| __timestamp | Automatic Data Processing, Inc. | Johnson Controls International plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 3125000000 |

| Thursday, January 1, 2015 | 2355100000 | 2209000000 |

| Friday, January 1, 2016 | 2579500000 | 2338000000 |

| Sunday, January 1, 2017 | 2927200000 | 4280000000 |

| Monday, January 1, 2018 | 2762900000 | 2741000000 |

| Tuesday, January 1, 2019 | 3544500000 | 2466000000 |

| Wednesday, January 1, 2020 | 3769700000 | 2572000000 |

| Friday, January 1, 2021 | 3931600000 | 3907000000 |

| Saturday, January 1, 2022 | 4405500000 | 3474000000 |

| Sunday, January 1, 2023 | 5244600000 | 3678000000 |

| Monday, January 1, 2024 | 5800000000 | 2800000000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) and Johnson Controls International plc have showcased intriguing trends in their EBITDA performance.

From 2014 to 2024, ADP's EBITDA has surged by approximately 122%, reflecting a robust growth trajectory. Notably, ADP's EBITDA peaked in 2024, marking a significant milestone in its financial journey. In contrast, Johnson Controls experienced a more volatile path, with a notable peak in 2017, followed by fluctuations that saw a decline of around 14% by 2024.

This comparison highlights ADP's consistent upward momentum, while Johnson Controls navigates a more turbulent financial landscape. Such insights are invaluable for investors and analysts seeking to understand the financial health and strategic direction of these industry giants.

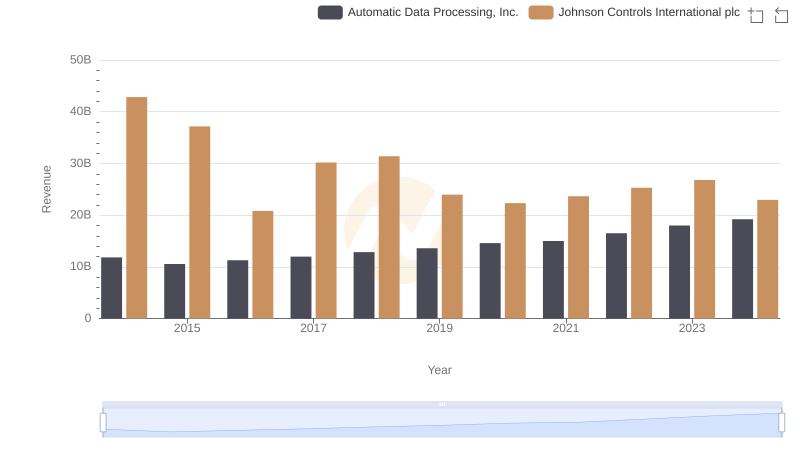

Automatic Data Processing, Inc. and Johnson Controls International plc: A Comprehensive Revenue Analysis

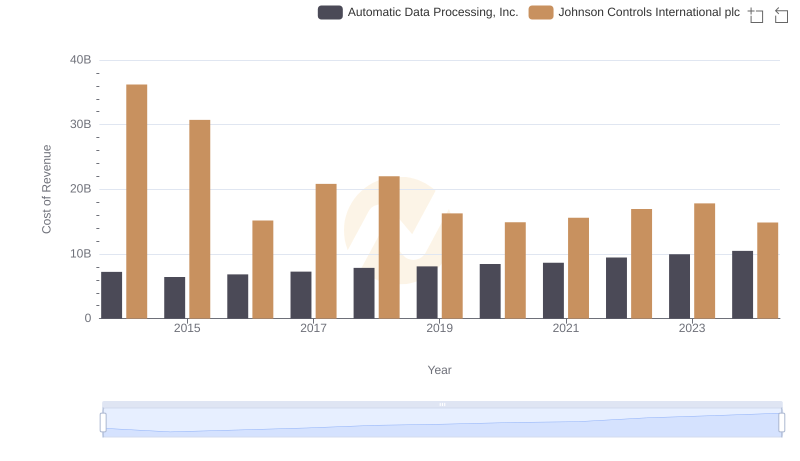

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Johnson Controls International plc's Expenses

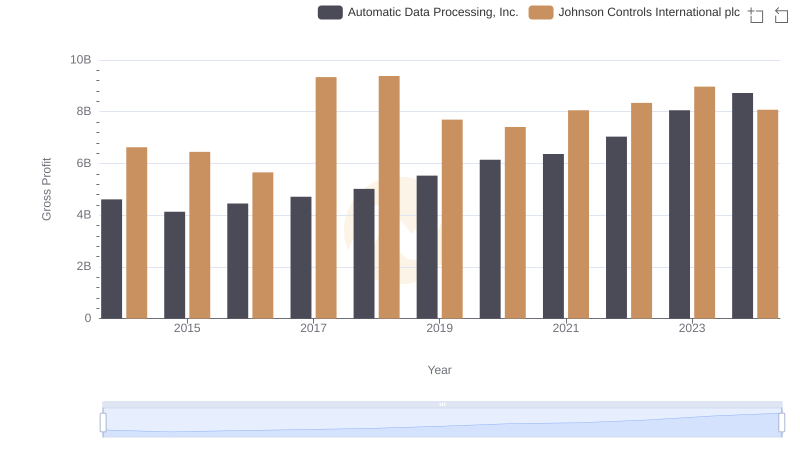

Automatic Data Processing, Inc. vs Johnson Controls International plc: A Gross Profit Performance Breakdown

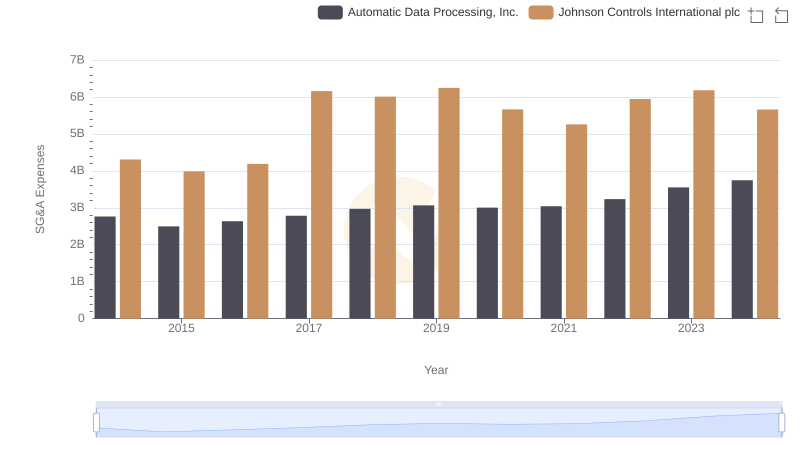

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?

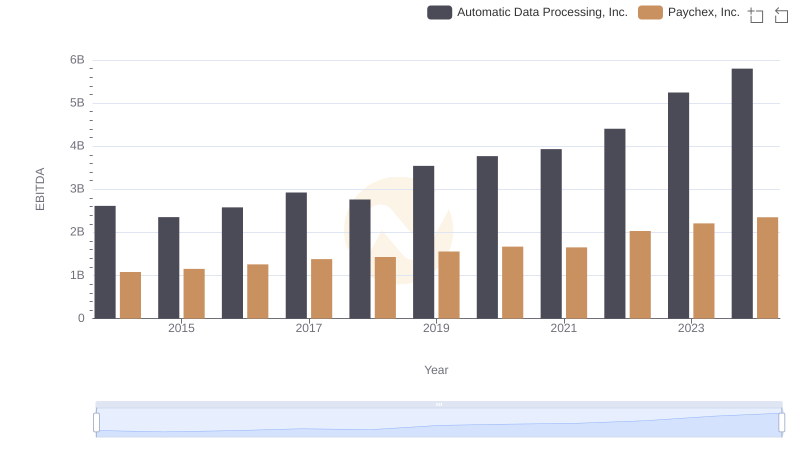

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Paychex, Inc.

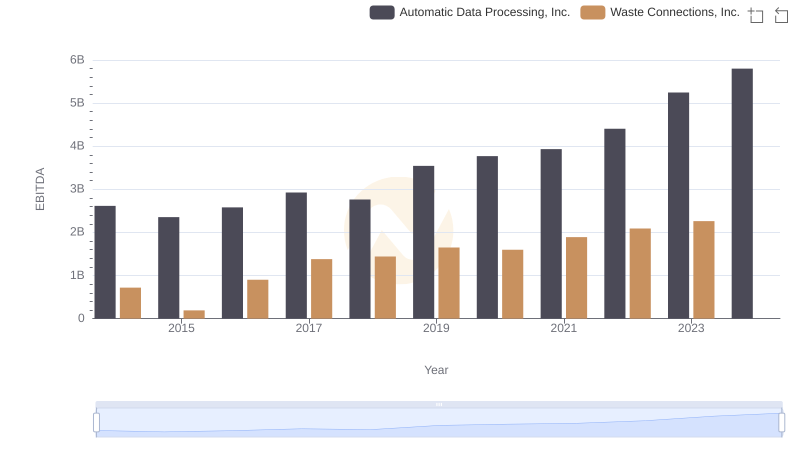

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Waste Connections, Inc.

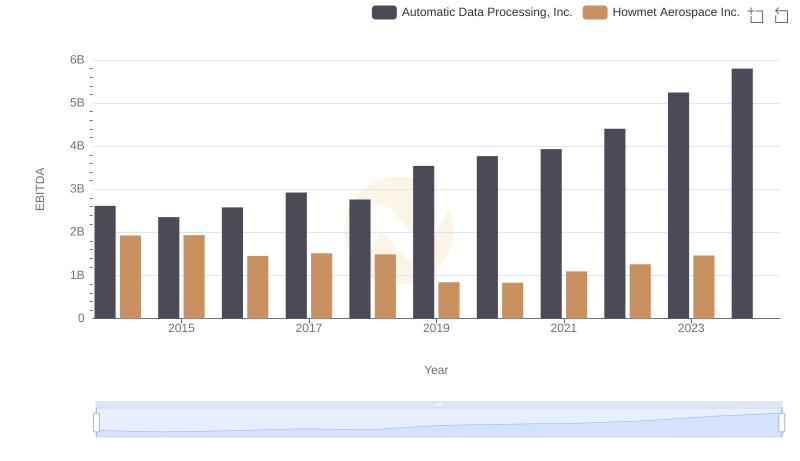

Comparative EBITDA Analysis: Automatic Data Processing, Inc. vs Howmet Aerospace Inc.

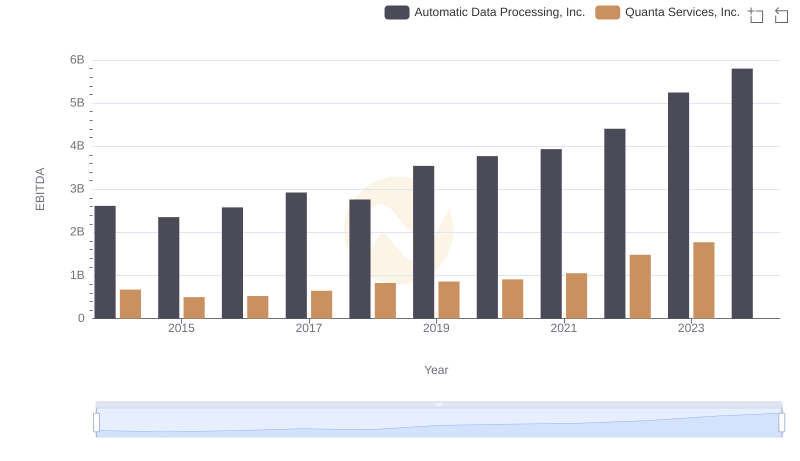

Automatic Data Processing, Inc. vs Quanta Services, Inc.: In-Depth EBITDA Performance Comparison