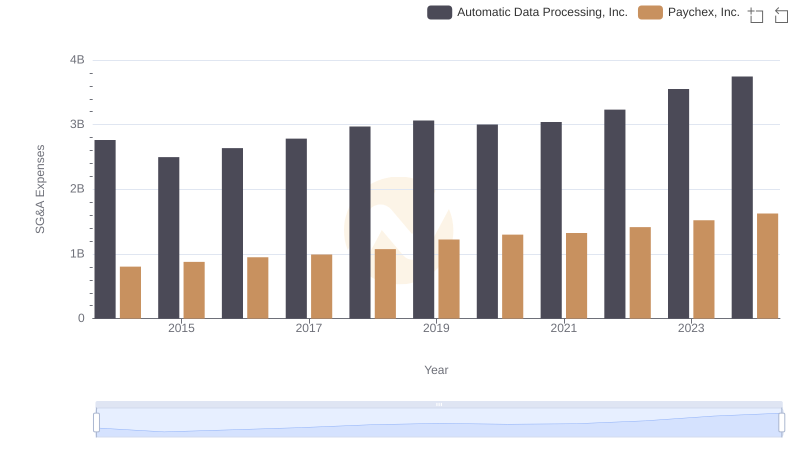

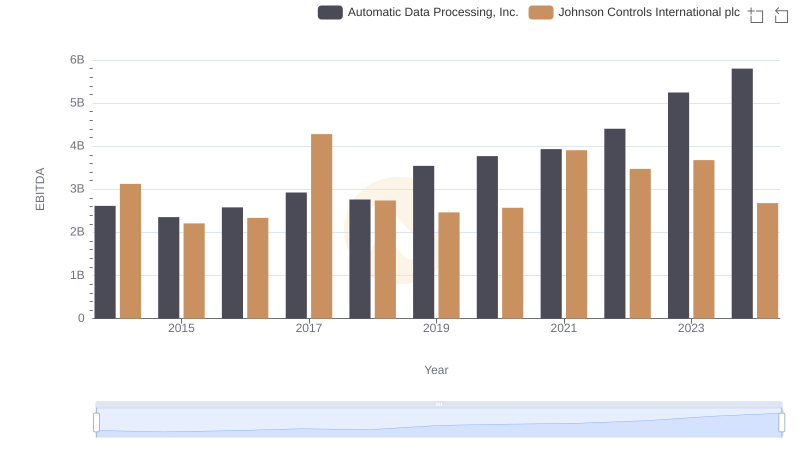

| __timestamp | Automatic Data Processing, Inc. | Johnson Controls International plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 4308000000 |

| Thursday, January 1, 2015 | 2496900000 | 3986000000 |

| Friday, January 1, 2016 | 2637000000 | 4190000000 |

| Sunday, January 1, 2017 | 2783200000 | 6158000000 |

| Monday, January 1, 2018 | 2971500000 | 6010000000 |

| Tuesday, January 1, 2019 | 3064200000 | 6244000000 |

| Wednesday, January 1, 2020 | 3003000000 | 5665000000 |

| Friday, January 1, 2021 | 3040500000 | 5258000000 |

| Saturday, January 1, 2022 | 3233200000 | 5945000000 |

| Sunday, January 1, 2023 | 3551400000 | 6181000000 |

| Monday, January 1, 2024 | 3778900000 | 5661000000 |

Unleashing insights

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Automatic Data Processing, Inc. (ADP) and Johnson Controls International plc (JCI) have been at the forefront of this challenge since 2014. Over the past decade, ADP has demonstrated a steady increase in SG&A expenses, growing by approximately 36% from 2014 to 2024. In contrast, JCI's SG&A costs have fluctuated, peaking in 2019 and showing a slight decline by 2024.

ADP's consistent growth in SG&A expenses, with a notable 10% increase from 2023 to 2024, reflects its strategic investments in operational efficiency. Meanwhile, JCI's 9% reduction in SG&A costs from its 2019 peak suggests a focus on cost optimization. This analysis highlights the different strategies these companies employ to manage their operational expenses, offering valuable insights for investors and industry analysts.

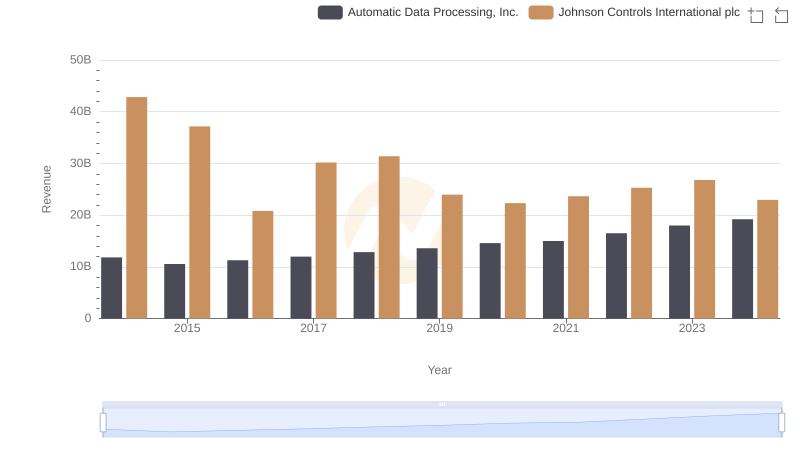

Automatic Data Processing, Inc. and Johnson Controls International plc: A Comprehensive Revenue Analysis

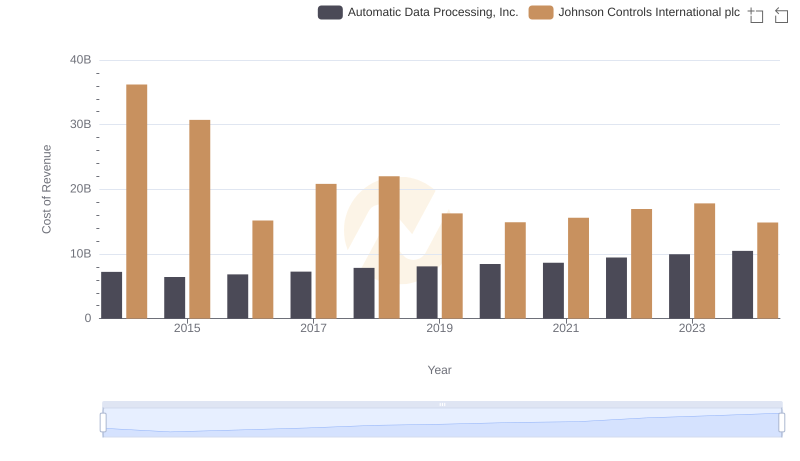

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Johnson Controls International plc's Expenses

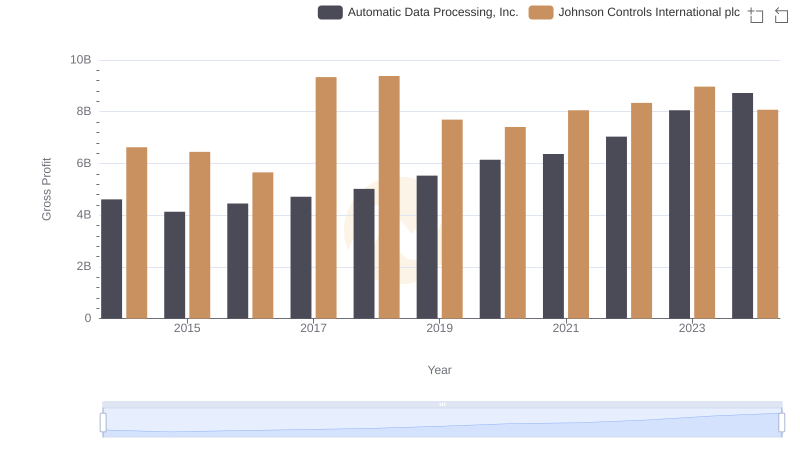

Automatic Data Processing, Inc. vs Johnson Controls International plc: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Paychex, Inc.

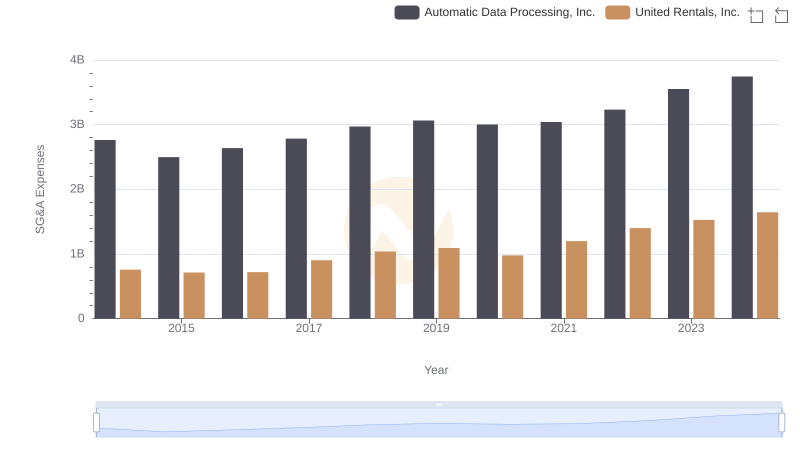

Automatic Data Processing, Inc. or United Rentals, Inc.: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Johnson Controls International plc