| __timestamp | Automatic Data Processing, Inc. | Johnson Controls International plc |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 36201000000 |

| Thursday, January 1, 2015 | 6427600000 | 30732000000 |

| Friday, January 1, 2016 | 6840300000 | 15183000000 |

| Sunday, January 1, 2017 | 7269800000 | 20833000000 |

| Monday, January 1, 2018 | 7842600000 | 22020000000 |

| Tuesday, January 1, 2019 | 8086600000 | 16275000000 |

| Wednesday, January 1, 2020 | 8445100000 | 14906000000 |

| Friday, January 1, 2021 | 8640300000 | 15609000000 |

| Saturday, January 1, 2022 | 9461900000 | 16956000000 |

| Sunday, January 1, 2023 | 9953400000 | 17822000000 |

| Monday, January 1, 2024 | 10476700000 | 14875000000 |

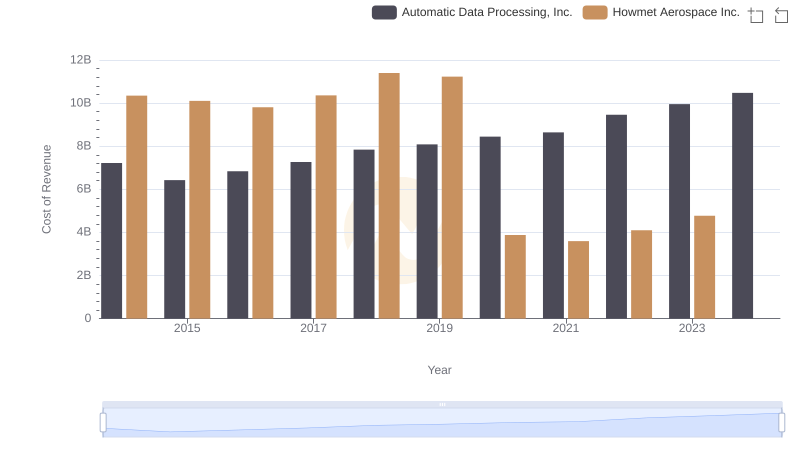

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. This analysis delves into the cost of revenue trends for Automatic Data Processing, Inc. (ADP) and Johnson Controls International plc (JCI) from 2014 to 2024. Over this decade, ADP's cost of revenue has shown a steady increase, rising approximately 45% from 2014 to 2024. In contrast, JCI experienced a more volatile trajectory, with a notable peak in 2014 and a subsequent decline of about 59% by 2024.

These insights provide a window into the financial strategies and market dynamics influencing these industry giants.

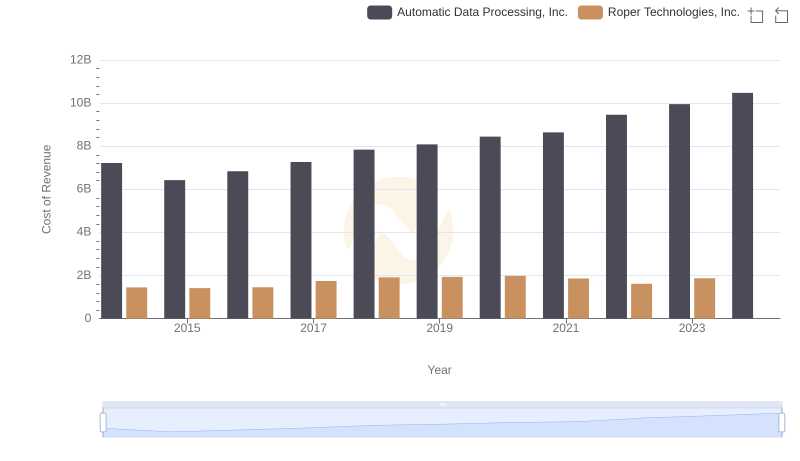

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Roper Technologies, Inc.'s Expenses

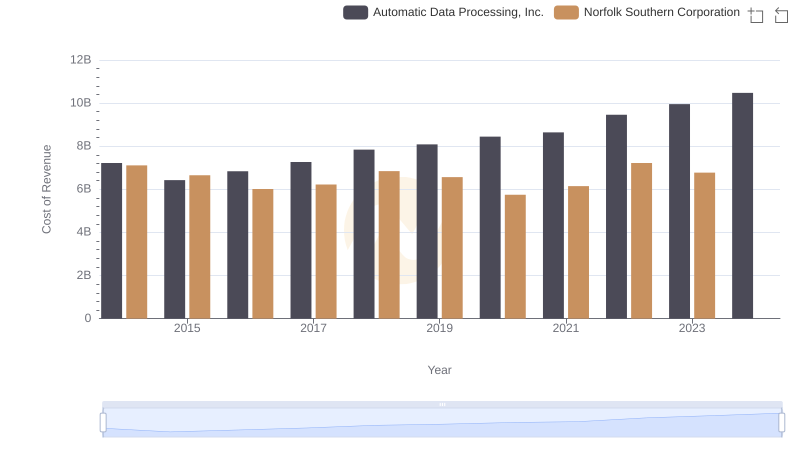

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Norfolk Southern Corporation

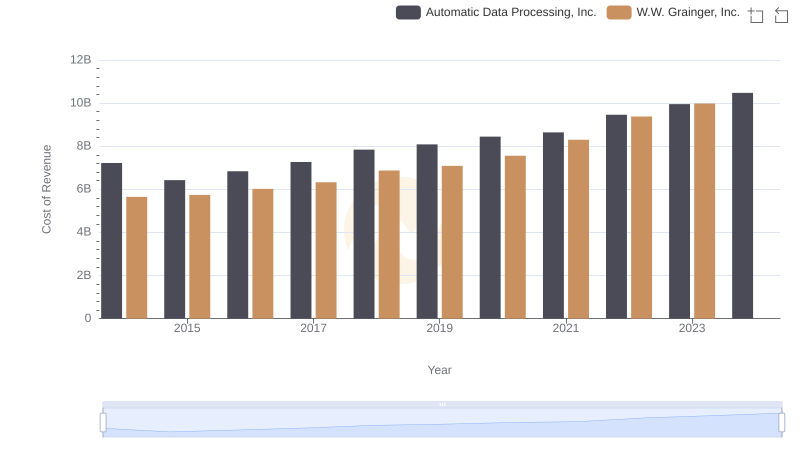

Automatic Data Processing, Inc. vs W.W. Grainger, Inc.: Efficiency in Cost of Revenue Explored

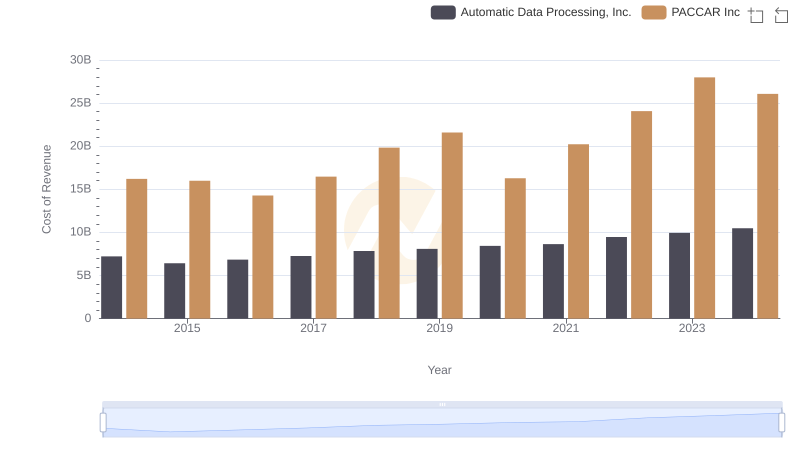

Automatic Data Processing, Inc. vs PACCAR Inc: Efficiency in Cost of Revenue Explored

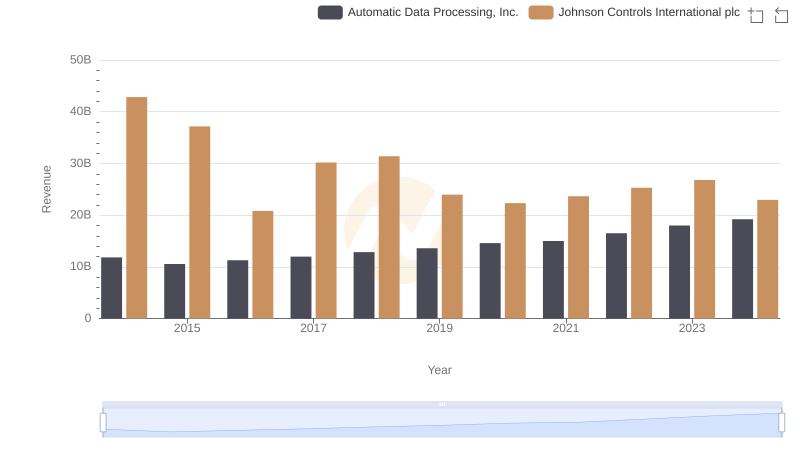

Automatic Data Processing, Inc. and Johnson Controls International plc: A Comprehensive Revenue Analysis

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Howmet Aerospace Inc.

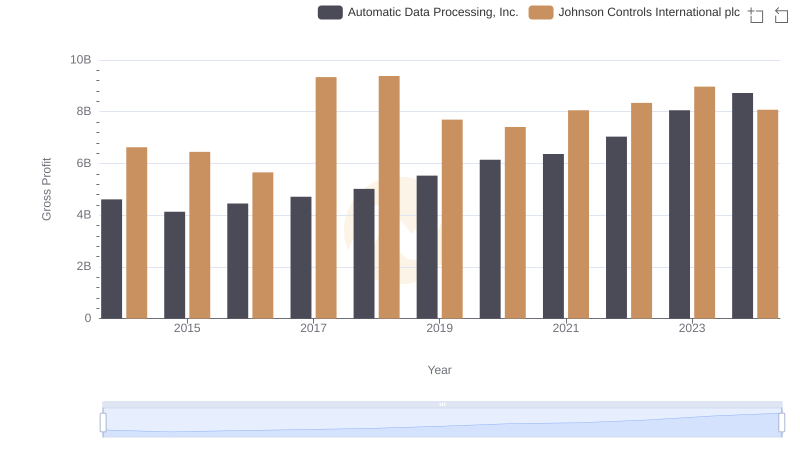

Automatic Data Processing, Inc. vs Johnson Controls International plc: A Gross Profit Performance Breakdown

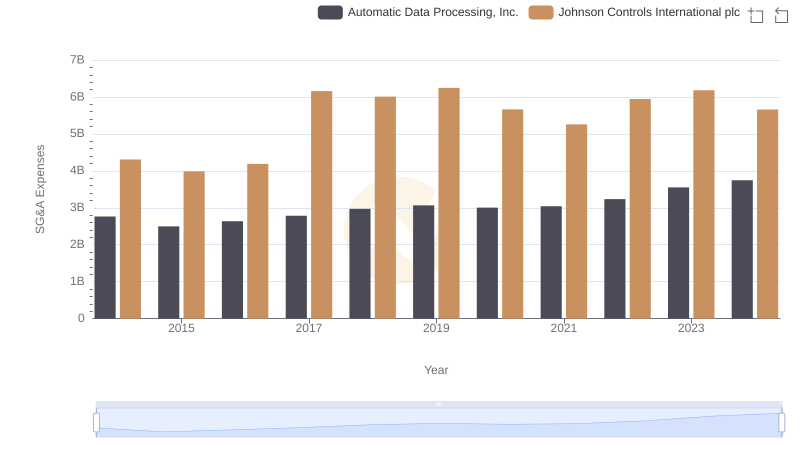

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?

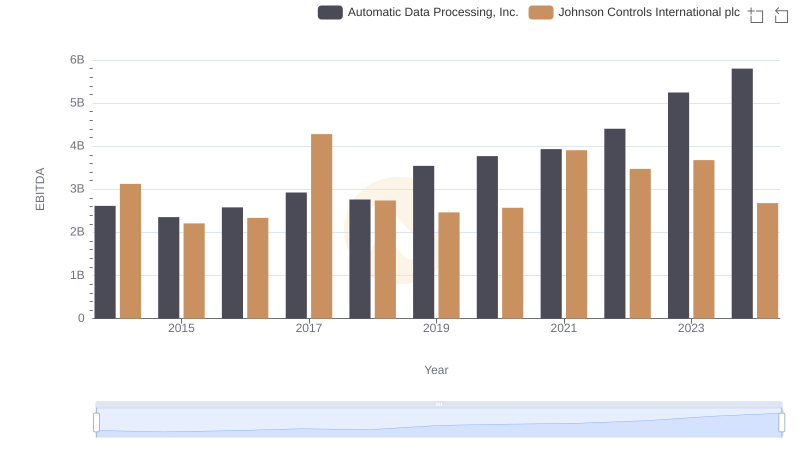

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Johnson Controls International plc