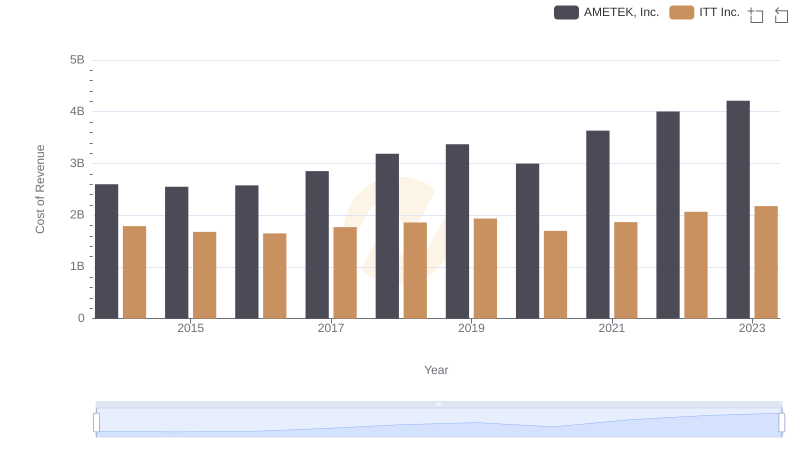

| __timestamp | AMETEK, Inc. | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2597017000 | 297500000 |

| Thursday, January 1, 2015 | 2549280000 | 310200000 |

| Friday, January 1, 2016 | 2575220000 | 376100000 |

| Sunday, January 1, 2017 | 2851431000 | 474900000 |

| Monday, January 1, 2018 | 3186310000 | 514200000 |

| Tuesday, January 1, 2019 | 3370897000 | 2099000000 |

| Wednesday, January 1, 2020 | 2996515000 | 2136400000 |

| Friday, January 1, 2021 | 3633900000 | 2239100000 |

| Saturday, January 1, 2022 | 4005261000 | 2737000000 |

| Sunday, January 1, 2023 | 4212484999 | 927000000 |

| Monday, January 1, 2024 | 0 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business, understanding cost structures is pivotal. This analysis delves into the cost of revenue trends for AMETEK, Inc. and Rentokil Initial plc from 2014 to 2023. AMETEK, Inc., a leader in electronic instruments, has seen its cost of revenue grow by approximately 62% over this period, peaking in 2023. In contrast, Rentokil Initial plc, a prominent pest control and hygiene services provider, experienced a more volatile trajectory, with a notable spike in 2019 and a subsequent decline by 2023. This divergence highlights the distinct operational challenges and market dynamics each company faces. As AMETEK, Inc. continues its upward trend, Rentokil's fluctuating costs underscore the impact of external factors on service-based industries. These insights offer a window into strategic financial management in diverse sectors.

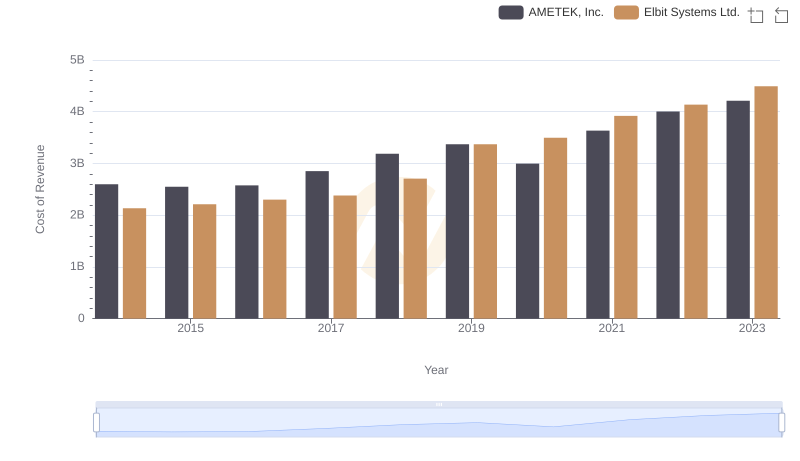

Cost of Revenue Comparison: AMETEK, Inc. vs Elbit Systems Ltd.

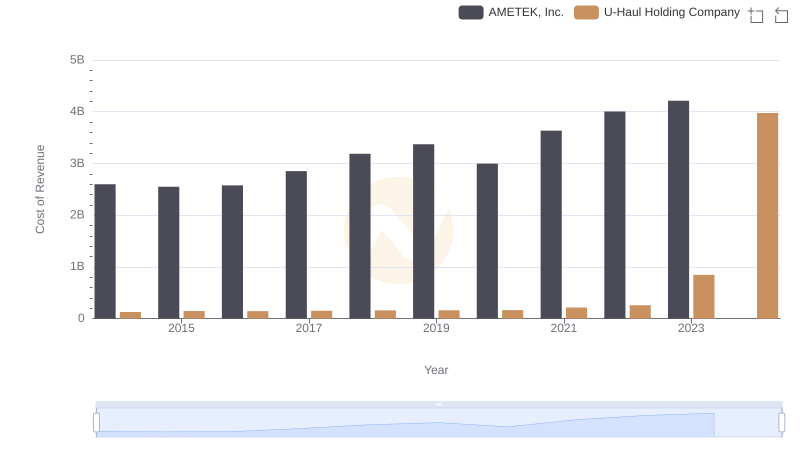

Comparing Cost of Revenue Efficiency: AMETEK, Inc. vs U-Haul Holding Company

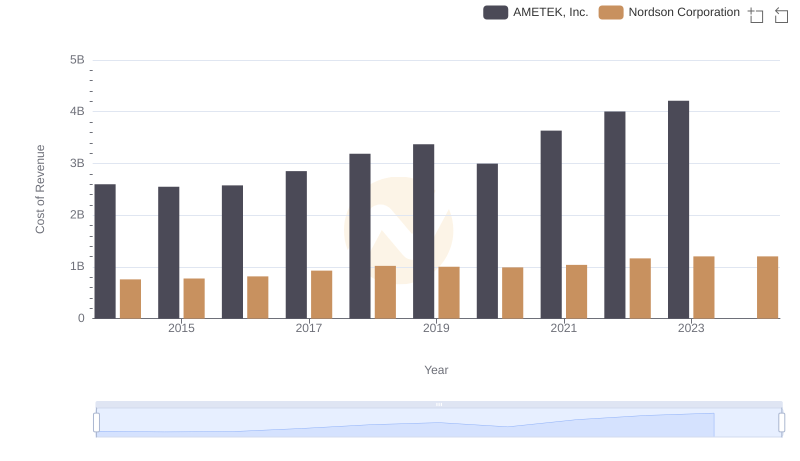

Analyzing Cost of Revenue: AMETEK, Inc. and Nordson Corporation

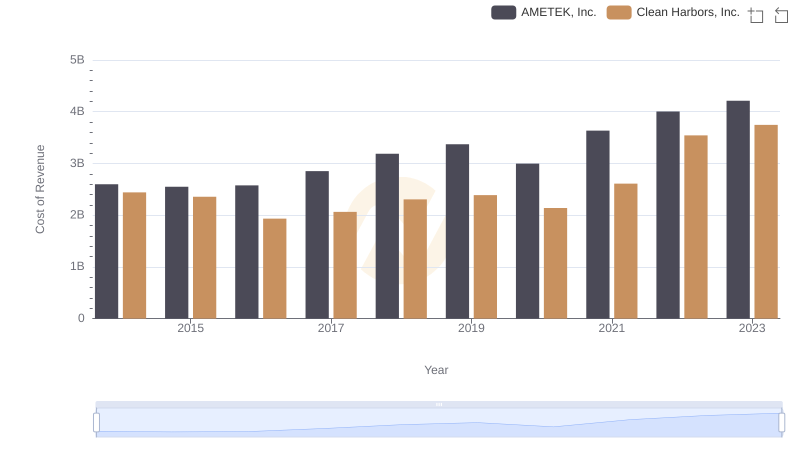

Analyzing Cost of Revenue: AMETEK, Inc. and Clean Harbors, Inc.

Cost of Revenue Trends: AMETEK, Inc. vs ITT Inc.

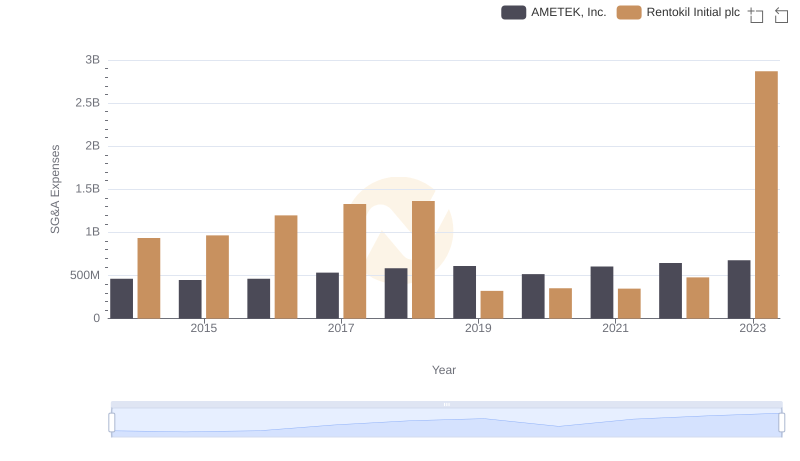

Selling, General, and Administrative Costs: AMETEK, Inc. vs Rentokil Initial plc

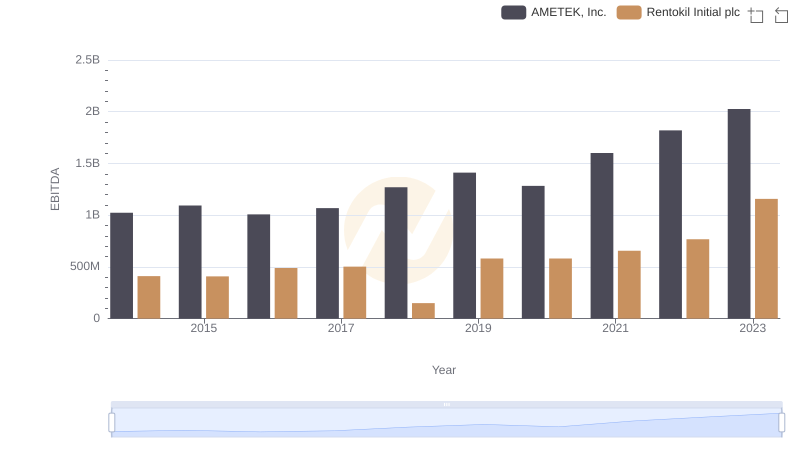

Comparative EBITDA Analysis: AMETEK, Inc. vs Rentokil Initial plc