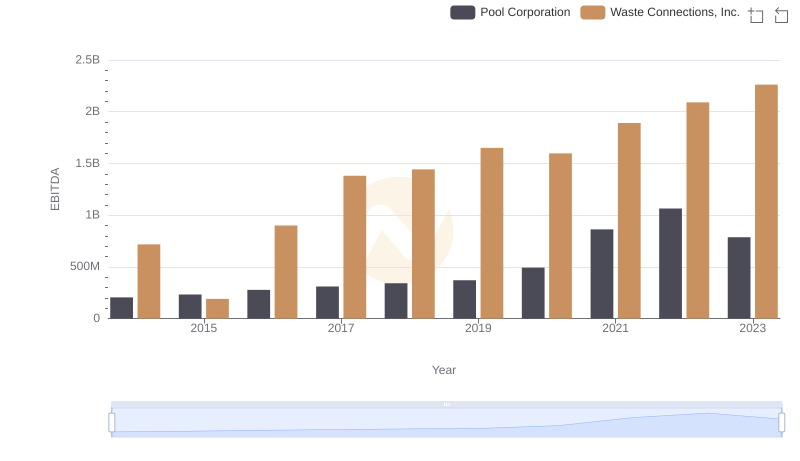

| __timestamp | Saia, Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144715000 | 717805000 |

| Thursday, January 1, 2015 | 154995000 | 191002871 |

| Friday, January 1, 2016 | 156092000 | 900371894 |

| Sunday, January 1, 2017 | 181629000 | 1380632000 |

| Monday, January 1, 2018 | 243709000 | 1442229014 |

| Tuesday, January 1, 2019 | 271318000 | 1650754605 |

| Wednesday, January 1, 2020 | 312448000 | 1597555000 |

| Friday, January 1, 2021 | 472947000 | 1891001000 |

| Saturday, January 1, 2022 | 627741000 | 2090554149 |

| Sunday, January 1, 2023 | 647607000 | 2261354000 |

| Monday, January 1, 2024 | 2389779000 |

Igniting the spark of knowledge

In the competitive landscape of the waste management and logistics sectors, Waste Connections, Inc. and Saia, Inc. have demonstrated remarkable EBITDA growth over the past decade. Since 2014, Waste Connections, Inc. has consistently outperformed Saia, Inc., with an average EBITDA nearly 4.4 times higher. By 2023, Waste Connections, Inc. achieved an EBITDA of approximately $2.26 billion, marking a 215% increase from 2014. Meanwhile, Saia, Inc. has shown impressive growth, with its EBITDA rising by 347% over the same period, reaching around $648 million in 2023. This growth trajectory highlights the robust operational efficiencies and strategic expansions undertaken by both companies. As the industry continues to evolve, these two giants remain at the forefront, setting benchmarks for financial performance and operational excellence.

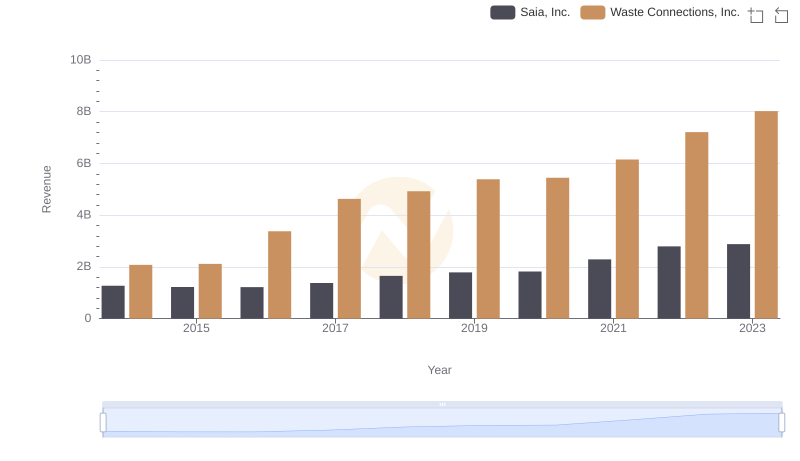

Comparing Revenue Performance: Waste Connections, Inc. or Saia, Inc.?

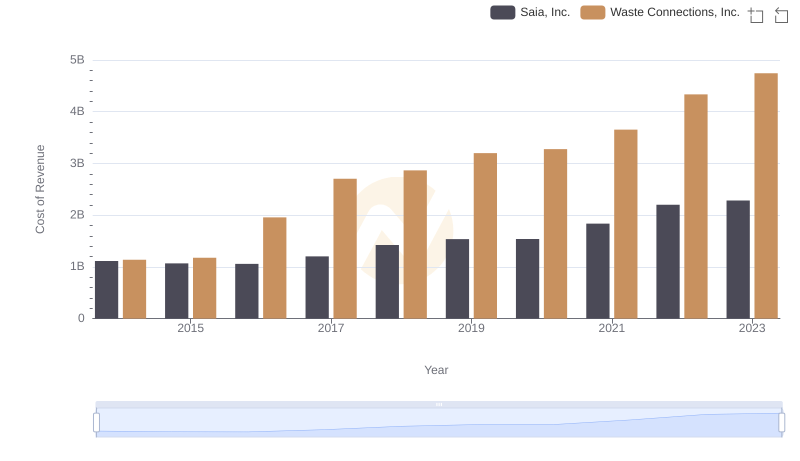

Cost Insights: Breaking Down Waste Connections, Inc. and Saia, Inc.'s Expenses

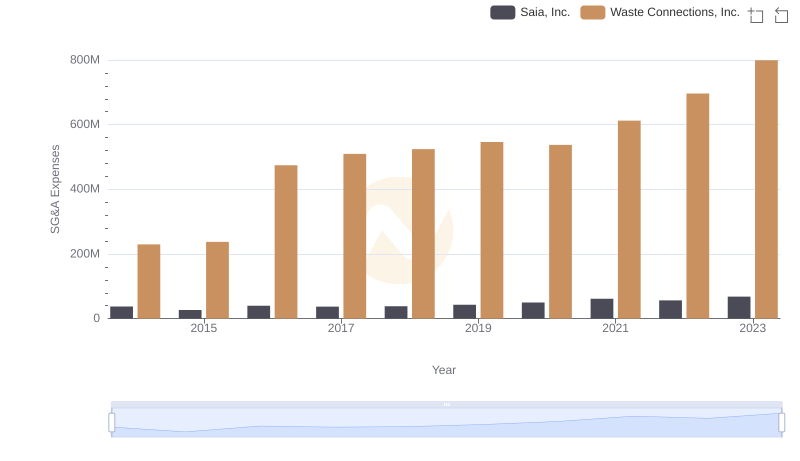

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Saia, Inc.

A Professional Review of EBITDA: Waste Connections, Inc. Compared to Pool Corporation

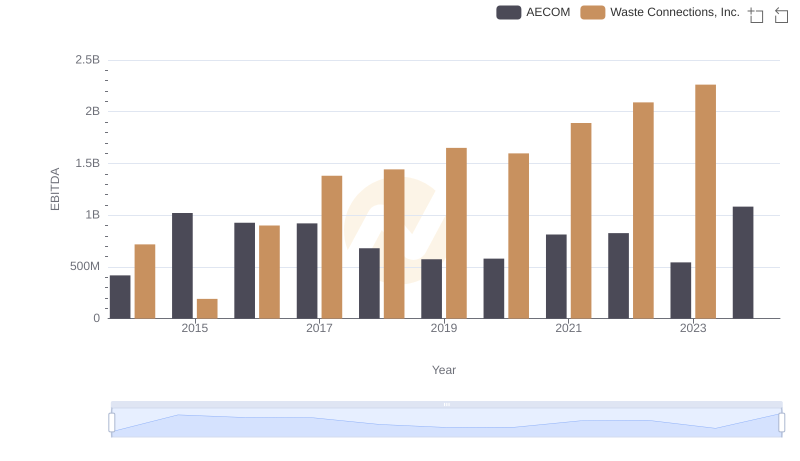

Professional EBITDA Benchmarking: Waste Connections, Inc. vs AECOM

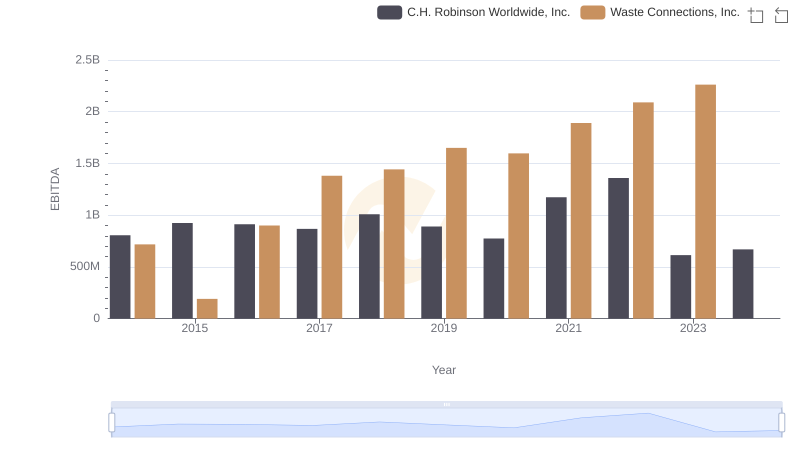

A Professional Review of EBITDA: Waste Connections, Inc. Compared to C.H. Robinson Worldwide, Inc.

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs Nordson Corporation