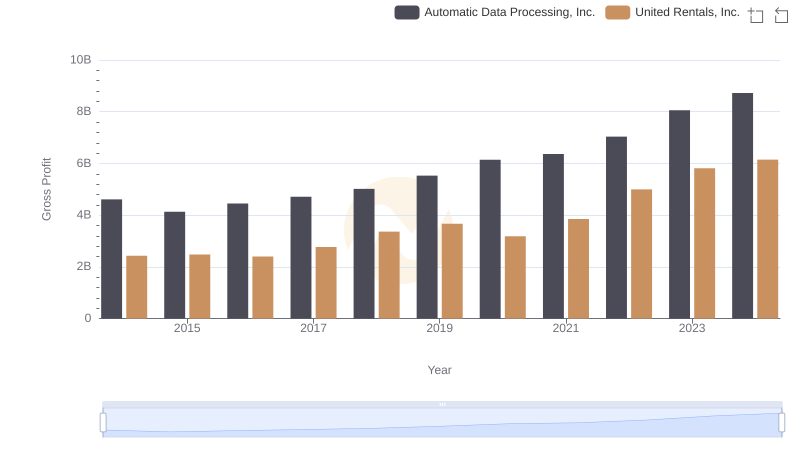

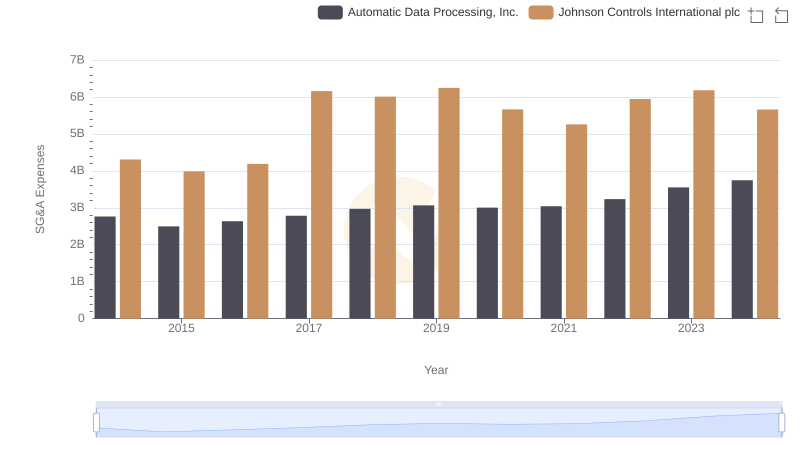

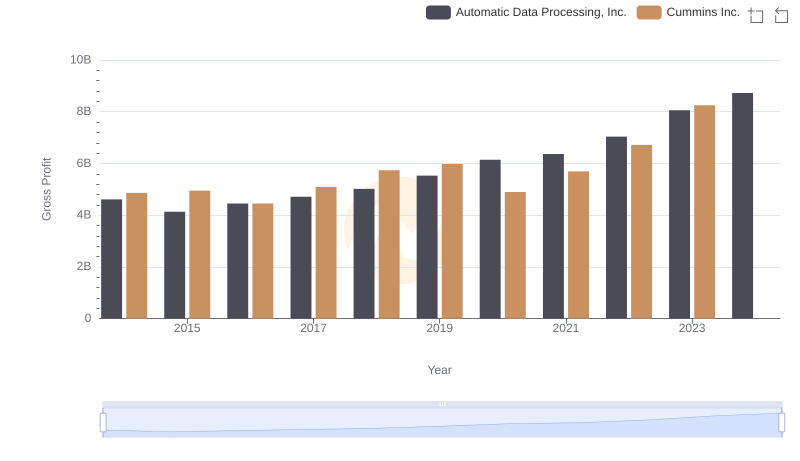

| __timestamp | Automatic Data Processing, Inc. | Johnson Controls International plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 6627000000 |

| Thursday, January 1, 2015 | 4133200000 | 6447000000 |

| Friday, January 1, 2016 | 4450200000 | 5654000000 |

| Sunday, January 1, 2017 | 4712600000 | 9339000000 |

| Monday, January 1, 2018 | 5016700000 | 9380000000 |

| Tuesday, January 1, 2019 | 5526700000 | 7693000000 |

| Wednesday, January 1, 2020 | 6144700000 | 7411000000 |

| Friday, January 1, 2021 | 6365100000 | 8059000000 |

| Saturday, January 1, 2022 | 7036400000 | 8343000000 |

| Sunday, January 1, 2023 | 8058800000 | 8971000000 |

| Monday, January 1, 2024 | 8725900000 | 8077000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, Automatic Data Processing, Inc. (ADP) and Johnson Controls International plc (JCI) have emerged as titans in their respective fields. Over the past decade, these companies have demonstrated remarkable resilience and growth in their gross profit margins. From 2014 to 2024, ADP's gross profit surged by approximately 89%, reflecting its robust business model and strategic initiatives. Meanwhile, JCI experienced a more modest growth of around 22%, showcasing its steady performance in a competitive market.

The year 2017 marked a significant peak for JCI, with a gross profit increase of nearly 65% compared to 2016, highlighting a pivotal moment in its financial journey. In contrast, ADP's consistent upward trajectory underscores its ability to adapt and thrive amidst economic fluctuations. As we look to the future, these trends offer valuable insights into the financial health and strategic direction of these industry leaders.

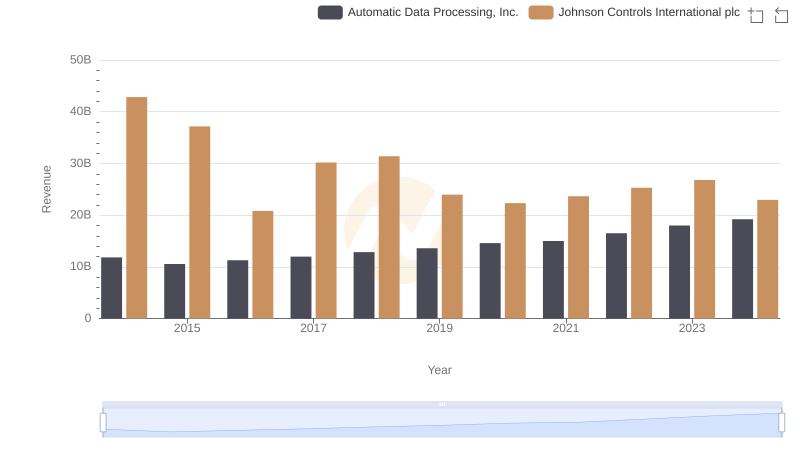

Automatic Data Processing, Inc. and Johnson Controls International plc: A Comprehensive Revenue Analysis

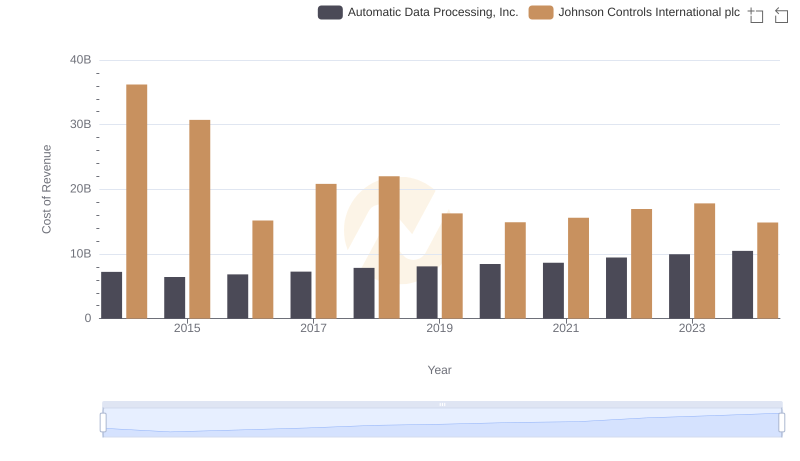

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Johnson Controls International plc's Expenses

Automatic Data Processing, Inc. vs W.W. Grainger, Inc.: A Gross Profit Performance Breakdown

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Rentals, Inc.

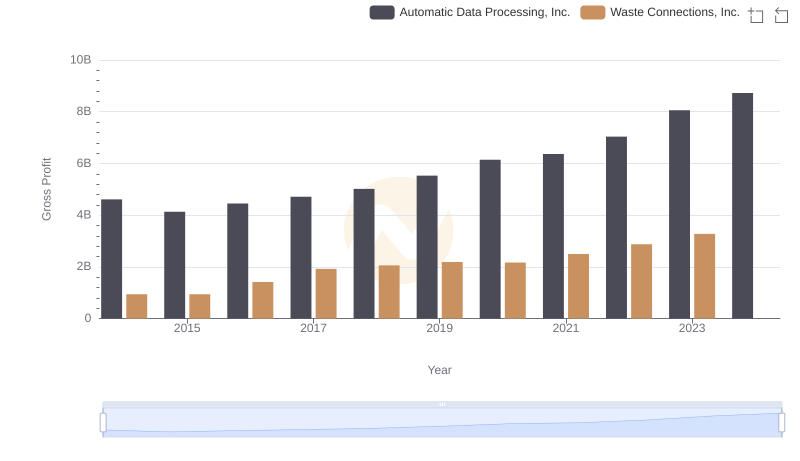

Automatic Data Processing, Inc. and Waste Connections, Inc.: A Detailed Gross Profit Analysis

Automatic Data Processing, Inc. or Johnson Controls International plc: Who Manages SG&A Costs Better?

Automatic Data Processing, Inc. and Cummins Inc.: A Detailed Gross Profit Analysis

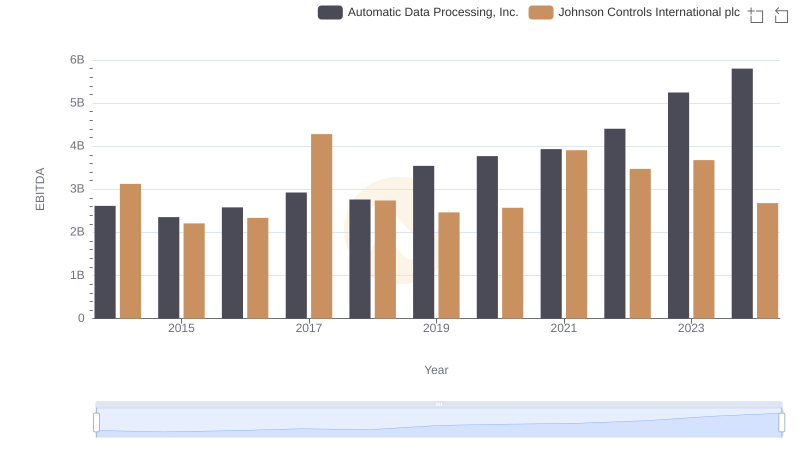

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Johnson Controls International plc