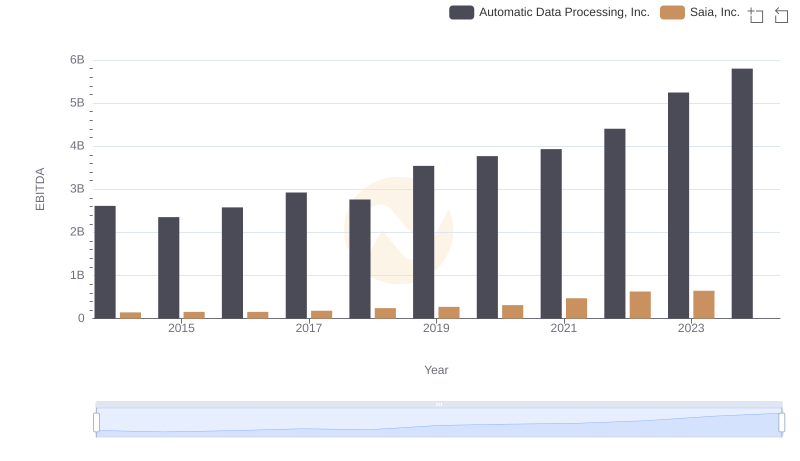

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Automatic Data Processing, Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?