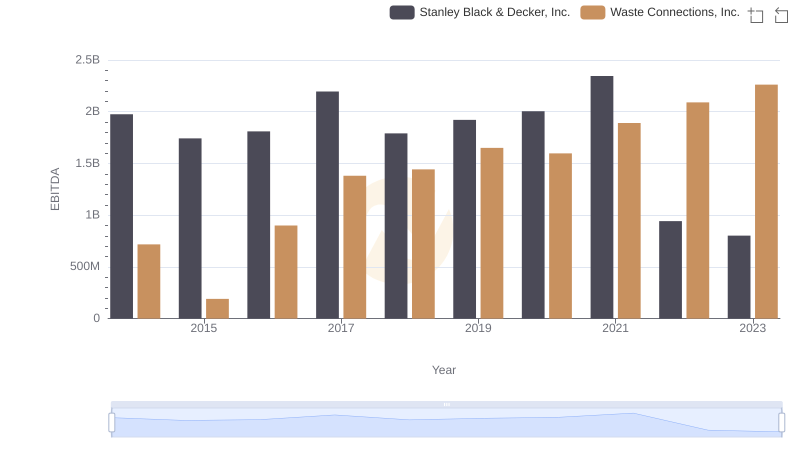

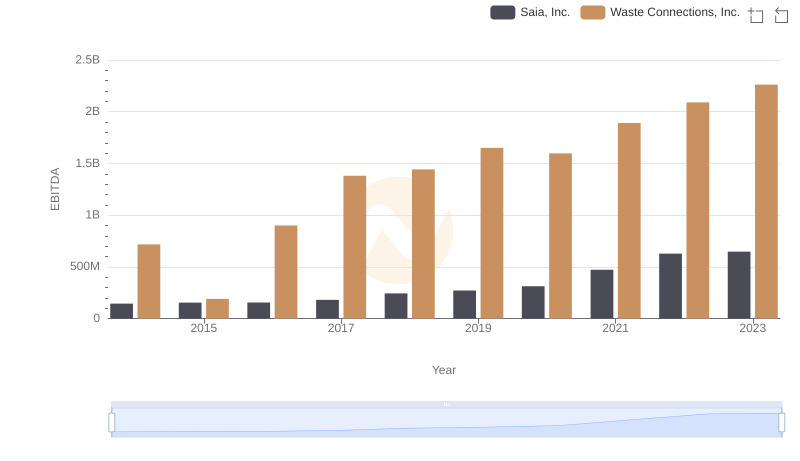

| __timestamp | Elbit Systems Ltd. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 358274000 | 717805000 |

| Thursday, January 1, 2015 | 390932000 | 191002871 |

| Friday, January 1, 2016 | 424003291 | 900371894 |

| Sunday, January 1, 2017 | 438616108 | 1380632000 |

| Monday, January 1, 2018 | 374866620 | 1442229014 |

| Tuesday, January 1, 2019 | 502866000 | 1650754605 |

| Wednesday, January 1, 2020 | 484464000 | 1597555000 |

| Friday, January 1, 2021 | 576645646 | 1891001000 |

| Saturday, January 1, 2022 | 505269000 | 2090554149 |

| Sunday, January 1, 2023 | 544811000 | 2261354000 |

| Monday, January 1, 2024 | 2389779000 |

Unleashing the power of data

In the ever-evolving landscape of global industries, Waste Connections, Inc. and Elbit Systems Ltd. have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Waste Connections, Inc. has consistently outperformed Elbit Systems Ltd. in terms of EBITDA, reflecting a robust growth strategy in the waste management sector. Notably, Waste Connections, Inc. saw its EBITDA surge by approximately 215% from 2014 to 2023, reaching a peak in 2023. In contrast, Elbit Systems Ltd., a key player in the defense industry, experienced a more modest growth of around 52% over the same period. This comparison highlights the dynamic nature of these industries, with Waste Connections, Inc. capitalizing on increasing environmental regulations and urbanization, while Elbit Systems Ltd. navigates the complexities of global defense demands. As we look to the future, these trends offer valuable insights into the strategic directions of these industry leaders.

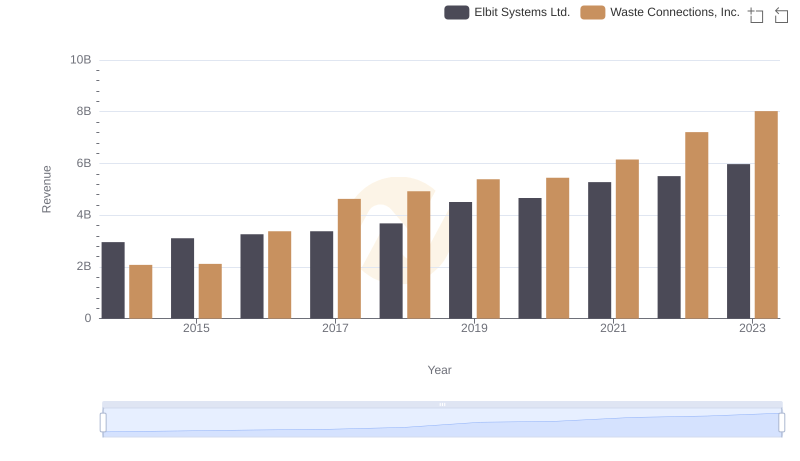

Revenue Showdown: Waste Connections, Inc. vs Elbit Systems Ltd.

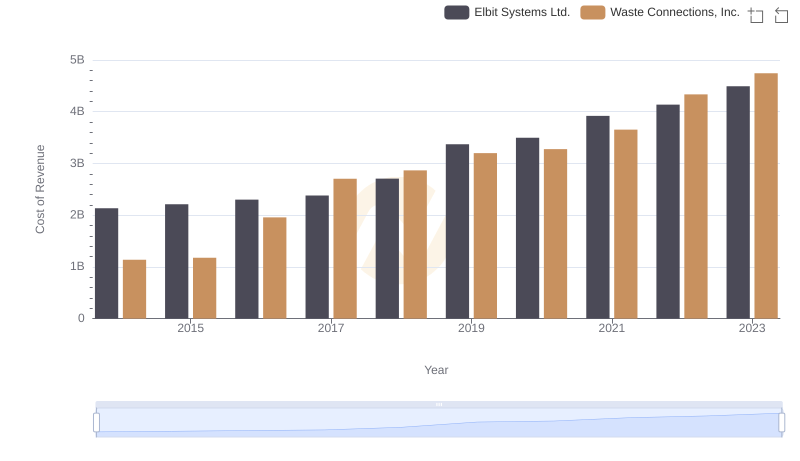

Cost of Revenue Trends: Waste Connections, Inc. vs Elbit Systems Ltd.

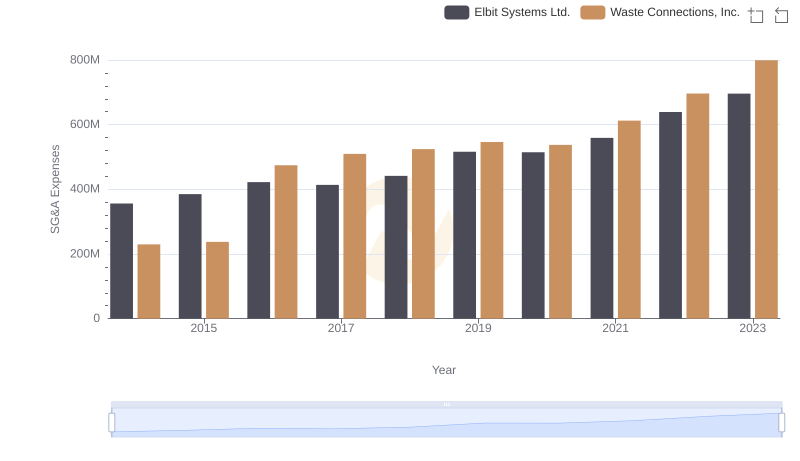

Waste Connections, Inc. and Elbit Systems Ltd.: SG&A Spending Patterns Compared

Professional EBITDA Benchmarking: Waste Connections, Inc. vs Stanley Black & Decker, Inc.

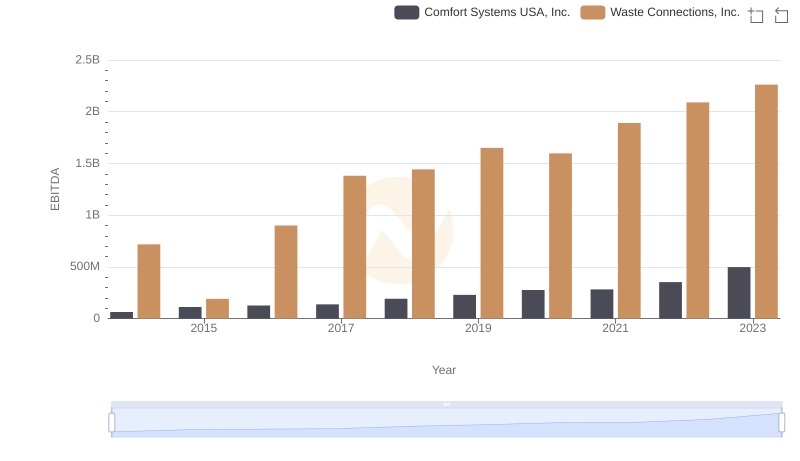

Waste Connections, Inc. vs Comfort Systems USA, Inc.: In-Depth EBITDA Performance Comparison

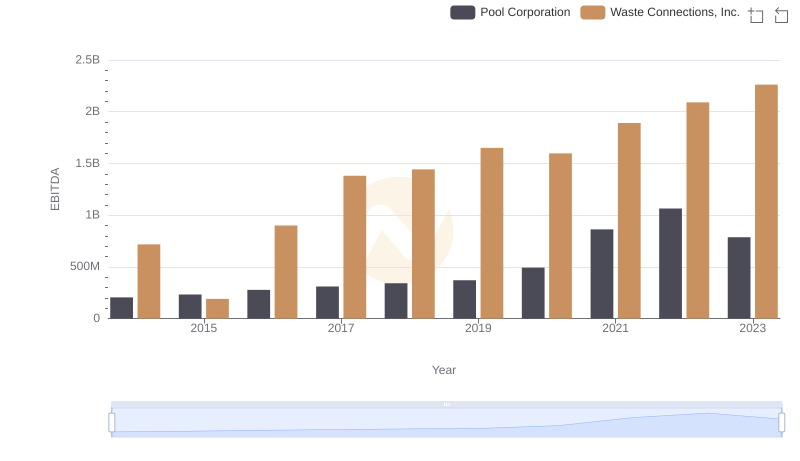

A Professional Review of EBITDA: Waste Connections, Inc. Compared to Pool Corporation

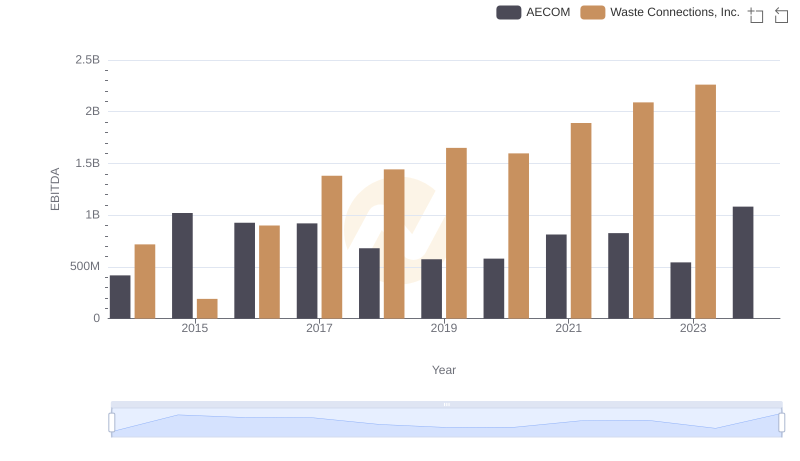

Professional EBITDA Benchmarking: Waste Connections, Inc. vs AECOM

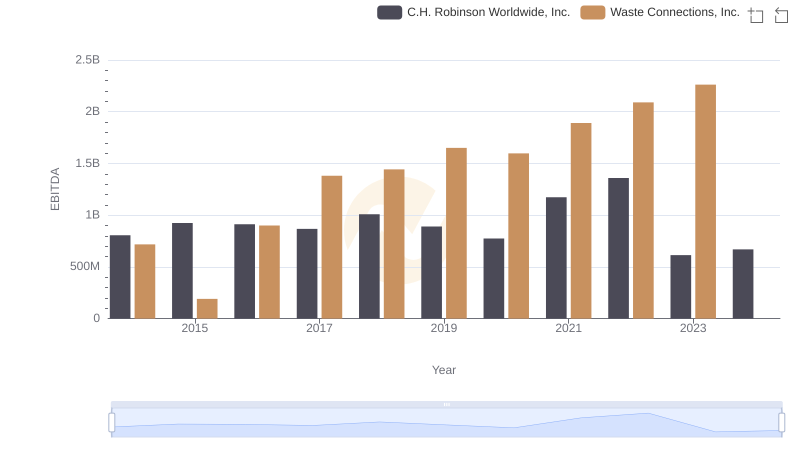

A Professional Review of EBITDA: Waste Connections, Inc. Compared to C.H. Robinson Worldwide, Inc.

EBITDA Performance Review: Waste Connections, Inc. vs Saia, Inc.