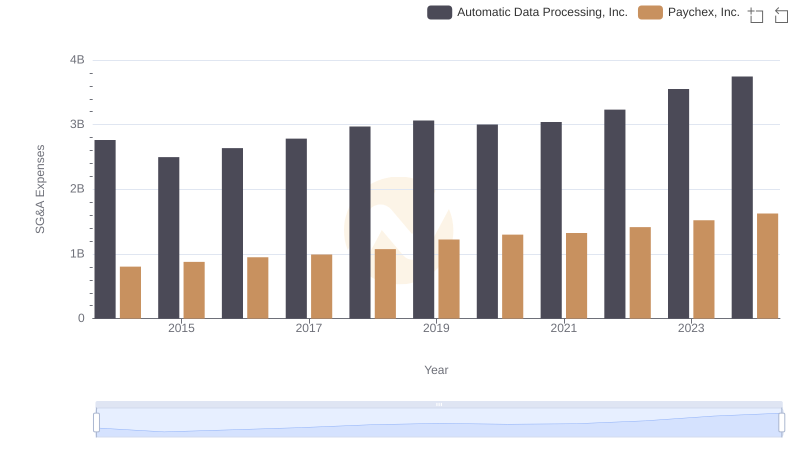

| __timestamp | Automatic Data Processing, Inc. | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 1082300000 |

| Thursday, January 1, 2015 | 2355100000 | 1153800000 |

| Friday, January 1, 2016 | 2579500000 | 1257200000 |

| Sunday, January 1, 2017 | 2927200000 | 1380800000 |

| Monday, January 1, 2018 | 2762900000 | 1429500000 |

| Tuesday, January 1, 2019 | 3544500000 | 1558100000 |

| Wednesday, January 1, 2020 | 3769700000 | 1670200000 |

| Friday, January 1, 2021 | 3931600000 | 1652700000 |

| Saturday, January 1, 2022 | 4405500000 | 2031800000 |

| Sunday, January 1, 2023 | 5244600000 | 2209700000 |

| Monday, January 1, 2024 | 5800000000 | 2350600000 |

In pursuit of knowledge

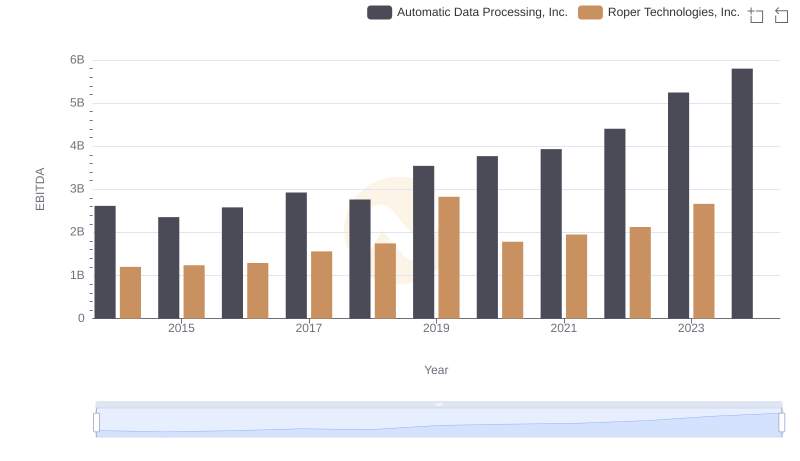

In the competitive landscape of payroll and human resources services, Automatic Data Processing, Inc. (ADP) and Paychex, Inc. have been industry stalwarts. Over the past decade, from 2014 to 2024, both companies have demonstrated significant growth in their Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), a key indicator of financial performance.

ADP has shown a remarkable upward trajectory, with its EBITDA increasing by approximately 122% over this period. Starting at around $2.6 billion in 2014, it reached an impressive $5.8 billion by 2024. In contrast, Paychex, while smaller in scale, has also experienced robust growth, with its EBITDA rising by about 117%, from $1.1 billion to $2.4 billion.

This consistent growth underscores the resilience and strategic prowess of both companies in navigating economic challenges and capitalizing on market opportunities.

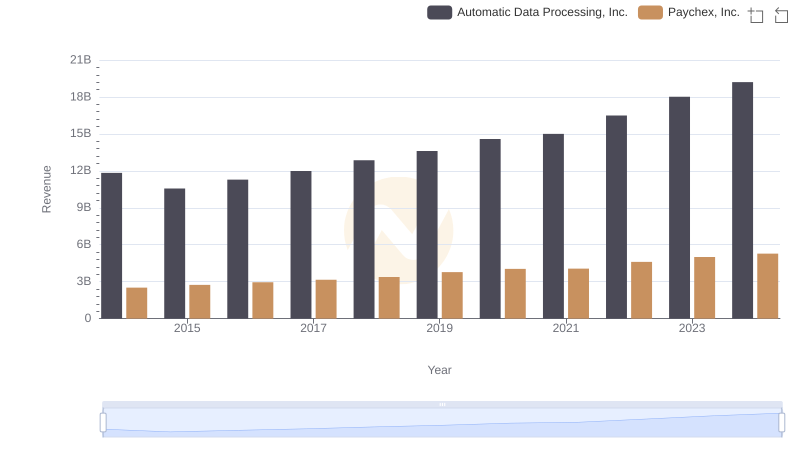

Automatic Data Processing, Inc. or Paychex, Inc.: Who Leads in Yearly Revenue?

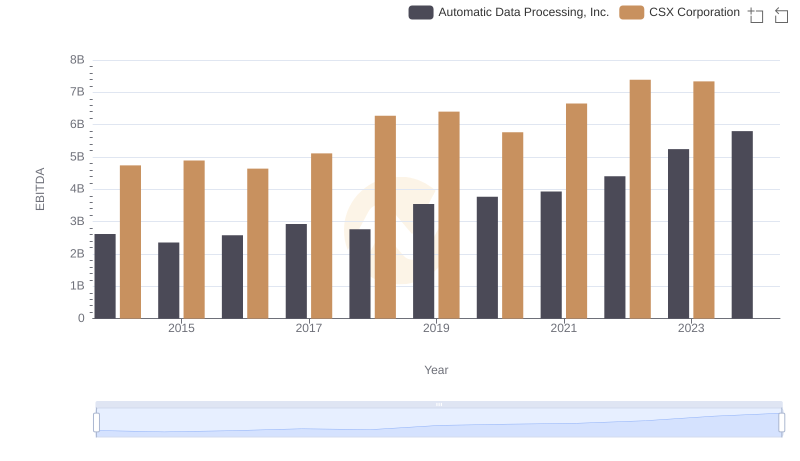

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and CSX Corporation

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Paychex, Inc.

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Roper Technologies, Inc.

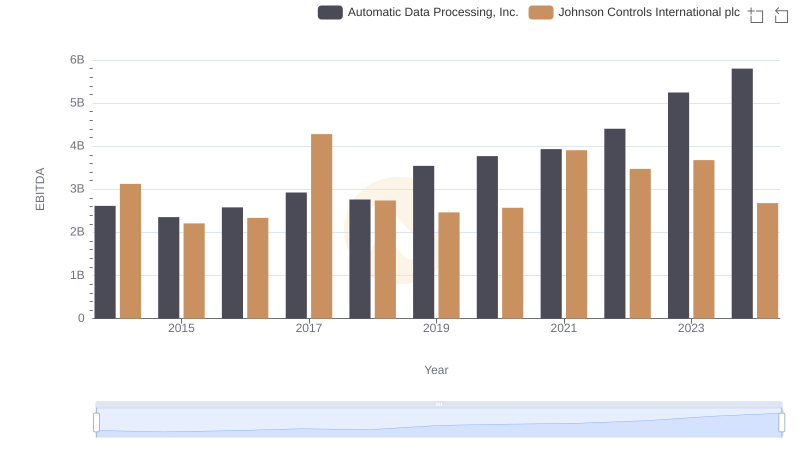

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Johnson Controls International plc

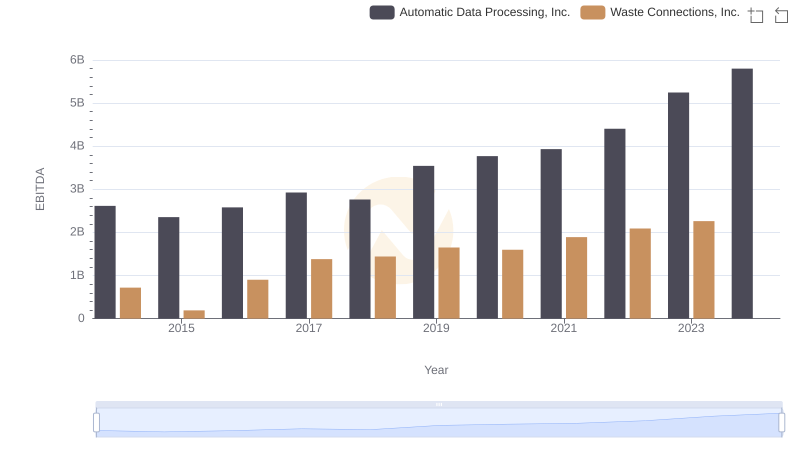

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Waste Connections, Inc.