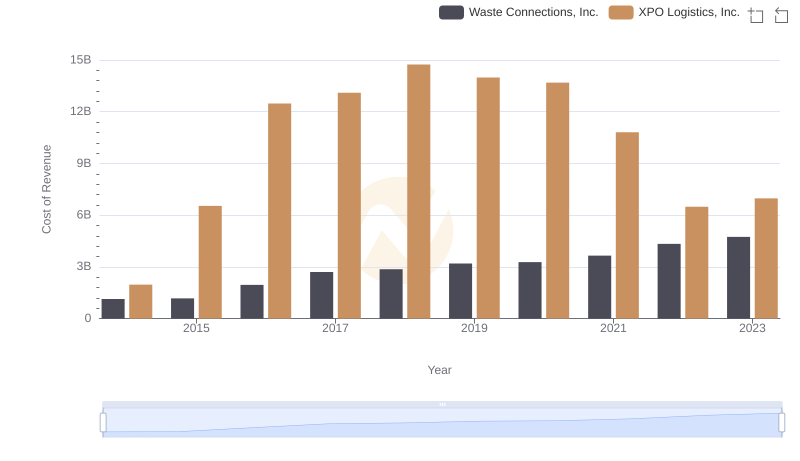

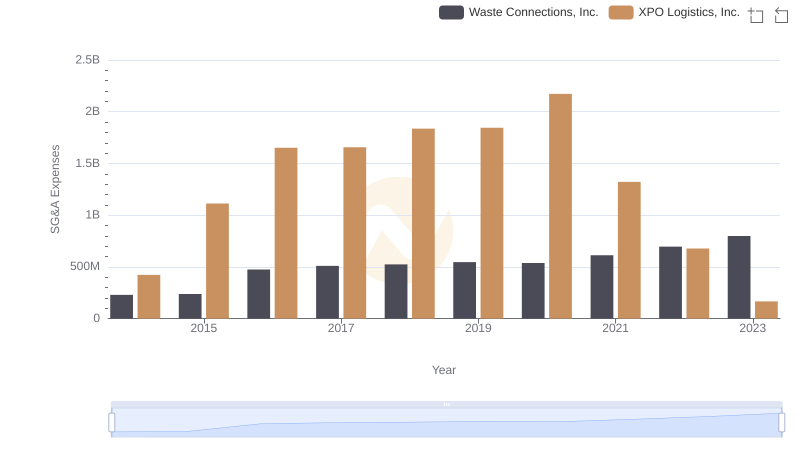

| __timestamp | Waste Connections, Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 717805000 | 56600000 |

| Thursday, January 1, 2015 | 191002871 | 298000000 |

| Friday, January 1, 2016 | 900371894 | 1108300000 |

| Sunday, January 1, 2017 | 1380632000 | 1196700000 |

| Monday, January 1, 2018 | 1442229014 | 1488000000 |

| Tuesday, January 1, 2019 | 1650754605 | 1594000000 |

| Wednesday, January 1, 2020 | 1597555000 | 727000000 |

| Friday, January 1, 2021 | 1891001000 | 741000000 |

| Saturday, January 1, 2022 | 2090554149 | 941000000 |

| Sunday, January 1, 2023 | 2261354000 | 860000000 |

| Monday, January 1, 2024 | 2389779000 | 1186000000 |

Unlocking the unknown

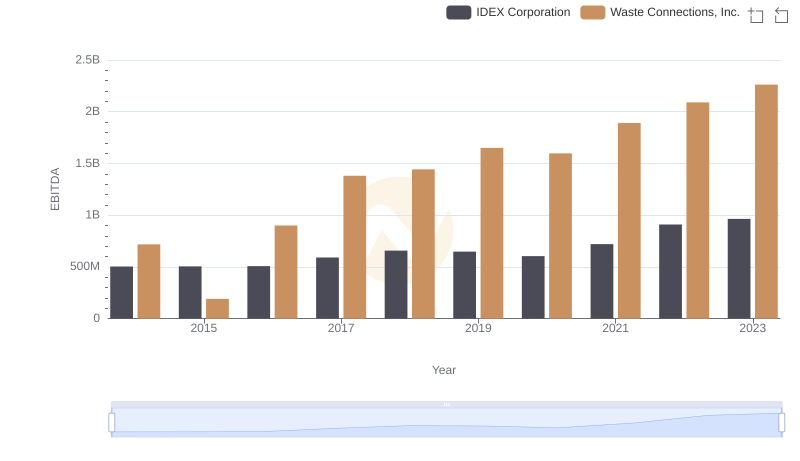

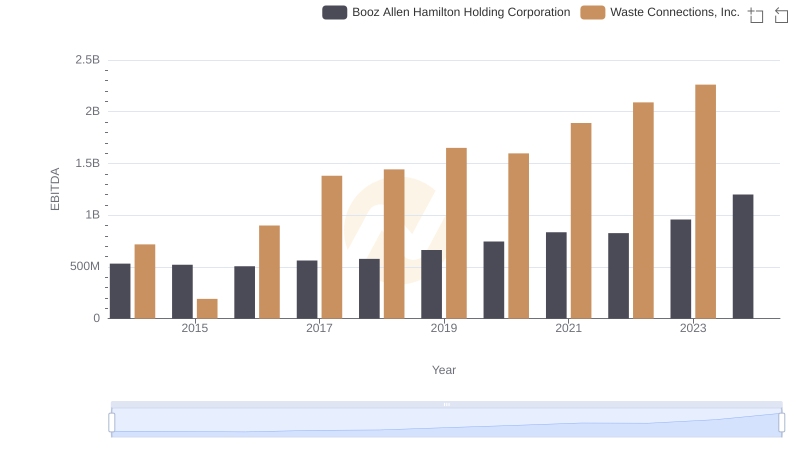

In the ever-evolving landscape of waste management and logistics, Waste Connections, Inc. and XPO Logistics, Inc. have emerged as industry leaders. Over the past decade, Waste Connections has consistently outperformed XPO Logistics in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Waste Connections' EBITDA surged by over 215%, peaking in 2023, while XPO Logistics experienced a more modest growth of approximately 142% during the same period.

This comparison highlights the strategic prowess of Waste Connections in capitalizing on market opportunities, setting a benchmark in the industry.

Comparing Cost of Revenue Efficiency: Waste Connections, Inc. vs XPO Logistics, Inc.

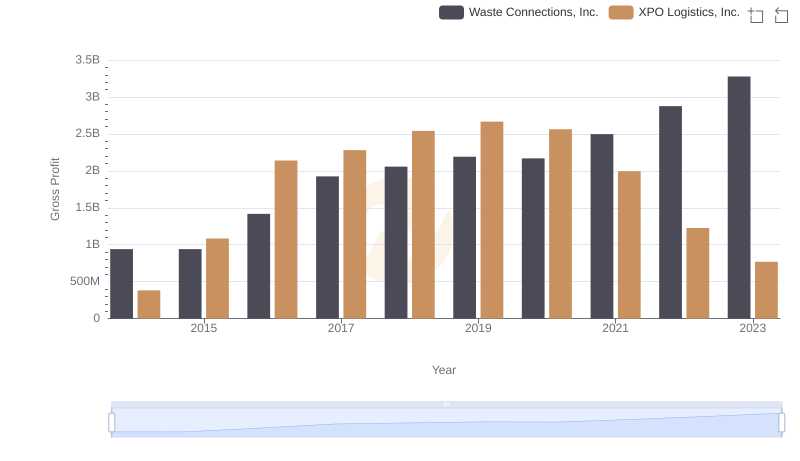

Who Generates Higher Gross Profit? Waste Connections, Inc. or XPO Logistics, Inc.

Waste Connections, Inc. vs IDEX Corporation: In-Depth EBITDA Performance Comparison

EBITDA Analysis: Evaluating Waste Connections, Inc. Against Booz Allen Hamilton Holding Corporation

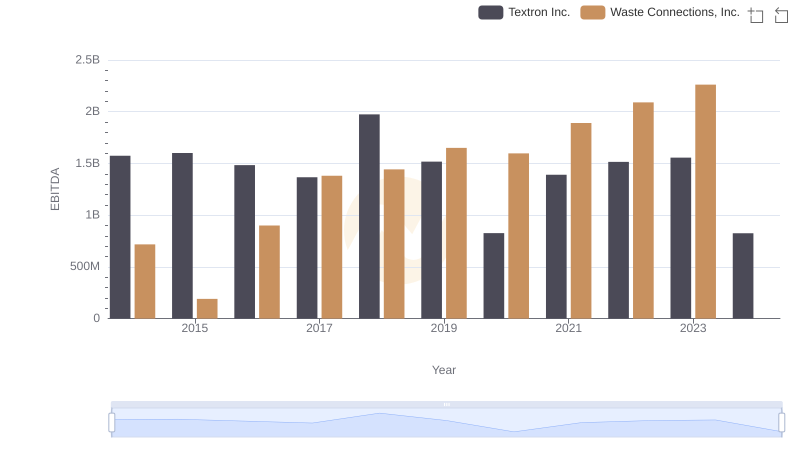

Waste Connections, Inc. and Textron Inc.: A Detailed Examination of EBITDA Performance

Breaking Down SG&A Expenses: Waste Connections, Inc. vs XPO Logistics, Inc.

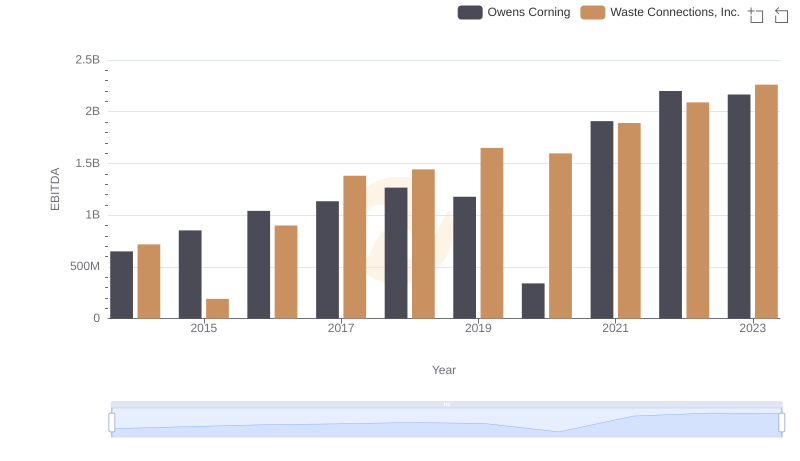

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Owens Corning

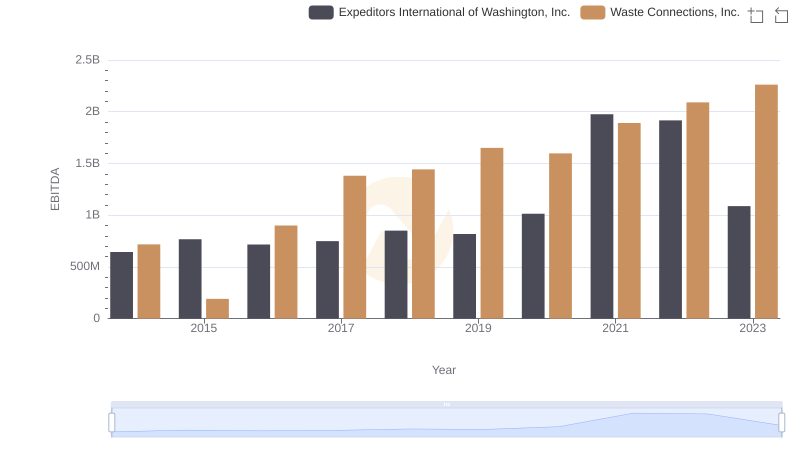

A Side-by-Side Analysis of EBITDA: Waste Connections, Inc. and Expeditors International of Washington, Inc.

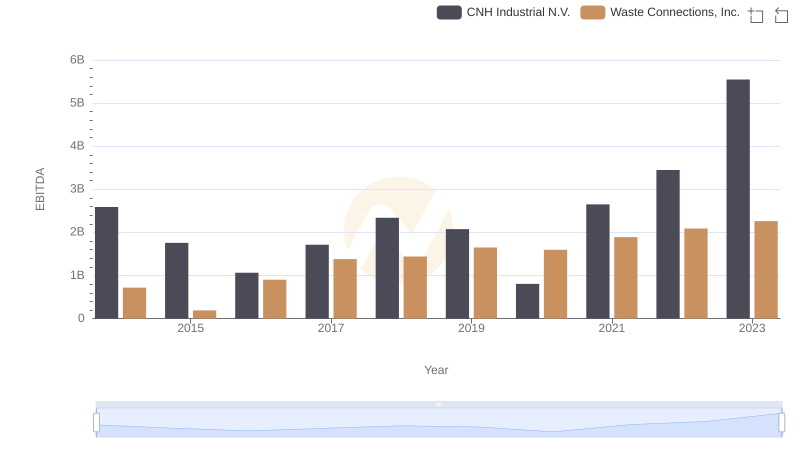

EBITDA Metrics Evaluated: Waste Connections, Inc. vs CNH Industrial N.V.